How Can I Find Out If A Car Has Insurance

In Ontario, it is the law to have insurance on your car. You may get a new car or a used car as you plan to buy a vehicle. That is when you may want to know if that used car has insurance. You could check with the owner. You may also verify the insurance documents. If may want to check the vehicle records. You could check on many government systems to find out if a car has insurance.

Penalties For 1st Offense

If you fail to show valid proof of active insurance when requested or are found to be driving a suspended vehicle, you will be charged with a misdemeanor. Any law enforcement officer has the power to ask for your ID card or other evidence at traffic stops or the scene of an accident.

For the 1st offense, your license and registration are suspended for 60 days and until a six-month insurance policy is in place that meets the state’s minimum. You must pay a lapse fee of $25 and a reinstatement fee of $60 to get them back. You could also receive jail time of up to 12 months, depending on the circumstances.

To get a policy after a lapse in coverage, you may need to find an insurer in the state that works with higher-risk drivers, such as those listed below. We recommend comparing rates from multiple companies to find the best price for coverage.

If you find yourself having trouble getting insurance coverage from private insurers, ask your agent about the Georgia Automobile Insurance Plan.

How License Plate Scanning Changes Insurance Priorities

Considering that the police can scan your license plate any time your car is out of your driveway, it makes sense to avoid driving without car insurance or providing false insurance information.

With the potential for out-of-pocket fines, plus lost income and lawyer fees, driving without insurance stacks up to significantly higher costs than simply purchasing the required car insurance.

You May Like: Where Can I Find Police Auctions

Can You Show Proof Of Insurance On Your Phone In Michigan

The law allows residents and motorists to “display an electronic copy of his or her certificate of insurance upon request.” The law prohibits the police officer from looking at other apps or information on the person’s smartphone, although the officer may be permitted to take the phone to a safer location to verify

Why Is It Illegal To Drive Without Car Insurance

Federal law requires drivers to have car insurance to ensure that the interests of pedestrians and other motorists are protected if an accident occurs. The cost of a car crash can be quite devastating, and if you dont have car insurance, you and the other parties involved can be ruined financially. If you are at fault in an accident and have insurance, your insurance provider will cover the claims of the person you hit. Now, if you dont have valid car insurance, youll have to pay for the other persons hospital bills, car repairs, and other losses from your pocket. What happens if you fail to do that? Simple, you run the risk of getting sued. This is on top of the payments for injuries you have sustained and the repairs on your car. To avoid all these issues, make sure you have valid car insurance.

Also read: How much is a ticket for getting caught driving without car insurance?

You May Like: Do Police Run Your Insurance

Why Service Canada Does Not Issue New Social Insurance Numbers For Those Affected By A Data Breach

A new Social Insurance Number is not a fresh start or protection from fraud or identity theft.

If someone else uses your old Social Insurance Number and the business does not check the persons identity, you may have to prove you were not involved in the fraud or pay the impostors debts.

The Government can only share your new Social Insurance Number with the federal departments and agencies that use your Social Insurance Number.

This means that it would be up to you to provide your new Social Insurance Number to all the financial institutions, creditors, pension providers, recent and current employers, and any other organizations with which you shared your old Social Insurance Number.

Not doing or failing to do so properly risks not receiving benefits or leaves the door open to subsequent fraud or identity theft.

A new Social Insurance Number does not erase your old Social Insurance Number. You would therefore need to monitor your accounts and credit reports for both Social Insurance Numbers on a regular and ongoing basis. This would put burden on you. Numerous Social Insurance Numbers multiply the risk of fraud.

The best way to protect yourself if you are affected by a data breach:

How Do Police Catch Uninsured Drivers

Driving without insurance is a secondary crime in all 50 states. The police cannot run your plates through the uninsured motorists database unless they pull you over initially for another reason. Common ways uninsured drivers get caught:

- Random checkpoints

Police often set up random checkpoints along major roadways. They can pull you over at these checkpoints and ask to see your license, registration, and proof of insurance. This is basically the only way police can search for your insurance details without having a specific reason to pull you over. If you think you can get away by showing an expired car insurance card or giving an expired car insurance policy number, youre wrong! The police will find out your insurance status, quote you, and then tow away your vehicle if you dont have a valid car insurance policy.

- Traffic violations

You can also invite trouble for yourself by violating traffic laws. The first thing to remember is that the police dont even need a major violation to pull you over. Cops can pull you over for speeding, running a stop sign, or even a busted headlamp! The police will then collect your license, registration, and insurance card and check your information. All they need to do is call your insurance providers 800 to find out whether you are currently insured by the insurance provider listed on your insurance card.

- Automatic License Plate Recognition Systems

Contents

Recommended Reading: How To Get Accepted Into Police Academy

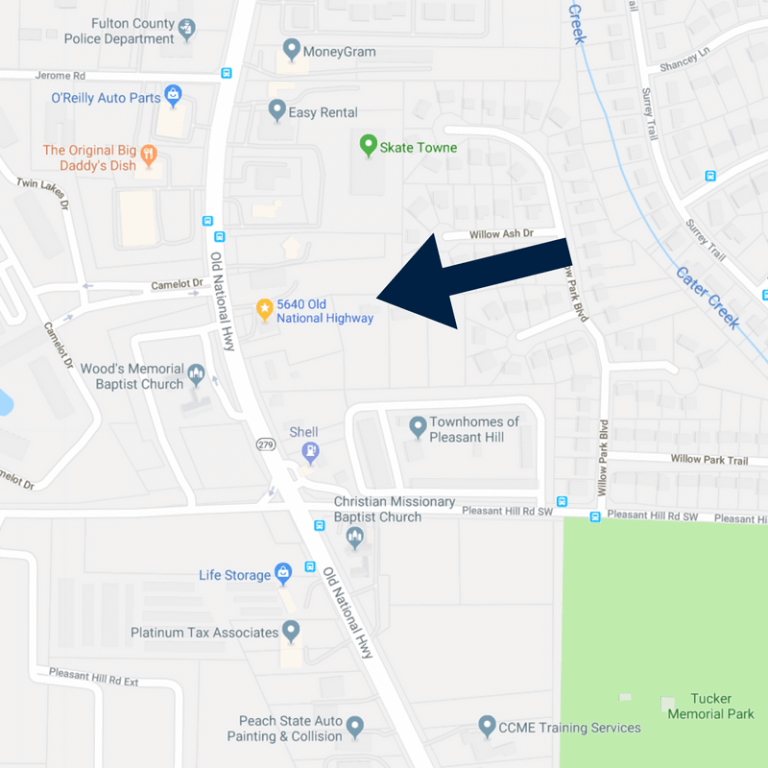

Contact Acar Accident Lawyer In Atlanta Georgia

If you have been involved in a motor vehicle accident, you should contact a car accident lawyer in Atlanta, Georgia. Your insurance claim could be denied. You have no idea whether itll be approved or not. It could be denied for any of the following reasons:

- The other driver did not have a valid license

- The insurance policy wasnt valid or had lapsed for non-payment

- The driver wasnt listed on the policy

- The insurance company believes you were at fault

- They dont believe your injuries were legitimate

If this happens, youre going to want an experienced auto accident lawyer to appeal your insurance claim.

Can Police Ask For Insurance In Indiana

Although not having auto insurance is a criminal offense in Indiana, police officers cannot enforce it because it violates the states insurance law.

Car Accident Insurance Checklist For Indiana

If you have been involved in an Indiana car accident, you should have all of your insurance information ready. If you are stopped by police, your insurance card, drivers license, and proof of insurance may be required. In addition to asking for the policy ID number, police may request that you provide them with the name of the driver on the policy. If you are unsure about your auto insurance, you should consult with your insurance company.

Also Check: How To Report Fraud To Police

What Information Should I Exchange With The Other Driver If I Get Into A Car Accident

If you both can get out of the car and are in a safe place to take down information, here are the critical pieces of information you should take down:

- Vehicle identification and license plate numbers

- Contact information for their insurance companies and policy numbers

- Cars registration and get the owners name and contact information if its not the driver

- Names, addresses and phone numbers of witnesses and passengers

If you have a camera or one on your cell phone, take photographs of the damage and the car accident scene. If you are without a camera, at least try to make a rough sketch of the accident.

Make sure to note the time, date, and location of the accident.

If a police officer does arrive, take down his/her badge number, and find out where and when you will be able to pick up this police report.

Car Insurance Laws In Georgia

In the state of Georgia:

- You’re responsible for driving with insurance, irrespective of who owns the car.

- Each driver must have continuous liability insurance in the vehicle whenever they’re on the road.

- Drivers can self-insure their vehicles if they’re not in a position to buy them from a carrier.

- A minimum cover must cater for $25,000 for an individual personal injury, $50,000 for two people and above in a single accident, and $2500 for property damage on every collision.

- Your insurance information is electronically submitted to the Georgia Division of Driver Services during purchase, terminations, deletion, or additions, and immediately it elapses.

- Drivers must provide liability insurance during the renewal and replacement of vehicle licenses, car plates, and car registration.

Recommended Reading: Can I Adopt A Retired Police Dog

What If You Dont Have Uninsured Motorist Coverage

If you dont have uninsured motorist coverage, you could take the at-fault driver to court to sue for these incurred expenses. But this could take time and money with no guarantee youll win a settlement so you very well could be stuck paying out of pocket for any injuries. Collision insurance coverage can be used to help fix your vehicle.

Read Also: Are Police Body Cameras Public Record

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships dont influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- You must carry proof of insurance with you whenever driving

- An office has the right to stop your car during a routine check or if they suspect something is wrong

- If youre stopped and fail to provide proof of your auto insurance, you will get a ticket for driving uninsured

Before getting behind the wheel, all drivers should have insurance. If youre pulled over for a traffic offense, or for any reason, the first thing law enforcement will ask for is your drivers license and verification of your insurance.

While selecting car insurance, ensure you choose a policy with the minimum coverage for your state. By doing so, you ensure youre both protected in the event of an accident and compliant with state laws.

More:What are state minimums for car insurance in Florida?

These days, police officers have real-time systems that can check if your auto insurance is valid and meets state requirements.

Read Also: How To Call The Police

When Do Officers Check For Car Insurance

Officers often use electronic verification systems to check on a drivers insurance status in real-time prior to or in the middle of a traffic stop. An officer can also run your license plate while you are driving to determine if the vehicle you are operating is insured. Should any insurance issues be detected in the system, the officer may pull a driver over and check that he or she has a valid insurance card.

More importantly, the system allows the police the ability to identify uninsured drivers and get them off the roads. An officer who runs a license plate through the system can find out if the driver has been previously cited for driving without a license in other words, a repeat offender. Insurance checkpoints are also a way for the police to scan every driver passing through for insurance coverage.

Will The Police Check For Auto Insurance

If you get pulled over, the police will check for car insurance if you are in a state that requires it. Likewise, anytime an accident is reported, the police are required to verify your insurance and your license to fill out the accident report. To avoid the consequences of driving without insurance, you should look up the regulations in your state to be sure you are in compliance.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

|

Rick Musson began his law enforcement career in Bozeman, Montana, shortly after completing his Bachelors Degree in Criminal Justice. He has served many roles in the department, including as a traffic officer, senior crash investigator, detective, field training officer, firearms instructor, and currently the training sergeant.For the past 15 years, he has been on the SWAT team and currently… |

Don’t Miss: How To Be A Police Officer In Gta

Driving Without Insurance In Georgia

First and foremost, if you’re caught driving without current valid insurance in Georgia, you will be charged with a misdemeanor, and it will remain on your record permanently. Additionally, you will have to appear in court and pay a fine of $200 to $1,000. To top it off, your license will be suspended for 60 to 90 days.

That means no driving at all. It’s also possible, although unlikely, that you will receive jail time of up to 12 months. While jail time is usually reserved for repeat offenders who will also face steeper fines and longer suspensions, you run the risk any time you get behind the wheel in Georgia without car insurance.

Be Careful When Changing Car Insurance Companies

It can be wise to switch car insurance companies if you find a better rate, but make sure you go about things the right way.

One possible mistake when changing companies is not taking into account an insurance gap. Make sure your new policy is scheduled to take effect as soon as your old policy ends.

Read Also: How Do Police Track Your Phone

Penalties For First Time Offenders

Whether it’s at an accident scene or a traffic stop, a driver must produce an insurance copy when asked. Failure to produce proof of valid insurance to traffic officers is a misdemeanor that leads to a 60 days suspension of car registration and license. If the circumstances surrounding your arrest are severe, a judge may impose a 12 months jail term.

Driving without insurance is an expensive affair that requires a convicted driver to produce proof of minimum coverage of six months before the state lifts the suspension. Insurance companies classify suspended drivers as high-risk drivers and end up charging more when covering you again.

Police Can Now See If You Have Insurance Before They Even Pull You Over

MICHIGAN — It’s something every driver should have on them when they get behind the wheel and it’s one of the first things police look for if you happen to get stopped.

But now, some existing technology is providing a new tool that’s being used by Michigan State Police and other agencies across the state giving officers the upper hand to determine if you’re driving without insurance.

Officers can run a driver’s license plate through their in-car computer systems to access the information which began to be available last September.

Insurance companies are now required to send information to the Secretary of State’s office twice a month, on the 1st and 15th, making that information readily available through the statewide Law Enforcement Information Network, or LEIN.

Its now linked to the license plate for that car so when were on a traffic stop and we run that persons license plate then it will come back either that they have insurance or dont,” said F/Lt. Chris McIntire with the Michigan State Police Rockford Post.

McIntire said state law still requires drivers to carry proof of insurance in their vehicles.

While the information might be more readily available, it doesn’t mean officers will be specifically targeting drivers for just this reason, McIntire said.

Not having insurance for your vehicle is considered a secondary violation which means police technically can’t pull a driver over just for that offense, according to McIntire.

You May Like: How Much Is A Police Radar

Why Is It Important To Call The Police After A Car Accident In Atlanta

The only time you should even contemplate not calling the police is in the rare event that you do not believe the crash resulted in any injuries and damage to your vehicle appears to be less than $500, or you do not need to use your own auto insurance to cover any of your damages. However, we always recommend that everyone involved in a crash call the police, even if you do not believe you will file a car accident claim.

Why? Because having the police investigate the wreck and determine who was at fault gives you an independent and reliable third-party witness to who caused the accident. Without a report of this nature, you are left to explain how the accident occurred to the other drivers insurance company on your own.

What if the other driver tells his or her insurance company a different story? The insurance company will almost always side with their insured. Then it becomes he said-she said situation.

In addition, the reason you do not want to call the police is not a good one either often times. We have seen many, many injury cases where the client felt fine at the scene of the crash only to learn days or weeks later that he or she was actually severely injured.

You always want to err on the side of caution and have the police investigate the wreck and determine who was at fault. This will make it easier to reach a car accident insurance claim settlement.