Are Motorcycles Or Commercial Vehicles Checked By This System

One of the limitations of the system is that it does not display results for motorcycles or commercial vehicles. Officers will be required to confirm the availability of insurance in such cases manually. Moreover, since information is only updated every two weeks, the information on the system is not real time. The officer has to verify an indication of lack of insurance with the physical proof provided by the driver before a ticket is given. Nevertheless, it has still helped ease the regulation of insurance coverage. Understanding the role of the police officer in a Michigan auto accident is critical.

While the system only targets to give officers more flexibility and faster access to information, drivers are still required to carry proof of insurance cover within their cars. It also does not mean that drivers will constantly be targeted for insurance violations. Lack of insurance is regarded as a secondary violation and is not a sufficient cause to pull over a driver. Moreover, pulling a driver over for lacking insurance will render any other identified ongoing criminal activity to be invalid since the initial cause of pulling over was invalid.

What Happens If You Get Pulled Over Without Insurance

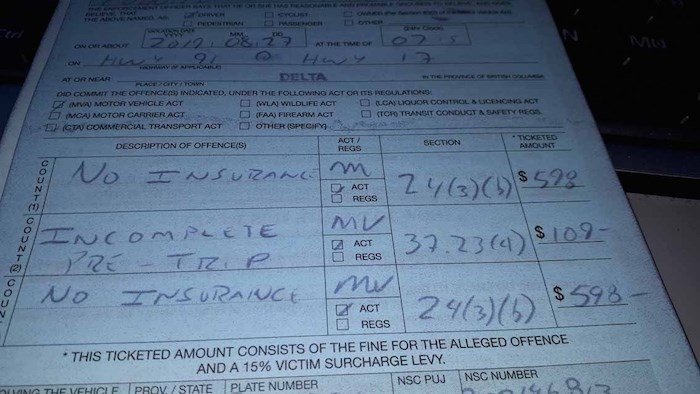

If youre caught driving without valid auto insurance, you could find yourself facing harsh penalties. The amount youll need to pay varies from state to state. Other possible outcomes of driving without car insurance include exorbitant tickets fees, license suspension, license reinstatement fees, having your vehicle impounded, and even jail time. Heres how some states deal with uninsured drivers:

Why Is Car Insurance Required By Law

You have a choice to purchase home insurance, boat insurance, and recreational vehicle insurance, but auto insurance is a form of property insurance thats required by law.

Its only natural to wonder why its your decision to buy one product and not the other, but in the eyes of the law, the potential for harm is much greater when youre driving a car.

Most state officials require vehicle owners to buy third-party protection.

This protection doesnt necessarily protect the owner but will pay for property damages and bodily injury that they might be responsible for.

Recommended Reading: How To Report Online Threats To Police

Are Police Able To Know If You Have Insurance By Running Your License Plate

One of the items the police check when stopping motorists is insurance. Therefore, before getting behind the wheel, motorists are required by law to have valid insurance. Lack of insurance or falsifications of documents is considered to be misdemeanor offenses that may result in one year of jail term or fines according to the type of offense. Lacking proof of insurance results in a fine of $143 while driving an uninsured car attracts a fine of up to $500 together with a $500 responsibility fee that must be paid in two years. Hence, lacking insurance is a rather costly affair. A leading Michigan car accident attorney at Elia & Ponto can help you or a loved one was injured in an auto accident.

Do I Still Need Insurance If I Am Test Driving A Car

Yes, you still need insurance if youre test driving a car. You can take out a temporary car insurance policy for test drives.

If youre buying a car from a dealership, they may well have insurance in place to cover you for this, but you should check. If youre buying or selling a car privately you will need to make sure that insurance cover is in place, even if it is only for a short trip. These policies can be taken out for as little as an hour.

If you need to borrow or share a car for a short trip, you can purchase Temporary Car Insurance to cover you for an hour or up to 30 days. The cover is fully flexible, so if you buy an hour you can top it up online if you need more.

There are monthly subscription and pay as you go car insurance options. Our Pay by Mile car insurance is purchased on a monthly rolling subscription that you can cancel at anytime for no charge. You pay a monthly parked premium and then only for the miles you drive as you do them.

Also Check: How Does A Police Officer Become A Detective

Why Is It Important That Cops Can Check If Your Vehicle Is Insured

The idea is that people will be so afraid of being pulled over by the police and facing the harsh fines and other law enforcement techniques that are in place in various states that they will simply not drive if their car is not insured. It is important that police can catch this as it can help reduce accidents as well as ensuring that the community as a whole is cared for. The point of this is that it will make the roads far safer for all road users. It gives people a deterrent against driving without insurance because of the harsh penalties associated with driving without insurance.

How Do Police Know If A Car Is Insured

All states require drivers to have some type of insurance. If a police officer catches you driving without insurance, then you could face penalties. But how do police know if a car is insured?

Police use various strategies to check the insurance status of a vehicle. Some police officers simply check paperwork. Other police officers check your insurance immediately after pulling you over. Some check your insurance against a public database, while others dont check insurance at all.

Today, were explaining how the police know if a car is insured.

Recommended Reading: Where Do I Get A Copy Of A Police Report

Can The Police Stop You For No Insurance Based On A Computer Check Of Your Plates

Though police can tell if you have insurance by running your plates, the Michigan Vehicle Code does not address this issue. The Michigan State Police has stated the information will not be used as a primary basis for a vehicle stop, but each police department may have its own policy. The Michigan Court of Appeals has upheld a stop for no insurance based on a LEIN check.

In its published opinion in People v. Mazzie , the Michigan Court of Appeals ruled that the police could make a traffic stop based on LEIN information showing that a vehicle in question was not insured as required by Michigan law. The judges stated:

The LEIN information gave the police at least a reasonable suspicion that defendant was operating his vehicle without insurance and, therefore, the stop and detention to check for valid insurance was reasonable under the Fourth Amendment.

What To Do If You’re Pulled Over

If you’re pulled over, and your insurance isn’t listed on the MID, don’t panic. It is not a legal requirement to show up on the MID. From the moment you buy your Cuvva policy, your insurance is valid. Your policy documents are your proof of cover – so just show them to the police officer.

You can find your policy documents in the app. Tap on the “Profile” button in the top left and then tap on your vehicle. You’ll see a list of all the policies you’ve bought.

You’ll also get an email copy of your policy documents as soon as you buy it.

Also Check: What’s A Police Officer Salary

Car Insurance Coverage For Police Officers

As a police officer, you know that accidents can happen to anyone at any time. Car insurance is designed to protect your finances if an accident does happen.

Although you likely do not have a choice about the coverage on your squad car, as those are dependent on law enforcement agencies, you can choose the coverage on your personal vehicles. As a police officer, you may want to consider the following options:

There are many different car insurance coverage choices, and different companies offer different endorsements. If you have any concerns about specific types of protection, talking with an insurance agent could be helpful.

Quick To Set Up Short

Having no car insurance in place is illegal but there are flexible, short-term car insurance options if you dont want the expense or commitment of taking out an annual policy.

Perhaps you want to test drive a car youre buying privately. You may not be covered for this on your annual policy. A test drive car insurance policy is designed specifically for this purpose and will cover you for as little as an hour.

If you need to borrow or share a car for a short trip, you can purchase temporary car insurance to cover you for an hour or up to 30 days. The cover is fully flexible, so if you buy an hour you can top it up online if you need more.

There are monthly subscription and pay as you go car insurance options. Our Pay by Mile car insurance is purchased on a monthly rolling subscription that you can cancel at any time for no charge. You pay a monthly parked premium and then only for the miles you drive as you do them.

Don’t Miss: What To Do If You Are Wanted By The Police

What Is A Car Accident Police Report

In the context of a car accident case, a police report is a written document that is usually generated at the scene of the crash, typically by the responding law enforcement officer. The police report often contains:

- details of the crash and the people/vehicles/property involved

- statements from drivers, passengers, and witnesses

- a drawn diagram of the accident , and

- in some instances, the officer’s findings or conclusions as to how or why the accident might have happened.

Do Car Insurance Companies Have Access To Police Reports In Canada

If you have been an accident, you might be wondering if your car insurance company can access police reports. Unfortunately, car insurance companies have a ton of different ways that they can access police reports. In fact, a car insurance company might ask you to give them the police report yourself after an accident. A police report is essentially evidence to an insurance company that an accident took place. The police report can give details as to who is at fault in an accident and therefore whose insurance premium should increase as a result.

Don’t Miss: How To Get A Certified Police Report

Report The Incident To Your Insurer

If you were involved in a hit-and-run and have made a police report, then you can report the incident to your insurance company to receive compensation.

Even if the other driver is unknown, your insurer must cover damage from the accident, assuming you have the right coverage.

For most hit-and-run claims, you need to pay your deductible, while your insurer covers all remaining costs. Some companies will waive your deductible after a hit-and-run.

Collision coverage covers hit-and-runs and similar incidents. If you have collision coverage, then your insurer will cover damage from the hit-and-run. If you dont have collision coverage, then you need to pay for repairs out of pocket.

After covering your damage, your insurer may seek compensation from the other driver. Your insurer may use the license plate number to identify the other driver. However, if the other driver is uninsured or if the car was stolen, then the insurer cannot obtain compensation from the other driver. Regardless, your insurer is required to cover the costs of the hit-and-run under your collision coverage.

What Are Alternatives To Satisfying A Financial Responsibility Law

If youre in a state where you can bypass insurance requirements by presenting other proof of financial responsibility, you might not need to worry about presenting police officers with an auto insurance ID card.

Here are some ways that you can comply with the law without buying insurance:

- Depositing cash with your state treasurer

- Purchasing a surety bond in an amount required by the state

- Putting up collateral for a self-insurance certificate

You May Like: How To Report Scam Phone Calls To Police

What Is A Vehicle Registration Number

All road vehicles in India are required to be registered with a licence number. The licence number is also referred to as vehicle registration number or number plate. The registration number is issued by the Regional Transport Office of the concerned state. The registration number plate is placed on the front and back of the car or bike.

As per The Motor Vehicles Act, 1988, the registration number should be in modern Hindu-Arabic numerals and Latin letters. Also, the number plate should be lit up at night so that it is visible and the fonts are required to be as per law.

The vehicle registration number is unique to each state and their locality it has been registered at. Below is the format for vehicle registration number plated in Karnataka:

-

TN or KA or DL Signifies the state.

-

01 Is the RTO that the vehicle has been registered at.

-

AA Is given when there is no number to be given and to make it unique.

-

4567 Is the registration number exclusive to your vehicle.

Law Enforcement Discounts On Insurance

Some companies offer special discounts for law enforcement officers. Some of these companies include:

- Geico: Geico offers a federal employee discount that you may qualify for as a police officer.

- Liberty Mutual: If you are a member of the Fraternal Order of Police , you may be eligible for special savings with Liberty Mutual.

- Country Financial: Police officers are eligible for Country Financials occupation discount.

- Farmers: In some states, Farmers offers an occupation discount. Speak with a local agent to see if it is available in your area.

In general, getting quotes from several providers is a good way to compare coverage, discounts and prices. This way, you may be able to find the coverage you need at a cheaper price. And while some companies list discounts online, not all savings opportunities may be advertised. Talking to a representative from each company might be the best way to find companies that offer law enforcement discounts on insurance.

Recommended Reading: How To Get In To Police Academy

Here’s What You Should Know

Vehicle collisions can be stressful when they occur, but it’s important to remember that your safety is always the number one priority. The following are a few tips to keep in mind immediately after involvement in a collision:

- Shift your vehicle into “park.”

- Check yourself and any passengers for injuries.

- If you cannot move your vehicle, or if medical assistance is needed, dial “911” and follow the operator’s instructions.

If your vehicle is operable, and neither you nor any passengers with you have suffered any injuries, you should move to a secure location before exiting to assess the situation. Doing so will:

- Protect you from oncoming traffic.

- Allow safer passage for other motorists on the road.

- Provide easier access for emergency responders to reach you, if necessary.

What Is The Penalty For Providing Fake Proof Of Insurance

Is not having auto insurance a criminal offense? Not only is it a criminal offense, but its also an additional crime to drive uninsured and attempt to use fake or invalid proof of insurance. If you hand over a card that appears to be valid, you could get in even more trouble when the officer discovers the policy was canceled for non-payment months back.

In some states, officers are allowed to arrest people on the spot who are knowingly furnishing fake ID cards. In addition to your moving violations, you may face penalties for falsifying documents or using counterfeit documents to government officials.

Also Check: Why Would The Police Call Me

Learn How To Check Car Insurance Expiry Date Online

In the last few years, Indias car insurance sector has witnessed unprecedented growth and was valued approximately at Rs.70,000 crore in 2019.

Furthermore, insurance claims have also spiked and now stand at Rs.1.2 crore nationally, which is frankly an astounding amount.

The data presented above solidifies the fact that awareness among Indias general populace regarding the importance of car insurance has considerably increased.

Nonetheless, this does not dispel the reality that carelessness and mistakes in handling insurance documents are also quite common, and can lead you to lose these policy details.

Furthermore, you may also need to track down the insurance status of a car with which you were involved in an accident.

Under such circumstances, what should be your course of action for checking the status of a cars insurance?

Take a look!

How Long Do I Have To File A Police Report

Generally speaking, your insurance company is going to want to see a police report if one is needed, when you file a claim. This essentially means that you have 24 hours to file a police report after getting into an accident. Legally, you are required to submit a police report if the damage to both vehicles exceeds $2000. You are also required to file a police report if someone is injured in the accident or if you believe anyone involved committed a criminal offense.

Recommended Reading: How To Join The Lapd Police Academy

Can Police Target Me For Driving Without Active Insurance

If youve been driving around uninsured for weeks or months without being stopped, theres a reason. Officers have the right to check your insurance status through their computer systems. These officers cannot, however, pull you over strictly because youre not insured. This is because not having insurance is a secondary violation.

Some other law must be broken before an officer will stop a driver for not having insurance or the driver charged with any criminal activity after the stop couldnt be prosecuted.

You dont even need to break the law to be penalized for driving uninsured. If you dont have insurance, theres a good chance something will be waiting for you in the mail within the next few months.