Elderly People As Fake Police Officer Victims

The scammers target older people in particular and fish for their debit card and online banking information. In most cases, the scammers trick the elderly by pretending to be police officers over the telephone or in person.

The fake police officer may, for example, call the elderly person first, and later a person or persons posing as police officers show up at the elderly persons door. The fake police officer then tell their victims about various, fictional, acute threats to their bank accounts. The victims are told to urgently provide their online banking details and passwords or bank and payment cards in order to protect their assets.

The money on the accounts has been stolen by using the banking information obtained. The money is often transferred to accomplices bank accounts with their help or by withdrawing cash directly from cash machines.

S To Protect Credit Cards:

Handsome Doctors Or Officers Appeal To Romantic Minds

A love or romance scam is a crime, and anyone can fall victim to it. The perpetrators are usually very skilled both in knowledge of the human mind and exploiting information networks. They ruthlessly use peoples natural need to find company or a partner. It can be very difficult for a victim to identify whether they are getting to know another person looking for company in the normal way or getting scammed by a professional criminal.

Romance scams aim to serve a love potion with the following ingredients:

Have you been or do you suspect having been the victim of a romance scam?

- Do not send money or your personal information to anyone anymore.

- Save the messages from the fraudster and write down the phone numbers used.

- Contact your own bank and close the accounts that you suspect have fallen into the hands of the fraudsters.

- Report the crime to the police.

- Talk about your situation at Victim Support Finland, which is involved in helping crime victims.

You May Like: How Do Police Know If Your Driving Without Insurance

How To Avoid Cashapp Scams

The FTC Recommends the Following!

- Never send money to anyone you dont know and trust!

- Dont send money when you receive a Cash App request from someone you know, make sure that they actually made the request and their phone wasnt hacked!

- Always contact your bank and read your bank statements, in case they need to reverse any money you didnt actually send!

Ready to search and find the scammer in your life? Social Catfish offers you more than a standard search and links you to the real-life details that only an algorithm-based smart search of the web can find.

Contact Your Banks And Credit Card Companies

If the scam involved your credit card information or login credentials for your financial accounts, contact your banks and credit card companies immediately to cancel your cards and receive new ones.

While you’re getting help with this process, ask the representative to check your recent transactions to make sure you recognize them. If there are some that you don’t, you can flag them as fraudulent.

Also, take some time to change your online passwords to stop the criminal from accessing your accounts. If you use the same password on more than one website, update each account with a unique password to make it more difficult for hackers to crack.

If you have many different passwords and need help keeping track of them, consider registering for a password manager like LastPass or 1Password.

Also Check: What Is A Police Challenge Coin

Ive Been A Victim Of Fraud Now What

If you lost money as a result of the fraudulent communication, you may file a report online.

To prevent further loss of monetary funds, please ensure you take the following steps:

If you have provided personal information but have not lost any money, please contact the Police Reporting Unit at 613-236-1222, extension 7300 to file a report as a report cannot be filed online.

Contact Us

Recommended Reading: How Do Police Warrants Work

Reporting A Scam By Yourself Isn’t Easy

You’ll need to gather evidence and find the right people to report the scam to. Even though the memory is probably painful, you’ll also need to think through what happened carefully. That’s because you’ll have to explain each step of the scam clearly not easy in the unfamiliar setting of a police station!

Also Check: What Education Is Required To Become A Police Officer

Preventing Crime Relating To Fake Police Officers

The police warns the public by disseminating information about the phenomenon, both nationally and regionally. Several stakeholders that work actively with the elderly, have also been asked to contribute.

It is important to talk about these offences and to explain to older people that they must keep information relating to their assets, debit cards and bank accounts secret. The information must not be disclosed to anyone, regardless of who they say they are. In their official capacity, the police will never request your bank card, PIN code or online banking codes!

- If you suspect that your bank card and codes have fallen into the wrong hands, cancel the card immediately in the banks locking service!

- Report the offence immediately.

Dont Fall Victim To Fraud

Whether its Internet or mail fraud, deceptive telemarketing or identity theft, fraud is a serious problem. York Regional Police wants to prevent you from becoming a victim through education and awareness.

Thousands of Canadians lose millions of dollars every year through frauds. Save your money and keep yourself from becoming a victim of fraud by learning how to identify a scam.

Also Check: What Training Do Police Officers Go Through

Fraudsters Rush Investment Decisions

The seller tries to rush the victim into making a decision by claiming, for example, that the company is about to go public, or that there are other major transactions in the pipeline that make it imperative to invest right now. The customer can also be pressured in such a way that they cannot refuse the offer.

Investors can initially be paid substantial profits and enticed in this way to invest more. After a while, all contact stops and telephone calls and e-mails go unanswered.

Reporting To The Police

In the UK, all fraud , is reported to the police through Action Fraud using its contact centre or online reporting tool. Action Fraud is the central repository for reports of fraud and cyber-dependent crime and feeds all data it receives into the National Fraud Intelligence Bureau that matches and analyses data and disseminate crimes that meet a certain criteria to police forces for investigation.

Action Fraud and NFIB are managed the City of London Police, the National Lead Force for Fraud Investigation.

You May Like: How Much Does A Police Lieutenant Make

What To Do If Youve Been Scammed

If youve been scammed, the very first step is to report them to the platform and the police. But when your report the scam to the police, it will be helpful to give them all of the information you possibly can. Using the search bar below, you can find all of the information available on the person who scammed you. Click the tab that best describes the information you have about the person, and run your search to find get more.

We Respect Your Privacy.

How To Report Fraud That Occurred Against Me

First steps you should undertake:

- Look after your mental health by reaching out to Lifeline for 24/7 crisis support on 13 11 14 or by the online chat. These types of services are here to support you during times of crisis.

- Contact IDCARE if you have concerns about your identity or related cyber security. IDCARE is a national identity and cyber support service that can help you reduce harm from identity compromise.

Secondly, make reports to:

You May Like: When To Call Police For Car Accident

Will The Police Investigate My Fraud

The vast majority of fraud reported to the police via Action Fraud is not allocated to a police force for further investigation and remains in the NFIB Know Fraud database for intelligence purposes.

Fraud reports will be allocated to a police force or other agency for further investigation when they meet certain criteria e.g. There are viable lines of enquiry such as known suspects who are based in the UK and include factors such as there are:

Multiple victims Significant losses to individuals, organisations or the State Organised criminal groups linked to terrorism, firearms, people trafficking and drugs Regulated professionals: Lawyers, accountants and financial advisors

The NFIB will conduct an assessment based on agreed guidelines. These are issued by the College of Policing and available to authorised users here.

The police will also allocate their resources according to local and national policing priorities and an assessment of the Management of Risk in Law Enforcement based scoring standards. In the past, police would consider guidance such as Home Office Circular 47/2004, which outlines the types of frauds that should be priorities and those where a more cautious approach might be appropriate.

How Do I Report Credit Fraud

You can submit a complaint about problems with credit reporting companies or a problem with your credit report by calling the Consumer Financial Protection Bureau at 1-855-411-2372 or visiting the CFPB online.

If there are charges on your credit card that you did not make, contact your credit card company.

Read what the FTC says about extended fraud alerts and credit freezes

Also Check: How Much Training Does A Police Officer Need

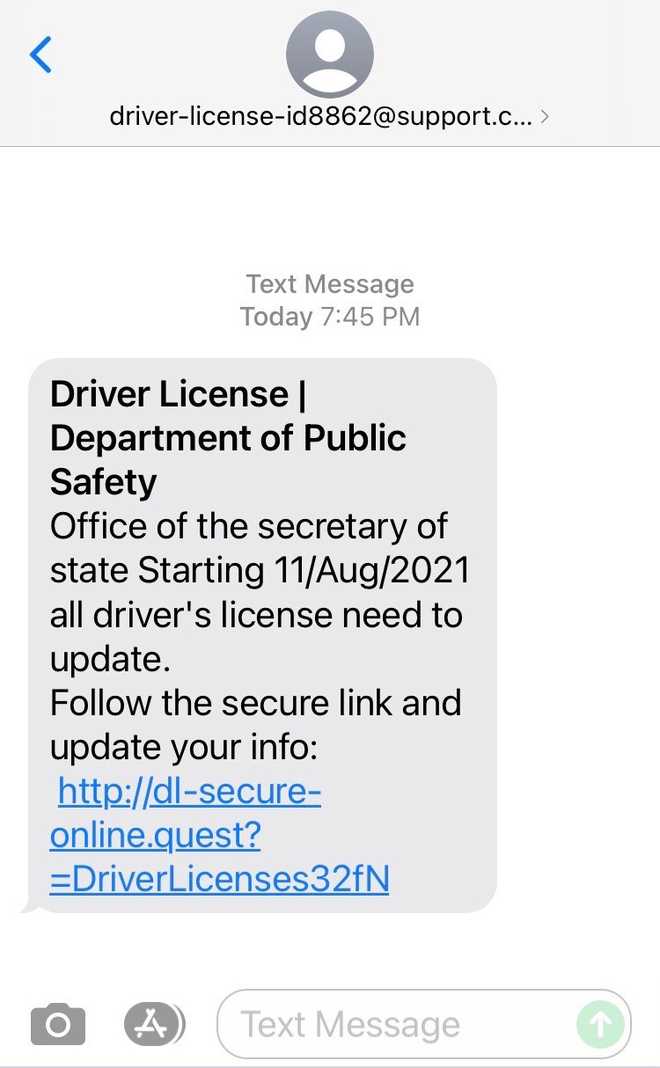

Information Is Used To Get Financial Benefits

Phishing for personal information, passwords, IDs and phone numbers is aimed at getting financial benefits. A fraudster may, for example, apply for a credit card in your name or enter into part payment contracts create a fake profile in online services.

Keep in mind that banks, public authorities and other upstanding institutions never ask for account details, passwords or other confidential information via e-mail or on the phone.

- Do not react to messages asking for personal information.

- Do not give your personal information, complete or confirm them, unless you are sure about the messages sender.

- Do not call a phone number included in a suspicious email message. Never give your personal information on the phone, unless you are completely sure about the callers identity.

- Do not click links in suspicious email messages or text messages. The link may direct you to a fake page that asks you to give personal information.

- You should also be sceptical about messages in social media. By opening an attachment, you may download spyware or virus software onto the computer or phone or join a service subject to a fee.

- Always be careful about your friends calls for help, and confirm the authenticity of the request before you send money or give your information electronically or in any other way.

If you suspect you have given your information in the wrong place, contact your banks or credit card companys closing service so that they can close the credentials and prevent misuse.

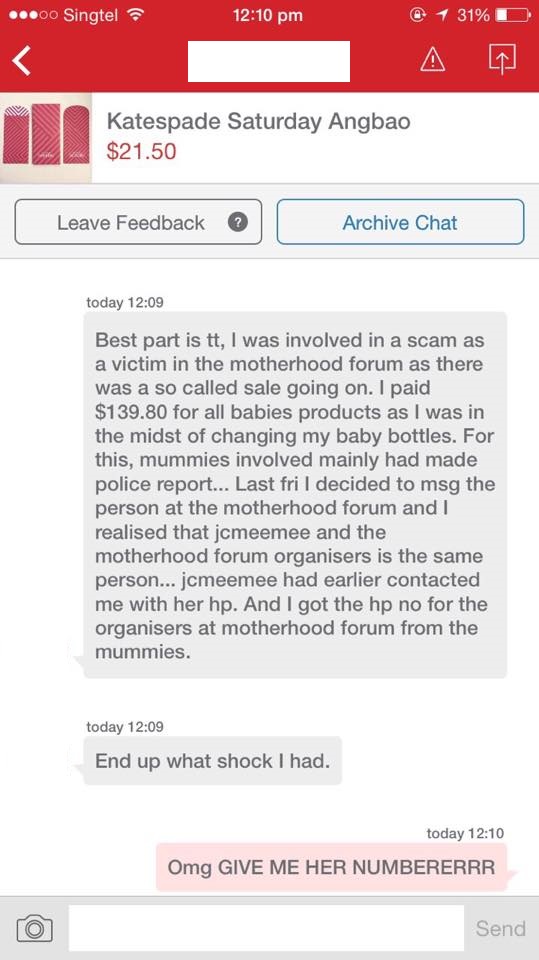

What Can You Do If You Get Scammed

If you have recently been scammed, take comfort in knowing that there are multiple resources out there to help. However, scammers come in all shapes and sizes, and reporting them may look different depending on the crime. If youve been scammed over the phone, the process of reporting it will look a bit different than if you have been scammed on a website or by a local scam artist.

Regardless of the details of the crime, you will want to notify your bank immediately if a debit or credit card was used to make the fraudulent purchase. When you call, ask to speak to the fraud department. The fraud representative will ask you several questions about the scam, such as when it took place, how much money you have lost, and if you have noticed any other suspicious transactions that resemble fraud. Many banks will investigate on your behalf and reimburse you if they find the purchase was indeed a scam.

You May Like: How To Get Started As A Police Officer

Timeshare Scams Make You Pay For False Promises

Many people have received an invitation to a timeshare presentation in the mail. People are also grabbed straight off the street to attend timeshare presentations, especially in Southern holiday destinations. Memberships of holiday clubs and their services may also be sold in presentations. The street-level merchants are often sincere and unaware of the true nature of the operation.

The marketing of timeshares is pushy and may involve prizes and offering alcohol. Impressive brochures may be shown in connection with the sales and sellers may emphasize that the shares are profitable investments. Attendees at the presentation are coerced into deciding there and then.

Before you invest in a timeshare, remember the following:

- Acquire detailed information about the item for sale in writing and in your own language.

- Avoid paying by credit card.

- You should check that the seller company actually exists.

- Always go and see the property first and make sure it is as promised.

- Dont hurry even though it intrigues you. Get additional information or ask for advice elsewhere.

Step : Make Sure Your Occurrence Can Be Reported Online

Use the information below to see if you can use this system. If your occurrence qualifies for online reporting, proceed to the next step. If your occurrence does not qualify for online reporting, it cannot be accepted by the officer managing online reporting. These occurrences require contact with a local OPP officer for investigation. Please call the OPP toll-free at 1-888-310-1122 to file a report. Links to external websites including those with video, digital images or documents that are not supported by this application cannot be managed through this online reporting service. Please include a narrative description of the occurrence if you will be filing an online report. Filing a false police report is a criminal offence.

Recommended Reading: How To Become A Tribal Police Officer

Would A Criminal Court Award Compensation

A guilty verdict at court will lead to the sentencing process for the defendant. Depending on the circumstances this may happen immediately or after several weeks. Victims are given a voice in the sentencing process by way of a Victims Personal Statement. This will explain how the fraud has affected the victim, whether financially, emotionally, psychologically, etc. The statement may be taken during the investigation stage, or at any point before sentencing.

After sentencing the court will move to consider any compensation. Provided the defendant has the means to pay, the court may make an order for the defendant to pay the victim the amount defrauded by the offence .

Confiscation proceedings may also be launched. These allow for the use of intrusive powers . The purpose of these proceedings is for the state to deprive the defendant of any benefit they have obtained from their criminal conduct . If the defendant has only sufficient means to pay either money to the victim or to the state, but not to both, then the victim comes first and the compensation order will be satisfied before the confiscation order.

Fraud Event Reporting Officer

The fraud event reporting officer receives and processes calls from people claiming to be victims of fraud and prepares the event report for investigation purposes. This officer also informs complainants on the procedure to follow and about other organizations that may help them in resolving their problems. This officer may also direct people to other legal recourse if fraud is not involved.

The officers responsibilities also include storing and disposing of, according to the defined standards, the various effects collected in investigations .

Recommended Reading: How To Look Up Old Police Reports

Means Of Payment Fraud

A means of payment fraud means using a bank, payment or credit card, cheque or a similar payment method without legal permission. The offence can also be another way of misusing cards. The attempt to withdraw money with a stolen bank card is a means of payment fraud.

A punishable means of payment fraud can also be exceeding an accounts balance or the maximum credit limit agreed. The development of payment card issuers monitoring systems prevents payment card crimes.