If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

How To Make An Electronic Signature For Your Identity Theft Police Report Example Form In The Online Mode

Follow the step-by-step instructions below to eSign your identity theft police report template:

After that, your sample police report for identity theft is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, etc. And due to its multi-platform nature, signNow works well on any gadget, desktop or mobile, irrespective of the OS.

Am I On The Hook For The Money

Per the Fair Credit Billing Act, most credit card companies have protections for those affected by identity theft, like zero-liability policies. The law also sets the maximum liability for unauthorized charges at $50.

Fraudulent ATM, debit cards and electronic transfers are protected under the Electronic Transfer Fund Act. However, it’s important to act fast to avoid charges. If you report your debit or ATM card as lost or stolen before anyone uses it, you’re off the hook for any fraudulent charges. Otherwise, if you report your card as lost or stolen within two days of learning of the loss or theft, your maximum liability for any unauthorized charges will be $50. If you report the card as lost or stolen between two days after learning of the loss or theft, but less than 60 days after your statement is sent to you, your liability is $500. If you report a card lost or stolen more than 60 days after your statement is sent to you, your liability is unlimited.

If you are a victim of identity theft, consider keeping a security freeze or fraud alert on your credit reports while you work to undo any damage. Being vigilant against signs of identity theft and catching the theft or fraud early can help keep the damages to a minimum.

Read Also: How Can I See A Police Report

When Should You File A Police Report For Identity Theft

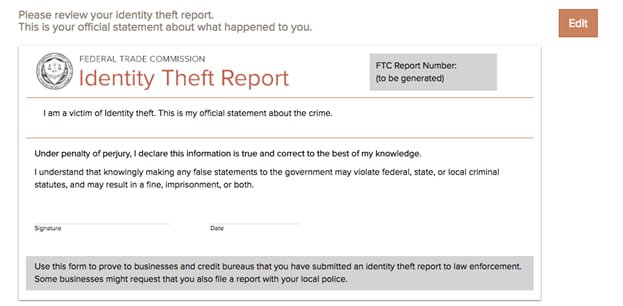

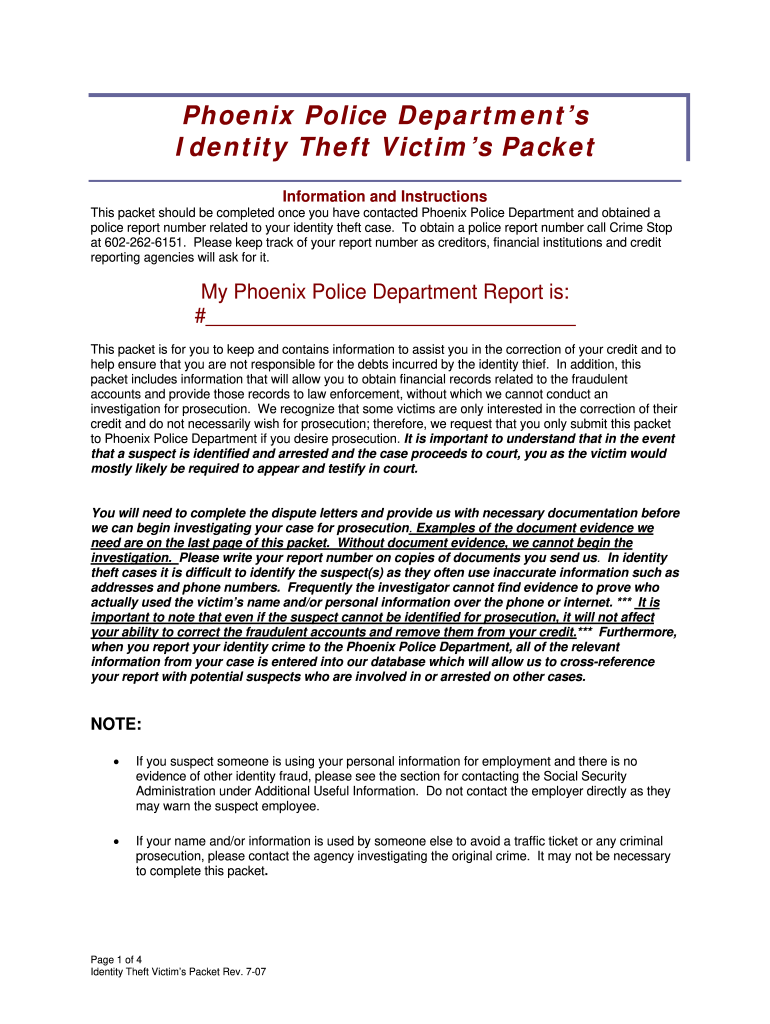

If you attempt to file a police report for identity theft, most police officers will ask for a copy of your FTC Identity Theft Report. So, follow the steps outlined above before going to your local police department.

As mentioned above, itâs not always necessary to file a police report for identity theft when you make an official report to the FTC.

Here are some instances when should report identity theft to the police:

- âYou know the person who committed the crime. If you know that a roommate, family member, friend, etc. had access to your information right before something showed up on your credit report or accounts, the police may investigate that person.

- âYou have information that could aid a police investigationinto the theftâ if someone used your name and address and then filed for a change of address in your area, this may pinpoint a potential suspect.

- âYour identity was used during a police interaction or crime. If a person stole your identity and used your name and address during a traffic stop or an arrest, you may have police records in your name even though you didnât commit the crime. Filing a police report protects you from any unwarranted penalties.

- âYour financial institutions require a police report for identity theft. Some banking institutions, credit unions, and debt collectors will need to keep an official police report on file for their records as they resolve disputes.

How To Create An Electronic Signature For The Identity Theft Police Report Example Form On Ios Devices

To sign a identity theft police report template right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your sample police report for identity theft: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as effective and powerful as the web solution is. Connect to a strong web connection and begin completing forms with a legally-binding eSignature within a couple of minutes.

You May Like: How To Get Old Police Records

Should You File A Police Report After Identity Theft

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you believe you’re a victim of identity theft, there are several steps you need to take to help rectify the situation. But is filing a police report one of them? You should file a police report after identity theft if you can provide evidence for the investigation, know the person or group responsible for the theft, or are asked for a report by a creditor or other entity.

Depending on how and what type of information is stolen, scammers may use your identity to siphon money from your financial accounts, open new accounts such as credit cards or phone plans, commit tax fraud, or apply for government benefits. In 2020, 1.4 million Americans filed identity theft reports, according to the Federal Trade Commission, a 29% increase over the previous year. The most common form of ID theft involved scammers using stolen information to apply for or receive government benefits, such as unemployment insurance.

Read on to find out the steps you need to take if you’re a victim of identity theft, and when a police report may be necessary to help resolve the issue.

Go The Extra Mile After Filing An Identity Theft Report

- âContact your bank, credit union, and credit card companies. Alert them regarding your case of identity fraud, so you can dispute fraudulent charges and unauthorized transactions instead of being held responsible for them.

- âCancel any compromised accounts and request new account numbers, card numbers, and PIN numbers. And of course, donât forget to change ALL your online passwords for your financial accounts, social media sites, online bill payment portals, and anywhere else your personal information may be stored.

- âGet in the habit of regularly checking your credit reports. Let Aura help you with this. Rather than contacting all three credit bureaus individually, Aura’s fraud resolution team can streamline the process for you.

- Consider an all-in-one digital security solution. Let Aura monitor your personal information and keep your devices secure. We’ll monitor your credit and online accounts 24/7.

- Get an Identity Theft Insurance Policy. Every Aura plan comes with a $1 Million Identity Theft Insurance policy that covers eligible losses due to identity fraud.

- Protect your family from identity theft. Keep your children and spouse safe with Aura’s family plans, which includes premium identity theft protection, credit monitoring, White Glove Fraud Resolution, and $1 million in identity theft insurance for every adult member in your plan.

Don’t Miss: How To Become A Police Officer In San Antonio Texas

Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

What If I Don’t Know Who Stole My Identity

Many people have no idea who stole their identity. Even if you don’t know who stole your identity, you can file and receive a police report. The police will ask you various questions about who may have committed the identity theft. Make sure you answer those questions truthfully and fully. But there is no need to guess or hypothesize on who may have committed the theft.

What if I don’t want to report the identity thief?

Sometimes the victim of identity theft knows who committed the illegal act – often it is a family member. If you are unwilling to file a police report and disclose the identity thief, there is little you can do to combat the theft. I encourage clients in this predicament to show some “tough love” and report the wrongdoer. Otherwise the victim cannot do anything to address the underlying issue and protect their identity, credit reports, and combat future lawsuits from the unpaid debts.

Don’t Miss: How To Lookup A Police Officer

Important Steps To Take If You Notice Any Red Flags

- Request a free credit report.

- Visit AnnualCreditReport.com which has data from the major credit bureaus: Experian, Equifax, and TransUnion.

- File an Identity Theft Report with the FTC.

- Report the Identity Theft to the Credit Bureaus.

- Consider a credit freeze.

- Notify your cellular carrier to prevent SIM swapping.

- Consider canceling all your bank accounts and credit cards.

- Immediately change the usernames and passwords to your online accounts.

Request Additional Free Credit Reports

California identity theft victims with a police report of identity theft are entitled to receive up to 12 free credit reports, one per month for the 12 months following the date of the police report. The procedure for requesting free monthly reports is different for each of the credit bureaus.

Experian: Make a single request to receive all of your free monthly reports. Mail your request for 12 free monthly reports to Experian at P.O. Box 9554, Allen, TX 75013. Enclose a copy of the police report of identity theft, a copy of a government-issued identification card , and a copy of proof of current mailing address . Also provide your full name including middle initial , previous addresses for the past two years, Social Security number and date of birth.

TransUnion LLC: Write or call in your request each month. Mail to TransUnion LLC, P.O. Box 2000, Chester, PA 19016. Or call the toll-free number printed on your most recent TransUnion LLC credit report. Provide your full name including middle initial , Social Security number, date of birth, and proof of residence .

Equifax: Write or call in your request each month. Mail to Equifax Fraud Department, P.O. Box 740250, Atlanta, GA 30374. Or call the toll-free number printed on your most recent Equifax credit report.

You May Like: Can I Go To The Police For Online Harassment

Review Your Credit Reports Carefully

When you receive your credit reports, read them carefully. Look for accounts you dont recognize. Look in the inquiries section for names of creditors from whom you havent requested credit. You may find some inquiries identified as promotional. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit. Promotional inquiries are not signs of fraud. Also, as a general precaution, look in the personal information section to verify your Social Security number, address and name.

If you find anything you dont understand, call the credit bureau at the telephone number listed on the report. Tell them you want to block, or remove, any information on the report that is the result of identity theft. For more on what to tell the credit bureaus, see the Privacy Rights Clearinghouses Identity Theft: What to Do When It Happens to Youwww.privacyrights.org/fs/fs17a.htm

S To Take If You’re A Victim Of Identity Theft

If you believe you’re a victim of identity theft, follow these steps:

Also Check: Can You Obtain A Police Report Online

Instructions And Help About Sample Identity Theft Police Report

all right Dave Sullivan here this time we’re going to talk about how to create an identity theft report if you think you’re a victim of identity theft it’s very important that you do a lot of work early on as soon as you discover that you’re a victim one of the best things that you can do is to create an identity theft report I’ll put a link down below this video on how to get over to that report you fill it out online you type it out your print it you sign it you take it down to the police department once they they take that they add it to your police report and now you have something that kind of has a little bit more of an official feel to it you then go to the repositories you should freeze your credit report right away there’s a video right here on how to do that freeze your credit report and then let them know that you’re a victim of identity theft and then any accounts that show up on your credit report you have a right to get all the information from that business so the monito

If You Are Contacted By A Debt Collector

Tell the debt collector that you are the victim of identity theft. Say that you dispute the validity of the debt. Say that you did not create the debt and are not responsible for it. Send the collector a follow-up letter saying the same things. Include a copy of your police report and of any documents youve received from the creditor. Write in your letter that you are giving notice to a claimant under California Civil Code section 1798.93, subsection that a situation of identity theft exists. Send the letter by certified mail, return receipt requested. If the debt collector is not the original creditor, be sure to send your letter within 30 days of receiving the collectors first written demand for payment.

Recommended Reading: How Much Money Do Police Make

What Kind Of Crimes Can Make Use Of A Stolen Identity

Identity thieves can also use your identity when they commit other crimes, such as entering a country illegally, trafficking drugs, smuggling other substances, committing cyber crimes, laundering money and much more. In fact, they can use your identity to commit almost any crime imaginable in your name.

Fraudsters can use your identity details to:

What Happens After I File A Report Online

- Upon submitting your completed report online, you will see the words Your online police report has been submitted indicating your report is complete.

- You will receive an email with a temporary case number until police have reviewed the report. Check your junk email folder if you do not receive the email in your inbox.

- Once a police officer has approved the online report, you will be notified and provided a permanent case number.

- The accuracy of the information you provide in the report greatly assists Peel Regional Police Service in investigating your incident. Please ensure the report is as complete and concise as possible.

Recommended Reading: Do Background Checks Show Police Reports