What Are The Benefits Of Reporting The Fraud To The Police

There are several benefits to reporting fraud these include:

⢠The possibility the State will investigate, seize assets and prosecute the offenders ⢠When a fraudster is prosecuted and found guilty, the Court may order the confiscation of assets and award compensation ⢠Alerting the police to the identity and activities of fraudsters may help to protect others from being defrauded ⢠Reporting fraud shows others that you take the matter very seriously

This Offer Is Not Available

If you own a credit card, the chances are rather high that you will become a victim of credit card theft at some point in your life. From large-scale data breaches to your wallet being stolen, theft and fraud do happen quite often. To limit your chances of this happening to you, taking the necessary steps is vital.

Do Police Investigate Credit Card Theft?

Rarely. Not because the police dont want to, but because they simply cant. This is inherently due to the nature of the crime itself. First, credit card fraud is seldom reported. With most consumers protected against any major liability, most cancel their cards at any sign of fraud. Furthermore, because of the relatively small sum of money involved in these fraudulent activities, banks and credit card companies opt to write it off as the cost of doing business or even sometimes force the retailer or merchant to take on the loss.

Moreover, credit card fraud being a non-violent crime makes it less of a priority for a police force with already limited resources. And even in the off-chance that the fraud warrants an investigation, the police are unlikely to be able to pursue this case because most large-scale fraud is committed by overseas operations, which is out of their jurisdiction.

You should also immediately notify them of the theft of your credit card. By doing this, you can prevent any fraudulent purchases from disrupting your credit history and driving down your credit score.

How Do Police Investigate Credit Card Theft

When it comes to identity theft, is the most common type.

In those rare situations where the police do investigate credit card theft, its usually because there has been multiple thefts in one area or a single perpetrator targeting certain individuals. For the most part, credit card theft is often not reported, and at the first sign of fraud, credit card holders usually cancel their cards.

As with any other investigation, the police will ask the card holder questions. Credit card transactions are easy to track, which is why thieves charge as much as possible in a short amount of time so they can sell it once theyve maxed out or discarded the card.

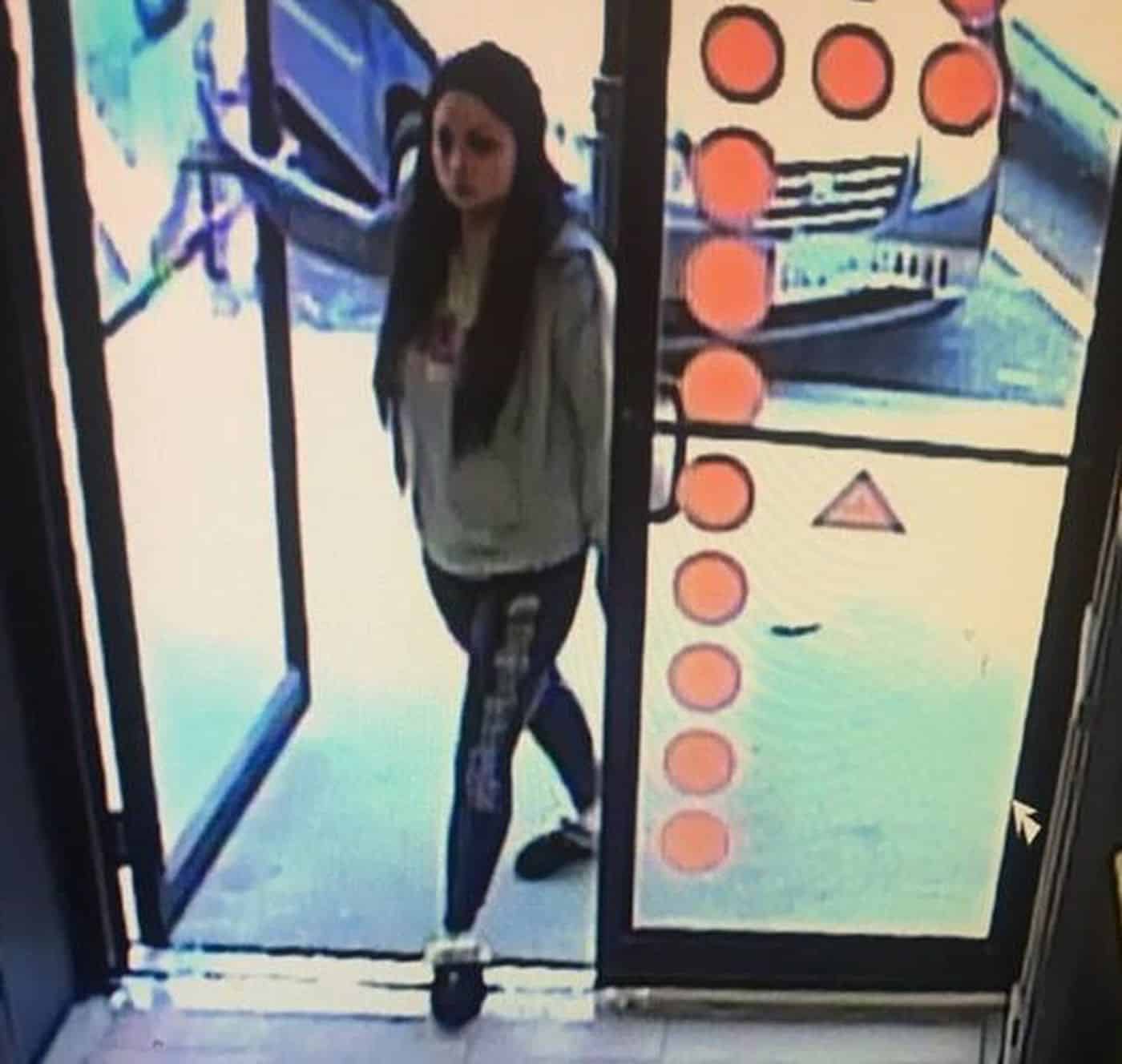

Police will also visit the stores where the charges were made and ask questions, as well as examine any available surveillance video or photo evidence.

Sometimes there is a local crime ring or repeat offender who gets caught in a sting operation put on by the police, or simply causes enough of a problem in one jurisdiction to warrant law enforcement to dedicate resources to catching the credit card thief. Many credit card fraud offenders work only online and law enforcement often uses their digital trail to track them down.

In either case, the police will attempt to use any evidence obtained to narrow down their investigation to a list of potential credit card theft suspects. If they are fortunate enough to track one down the offender could be charged, tried, and convicted of the credit card theft.

You May Like: How To Get A Copy Of Police Incident Report

Should I Report Identity Theft To The Police

Yes, you should report identity theft to the police. A police report is a sworn statement that you were not responsible for any crimes, theft, or similar actions that were committed in your name. You can also file an FTC identity theft report at IdentityTheft.gov.

According to the FTC, you should report identity theft to the police in these cases:

Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

Also Check: How Much Is A Police Scanner

How Can I Tell If I’m A Victim Of Identity Theft

You may become a victim of identity theft if:

- you have lost or had stolen important documents such as your passport or driving licence

- mail expected from your bank has not arrived or you are receiving no post at all.

You may already be a victim of identity theft if:

- items have appeared on your bank or credit card statements that you donât recognise

- you applied for a government benefit but are told that you are already claiming

- you receive bills, invoices or receipts addressed to you for goods or services you haven’t asked for

- you have been refused a financial service, such as a credit card or a loan, despite having a good credit history

- a mobile phone contract has been set up in your name without your knowledge

- you have received letters from solicitors or debt collectors for debts that aren’t yours.

Do You Have To Choose Between The Criminal And Civil Justice Systems

No. The two systems can work together. There is nothing to prohibit a civil claim following a criminal claim, or vice versa â or even both happening simultaneously . Simultaneous proceedings are allowed unless the defendant would face a real risk of serious prejudice which may lead to injustice in either the civil proceeding, the criminal proceedings or both.

For instance, serious prejudice would occur if there was significant adverse publicity generated by both cases occurring simultaneously. Please visit the Fraud Advisory Panel charity website and complete their interactive decision tree that will help you understand more about the civil and criminal justice routes.

Recommended Reading: How To Become A Police Officer In Michigan

Reporting To The Police

In the UK, all fraud , is reported to the police through Action Fraud using its contact centre or online reporting tool. Action Fraud is the central repository for reports of fraud and cyber-dependent crime and feeds all data it receives into the National Fraud Intelligence Bureau that matches and analyses data and disseminate crimes that meet a certain criteria to police forces for investigation.

Action Fraud and NFIB are managed the City of London Police, the National Lead Force for Fraud Investigation.

Monitor And Protect Your Identity

Credit card fraud can be one of the many consequences of having your personal information stolen. Monitoring your credit reports and accounts can help you respond quickly, while a more robust identity monitoring service like Experian IdentityWorksSM can offer additional protections, such as dark web surveillance and address change verification. And if something does happen, the service comes with the lost wallet assistance, identity theft insurance and fraud resolution services.

You May Like: Can You Sue A Police Department For Wrongful Arrest

How Card Issuers Investigate Fraudulent Charges

Once a suspected fraud transaction is noticed, your credit card issuer may cancel your card, send you a replacement and start a fraud investigation. It may also refund the amount back to your account. Even if it doesn’t immediately issue a refund, you’re not responsible for disputed amounts during the investigation.

A credit card fraud investigation could take up to 90 days, during which time the credit card issuer may contact the merchant that charged your card to get more details about the transaction. The card issuer may request copies of a police report or receipts to compare signatures if they’re available.

Card issuers and merchants may also look for “friendly fraud,” which is when a cardholder makes a purchase and then disputes it as fraudeven though it wasn’t.

If fraud has occurred, the outcome of the investigation will also help the merchant and credit card issuer settle who is responsible for covering the fraudulent purchase . Either way, you won’t pay anything if your card’s payment network provides $0 fraud liability.

What Are The Risks Of Reporting The Fraud To The Police

Many victims who report fraud in the UK are critical that no action is taken even when suspects are known. This is especially so in the case of investment frauds such as boiler room fraud , Ponzi schemes and dating scams.

When you decide to report fraud to the police, you are providing information that helps the police build a better intelligence picture that may prevent others falling prey to criminals. However, there is a likelihood that the police will not investigate your individual case, even when youâve suffered a substantial loss.

You should also be mindful that if the matter does go to crown court it may attract media attention. Publicity highlights the plight of victims and alerts others of the risk.

You May Like: How Can I See My Police Report Online

Review Your Credit Reports Carefully

When you receive your credit reports, read them carefully. Look for accounts you dont recognize. Look in the inquiries section for names of creditors from whom you havent requested credit. You may find some inquiries identified as promotional. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit. Promotional inquiries are not signs of fraud. Also, as a general precaution, look in the personal information section to verify your Social Security number, address and name.

If you find anything you dont understand, call the credit bureau at the telephone number listed on the report. Tell them you want to block, or remove, any information on the report that is the result of identity theft. For more on what to tell the credit bureaus, see the Privacy Rights Clearinghouses Identity Theft: What to Do When It Happens to You.

If Youve Been Scammed

If you think you may be a victim of a fraud or scam, there are some key steps you should take immediately to reduce your risk of losing more money, protect your personal information and avoid being scammed again.

You should:

- stop all communication with the fraudster or scammer

- report the scam or fraud to your local police, the Canadian Anti-Fraud Centre and any regulatory bodies

- notify financial institutions and other companies where you have an account that may have been affected

- avoid making any major financial decisions until you feel youve taken action to secure your accounts

- put an alert on your credit report by contacting a consumer reporting agency, such as Equifax Canada or TransUnion Canada

- gather all records you have of the fraud or scam, such as:

- correspondence with the scammer

- contact information the scammer used to contact you

- websites and social media accounts used for the scam

- any papers, marketing material or ads used for the scam

Recommended Reading: How Much Does A Police Report Cost

Monitor Your Credit Card Statement Regularly

Monitoring your credit card statements regularly is one of the best ways to protect yourself against credit card fraud and theft. You can quickly spot any suspicious activity and report it to your bank or credit card issuer by keeping an eye on your account.

Set Up Credit Card Alerts

One good way to protect yourself is to set up credit card alerts. Most banks and credit card issuers offer this service, which allows you to receive an alert whenever your card is used. This can help you spot fraud quickly and report it to your bank or credit card issuer.

Only Use ATMs Owned By Banks

When using an ATM, make sure that a bank owns it. This will help to ensure that the machine is safe and secure. Additionally, consider using mobile app payments instead of credit or debit cards. This can help to reduce the risk of your information being stolen.

Inform Yourself Of Common Credit Card Fraud Techniques

Be sure to inform yourself of common credit card fraud techniques. There are many ways that criminals can steal your information, so it is important to be aware of them. One way to do this is to check your credit card statement regularly for any unusual activity.

Use A Virtual Number

When shopping online, you can often use a virtual credit card number instead of your real one. This can help protect your information if the website is hacked.

Who Pays When A Credit Card Is Used Fraudulently

This is a great question, and the easy answer is that its usually not the credit card holder.

That is to say, not directly. Ultimately, is a problem each year to the tune of several hundred million dollars, which is another reason the police simply cannot investigate them all. And unfortunately, the loss felt by merchants is ultimately passed onto consumers in the form of higher retail prices to offset the lost profits.

As mentioned above, the Fair Credit Billing Act limits a cardholders maximum liability to $50 for fraudulent or unauthorized charges. However, as a nugget to entice consumers to use their particular card, major credit card companies will offer $0 liability to the cardholder for unauthorized charges. If you have one of these cards, this means that the charges the lady thief made on your card while you were sunning on the beach will cost you nothing .

The merchant may be on the hook for the fraudulent or theft-based charges. Why? When the card is actually used versus when only the number is used the bank is usually responsible. Conversely, merchants often take the hit when the number is used in a card-not-present transaction. The major credit card companies often set the rules for how this liability is handled.

In the end, due to these protections and rules, law enforcement agencies know that the issue of the theft will be handled in a civil manner. Therefore, conducting millions of unsolved investigations is simply not an effective use of resources.

You May Like: How To Find Police Report For Car Accident

Only Use Atms Owned By Banks

One device credit card thieves often use is known as Skimmer. This device is used to steal the credit card information of people. What they do is to put the device on fuel pumps and ATMs and they skim the needed data from the strip that is on the back of the credit card. This is why it is advisable that if you must use an ATM, use the one affiliated to your bank. Ensure you do not use the one at a bar or convenience store. This is because their machines are often less secure.

It will also be wise for you to even stay away from cash advances. One of the main reasons for this that the card issuers often begin charging interest rates without any grace period.

Would A Criminal Court Award Compensation

A guilty verdict at court will lead to the sentencing process for the defendant. Depending on the circumstances this may happen immediately or after several weeks. Victims are given a voice in the sentencing process by way of a Victims Personal Statement. This will explain how the fraud has affected the victim, whether financially, emotionally, psychologically, etc. The statement may be taken during the investigation stage, or at any point before sentencing.

After sentencing the court will move to consider any compensation. Provided the defendant has the means to pay, the court may make an order for the defendant to pay the victim the amount defrauded by the offence .

Confiscation proceedings may also be launched. These allow for the use of intrusive powers . The purpose of these proceedings is for the state to deprive the defendant of any benefit they have obtained from their criminal conduct . If the defendant has only sufficient means to pay either money to the victim or to the state, but not to both, then the victim comes first and the compensation order will be satisfied before the confiscation order.

Also Check: How To Make Anonymous Call To Police

How Thieves Get Your Information

There are several ways that thieves can get your credit card information, and once they have it, they can use it to make unauthorized purchases or even apply for new in your name:

Skimming

One of the most common ways thieves get credit card information is by skimming it from the magnetic stripe on the back of your card. This can happen when you hand your card to a waiter or waitress at a restaurant or use a self-checkout lane at a store. The thief can then use a special device to read the information from the stripe and create a duplicate of your card.

Phishing

Another common way is by phishing. This is when a thief sends messages that appear to be from a legitimate company, like your bank or credit card issuer. The message will usually say that there is a problem with your account and ask you to click on a link, but when you click on the link, youre taken to a fake website where the thief can collect your information.

If youre ever asked to update your credit card information online, go directly to the companys website and not through a link in an email or text message link. And if youre ever unsure whether a website is legitimate, you can always call the customer service number on the back of your credit card to check.