If Youve Been Scammed

If you think you may be a victim of a fraud or scam, there are some key steps you should take immediately to reduce your risk of losing more money, protect your personal information and avoid being scammed again.

You should:

- stop all communication with the fraudster or scammer

- report the scam or fraud to your local police, theCanadian Anti-Fraud Centre and any regulatory bodies

- notify financial institutions and other companies where you have an account that may have been affected

- avoid making any major financial decisions until you feel youve taken action to secure your accounts

- put an alert on your credit report by contacting a consumer reporting agency, such as Equifax Canada or TransUnion Canada

- gather all records you have of the fraud or scam, such as:

- correspondence with the scammer

- contact information the scammer used to contact you

- websites and social media accounts used for the scam

- any papers, marketing material or ads used for the scam

To Report Any Of The Types Of Financial Crimes Described Below Complete An Online Crime / Incident Report Or Call 277

Forgery, Fraud and Identity Theft are investigated by the Financial Crimes Unit of the Bureau of Investigations. The Financial Crimes Unit is located on the third floor of the Police Administration Building located at 201 W. Mission Street, San Jose, CA 277-4521.

The Financial Crimes Unit investigates financial crimes occurring in the City of San Jose, including:

- Unauthorized Use of Credit, Check, Debit Cards or Account Numbers

- Theft by Deception Including Scams, Con Games, Misrepresentation, and Elder Fraud.

To report any of these types of crimes in San Jose complete an ONLINE CRIME / INCIDENT REPORTor call 277-8900.

- Dispatchers are available 24-7 however phone reports should be made between noon and 4 pm.

If you have other questions Call our Financial Crimes Unit at 408-277-4521 or e-mail us via our contact form. The contact form is for general information and cannot be used to report crimes.

Merchants who accept a check that is subsequently returned by the bank marked NSF , or Account Closed may Bad Check Restitution Program Victim Hotline: 877-520-6137 or visit www.checkprogram.com/santaclaracounty.

If the Bad Check Restitution Program is unsuccessful and if they believe a criminal case can be made, you may file a Police Report Online or you may call 277-8900 and make a report, or you can visit the Police Administration Building to make your report to an officer or via a computer kiosk in main lobby.

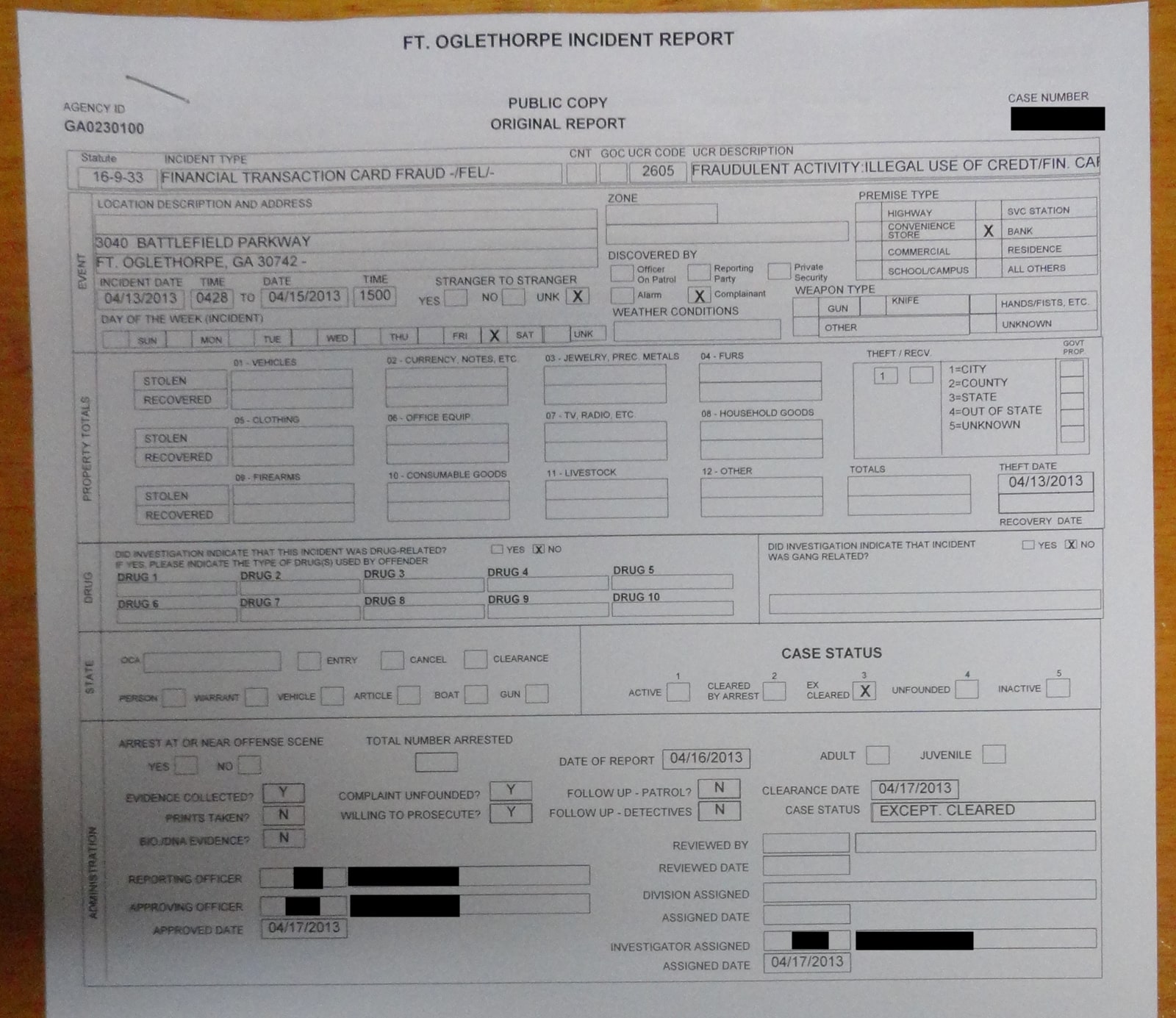

| Agency |

Shopping And Auction Site Fraud

Many people use the Internet to buy things through online shops or auctions. With some simple precautions, this can be a safe and convenient way to shop.

When you buy something from an Internet auction site, you are purchasing from an individual or company, not the auction house. Once the bidding has finished, negotiations about payment and delivery take place between the purchaser and seller. Regarding online transactions, it is advisable to select an escrow service yourself rather than accept advice from the seller. Do not click on links to banking or escrow services provided in emails as these may lead to fraudulent sites.

The auction house will usually adopt a policy of not taking legal responsibility for any loss that is suffered from using their service. Goods bought at auction are not covered by statutory warranties under the Trade Practices Act. The seller’s only obligation is to give clear title.

It is therefore important to take care when using online auction sites. The Australian Competition and Consumer Commission provides useful advice for using online auction sites or conducting transactions over the internet.

The following general advice is a good start:

You May Like: When’s The Next Police Auction

Take Part In Our Research

Are you interested in sharing your feedback on the new reporting tool? If so, weâd like to speak with you to better understand what Canadians and Canadian organizations need from a scam, fraud and cybercrime reporting service.

If you would like to help us, or know someone else who can, please take part in our research.

What Are The Benefits Of Reporting The Fraud To The Police

There are several benefits to reporting fraud these include:

The possibility the State will investigate, seize assets and prosecute the offenders When a fraudster is prosecuted and found guilty, the Court may order the confiscation of assets and award compensation Alerting the police to the identity and activities of fraudsters may help to protect others from being defrauded Reporting fraud shows others that you take the matter very seriously

Recommended Reading: How Do I Look Up A Police Report

Recommended Reading: Can Police Remotely Access My Phone

Prevention Of Identity Theft

Limit the amount of confidential or personal information you carry in your wallet or purse. Do not carry bank account numbers, personal identification numbers, passports, birth certificates or Social Security cards.

Avoid carrying more blank checks than you actually need. A criminal can fraudulently used these sensitive information often pre- printed on your checks . Do not have your Social Security Number pre- printed on your checks.

Keep good backup information about your accounts, in case your wallet or purse is lost or stolen.

When you go on vacation, take a long list of toll- free telephone numbers for your banking and credit card companies not your card numbers and keep the list in a safe place other than your wallet or purse.

Consider canceling any credit cards you dont really need or havent used in six months.

Never provide personal information over the telephone unless you initiate the call and are familiar or acquainted with the business.

Shred all credit card applications you receive in the mail and dont use.

Review your credit card bills and youre checking statements as soon as they are received, to ensure that no fraudulent activity has taken place.

Obtain a copy of your credit report at least once a year to check for errors.

Be careful at ATMs, Shoulder Surfers can obtain your Pin Number and get access to your accounts.

Obtain a P.O. Box, or locked mailbox, if you can.

Do not put your telephone number on your checks.

Reporting To Law Enforcement

Read Also: How To Become A Police Officer In Orlando

Here’s How Donotpay Makes It Easy To Report A Bank Account Fraud

As you can see, there’s a lot of documentation and communication required to report a bank account fraud. Here’s where DoNotPay comes in to simplify the process. All you need to do is fill in as much information as possible about the fraud, and we deal with the rest.

We can help you determine if you need to make an FTC report, alert state agencies, or contact the IRS. We also make it super fast and easy to write letters and contact banks after a fraud incident. The whole process is online and automated, so you can say goodbye to long wait times synonymous with reporting bank frauds or seeking compensation after a fraud.

What Is Bank Account Fraud

Bank account fraud occurs when someone uses illegal means to access your account assets. These frauds can happen if someone gains access to your personal information such as pins, debit card numbers, and other bank account information.

Most of the time, scammers get access to your bank information through online phishing, skimming, stealing debit and credit cards, or company data breaches.

There are many types of bank account fraud, but here are the most common ones:

Don’t Miss: How Much Do Military Police Make

Place Flags On Your Accounts And Check Your Credit Report

In addition to reporting suspected fraud or identity theft to the Canadian Anti-Fraud Centre, you should also contact both of Canadas national credit bureausEquifax Canada and TransUnion Canadato order a free credit report immediately and ask that a fraud alert be put on your file.

Place a fraud alert on your file :

You May Like: How To Become A Metro Police Officer

Review Your Credit Reports Carefully

When you receive your credit reports, read them carefully. Look for accounts you dont recognize. Look in the inquiries section for names of creditors from whom you havent requested credit. You may find some inquiries identified as promotional. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit. Promotional inquiries are not signs of fraud. Also, as a general precaution, look in the personal information section to verify your Social Security number, address and name.

If you find anything you dont understand, call the credit bureau at the telephone number listed on the report. Tell them you want to block, or remove, any information on the report that is the result of identity theft. For more on what to tell the credit bureaus, see the Privacy Rights Clearinghouses Identity Theft: What to Do When It Happens to Youwww.privacyrights.org/fs/fs17a.htm

Read Also: How Can You Find A Police Report Online

State Law: Notice Regarding Resellers Of Stored Value Cards

The excerpt from the law that is related to the Pawn Shop Unit is shown below:

Local law enforcement agencies shall notify merchants known to sell stored value cards of the recording and reporting requirements required by subdivisions -. The notification to merchants shall be in writing and shall state the law enforcement agency’s policy regarding how the information is to be reported in the applicable jurisdiction and certify that any data collected from the merchant will be stored in a secure and confidential manner. All records shall be delivered to the appropriate law enforcement agency or its designated reporting database in an electronic or other report format approved by that same agency within twenty-four hours from the date of the transaction. The information shall be stored on a law enforcement owned, operated, and housed server. Any gift card database software should be free for state law enforcement agencies state, county, and city government agencies and for the merchants that are reporting.

This excerpt is taken from state law: Senate Bill 1717, An Act to amend Tennessee Code Annotated, Section 39-14-113, relative to the Organized Retail Crime Prevention Act.

Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for dispute on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

Recommended Reading: What Happens When Someone Files A Police Report Against You

How To Report Bank Account Fraud By Yourself

You can report bank account fraud by following the steps outlined below:

If you receive a fake check, make sure to report the check through the mail to the US postal inspection service and report all counterfeit checks to the FTC. You can do this on their website or by phone on 1-877-382-4357. If scammers accessed your account online through phishing, forward the emails to the Anti-phishing Working Group.

Financial Crimes Online Reporting

Financial Crimes Information and Online Reporting System

Welcome to the Financial Crimes Information and Reporting System. This site will provide you with important information on financial crime protection and prevention methods, and will also assist you with filing a report if you have become a victim. Take a moment to navigate through the sections listed below and file a report when you are ready.

Also Check: What To Do If A Police Dog Bites You

Place A Security Freeze

Federal law allows consumers to place and lift a security freeze on their credit reports for free. A security freeze prohibits a credit reporting agency from releasing any information from a consumers’ credit report without written authorization. Note: placing a security freeze on your credit report may delay, interfere with, or prevent the timely approval of any requests you make for new loans, credit, mortgages, employment, housing or other services.

Freezing a minor’s credit file:

Federal law also now allows parents, guardians, and representatives acting on behalf of a young person in foster care, to freeze a minor child’s credit report. In this instance, a minor is someone 16 years old or younger.

If the child does not have a credit report , parents and guardians may request that the credit reporting agency create a credit report for the child in order to freeze it.

Are There Any State Laws About Identity Theft

Massachusetts identity theft law requires businesses and others that own or license personal information of residents of Massachusetts to notify the Office of Consumer Affairs and Business Regulation and the Office of Attorney General when they know or have reason to know of a breach of security. The law also requires that the breached entity notify consumers of any breach of their personal information that creates a substantial risk of identity theft or fraud as soon as practicable and without unreasonable delay after a breach occurs, except when a law enforcement agency determines that notice may impede a criminal investigation.

Recommended Reading: Are Police More Likely To Be Killed By Black

Recommended Reading: What Happens When You Call The Police For Domestic Violence

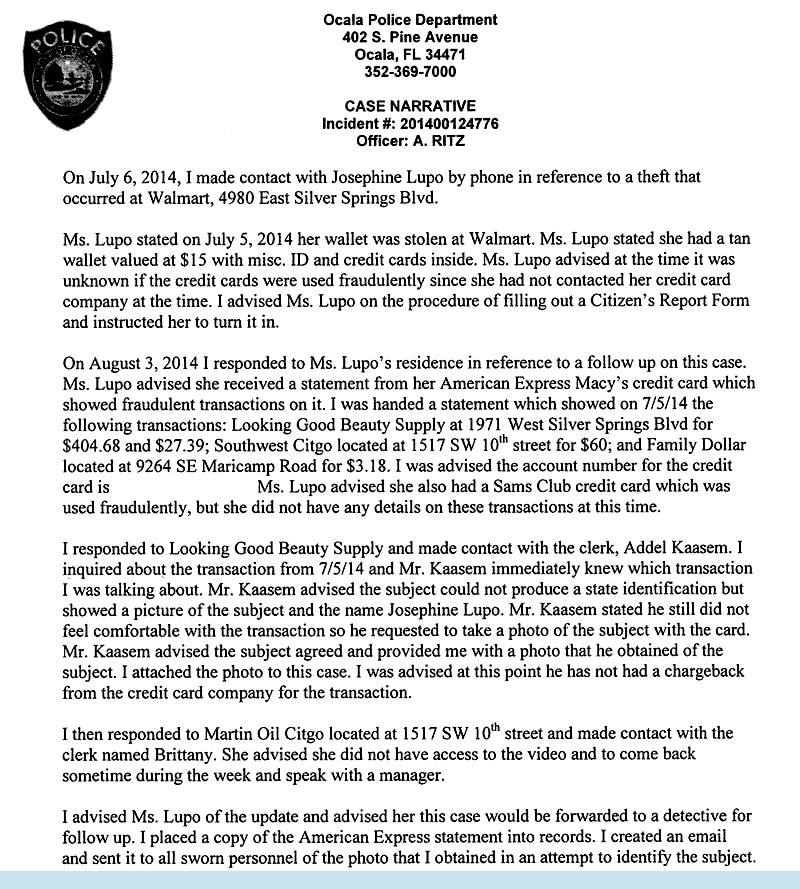

Reporting To Your Bank

What Is The Purpose Of Filing A Report Online Using This System

- This system enters your information into our reporting system. Investigators will review your report and assign your case to a detective for follow-up if necessary.

- Most victims of financial crimes are required to notify the police before filing an Affidavit of Fraud with the financial institution. This system will allow you to do that quickly so you can recover your loss.

Read Also: How Long Can A Police Drone Stay In The Air