How Identity Crime Occurs

There are numerous ways in which offenders are able to facilitate identity theft of an individual or Body Corporates and subsequently fabricate and manipulate that identity, including:

- Theft of mail articles

- Hacking of websites or business servers containing personal information databases

- Fake online social media profiles

The use of stolen, fabricated or manipulated identities to commit or enable crime has been enhanced by the expansion of new technologies and change in online behaviour.

Identity Theft is organised crime. It is used to facilitate fraud offences but also used for terrorism, drug importation, people smuggling and money laundering.

Extent Of Identity Theft

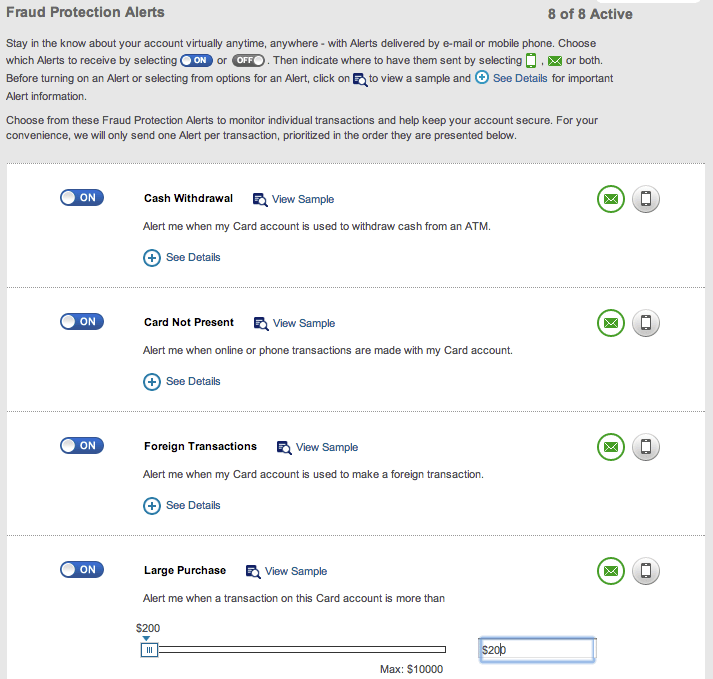

The extent of identity theft is hard to quantify as most victims do not know they are victims until their personal information has already been used, if at all. With increasing levels of fraud, financial institutions have become more experienced in identifying fraud, and can terminate fraudulent transactions often before the victim realises they are a victim.

According to the Australian Bureau of Statistics the scale and impact of personal fraud is hard to measure, due to issues of definition, awareness of victimisation, low reporting rates and inconsistent data recording practices among agencies that detect or deal with these incidents.

The ABS conducted a national survey from July 2014 to June 2015 about Personal Fraud which covered Identity Theft.

- In that 12 month period, an estimated 126,300 persons in Australia were victims of identity theft .

- The majority of persons who experienced identity theft experienced a single incident only

The credit agency VEDA conducted a similar survey in 2015 claiming that 17% of Australians were the victim of identity theft however the validity of this result is questioned due to a commercial interest by the company.

Auras White Glove Fraud Resolution Team Can Assist

Save time and hassle by allowing Aura to monitor and alert you to any new inquiries to your credit file across all 3 major credit bureaus .

Auras White Glove Fraud Resolution service eliminates the stress of recovering your identity and assets if youâre a victim of identity theft or financial fraud. A dedicated Aura case manager will work with you to craft a mitigation and remediation plan to recover your damages. Auras team of trained experts will help you navigate the challenges of dealing with credit bureaus and federal institutions.

Victims of identity theft have a right to:

Also Check: Can I Call The Police Department To Ask A Question

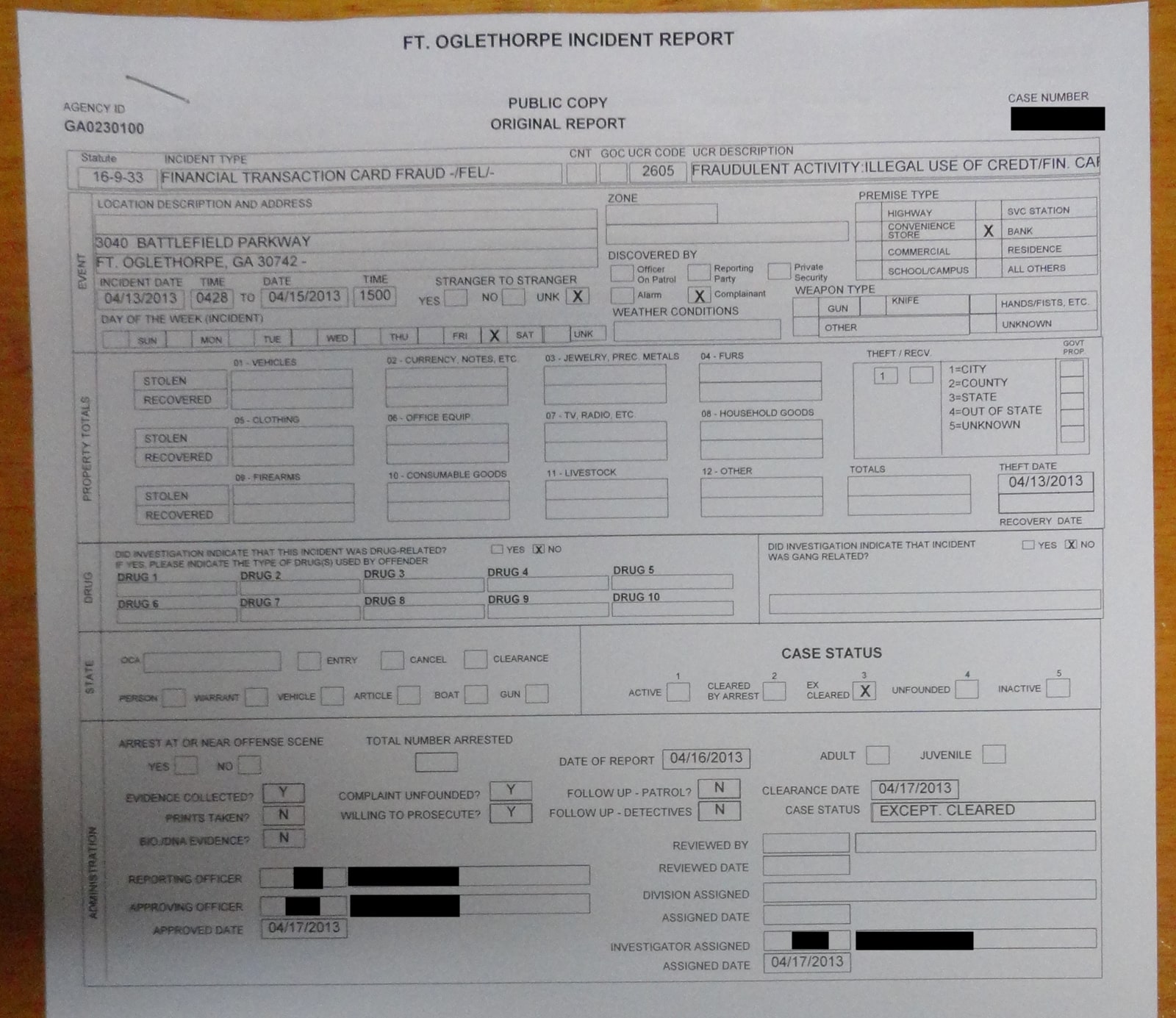

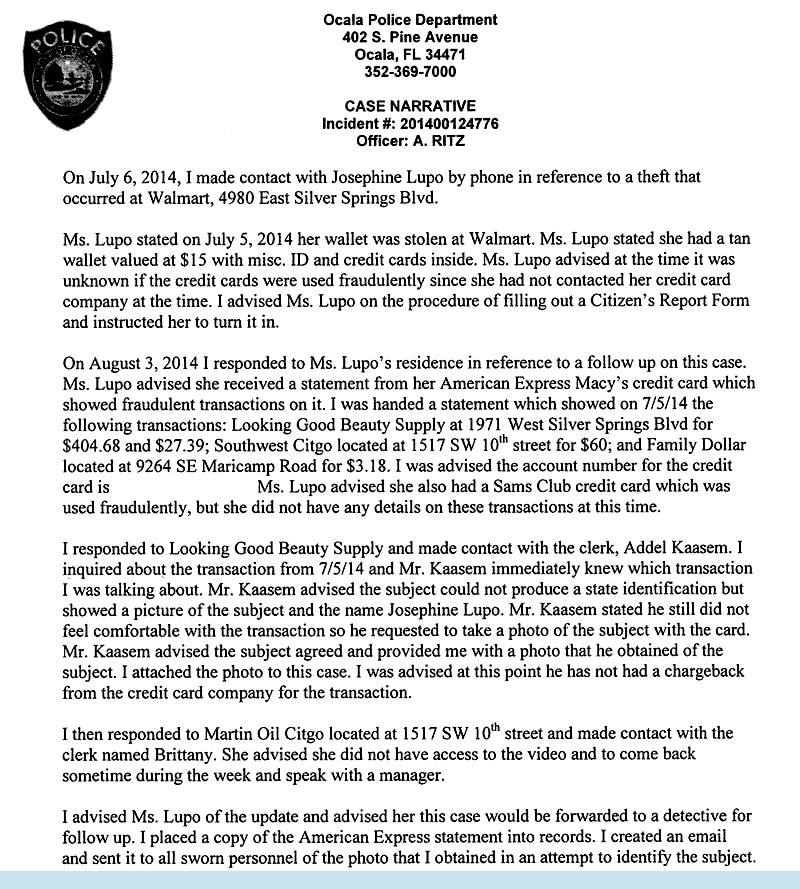

Reporting The Credit Card Fraud To Law Enforcement

If you’ve confirmed that you’re a victim of credit card fraud, you may want to report the crime to law enforcement. To begin this process, visit the Federal Trade Commission’s IdentityTheft.gov website. The site will then give you the opportunity to file an identity theft report, which is used by law enforcement agencies in their investigation. You can then follow up with local law enforcement, as advised by your creditors.

Not every case of identity theft necessitates getting the police involved, but doing so can help assist in investigations of theft and might help you recover belongings that were stolen along with your credit cards.

Review Your Credit Reports Carefully

When you receive your credit reports, read them carefully. Look for accounts you dont recognize. Look in the inquiries section for names of creditors from whom you havent requested credit. You may find some inquiries identified as promotional. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit. Promotional inquiries are not signs of fraud. Also, as a general precaution, look in the personal information section to verify your Social Security number, address and name.

If you find anything you dont understand, call the credit bureau at the telephone number listed on the report. Tell them you want to block, or remove, any information on the report that is the result of identity theft. For more on what to tell the credit bureaus, see the Privacy Rights Clearinghouses Identity Theft: What to Do When It Happens to You.

Also Check: Is It Hard To Become A Police Dispatcher

Ive Been A Victim Of Fraud Now What

If you lost money as a result of the fraudulent communication, you may file a report online.

To prevent further loss of monetary funds, please ensure you take the following steps:

If you have provided personal information but have not lost any money, please contact the Police Reporting Unit at 613-236-1222, extension 7300 to file a report as a report cannot be filed online.

Contact Us

Recommended Reading: What To Do To Become A Police Officer

How To Report Credit Card Fraud

If you spot unauthorized transactions on a card, the best way to report credit card fraud is to call your credit card issuer. Its safe and easy to use the number on the back of your card, since you know this is the official phone number. But, if you dont have your card, you can usually find the issuers phone number on a recent billing statement or by logging in to your online account.

Youll want to use the phone number associated with your account if possible, as this will reduce the number of security questions you need to answer. Once you get a representative, tell them that youve detected an unauthorized transaction on your account.

This same advice holds true if your card has been lost regardless of whether it has been used. Report it immediately in order to prevent that loss from turning into fraud.

You May Like: When Does Police Use Of Force Become Excessive Or Unjustified

Don’t Miss: How To Look At Your Police Record

Was Your Identity Stolen Here’s How To File A Police Report

If your personal information has been compromised, you may need to file a police report for identity theft.

The sooner you report identity theft, the faster you can prevent further damage to your financial reputation.

However, victims of identity theft are often surprised to hear that filing a police report is only required in certain situations.

Filing an Identity Theft Report with the Federal Trade Commission should be your top priority.

In this guide, you’ll learn when you should file a police report if your identity was stolen.

The Credit Card Fraud Investigation Process

Because of the sensitive nature of credit card fraud investigations, it may take longer for the card issuer to respond. Some cases may involve notification of law enforcement based on the severity of fraud and identity theft. Card issuers may issue a dispute letter to merchants if they determine that their complaint is valid. As soon as the merchant has proof that the transaction was authorized by the card, he or she has the option of submitting a claim.

You May Like: How Many White People Were Killed By Police In 2020

What To Do If Your Identity Has Been Stolen

If you are a victim of identity theft, the FTC recommends taking the following four steps as soon as possible.

As you work through these steps, its important to keep a record with the details of all your conversations and copies of all correspondence.

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Read Also: What Do Military Police Do

How Card Issuers Investigate Fraudulent Charges

Once a suspected fraud transaction is noticed, your credit card issuer may cancel your card, send you a replacement and start a fraud investigation. It may also refund the amount back to your account. Even if it doesnt immediately issue a refund, youre not responsible for disputed amounts during the investigation.

A credit card fraud investigation could take up to 90 days, during which time the credit card issuer may contact the merchant that charged your card to get more details about the transaction. The card issuer may request copies of a police report or receipts to compare signatures if theyre available.

Card issuers and merchants may also look for friendly fraud, which is when a cardholder makes a purchase and then disputes it as fraudeven though it wasnt.

If fraud has occurred, the outcome of the investigation will also help the merchant and credit card issuer settle who is responsible for covering the fraudulent purchase . Either way, you wont pay anything if your cards payment network provides $0 fraud liability.

Is There A Difference Between Credit Card Fraud And Identity Theft

While Identity thieves use your personal information to gain access to much more than a credit card account.

That being said, credit card fraud and identity theft see about the same amount of activity across the nation.

Once an identity thief gets your social security number, address, and driver’s license information, they can do a bit more damage to your credit history. In either case, you are going to need to involve the local police in the matter.

Recommended Reading: Can You Lookup Police Reports

Should You File A Police Report For Credit Card Fraud

You usually don’t need to file a police report for credit card fraud.

However, if you also believe your identity has been stolen, you should take additional steps. One such step is to file an identity theft report with your local police station. Another such step is to contact each of the major credit bureaus to set up a fraud alert on your credit reports, or even place a .

Reporting To The Federal Trade Commission

Recommended Reading: What Hours Do Police Officers Work

Contact The Credit Bureaus

- Reach out to one of the three bureaus confirm your identity and ask for a free fraud alert to be linked to your report. Once the alert is placed, it will become much harder for fraudsters to use your information maliciously. Note that you only need to order a fraud alert with one bureau: the others will be notified automatically.

- You can extend the default fraud alert lifespan to seven years, but you’ll need a police report or the Federal Trade Commission report to do this.

What Can I Do If I Am A Victim Of Identity Theft

Report the identity theft to the police.

Get a copy of the police report so that you can share it with your financial institutions, credit card issuers, the credit reporting agencies, and any other companies.

Tell the financial institutions, credit card issuers, or companies that are involved.

You may need to change your account numbers, your PINs, and get new debit and credit cards.

Report the identity theft to the Canadian Anti-Fraud Centre .

They provide advice and assistance to victims. Call 1-888-495-8501 or visit www.antifraudcentre-centreantifraude.ca.

Cancel any missing or stolen identification documents.

Immediately cancel government-issued documents like your drivers licence, passport, birth certificate, or health card and get new ones as soon as possible.

Contact Service Ontario at 416-326-1234 or toll-free at 1-800-267-8097.

Contact Equifax and TransUnion.

They are the two main credit reporting agencies in Canada. Ask both agencies for a copy of your credit reports. They must send you a free copy of your report in the mail if you ask them to. Review your credit reports and let them know if you want to dispute a debt. Ask if a fraud alert should be placed in your file.

Contact Equifax at 1-800-465-7166 or www.equifax.ca. Contact TransUnion at 1-800-663-9980 or www.transunion.ca.

You may need legal help for some situations.

Call Pro Bono Ontarios help line at 1-855-255-7256.

Read Also: What Qualifications Do You Need To Be A Police Officer

What Is Credit Card Fraud

in which criminals make purchases or obtain cash advances using a credit card account assigned to you. This can occur through one of your existing accounts, via theft of your physical credit card or your account numbers and PINs, or by means of new credit card accounts being opened in your name without your knowledge. Once they’re in, thieves then run up charges and stick you and your credit card company with the bill.

Because card issuers are well-versed in dealing with card fraud, it’s unlikely that being defrauded will cost you money out-of-pocket over the long haul, but necessary investigations can take months and, as discussed at greater length below, unaddressed credit card fraud can do major damage to your credit reports and scores.

Dealing with credit card fraud can cost you a great deal of time and aggravation, and the theft of hundreds of millions of dollars every year adds to the overall cost of using credit cards for all account holders.

Credit card fraud is a form of a broader category of crime known as identity theft, by which criminals use your personal information to impersonate you and hijack your finances. In addition to credit card information, identity thieves can use credentials including your name, date of birth, address and Social Security number to take over bank accounts, take out loans in your name, and apply for bogus tax refunds, unemployment benefits and Social Security checkstaking advantage of benefits you’ve earned.

Is Credit Card Fraud Reported To The Police

You can either file a complaint with the police department or request an officer to visit your home. You must include all relevant information you have about credit card fraud. If you provide your contact information and personal information, you should be prepared to do so. The police report you file will not be subject to any fees.

If you suspect that you have been a victim of identity theft, please file a report with Fairfax County. Credit card forgery is committed when someone signs a or draft. Its a good idea to keep a close eye on your credit reports. One free credit report per year must be provided by the three major credit bureaus in order to qualify for the Fair and Accurate Credit Transactions Act.

You May Like: Can I Sue The Police For Negligence

If Your Driver’s License Or Dmv

Immediately contact your local DMV office to report the theft. Ask them to put a fraud alert on your license. Then call the toll-free DMV Fraud Hotline at 1-866-658-5758. If the thief is using your license as ID, you may want to change your license number. Ask DMV for an appointment. Take a copy of the police report and copies of bills or other items supporting your claim of fraud. You will also need to prove your identity. Take current documents such as a passport, a certification of citizenship or naturalization, or a U.S. military photo ID. DMV will issue a new license or ID card number when you meet all the requirements.

Getting Local Law Enforcement Involved

After you have the affidavit complete, you can either go to a local police station or have an officer come to your home. Filing a police report of the incident shouldn’t cost you anything but policies do vary from state to state and town to town.

Be prepared to produce the following items

- Government-issued photo ID such as a state-issued driver’s license

- Proof of residency

- Proof of the fraud

Be sure to keep a copy of the police report for your records. Local law enforcement will issue a case number for the police report, and you will need that number when corresponding with the police concerning your case.

Recommended Reading: Can I Get Police Accident Report Online

What Happens When You Report Credit Card Fraud

When you call your card issuer to report credit card fraud, the representative will ask you questions and then usually deactivate your compromised card and card number. Youll be issued a new card, which will generally be sent to your home address. If you need the card urgently, be sure to say so as the issuer may be willing to overnight you the new card.

Usually, calling your card issuer is all you need to do if you detected unauthorized transactions on just one card account. But, its a good idea to check your credit report, keep an eye on your other accounts and bank statements and regularly change your online passwords. When you check your credit report, look for unfamiliar inquiries, new accounts you didnt authorize or addresses where youve never lived as these can be signs that someone has stolen your identity. And, make sure you recognize all activity on your accounts and bank statements. If you notice any issues, take appropriate action quickly as you could be a victim of identity theft.

Related reading: How to check your credit score for absolutely free