Filing A Police Report For Fraud

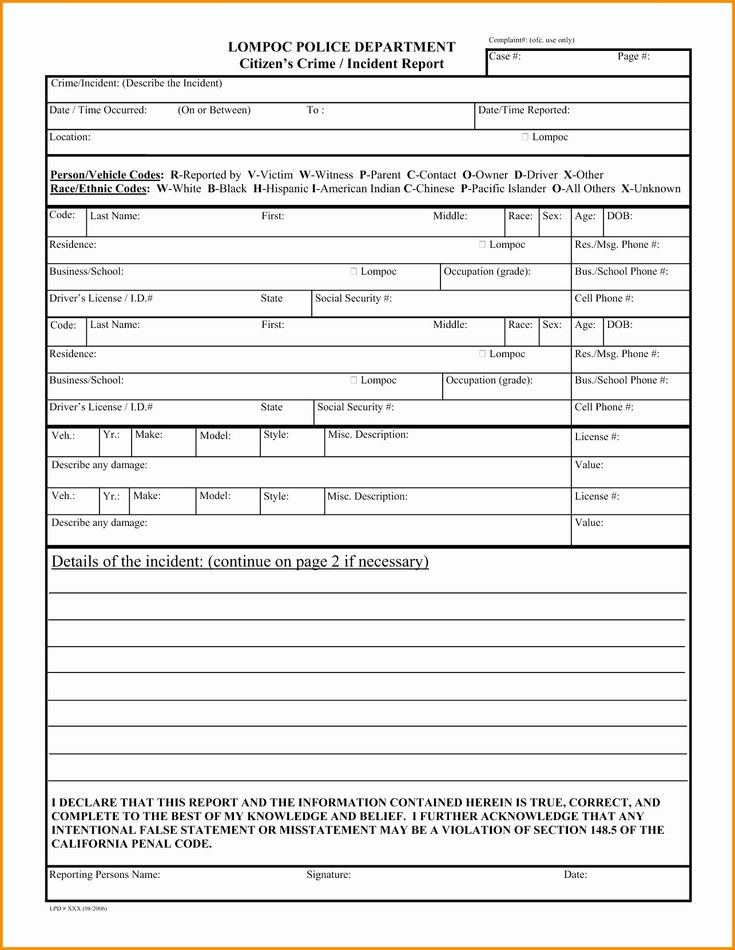

After reporting the matter to the FTC, call your local police and tell them you’d like to file a fraud report. Ask them if it’s possible to do so in person at the station. If not, ask how you can file by phone or online and take notes on their instructions. If you go into the station to file, bring a copy of your FTC report and any supporting documentation, such as your bank statements or correspondence you may have received from the thief or companies the thief has dealt with. Fill out the forms given to you by the police and ask them to attach the copy of the FTC report to your police report.

Ask for a copy of your police report. Hold on to your report as proof of fraudulent activity on your accounts and credit report. If the police cannot offer you a copy of the police report, as is the case in some jurisdictions, have the officer sign your FTC complaint form and list the police report number in the “Law Enforcement Report” portion of the complaint form.

If your local police are unwilling to take a fraud report, try filling out a Miscellaneous Incident report. Then contact your state’s attorney general to see if your state requires local police to take fraud reports. Your state’s attorney general may also have a special task force to combat fraud, and his office may be able to refer you to another jurisdiction, such as the state police, to file your report. Read More:Procedure for Filing a Police Report

Contact The Card Issuer

As long as you report credit card fraud quickly, you have no additional financial responsibility for unauthorized charges, and your maximum liability for each lost or stolen card is $50, according to federal law. In addition, youre never responsible for any charges if only your card number is stolen and used.

Heres how to report credit card fraud to your card issuer:

Request Additional Free Credit Reports

California identity theft victims with a police report of identity theft are entitled to receive up to 12 free credit reports, one per month for the 12 months following the date of the police report. The procedure for requesting free monthly reports is different for each of the credit bureaus.

Experian: Make a single request to receive all of your free monthly reports. Mail your request for 12 free monthly reports to Experian at P.O. Box 9554, Allen, TX 75013. Enclose a copy of the police report of identity theft, a copy of a government-issued identification card , and a copy of proof of current mailing address . Also provide your full name including middle initial , previous addresses for the past two years, Social Security number and date of birth.

TransUnion LLC: Write or call in your request each month. Mail to TransUnion LLC, P.O. Box 2000, Chester, PA 19016. Or call the toll-free number printed on your most recent TransUnion LLC credit report. Provide your full name including middle initial , Social Security number, date of birth, and proof of residence .

Equifax: Write or call in your request each month. Mail to Equifax Fraud Department, P.O. Box 740250, Atlanta, GA 30374. Or call the toll-free number printed on your most recent Equifax credit report.

Recommended Reading: How Long It Takes To Be A Police Officer

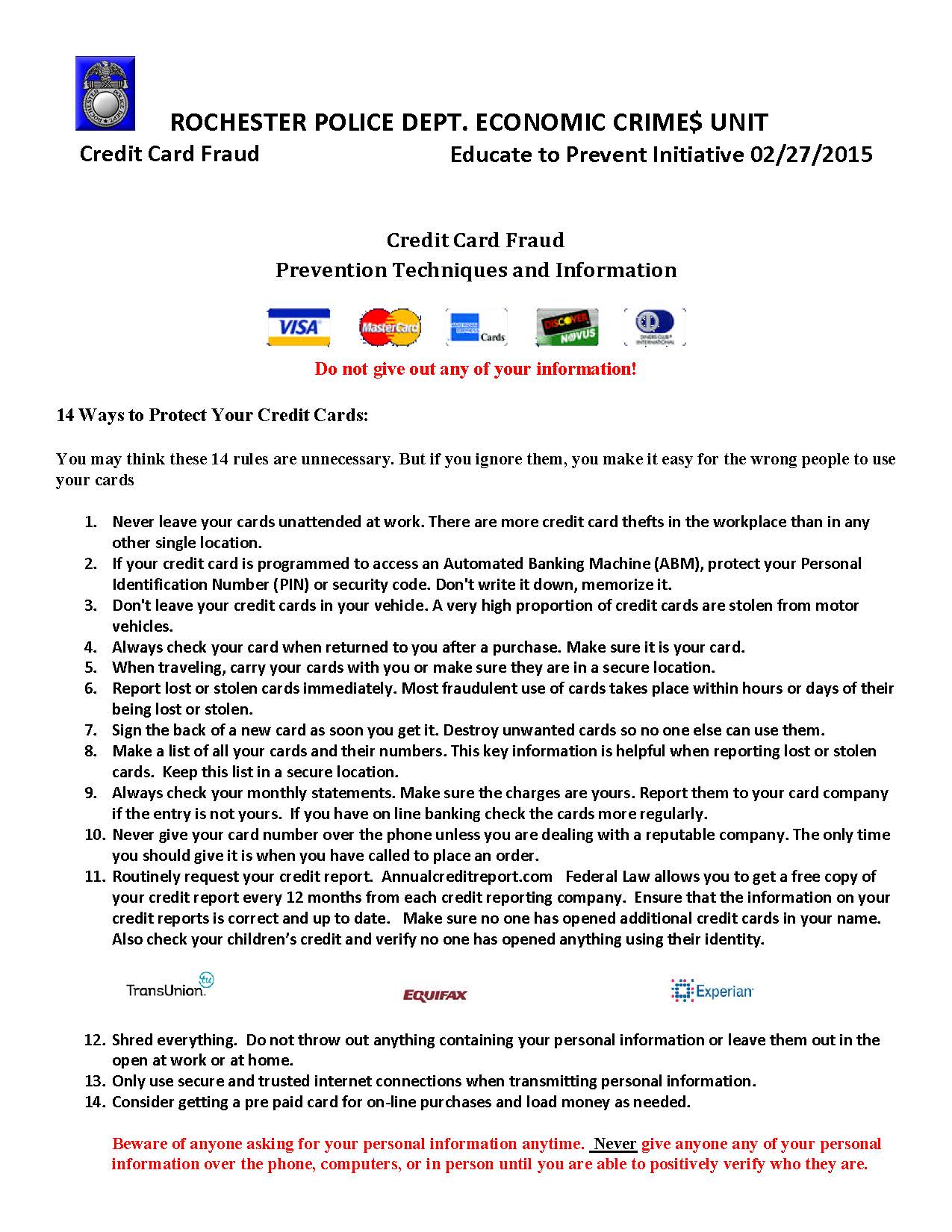

How To Protect Your Credit Card Information Offline

- Always sign the back of your credit card instead of writing Check ID or See ID.

- Dont provide your credit card information over the phone unless you have initiated the call or you trust the party or retailer.

- Review receipts before signing and save them instead of throwing them away.

- Shred receipts after youve reconciled your monthly billing statement.

If Your Debit Card Or Number Is Stolen

A debit card is an ATM card with a credit card logo on it. It accesses money directly from your bank account, and the legal protections are different from those for credit cards. If your debit card is compromised, call your bank right away and cancel the card. The bank will send you a new debit card and your checking account number will not change. The stolen money, however, will be gone while your bank investigates the matter. If you call the bank within two business days of the fraudulent transaction, your liability is limited to only $50. As time goes by, your liability for fraudulent transactions increases. If you wait more than 60 business days from the date the bank mailed the statement with the fraudulent transaction, you could lose the entire amount of the fraud.

Read Also: How Many Blacks Were Killed By Police In 2020

Reporting Internet Banking Fraud

If you receive an email asking for your bank account details, report it to the ACSC.

If you are the victim of internet banking fraud, report it to your financial institution and find out about their process for investigating the incident. Once the financial institution clears you of any involvement, generally under the Electronic Funds Transfer Code of Conduct they will reimburse your bank account. Under Victorian law, the financial institution is the victim of the criminal offence not you. The responsibility for reporting the crime is therefore with the financial institution.

If you also report to ACSC, this will give Australian law enforcement a national picture of the overall cybercrime issue and will assist in reducing the incidence of cybercrime.

For more information on unauthorised and mistaken transactions visit www.moneysmart.gov.au

What To Do If Youre A Victim Of Credit Card Fraud

Contact your financial institution immediately if your credit card is lost or stolen. Contact it if you find payments on your credit card statement that you didnt make or approve.

If you think youre a victim of credit card fraud:

- write down what happened and how you first noticed the fraud

- contact your credit card issuer to tell them about the fraud

- take notes of who you talked to and when you spoke to them

- keep all documents that you think might be helpful when the police investigate the fraud

- contact your local police service to file a complaint

- contact other accounts that could be tampered with by the person

Read Also: How To Lookup A Police Officer

Filing An Identity Theft Police Report

ID theft victims should reach out to law enforcement

If you are a victim of identity theft, you should file a police report with the law enforcement agency closest to where you live.

Your local police or sheriff department must take an identity theft report if you have documents to show you were a victim.

When you go to the police station, bring supporting documents such as:

- Copies of bills or collection notices

- Bank or credit card statements

Make sure to write down the number on the police report. Your creditors may ask for the report number.

If the officers do not want to take your report, ask to speak the watch commander and mention Penal Code Section 530.6.

County of Los Angeles Department of Consumer and Business Affairs. Last change: Oct. 25, 2011

How To Protect Yourself

There are steps you can take to minimise the risk of fraud and protect your identity. If you do not, your financial institution may hold you responsible for any losses that occur due to fraudulent transactions. If you have lost your credit card or had it stolen, contact your financial institution, and be advised whether you need to report it to the ACSC.

ACSC is a secure reporting service for cybercrime incidents that may be in breach of Australian law. Certain reports will be directed to Australian law enforcement and government agencies for further investigation. The more information you enter into a report, the better equipped agencies will be to consider your matter. The public can also access education and prevention information from the ACSC.

The following tips will help you to increase the security of your card and account details.

Be aware of general security

- keep your card safe and secure at all times

- secure your mail by locking your letter box

- tell your institution as soon as you realise your card has been stolen or lost, or if you think it may have been used without your authorisation

- never lend your card to another person

- sign the back of a new card as soon as you receive it

- consider picking up a new or replacement card in person

Guard your PINs and passwords

Take care with online transactions

Check your history

Watch your card when it is out of reach

Don’t Miss: How Do I Get A Police Report After An Accident

Types Of Credit Card Fraud

- Lost or stolen cards

A card may be picked up and used after falling from your pocket, or get taken from your wallet or mailbox. Both of these situations are considered fraud.

- Account takeovers

Takeovers occur when a fraudster contacts your card issuer and pretends to be you, then orders a new card to their address.

- Counterfeit cards

Electronic devices, like skimmers, can be used by fraudsters to copy your card information when they use it to debit your account, and then reprint it on another card.

- “Card Not Present” transactions

If a fraudster acquires your card number and uses it without the physical card present-e.g., in an online purchase-this constitutes a CNP transaction.

- Falsified credit applications

Many card issuers mail out “pre-approved” credit card offers. A fraudster can intercept one of these offers and complete it to get a new card in their name. While credit card applications from major card issuers will require many different proofs of identity to finalize approval and prevent fraudsters from opening these pre-approved lines of credit, victims of identity theft should review their credit report regularly to avoid fraud.

Shopping And Auction Site Fraud

Many people use the Internet to buy things through online shops or auctions. With some simple precautions, this can be a safe and convenient way to shop.

When you buy something from an Internet auction site, you are purchasing from an individual or company, not the auction house. Once the bidding has finished, negotiations about payment and delivery take place between the purchaser and seller. Regarding online transactions, it is advisable to select an escrow service yourself rather than accept advice from the seller. Do not click on links to banking or escrow services provided in emails as these may lead to fraudulent sites.

The auction house will usually adopt a policy of not taking legal responsibility for any loss that is suffered from using their service. Goods bought at auction are not covered by statutory warranties under the Trade Practices Act. The seller’s only obligation is to give clear title.

It is therefore important to take care when using online auction sites. The Australian Competition and Consumer Commission provides useful advice for using online auction sites or conducting transactions over the internet.

The following general advice is a good start:

Also Check: How Much Do Police Officers Make In Nc

Protect Yourself Against Plastic Card Fraud

Keep all your cards and financial details safe:

- look after your cards and card details at all times. Try not to let your card out of your sight when making a transaction

- check receipts against statements carefully. Contact your card company immediately if you find an unfamiliar transaction

- store your statements, receipts and financial documents safely and destroy them, preferably using a shredder, when you dispose of them

- sign any new cards as soon as they arrive

- cut expired cards through the magnetic strip and chip when replacement cards arrive.

Secure your PIN:

- memorise your PIN and destroy any paper notification as soon as you receive it

- ensure that youre the only person that knows your PIN. Never write it down or record it. Your bank or the police will never phone you and ask you to disclose your PIN

- when entering your PIN, use your free hand and your body to shield the number from prying eyes or hidden cameras. If you think someone has seen your PIN or if you want to change it to something more memorable, you can change it at a cash machine or by contacting your bank.

File A Complaint With The Ftc

You can file a complaint with the FTC using the FTC’s online complaint form or by calling 1-877-ID-THEFT . By sharing your identity theft complaint with the FTC, you will provide important information that can help law enforcement officials across the nation track down identity thieves and stop them. The FTC can refer victims’ complaints to other government agencies and companies for further action, as well as investigate companies for violations of laws the agency enforces.

The printed FTC ID Theft Complaint, in conjunction with the police report, can constitute an Identity Theft Report and entitle you to certain protections. This Identity Theft Report can be used to:

- Permanently block fraudulent information from appearing on your credit report,

- Ensure that debts do not reappear on your credit report,

- Prevent a company from continuing to collect debts that result from identity theft, and

- Place an extended fraud alert on your credit report.

You May Like: Can You Be A Police Officer Without Going To College

How To Identify And Report Credit Card Fraud

The good news: If you are a victim of credit card fraud, your responsibility for the fraudulent charges will be capped at $50 and-with many card issuers-you won’t be responsible for any charges made to your account. But reporting credit card fraud through the proper channels is just the first step. In addition to filing fraud reports and ordering a new card, you should consider putting a credit freeze on your accounts and checking your financial statements on an ongoing basis for any unusual activity.

Tips When Filing A Police Report

With luck, filing a police report will go smoothly. You can then concentrate on taking steps to recover from identity theft.

But some police departments may not be fully prepared to take your report. For instance, officers may be preoccupied with other crimes or unfamiliar with how to handle identity theft cases.

Here are some tips that can help.

- Be firm, but calm when seeking to file a police report.

- Try to remain flexible. The police may send you to a website to fill out a form, instead of taking your information in person.

- Contact your state attorney generals office if the police are unable or unwilling to take your report. States may have different processes for filing a report. An attorney generals office or website may be able to provide the details.

- Be specific. When you make a police report, give detailed information about the identity theft, such as dates accounts were opened in your name or who might have committed the fraud.

- Make copies of your identity theft police report and your FTC complaint. Youll need these to resolve any disputes with companies where the identity thief used your name.

Bottom line: Reporting identity theft to the police or the FTC is a smart step to take. It could save time and money as you recover from identity theft.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Start your protection now. It only takes minutes to enroll.

You May Like: Can Police Find Your Location On Cell Phone

Report Scams To The Federal Government

You can report scams to the federal government. Your report may keep others from experiencing a scam. Government agencies use reports of scams to track scam patterns. They may even take legal action against a company or industry based on the reports. However, agencies usually dont follow up after you report, and can’t recover lost money.

Do not use the agency contact information included in scam messages. Use contact information in the federal agency directory to report other government imposters.

Report Disaster and Emergency Scams

Report coronavirus scams and other scams about disasters and emergencies.

-

Use the National Center for Disaster Fraud’s web complaint form or call .

-

Find more information on identifying and reporting coronavirus scams.

Report Most Common Scams

The Federal Trade Commission is the main agency that collects scam reports. Report your scam online with the FTC complaint assistant, or by phone at . The FTC accepts complaints about most scams, including these popular ones:

- Phone calls

- Demands for you to send money

- Student loan or scholarship scams

- Prize, grants, and sweepstakes offers

The FTC also collects reports of identity theft. Report identity theft online at IdentityTheft.gov or by phone at .

Report Online and International Scams

Report IRS or Social Security Imposter Scams

Scammers often pretend to work for the Social Security Administration or Internal Revenue Service . Common signs include:

On This Pageskip This Page Navigation

If you received an email from a sender posing as Public Health Ontario offering you next steps for signing up for a vaccine certificate or asking for your private health information: Do not open it or click on any links.

*A phishing scam is an attempt to deceive you into giving sensitive information to someone posing as an individual or company that you know .

You May Like: How To Put Yourself Through The Police Academy