What Happens When You Report Credit Card Fraud

When you call your card issuer to report credit card fraud, the representative will ask you questions and then usually deactivate your compromised card and card number. Youll be issued a new card, which will generally be sent to your home address. If you need the card urgently, be sure to say so as the issuer may be willing to overnight you the new card.

Usually, calling your card issuer is all you need to do if you detected unauthorized transactions on just one card account. But, its a good idea to check your credit report, keep an eye on your other accounts and bank statements and regularly change your online passwords. When you check your credit report, look for unfamiliar inquiries, new accounts you didnt authorize or addresses where youve never lived as these can be signs that someone has stolen your identity. And, make sure you recognize all activity on your accounts and bank statements. If you notice any issues, take appropriate action quickly as you could be a victim of identity theft.

Related reading: How to check your credit score for absolutely free

Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

Immediate Steps To Take

- File a report with the police/sheriff in the jurisdiction in which you live and get a copy of the report for the credit reporting agencies, banks and credit card companies. You can file the report at the police station or file online.

- In Denver, you can file at www.denvergov.org/policereport.

- You can also complete the ID Theft Affidavit provided by the Federal Trade Commission at www.ftc.gov.

- Consider placing a Security Freeze or Fraud Alert on/in your credit reports. See below.

Read Also: How To Be A Reserve Police Officer

Consider A Credit Freeze

The strongest protection against new accounts being opened in your name is a credit freeze, also called a security freeze. A freeze means that your file cannot be shared with potential creditors, insurers, employers, or residential landlords without your permission. For more information, see our CIS 10: How to Freeze Your Credit Files.

Replacing Lost Or Stolen Identification

Read Also: Can A Convicted Felon Become A Police Officer

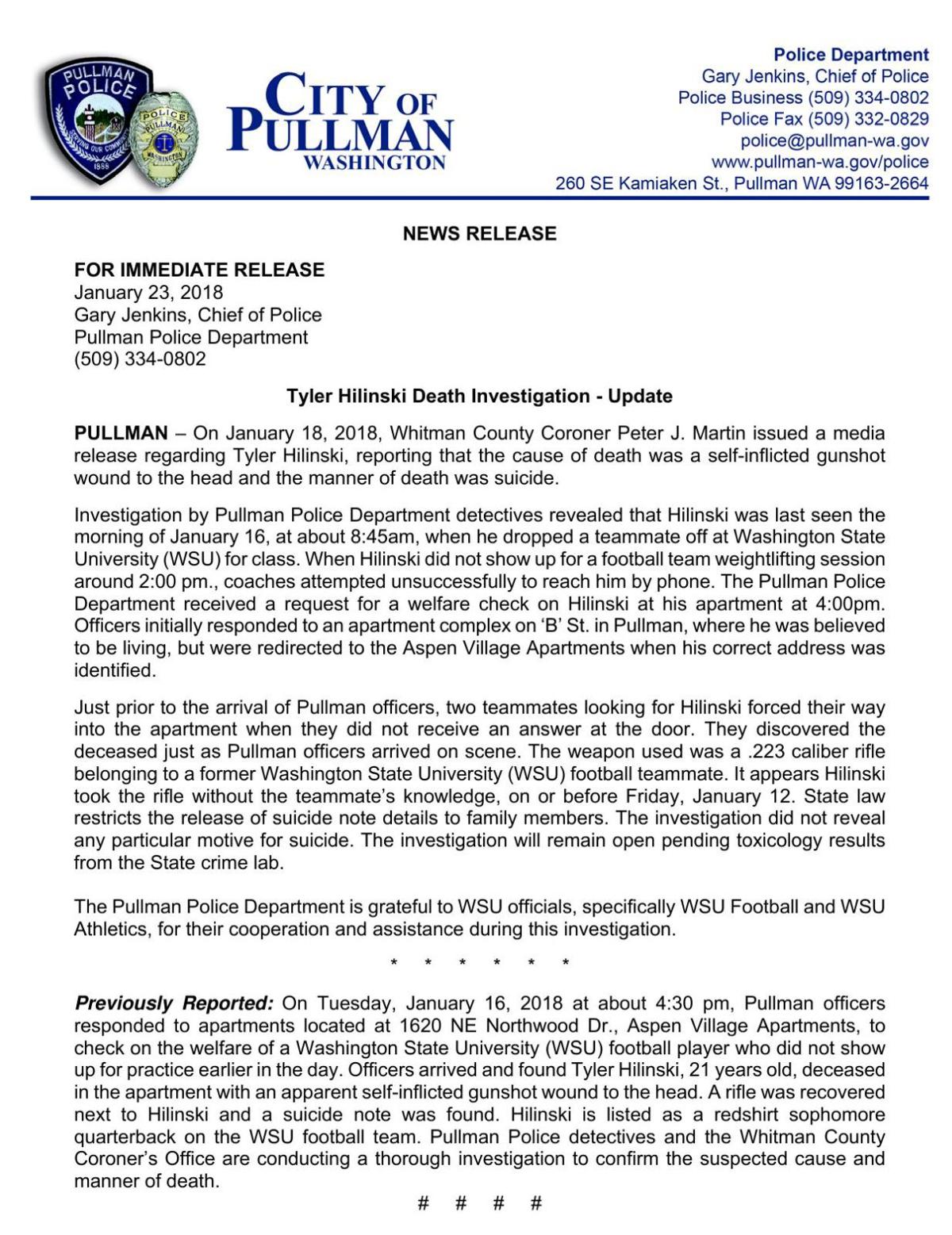

How To File A Fraud Report With Police

Reporting fraud, from embezzlement to identity theft, is important for two reasons: it can help you as a victim recover personal losses, and it can prevent other people from falling victim to the same scheme. Sometimes, whether because of the high volume of fraud reports or because your local police force is ill-equipped to deal with such cases, filing a fraud report with local authorities can be difficult. Still, you should always report a crime, including fraud, to the local police, as a police report will help protect you in the future. If you’re the victim of a fraud, close your affected bank accounts and credit cards, file a report with the Federal Trade Commission , place an alert on your credit report and begin the process of filing a police report with your local law enforcement agency.

How To Report Credit Card Fraud

If you spot unauthorized transactions on a card, the best way to report credit card fraud is to call your credit card issuer. Its safe and easy to use the number on the back of your card, since you know this is the official phone number. But, if you dont have your card, you can usually find the issuers phone number on a recent billing statement or by logging in to your online account.

Youll want to use the phone number associated with your account if possible, as this will reduce the number of security questions you need to answer. Once you get a representative, tell them that youve detected an unauthorized transaction on your account.

This same advice holds true if your card has been lost regardless of whether it has been used. Report it immediately in order to prevent that loss from turning into fraud.

You May Like: When Does Police Use Of Force Become Excessive Or Unjustified

S To Take If You Are A Victim Of Credit Card Fraud

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’ve fallen victim to credit card fraud, you’re far from alone. There were nearly 400,000 reports of credit card fraud reported to the Federal Trade Commission last year, a number that grew 44% from 2019 to 2020. The key to minimizing the damage of this insidious crime is to detect it early and act immediately. Adopting smart habits and taking advantage of resources from Experian and others can help. The right moves can even help you avoid becoming a victim altogether.

Here are some tips on how to protect yourself from credit card fraud and recover as quickly as possible if it does happen.

How To Identify An Investment Scam

Investment scams can come to you via a phone call or email. It may even be an offer from someone you trust. There are three main types of investment scams:

- the investment offer is totally fictitious and does not exist

- the investment offer exists but the money you give the scammer is not going towards that investment

- the scammer says they are representing a well-known investment company but they are lying

Example of a fake investment offer

Organised crime groups are targeting the retirement savings of middle-aged and older Australians with sophisticated fraud operations. Criminals claiming to be investment brokers initially make contact with victims by phone. They build a rapport through regular contact over the phone and by email and create a perception of legitimacy through:

- professional looking websites

- personal accounts for victims with login access

- regular reports of a strong return on investment

- media releases and in some cases

- professional-looking documents delivered via courier

For more examples visit www.moneysmart.gov.au

Read Also: Can You Call The Police For Online Harassment

Contact The Card Issuer

As long as you report credit card fraud quickly, you have no additional financial responsibility for unauthorized charges, and your maximum liability for each lost or stolen card is $50, according to federal law. In addition, youre never responsible for any charges if only your card number is stolen and used.

Heres how to report credit card fraud to your card issuer:

Place A Security Freeze

Federal law allows consumers to place and lift a security freeze on their credit reports for free. A security freeze prohibits a credit reporting agency from releasing any information from a consumers’ credit report without written authorization. Note: placing a security freeze on your credit report may delay, interfere with, or prevent the timely approval of any requests you make for new loans, credit, mortgages, employment, housing or other services.

Freezing a minor’s credit file:

Federal law also now allows parents, guardians, and representatives acting on behalf of a young person in foster care, to freeze a minor child’s credit report. In this instance, a minor is someone 16 years old or younger.

If the child does not have a credit report , parents and guardians may request that the credit reporting agency create a credit report for the child in order to freeze it.

Also Check: Are Police Officers Names Public Record

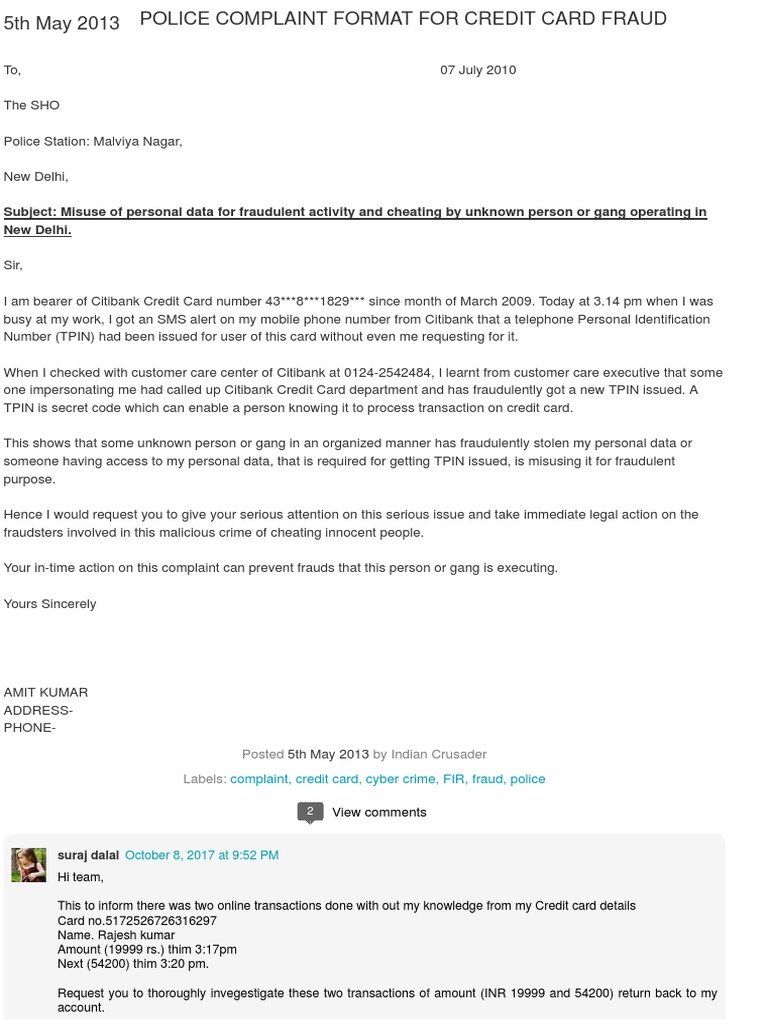

Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for “dispute” on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

Watch Your Card When It Is Out Of Reach

- When paying bills at restaurants or other locations, keep your eye on your card at all times.

- Do not give your card to a waiter and allow it to be taken away.

- Be wary of employees who swipe your card on more than one card reader.

SUPPORT: For assistance and counselling services please go to ScamNet – Help for Victims. If you need to speak to someone urgently call Lifeline on 13 11 14.

Recommended Reading: Can You Become A Police Officer With An Expunged Felony

Debit Card Vs Credit Card Fraud

When it comes to protecting your wallet, its important to know what payment methods scammers are targeting. Although many credit cards offer protections or zero liability against fraud for consumers, theyre also the most frequently targeted payment method. Debit cards follow as a close second, so its best to guard your card information closely.

12. Out of nearly 2.2 million reports of fraud in 2020, only 373,423 identified a payment method.

13. Of those, 91,515 reports identified credit cards as the payment method.

14. Making up nearly 25% of fraud reports with payment identified, credit cards were the most common payment stolen.

15. In contrast, debit cards were identified as the payment method in 63,352 fraud reports.

16. Debit cards made up 17% of fraud cases that mentioned a payment method, and theyre the second most common payment method used.

17. Credit card fraud resulted in more lost dollars than debit cards in 2020, with $149 million in total losses.

18. Debit cards resulted in a total of $117 million lost in 2020.

Protect Yourself Against Bank Card And Cheque Fraud

Keep all your cards and financial details safe:

- look after your cards and card details at all times. Try not to let your card out of your sight when making a transaction

- check receipts against statements carefully. Contact your card company immediately if you find an unfamiliar transaction

- store your statements, receipts and financial documents safely and destroy them, preferably using a shredder, when you dispose of them

- sign any new cards as soon as they arrive

- cut expired cards through the magnetic strip and chip when replacement cards arrive.

Secure your PIN:

- memorise your PIN and destroy any paper notification as soon as you receive it

- ensure that youre the only person that knows your PIN. Never write it down or record it. Your bank or the police will never phone you and ask you to disclose your PIN

- when entering your PIN, use your free hand and your body to shield the number from prying eyes or hidden cameras. If you think someone has seen your PIN or if you want to change it to something more memorable, you can change it at a cash machine or by contacting your bank.

Take care when using cash machines:

You May Like: How Do I Find A Police Officer By Name

What To Do If Youre A Victim Of Credit Card Fraud

Contact your financial institution immediately if your credit card is lost or stolen. Contact it if you find payments on your credit card statement that you didnt make or approve.

If you think youre a victim of credit card fraud:

- write down what happened and how you first noticed the fraud

- contact your credit card issuer to tell them about the fraud

- take notes of who you talked to and when you spoke to them

- keep all documents that you think might be helpful when the police investigate the fraud

- contact your local police service to file a complaint

- contact other accounts that could be tampered with by the person

What Is Credit Card Fraud

in which criminals make purchases or obtain cash advances using a credit card account assigned to you. This can occur through one of your existing accounts, via theft of your physical credit card or your account numbers and PINs, or by means of new credit card accounts being opened in your name without your knowledge. Once they’re in, thieves then run up charges and stick you and your credit card company with the bill.

Because card issuers are well-versed in dealing with card fraud, it’s unlikely that being defrauded will cost you money out-of-pocket over the long haul, but necessary investigations can take months and, as discussed at greater length below, unaddressed credit card fraud can do major damage to your credit reports and scores.

Dealing with credit card fraud can cost you a great deal of time and aggravation, and the theft of hundreds of millions of dollars every year adds to the overall cost of using credit cards for all account holders.

Credit card fraud is a form of a broader category of crime known as identity theft, by which criminals use your personal information to impersonate you and hijack your finances. In addition to credit card information, identity thieves can use credentials including your name, date of birth, address and Social Security number to take over bank accounts, take out loans in your name, and apply for bogus tax refunds, unemployment benefits and Social Security checkstaking advantage of benefits you’ve earned.

Recommended Reading: How To Join The Police Academy In Florida

Reporting Internet Banking Fraud

If you receive an email asking for your bank account details, report it to the ACSC.

If you are the victim of internet banking fraud, report it to your financial institution and find out about their process for investigating the incident. Once the financial institution clears you of any involvement, generally under the Electronic Funds Transfer Code of Conduct they will reimburse your bank account. Under Victorian law, the financial institution is the victim of the criminal offence not you. The responsibility for reporting the crime is therefore with the financial institution.

If you also report to ACSC, this will give Australian law enforcement a national picture of the overall cybercrime issue and will assist in reducing the incidence of cybercrime.

For more information on unauthorised and mistaken transactions visit www.moneysmart.gov.au