How Do Insurance Companies Use Police Reports

After a car accident, when a claim is reported, the insurance company will conduct its own investigation. One of the first things that an insurance company will ask for is the police report. This is because, as we discussed above, the report contains a vast amount of information pertaining to the car accident.

Sometimes the insurance company and police officer’s opinions are different. This is why there are times when the police report is in your favor in terms of a fault determination, but the other driver’s insurance company still denies your insurance claim.

Learn more about the role of insurance in a car accident case.

Review Your Insurance Policy

You should know exactly what you are covered for. While your insurance broker or company can provide you with this information, the claims process will be less stressful for you if you clearly understand what your specific policy will do for you. Read through your policy and understand your coverage limits.

If Your Car Can Be Repaired

Repairs to a vehicle may be necessary as a result from a claim on your own policy as a first party claimant or from your claim on someone elses liability policy as a third party claimant for damages for which the person covered by the policy becomes legally responsible. In either circumstance, the insurance company is responsible for the costs to repair your vehicle. The insurance company may recommend a repair shop however, you have the right to select the repair shop of your choosing. The amount determined by the insurer to be payable under the policy, will be paid regardless of whether or not you use the recommended repair service. No insurance company shall require the use of after-market parts unless the part is equal to the original part in terms of fit, quality, performance and warranty. Any modifications made necessary because of the use of after-market parts shall be included in the estimates.

If you, as the first party claimant, disagree with the amount of the loss, your policy contains an Appraisal Provision, where you and your insurance company select a competent appraiser and the two appraisers will select an umpire. The appraisers will state separately the Actual Cash Value and the amount of the loss. If they do not agree, they will submit their differences to the umpire. A decision by any two will be binding. You and the insurance company will each pay their chosen appraiser and bear the expenses of the appraisal and umpire equally.

Read Also: How Do I Know If Police Report Was Filed

Reporting To The Police

There are certain situations in which you are required to immediately report an accident to the police. When you do, the police will come directly to the scene. Here are five accident situations that you must report:

- Someone has been killed or injured in a car crash in Ontario

- There is damage to public or private property

- At least one of the drivers appears intoxicated

- The accident involves a cyclist or pedestrian

- At least one of the drivers is unlicensed or uninsured

There is one other situation in which you must report an accident to the police, and that isIif the total amount of damage estimated is more than $2,000. However, depending on the situation, the police may not come out to the scene.

Youre Legally Required To Report Some Accidents

Different states have different rules. However, in virtually all jurisdictions in the United States, you need to immediately report all accidents involving death or bodily injuries. Youll need to report the incident to the local police, sheriff, or highway patrol.

Furthermore, if the injuries or property damage exceed a certain amount typically around $1,000 then the incident will need to be reported to your states Department of Motor Vehicles .

Failing to report an accident can result in penalties like a one-year suspension or worse.

In general, you should report all accidents immediately to the local police. The police will make a report if necessary, but if its a minor accident with minimal damage or injuries, then it may not be necessary.

Even if you dont intend to make a claim, you should report all accidents to your insurance company. Your insurance agent can help you decide if its in your best interest to make a claim or if youre better off paying out of pocket.

You May Like: How Long Is Police Training

Are Accident Reports Required At All Collisions

Unlike major collisions, which need to be reported to law enforcement immediately, minor fender benders are a different story. If your auto accident resulted in no injuries and minor damage, estimated to be less than $1,000 total, then you are not required by law to report the accident in most cases.

It still may be in your best interest to report a minor accident. Why?

When you contact the police, officers will come out to the scene of the accident and investigate your crash, writing down their findings in their police report. If you decide to file an insurance claim or pursue a personal injury lawsuit, the information in this police report will be incredibly vital for your case, as many times, it will discuss not only what happened but who was at fault for the collision.

In fact, reporting the accident is just one of many steps you should take after an accident.

How To Report An Accident To Insurance

Fact-checked with HomeInsurance.com

Accidents are never a good thing, but they happen more frequently than you might expect. Whether youre in a fender-bender or multi-car collision, knowing what to do after the accident is something you should learn beforehand. It enables you to handle the situation effectively in the chaotic moments following an accident.

In this report, well look at when you need to report an accident to your insurer, and when you might not need to report it. Well also review what information you should provide and what to expect after youve reported your accident.

Don’t Miss: How To Sign Up To Become A Police Officer

What Is A Third

Here are some tips to ensure you maintain your cool and your sanity when making a claim with someone elses auto insurance company, known as a third-party claim. .

Typically, you file a third-party claim when you are involved in an accident in a no-fault state and the accident is not your fault.

Since you arent at fault, the other drivers state mandated liability insurance coverage would generally pay for damage to your car and property and for your medical bills for injuries, up to the limit of the policy. In no-fault states, however, regardless of who is determined to have caused the accident, youd file a claim with your own insurance company.

Key Takeaways

- Filing a claim with someone elses insurance company is called a third-party claim. A claim with your own insurance provider is a first-party claim.

- Its vital to not only call the police, but gather as much information as possible at the accident scene to make the claim process easier.

- Inform the other persons insurer that youve been in a crash with one of its policy holders dont assume the other driver will report this.

- Some car insurance companies may demand authorization before proceeding with any vehicle repairs or injury treatments.

Where Is My Accident Record Kept

Insurance companies collect and report your driving record and accidents to third party vendors who keep a database detailing the information. The reports are referred to as your MVR and C.L.U.E. reports.

These reports are run for property and casualty insurance underwriting purposes. These reports ensure insurance companies properly rate an individual for auto or property insurance based on their statistical chance of filing a claim.

Without these reports, we could simply switch insurance companies after every claim and present ourselves to another insurer who would rate us as claim-free.

Insurers would lose a lot of money if they werent able to keep track of everyones driving records and claims history.

Also Check: How Do You Apply To Become A Police Officer

Why Would I Wait To File A Claim

After an accident, some damages or injuries do not become apparent until days or weeks later. If you think this may be the case with you, it may be a good idea to wait to file a claim. However, you should be aware of your states statute of limitations and file a claim within the time set by the government. If you file later than the time limit, the insurer has the right to reject your claim.

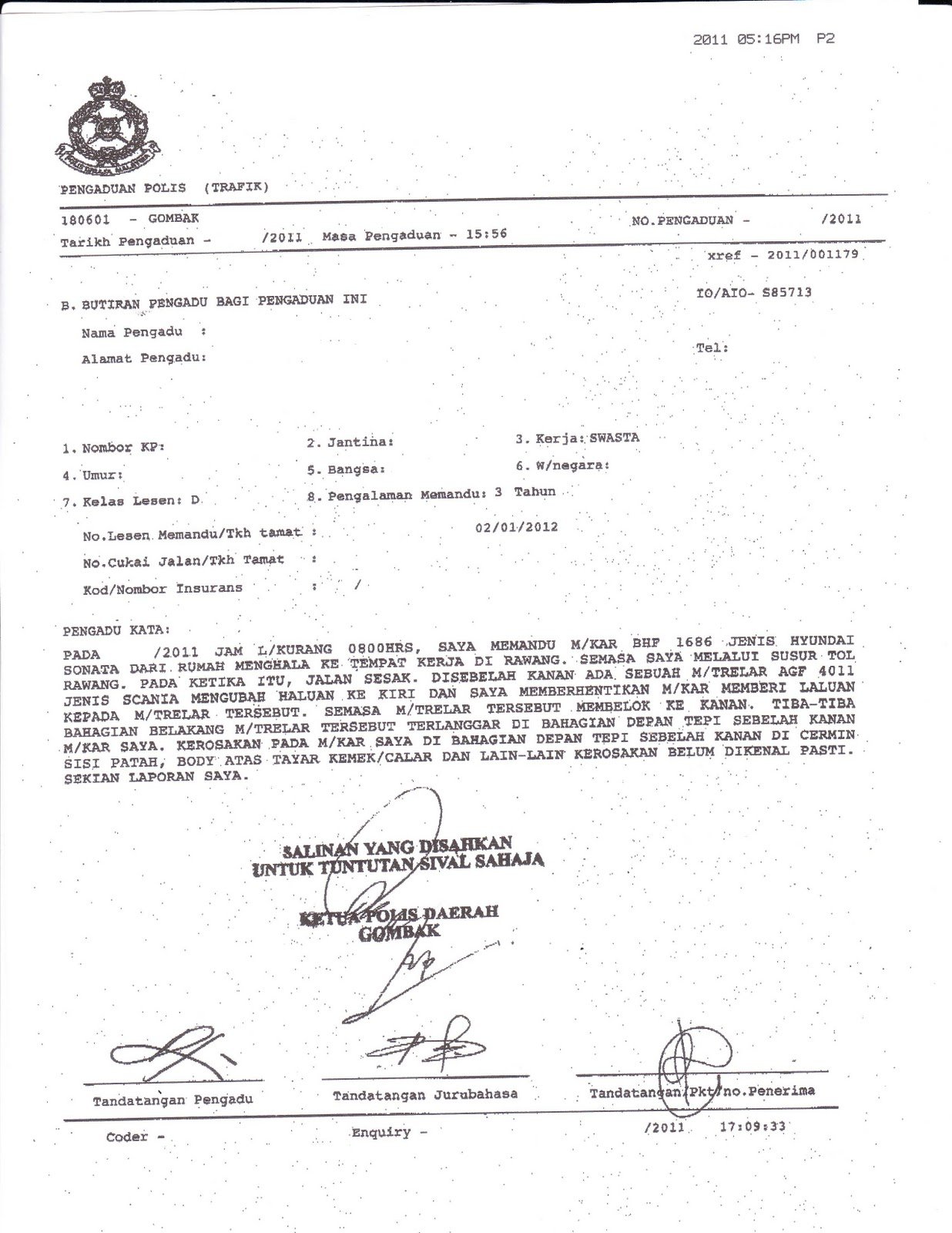

Using The Car Accident Police Report To Support Your Insurance Claim

The police report can be key evidence in a successful auto insurance claim. See how using a crash report can boost your injury compensation.

If youre in a traffic accident, you expect the at-fault driver or their auto insurance to compensate you for your damages. But insurance companies dont just hand over their money.

It may be clear to you that the other driver caused the crash, but you have to prove it to the claims adjuster. Police reports are powerful evidence that can help you meet your burden of proof.

Police accident reports are usually available within a week or two of the accident. Most reports can be ordered online for a small fee. If you need help requesting a report, contact the state or local law enforcement agency that handled your accident investigation.

Heres where we unpack whats in a car accident police report, how to use the report to support your claim, and what to do if youre in a crash that doesnt result in a police investigation.

Recommended Reading: How To Become A Police Officer In Huntsville Alabama

How Long Accidents Stay On A Driving Record

When you’re involved in a car accident, whether you’re at fault or not, it can be reported to the Department of Motor Vehicles in your state. The accident then becomes part of your driving record. Which state you live in can determine how long an accident remains on your record.

Here are some examples of how long states maintain accident records for drivers:

- California: Three years from the date of the accident

- New York: Three years from the end of the year in which the accident occurred

- New Hampshire: Five years from the date of the accident

- Oregon: At least five years

As you can see, the typical length of time an accident can remain on your record is three to five years. But it’s important to check the driving record requirements in your state as they may be different.

In terms of how a car accident can affect your car insurance rates, it typically depends on several things include:

- The seriousness of the accident

- Who was at fault

- Prior driving record

- Where you live

Your insurance company can also determine what you’ll pay, as every insurer rates accidents differently. Though it can be difficult to predict an exact increase amount, it’s safe to assume that if you’re involved in a car accident you can expect to pay more for insurance going forward.

What Are The Risks Of Not Reporting A Car Accident

If you decide to skip reporting a car accident, you are susceptible to many different risks. If the other driver happens to report the accident to an insurance company, you risk your insurance being completely canceled because you didnt file a claim. Also, if the other driver happens to file a police report, you can even be charged with leaving the scene of an accident. This can lead to jail time and a large fine. The other driver may decide not to pay for your repairs, even if they are at fault, which means that youre on the hook for them. Finally, you could even be taken advantage of by the other driver in the case of insurance fraud. Keeping these things in mind, it probably is not worth the risk to not report a car accident to your insurance company.

You May Like: What Type Of Radio Do Police Use

Do You Have To Report A Car Accident Reporting Accidents To The Police And Insurance

Home / Blog / Do You Have to Report a Car Accident? Reporting Accidents to the Police and Insurance

If you have been in a serious car accident, you must report your vehicle collision to the police and the insurance company. Not only does state law often dictate that you are required to notify these appropriate parties but failing to do so can impact the value of your claim and leave you on the hook for thousands of dollars.

That is why no matter how overwhelming the scene of a car accident may be or how many things you have running through your mind, it is vital that after a crash, you take specific actions.

These steps will not only ensure you stay safe after an accident but that your legal rights also remain protected.

To better help you understand these specific actions, this blog post will walk you through two of the more critical stepsfiling a police report and an insurance claim and what can happen if you decide not to follow through with them.

Do You Need A Police Report For A Car Insurance Claim

Claims for things such as windshield chips dont require police accident reports, obviously, but claims involving collisions definitely do. This is a standard operating procedure. In Ontario drivers are required by law to report any collisions that meet or exceed $2,000 in damages.

Having said that, most drivers dont know how to estimate the value of damage to a vehicle just by looking at it . The truth is that even modest fender benders can create a significant bill because of several factors:

- Car parts are suspiciously expensive.

- New vehicle parts may be embedded with sensors or cameras.

- Labour costs to re-install parts and recalibrate electronic components.

- Internal damage would only be visible to a mechanic.

Most insurance companies want a police report for car insurance claims anyway so that they have documents and context to help them assess fault and to coordinate with the other drivers insurance company.

In practice, police officers on the scene will just tell you to report the accident at the nearest reporting center, and youll end up doing exactly that before getting on the phone with your insurance provider. It makes everything easier.

Recommended Reading: What Do You Major In To Become A Police Officer

Do I Need To Call The Police For A Minor Car Accident

You have a legal obligation to report accidents to your insurer under the terms and conditions of your car insurance policy. If you do not report your accident to your insurer, they may deny coverage for your accident.

As for reporting your car accident to the police, accidents involving an injury, death, a hit-and-run, an intoxicated driver, or property damage more than $500 must be reported immediately to law enforcement. If you dont call the police and have them fill out a report documenting the accident and gathering facts, then its your word against the other drivers word. This makes your claim difficult and can cause significant problems in any case.

I’ve written a book Quick Guide to Louisiana Accident and Injury Claims. This is a helpful and informative guide that will lead you through some of the common mistakes that can wreck your personal injury claim. Discover why you may not even need an attorney! Get answers to your questions about recorded statements, paying medical bills, getting your vehicle repaired, negotiating a settlement, and much more! Don’t make a costly mistake that could cause you to accept a settlement that is too small to cover your medical bills and lost wages! You need to read this before you talk to an attorney or insurance adjuster. I’d love to send you a copy. Just click here to receive your free copy of my book Quick Guide to Louisiana Accident and Injury Claims.

Does A Police Report Say Who Was At Fault

Car accident reports convey the impressions of the responding officer at the scene. While the police officer may give their opinion of who was at fault, the insurance company and your attorney may each conduct their own investigations and ultimately reach different conclusions about who was to blame for the accident.

Whatever the officers opinion is, our skilled Houston car accident attorneys can gather evidence to support or refute their statements as needed. In addition to the police report, other evidence your attorney can collect includes:

- Statements from all drivers or passengers involved

- Statements from witnesses at the scene

- Surveillance tapes from nearby stores of traffic signals

- Testimony from accident reconstruction experts.

Recommended Reading: How To Report Someone To The Police Online

Do You Have To Report An Accident To The Police

In West Virginia, motor vehicle laws dictate that if you have been involved in an automobile accident, you must report it immediately to proper local authorities if it resulted in an injury, property damage, or death.

If, for some reason, your injuries prevent you from reporting the accident immediately after your crash, you will be able to report the incident to the State Police or the local law enforcement agency. You must do so as soon as possible.

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships dont influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- Insurance companies can access police reports in a variety of ways

- The DMV gains access to all reports, allowing insurance companies to see them as well

- The reports are used to help with investigations and calculate insurance premiums

Car insurance companies can access police reports. The reports can be obtained in a variety of ways.

The police reports are used to learn about whether you have been involved in an accident or not, towards an investigation when you file a claim, as well as to adjust your premiums periodically.

If you were in a car accident recently and need better auto insurance, compare at least three to four policies today to find the best rates for you! Enter your ZIP code above to begin!

You May Like: How To Become A Police Officer In Los Angeles California