Benefits Of A Police Report

Although you are not legally required to file a police report after every accident, there are some benefits to doing so.

Filing a police report provides an objective third party to review the scene of the accident and give an unbiased account of who was at fault for the crash. This could serve as evidence to prove the other drivers negligence to the insurance company.

Another benefit of a police report is that police officers sometimes interview witnesses at the scene who may also provide testament to how the crash happened. Having someone who saw the lead up to the crash first-hand could also help you prove your claim.

Reporting An Accident To Your Insurance Company

People who are involved in minor collisions often try to avoid reporting these types of accidents to their insurance companies for two reasons:

- the driver assumes that his insurance rates will increase, and

- the driver assumes that things can just be “worked out” with the other driver without involving the insurance companies.

It is important to understand that every single automobile insurance policy in the country requires policyholders to immediately report any accident in which they are involved. Failing to report an accident to your insurance company may result in significant complications or penalties down the road.

Let’s say you agree with the other driver at the accident scene that you’ll just “work things out” and not file insurance claims , what happens if the other driver gets home and realizes the damage was more severe than she first believed? Or, maybe injuries later appear that weren’t obvious at the accident scene?

If, after several weeks or months the other driver makes a claim for unnoticed vehicle damage, or for injuries that have cropped up, your insurance company might deny certain protection to you because you failed to promptly report the accident. So, your attempt to avoid a possible increase in your insurance premiums may result in even greater monetary losses down the road.

How Do Insurance Companies Use Police Reports

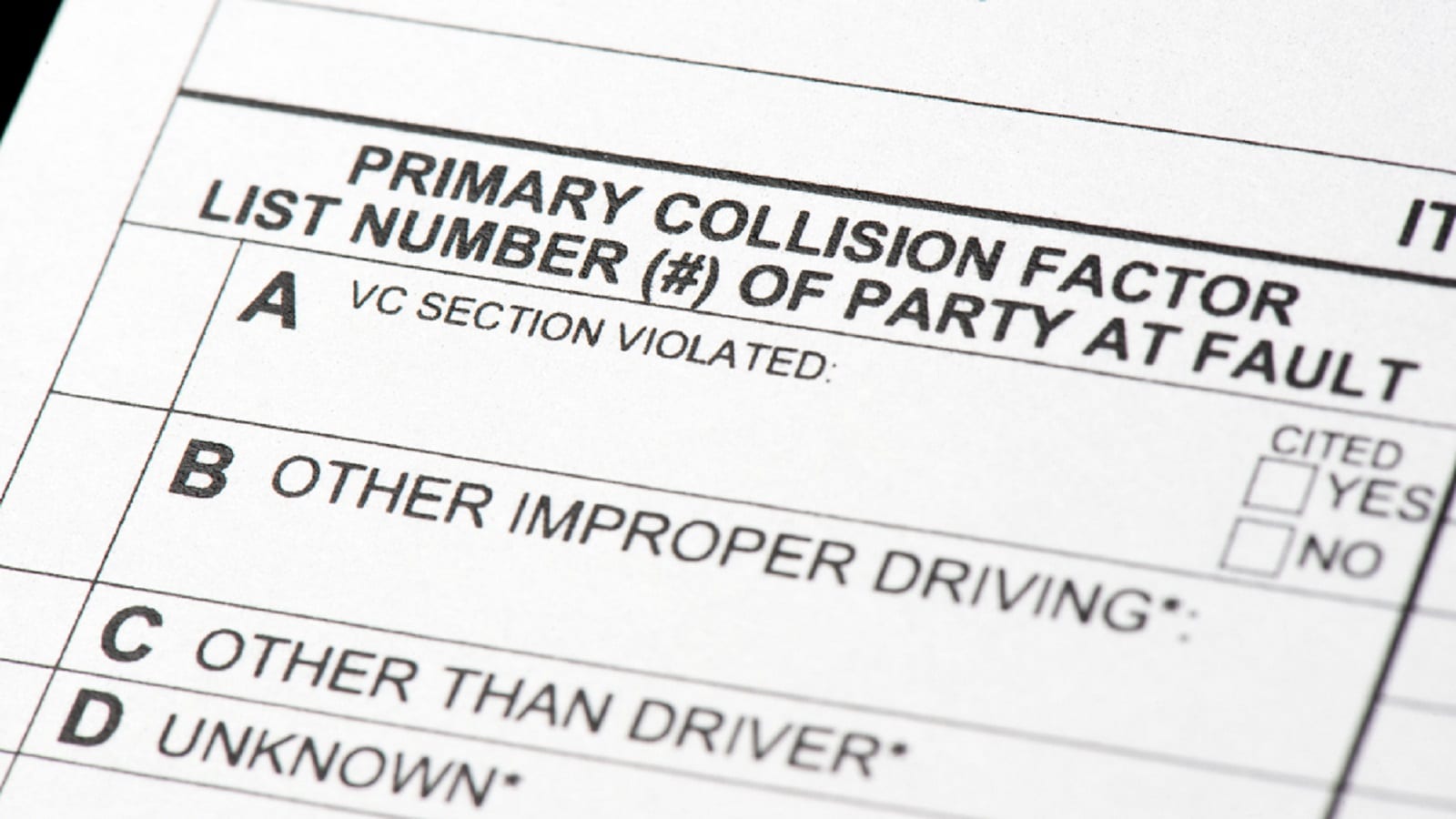

After a car accident, when a claim is reported, the insurance company will conduct its own investigation. One of the first things that an insurance company will ask for is the police report. This is because, as we discussed above, the report contains a vast amount of information pertaining to the car accident.

Sometimes the insurance company and police officer’s opinions are different. This is why there are times when the police report is in your favor in terms of a fault determination, but the other driver’s insurance company still denies your insurance claim.

Learn more about the role of insurance in a car accident case.

You May Like: How Can I Become A Police Dispatcher

Situations Where A Police Report Can Make A Difference

Your car accident claim might fail without a police report if the other driver has no insurance. Your insurer could refuse to apply your uninsured motorist coverage if you do not file a police report. If you do not know the identity of the liable party, it is always best to file a police report. Certain insurance companies, however, do not need a police report to provide uninsured motorist coverage.

Lack of a police report negatively affects your car accident claim if there is no evidence. For instance, if there are no eyewitnesses, it might be hard to prove that you are not liable.

A police report is important if the at-fault party is refusing liability for the accident. Without a police report, it is difficult to ascertain who is at fault. The negotiating process will be difficult because the liable partys insurer may refuse to settle. The best available option for making a car accident claim without a police report is to hire a lawyer.

Are Police Reports Needed To File A Car Accident Claim

Do you need a police report to file a car accident claim? No, it is not 100% necessary to have a police report when filing your car accident claim. Although, it is greatly beneficial that you do have one.

A police report is useful for a car accident claim because:

- It provides a reputable source that the car accident happened.

- It can include mention of who the police officer thinks caused the crash.

- It can note if the other driver was distracted or intoxicated.

- It can detail how much damage was done to your vehicle.

- It can sometimes list important witness information.

Essentially, if there may be any dispute that your car accident happened or how it happened, then a police report can clear things up fairly easily. For this reason, many car insurance companies tell their policyholders to get a police report before filing a claim. Otherwise, if they file without it, then the insurance company or the opposing insurance company will see it as an opportunity to deny or delay the claim.

How Do You Get a Police Report?

If the police are notified of an accident, they will respond to the scene. When an officer shows up and if someone was hurt in the accident or a vehicle was seriously damaged, then the officer should complete a police report for you. To get a copy of that report, you can call the responding police station or department and provide basic information about the crash, assuming you did not get the report number handed to you directly by the officer.

Categories

You May Like: How Long Does It Take To Be A Police Officer

Do I Have To File A Police Report After A Car Accident

The law in South Carolina requires that you report car accidents under certain circumstances. If either of the following exists in conjunction with a car accident, you must file a police report:

- A person dies as a result of the accident or

- A person suffers serious bodily injury as a result of the accident.

Since drivers cannot determine by sight all damages or injuries, you should always file a police report after a car accident. Also, it is a crime to flee the scene of a car accident. Therefore, if the other driver flees, you should file a police report.

Talk To The Department Of Insurance

We are the state agency that regulates the insurance industry. We also work to protect the rights of insurance consumers.

Contact the California Department of Insurance :

- If you feel that an insurance agent, broker, or company has treated you unfairly.

- If you have questions or concerns about health insurance.

- If you want to order CDI brochures.

- If you want to file a request for assistance against your agent, broker, or insurance company.

- If you are having difficulty opening a claim with your insurance company.

- To check the license of an agent, broker, or insurance company.

You May Like: Do Police Know If You Have Insurance

Peace Law Firm: Offering Highly Competent Caring Representation

After graduating from the University of South Carolina Law School, John Robert Peace founded the Peace Law Firm in Greenville, South Carolina, in 2002. Peace is licensed to practice law in South Carolina and North Carolina.

The Peace Law Firm believes in stepping up for the injured and mistreated. When you hire the Peace Law Firm, you will receive personal attention and superb legal representation. Contact the Peace Law Firm today to schedule a free, confidential consultation regarding your car accident claim.

How Do I Get A Copy Of The Police Report From An Accident

There are two ways that you could receive a copy of the police accident report. The first is by calling the law enforcement office that responded to the accident and making the request for the copy using the identification number from the initial report. The second way is to contact your insurance adjuster and ask if they already requested and received a copy of the report. If they have, you can ask for a copy of it.

Don’t Miss: How To Look Up My Police Report

Can I Still File A Claim Without A Police Report

Not every car accident requires police coming to the scene, especially a minor collision. If you dont have a police report, what happens when you file a claim and the insurance company asks for one?

The insurance company cannot outright deny your claim just because you are missing a police report. However, there are some ways it can impact your claim, and Sacramento car accident attorneys can help you.

Can You File An Insurance Claim If You Dont Have A Police Report

Even if you dont have a police report, you still can and should file an insurance claim after a car accident. While having a police report can be helpful , it is not necessary.

So, if you were involved in a car accident, you should contact your insurance company promptly. You can get started by providing the information that is required in order to initiate a claim.

Read Also: What Kind Of Walkie Talkies Do Police Use

Collision On Private Property

Police typically wont file a report for accidents that happen on private property. For example, police might not respond to a call if your teenage son hits the garage door or your friend backs up into your mailbox.

These are considered personal matters, and police will usually only file reports on public property like roads, backstreets, highways, and public property. Even your local pharmacy or coffee shop might be considered private property.

It doesnt hurt to call police anyway, though.

Do I Have To File A Police Report

You can avoid filing a police report if the other driver agrees. You will want to get the persons contact information, insurance, and license plate number. You wont need anything else to file a claim with your insurance company.

If the accident was something that was your fault, you may wish to avoid filing a police report. If you rear-ended the other driver, the police officer may issue you a citation.

It is against the law to flee the scene of the accident. You will want to make sure you are on the same page with the other driver if you are going to leave without filing a police report.

You will have to wait longer for your claim to be processed, but in this case, it may be worth it to avoid having a fine to pay and a traffic ticket on your driving record.

As long as no drivers have prematurely left the scene and there are no injuries to report, it may be acceptable to avoid filing a police report.

Get your free auto insurance quote by entering your ZIP code below.

Recommended Reading: What Grades Do You Need To Be A Police Officer

What Are My Options For Repairing My Car

We offer quite a few choices. For your initial estimate, we offer Photo Based Estimating for eligible claims which allows you to take and submit photos of your damaged vehicle which will expedite your claim rather than wait for an in-person appraisal. To repair your vehicle, you can choose from the options listed below.

You can bring your car to one of our TD Insurance Auto Centres, where we have dedicated Claims Advisors, a rental company and body shop all in one convenient location. These centres are exclusive to TD Insurance customers.

You can also bring your car into one of the many shops in our preferred network. We only work with highly rated repair shops, and thats why we stand by our lifetime guarantee for the repairs for as long as you own your car and are insured with us.

Of course, if you prefer, you can take your car to a repair shop of your choice. We will send an appraiser to assess the damages. You will have to secure a warranty on repairs from your repair shop directly.

When To Call The Police

There are two situations in which you really need to call the police. If your claim has anything to do with an accident with another party, the police should come to the scene and file a report. This includes accidents with another vehicle, accidents involving a biker, or accidents involving a bicyclist or pedestrian.

You will also need to call the police and file a report if your vehicle is damaged by vandalism or stolen. A police report must be filed, and the police must see the damage or investigate the theft in order for you to get compensation from the car insurance company.

Read Also: How To Get A Job As A Police Dispatcher

What Happens If You Fail To Report A Car Accident In Georgia

If your car accident meets the legal criteria above and you did not report the accident, you could face criminal charges.

A victim could claim the crash as a hit and run accident because you drove away and left the scene of an accident. That means fines between $300 and $1,000, drivers license suspension, and up to 12 months in jail. When someone gets seriously hurt or dies from an accident, leaving the scene can mean a felony hit and run charge. A felony charge can result in one to five years of imprisonment.

In addition to the above charges, not reporting an accident can also lead to legal action from an injured victim in the crash. For example, if you caused the car accident and left without reporting it, the injured driver can file a claim or sue you for damages.

Can You File A Car Accident Claim Without A Police Report

Were you involved in a car accident but did not file a police report? A police report is an important piece of information for your attorney and your insurance carrier, and may support your claim, should you choose to file one.

In Florida, a police report is not always required, which means you can usually file a claim for financial recovery from the at-fault driver without one. As an attorney will tell you though, filing a police report may support your claim by serving as evidence.

Were you involved in a car accident but did not file a police report? If you want to know if you can still file a car accident claim, then you may benefit from speaking to an attorney in your area.

For a free legal consultation, call

Don’t Miss: Can I See My Police Report Online

How Do You File An Accident Claim

After you have exchanged information with the other driver, taken photos of the vehicle damage and the accident scene, its time to contact your insurer. If your accident was anything more than a tiny scratch or a broken side-view mirror, you should report your accident to your insurance company as soon as possible. Heres what you can expect as you begin the claims process:

- When you call your insurance company, you will need to have information about the other driver, vehicle damage, injuries, and witnesses. Keep the police report on hand as a reference.

- You will likely tell and retell the sequence of events leading up to and during the accident several times during this process. In order to provide the most accurate information possible, you should write down the details of the wreck as soon as possible. Youll want the events to remain clear in your mind and to retell the details correctly each time.

- During your initial phone call, your insurance agent or a company representative will most likely talk to you about getting a vehicle inspection and damage estimate or appraisal, reserving a rental car if necessary and if your coverage allows for one, towing assistance, and payment options.

Rates vary from company to company. Shop around for the lowest rate, as you may be able to find a cheaper policy with a different insurer.

What Will The Police Do At The Scene Of A Car Accident

The police are there to help. They will be able to provide support to the parties involved in the crash, interview witnesses, and gather all necessary information about the accident. The cops will do some or all of the following:

- Take down basic information.

- Make sure the area is secure and safe for traffic and all people involved.

- Give tickets if this is required due to violations or negligence.

- Speak to witnesses, third parties, or any other people involved.

- Evaluate the situation to help avoid scams or other issues.

- Prepare a report you can later use to file your insurance claim or use in court if needed.

Don’t Miss: Do I Have To Pay For Police Academy

How Will A Tardy Police Report Affect My Insurance Claim

When accident victims come to us and ask, Can I still file a police report after an accident? they are often just as worried about the financial stakes as they are the formal filing requirements. After all, auto accidents can carry a tremendous financial toll for the victims, and the idea that a tardy form could keep you from the compensation you deserve is a terrible thought.

Earlier in this article, we explained that filing an insurance claim and filing a police report after an accident are two totally different processes. Its important to keep that fact in mind.

So heres the bottom line: if you were injured in a New York auto accident as a result of someone elses negligence, you have rights.

Failure to file an accident report on time may complicate your insurance claim , but it doesnt necessarily mean you cant recover the compensation you deserve.

If you have been injured, please contact the Kingston personal injury lawyers at OConnor and Partners as soon as possible. It is important never to make assumptions about your legal rights or your options for pursuing them. Consult with an experienced personal injury attorney instead.