How Should I Act If I Am Pulled Over

If you are driving and you get stopped by the police for any reason, be polite. Do not argue with the officer. At best, when you go to court, the officer may tell the judge you were respectful and cooperative, and the judge may show you a little mercy.

If the officer asks for your proof of insurance, show him your insurance card or certificate. If you do not have insurance or you dont have your card or certificate, be honest and tell the officer you dont have it with you, or you dont have insurance. Do not invent an explanation.

The officer will take a few notes, and in court, he will repeat back to the judge exactly what you said two months ago while on the side of the road.

If you are able, before you go to court, get insurance coverage, or pay the uninsured fee of $500 to the DMV. Bring your proof of insurance to court and ask the judge to give you a break.

When Can The Police Stop Your Vehicle

The police have the legal right to stop a car at any time for the purpose of checking certain things, such as whether the:

- driver has consumed alcohol or drugs,

- driver has a valid drivers licence,

- driver has valid car insurance,

- car is mechanically fit to be driven, etc.

The police do not have to suspect that a driver is impaired before they stop a vehicle. In fact, the police have the legal right to conduct random spot checks for impaired drivers, and they have the right to pull any car over at a RIDE program check point.

Penalties For Driving Without Insurance

Driving without insurance is illegal in all states. Some states do not technically require auto insurance , although these states still require proof of some type of insurance like a surety bond.

If you are caught driving without insurance, then you may pay a fine for your first conviction. Most states charge a fine of $500 to $1,000 for the first offense, although some states charge as much as $5,000 even for the first offense. You might also have to pay the DMV hundreds of dollars in reinstatement fees.

You might also face higher insurance premiums in the future. If you are caught driving without insurance, then your insurer will consider you a high-risk driver. If you try to buy a policy, then you might pay significantly higher rates than a low-risk driver. You have a history of driving without insurance, and that means youre considered a higher risk.

Obviously, theres another cost of driving without insurance: you might have to pay accident costs out of pocket. If you cause an accident as an uninsured driver, then you still have to pay for any medical bills and vehicle damage. Typically, car insurance would cover these costs. As an uninsured driver, you must cover these costs yourself. That could mean paying thousands or hundreds of thousands of dollars to the other driver after an at-fault accident.

For all of these reasons, driving without insurance is rarely worth it.

Don’t Miss: How Can I Get A Copy Of My Police Report

Can Cops Tell If You Have Insurance By Running Plates

Cops can tell if you have insurance by running your plates. At a traffic stop, officers dont have to pick up the phone and call the number on the ID card to verify the status of a policy. Instead, they can walk to their patrol car, access a web portal, and review the real-time status of insurance data on a specific vehicle by its license plate number.

These real-time systems save officers time and will hold drivers accountable to follow the law.

While many states have enforced some type of electronic reporting requirement, there are still states that havent fully implemented a computerized way to verify insurance data. Instead, they use a Random Selection Program that requires random people to prove insurance on a specific date.

In these states, the number of uninsured drivers may be much higher than whats reported because its much easier to fake coverage. Take a look at this table populated with Insurance Information Institute data to see the uninsured motorist data for every state in the country so you can see the percentage of uninsured drivers in your state.

Percentage of Uninsured Drivers by State

| State |

|---|

While the average varies per state, the overall average is about 13 percent across the country.

Obtaining Police Reports From The Dmv

The DMV will have the police reports as these are submitted to the state directly from the law enforcement agencies.

They use a system such as CLUE that will provide details about the accident. It is a report generated by LexisNexis, and the information has the potential to stay on your driving record for as long as seven years.

In most cases, insurance companies will use the information for three years and then it goes away.

Even if you dont file a police report on the spot, the information about the accident might still get into the system. Many collision centers and other mechanic shops have access to the CLUE database as well, and they will include details about the accident once you bring your car in for repair.

The CLUE report will contain:

- Date of the incident

- Description of incident

- Amount that was paid

No matter what, you wont be able to hide a police report from the insurance company. You provide your drivers license number when getting quotes which allows them to get your driving history from the DMV. Accidents and more will be visible to them.

Also Check: How Do I Get A Police Report After An Accident

The Consequences Of Reporting A Car Crash

Reporting a car accident usually means that there will be an increase in your premiums.

Even just being partially at fault can mean that you are considered to be a higher-risk driver than you were prior to the accident.

If you decide to pay the claim yourself you may save yourself some of the increase in your coverage because you will not add a claim to your claims history. However, your premium will still likely be affected because your driving record will be tarnished by the crash.

Not reporting a car wreck to your insurance can drastically affect your car rates.

If you are completely not at fault, reporting a car crash will not affect your coverage.

This does not mean that you should simply not report it at all. You should always consider your options when you are involved in a minor accident.

Some people may speak with the other involved party and agree to pay for any damages and repairs out of pocket rather than involving the insurance company. While this can work in many cases, you may be putting yourself at risk.

While this can work in many cases, you may be putting yourself at risk.

If you leave the scene of the accident after discussing out-of-pocket settlement, the other party may still call the police and make a report.

If so, you can be charged with leaving the scene of an accident, a serious violation which will cause your insurance to rise and get you in trouble with the law.

What If You Dont Have Uninsured Motorist Coverage

If you dont have uninsured motorist coverage, you could take the at-fault driver to court to sue for these incurred expenses. But this could take time and money with no guarantee youll win a settlement so you very well could be stuck paying out of pocket for any injuries. Collision insurance coverage can be used to help fix your vehicle.

Read Also: Are Police Body Cameras Public Record

Do Police Officers Always Call Your Insurer

In many cases, a police officer will not call your insurer to verify insurance information. If you have documentation showing you have a policy from your insurer, and that policy is active within the stated dates, then the police officer will accept that documentation as proof of insurance.

If the officer is suspicious, however, or believes you are committing insurance fraud, then the officer may call your insurer to verify your policy. If you have faked documentation, then you could face severe penalties.

In other cases, however, the police officer will never call your insurer to verify the information. If you have documentation proving you have an active policy, then the officer may believe you.

Driving Without Insurance Police In Michigan Can Now Tell Just By Running Your Plate

Police can determine insurance validity by running license plate

Bay County Deputy Josh Rytlewski sits in his patrol vehicle to demonstrate the in-car computer system. As of Wednesday, Nov. 12, police throughout the state can determine if a motor vehicle has insurance simply by running its license plate.

BAY COUNTY, MI — Police now have an easier way of telling if you are riding dirty on the streets of Michigan.

As of mid-September, police throughout the state can determine if a motor vehicle is properly insured simply by running its license plate.

“When they run a license plate on an in-car computer, it will tell them if the driver of the vehicle has insurance that’s valid or not,” said Bay County Undersheriff Troy Cunningham. “It doesn’t apply to motorcycles or commercial vehicles at this time.”

Michigan State Police 1st Lt. David Simon, commander of the Tri-City Post in Bay County’s Williams Township, also said the new technology has led to his troopers issuing more tickets with greater ease.

“It is convenient and it’s nice for the officers to verify if someone’s got insurance or not. It’s one more thing we can do at a traffic stop or at a crash.”

Between Sept. 13, 2013, and March 25, 2014, state troopers issued 8,664 citations to motorists who had no proof of insurance. By contrast, between Sept. 13, 2014, and March 25, 2015, troopers issued 10,009 such citations, Banner said.

Don’t Miss: How To Get A Police Report Amended

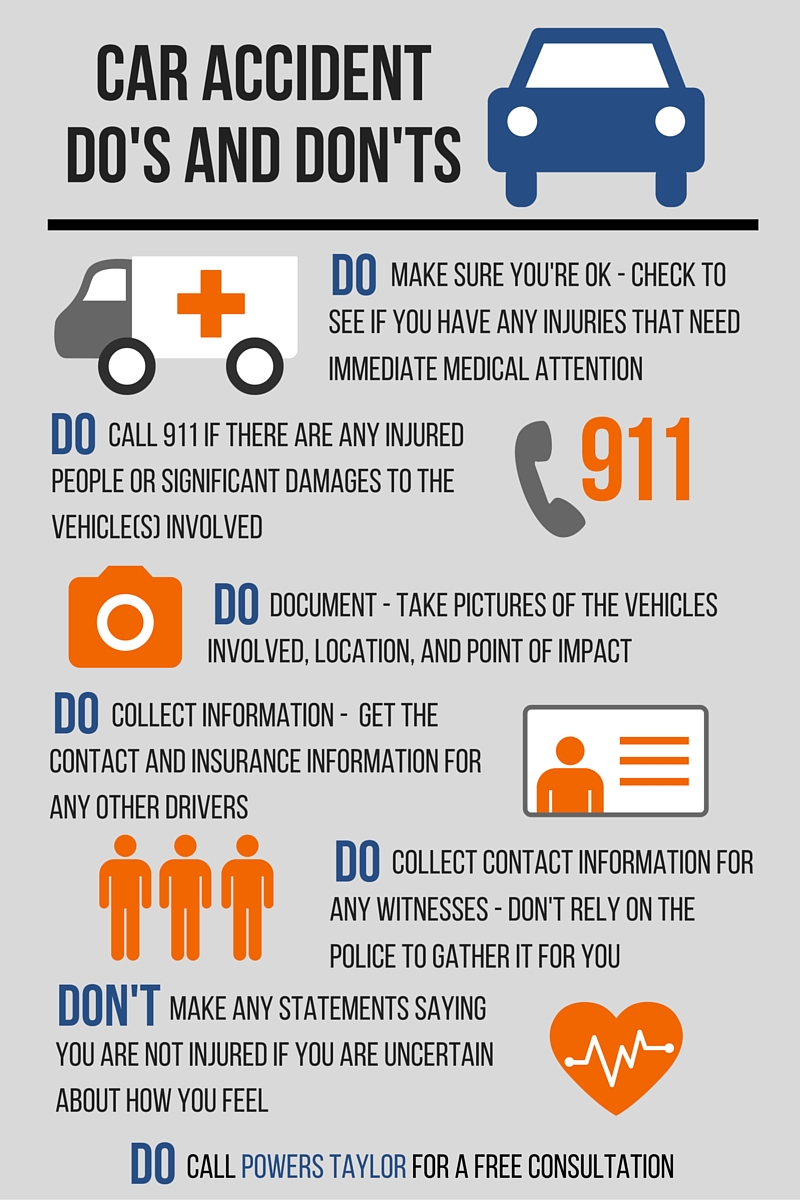

What Information Should I Exchange With The Other Driver If I Get Into A Car Accident

If you both can get out of the car and are in a safe place to take down information, here are the critical pieces of information you should take down:

- Names

- Vehicle identification and license plate numbers

- Contact information for their insurance companies and policy numbers

- Cars registration and get the owners name and contact information if its not the driver

- Names, addresses and phone numbers of witnesses and passengers

If you have a camera or one on your cell phone, take photographs of the damage and the car accident scene. If you are without a camera, at least try to make a rough sketch of the accident.

Make sure to note the time, date, and location of the accident.

If a police officer does arrive, take down his/her badge number, and find out where and when you will be able to pick up this police report.

Is Accidental Policy Lapse A Legitimate Defence

I accidentally let my policy lapse. Is that a legitimate defence? No. Even if its just for a day, driving uninsured can land you in hot water.

Theres no obligation on insurers to automatically renew your cover, although many will do that these days.

Its your responsibility to make sure youre covered before you drive a vehicle.

You may be able to argue mitigating circumstances, but youd still be guilty of the offence.

Recommended Reading: What Happens When You File A Police Report For Theft

Why Service Canada Does Not Issue New Social Insurance Numbers For Those Affected By A Data Breach

A new Social Insurance Number is not a fresh start or protection from fraud or identity theft.

If someone else uses your old Social Insurance Number and the business does not check the persons identity, you may have to prove you were not involved in the fraud or pay the impostors debts.

The Government can only share your new Social Insurance Number with the federal departments and agencies that use your Social Insurance Number.

This means that it would be up to you to provide your new Social Insurance Number to all the financial institutions, creditors, pension providers, recent and current employers, and any other organizations with which you shared your old Social Insurance Number.

Not doing or failing to do so properly risks not receiving benefits or leaves the door open to subsequent fraud or identity theft.

A new Social Insurance Number does not erase your old Social Insurance Number. You would therefore need to monitor your accounts and credit reports for both Social Insurance Numbers on a regular and ongoing basis. This would put burden on you. Numerous Social Insurance Numbers multiply the risk of fraud.

The best way to protect yourself if you are affected by a data breach:

When Can The Officers Pull Me Over

-

If the officers know your driver’s license is suspended or invalid by running your license plate.

-

If officers observe a problem with your car, such as a broken headlight, expired vehicle registration, or a defective exhaust system.

-

If officers observe you driving dangerously, such as by running red lights and stop signs, speeding, or making illegal turns.

-

If officers have a reasonable suspicion that you or someone in your vehicle committed a crime, such as theft or assault.

Read Also: How Much Is A Police Radar

Your Own Cellphone Records

This is not a commonly used tactic unless you have been involved in a car accident that resulted in an injury or death.

If the police believe texting led to an accident they will gladly pursue your phone records. “If we believe someone had been texting and driving we can go through a process to obtain those phone records,” Trooper Jeff Petucci of the Pennsylvania State Police told CentralPa.com.

“It’s not an automatic thing, but at the same time if it’s a crash that causes serious injury and death we’re going to look at that angle if someone has been texting and driving,” Petucci says.

What Happens If I Drive Without Insurance

Posted at 10:02on 12th November 2018in Campaigns

Is it illegal to drive a car without insurance?

Yes, its against the law to drive a vehicle on a public road without at least the most basic level of car insurance .

How do police know I dont have insurance?

Police work closely with the Motor Insurance Database. Data from the is shared with all UK police forces so that Automatic Number Plate Recognition cameras can quickly and easily tell officers if a vehicle in front is insured or not.

The MIB dedicated police helpline is available to officers who have stopped a vehicle at the roadside where the validity of the vehicle and drivers insurance is in question. Phone operators are available to speak with insurance companies to clarify information and make sure that we have the right information to make a decision.

In 2017 the data-led analysis of vehicles meant warnings were sent to hundreds of thousands of motorists who appeared to be uninsured and around 250,000 people were automatically issued with a fixed penalty notice.

What would police do if they stopped me for driving without insurance?

If officers suspect your car may be uninsured they can pull you over and call the MIDs dedicated helpline, running the number plate through their system. If the vehicle is found to be uninsured then we can issue 6 points on your license, a fine of £300 or seize your vehicle. We also have the power to destroy your vehicle.

Recommended Reading: How To Find Out About A Police Report

Not All States Require That You Show An Officer Your Identification

Of course, when you’re traveling internationally, you are legally obligated to show authorities your identification. However, when it comes to identifying yourself within the States, whether you are legally required to show an officer your ID is determined by each state.

In Alabama, for instance, the law states that a sheriff or any other officer of the law can “stop any person abroad in a public place whom he reasonably suspects is committing, has committed, or is about to commit a felony or other public offense and may demand of him his name, address, and an explanation of his actions.” But over in Maryland, an officer can only ask for identification if they believe that a person “may be wearing, carrying, or transporting a handgun.”

Regardless of which state you’re in, keep in mind that you are never obligated to identify yourself to an officer if they have no reason to suspect you of committing a crime.

Are Police Able To Know If You Have Insurance By Running Your License Plate

One of the items the police check when stopping motorists is insurance. Therefore, before getting behind the wheel, motorists are required by law to have valid insurance. Lack of insurance or falsifications of documents is considered to be misdemeanor offenses that may result in one year of jail term or fines according to the type of offense. Lacking proof of insurance results in a fine of $143 while driving an uninsured car attracts a fine of up to $500 together with a $500 responsibility fee that must be paid in two years. Hence, lacking insurance is a rather costly affair. A leading Michigan car accident attorney at Elia & Ponto can help you or a loved one was injured in an auto accident.

Recommended Reading: When’s The Next Police Auction