Can I Report An Accident After 24 Hours

Yes, you can report an accident after 24 hours. Many insurance companies are not open on the weekend. This essentially allows you to be able to wait up to 48 hours before contacting your insurance company about an accident if your accident occurs on the weekend. Also, if you report an accident after 24 hours, during a regular work week, you might be penalized. In fact, your insurance company might not accept your claim whatsoever. This is why it is extremely important to make sure that you report any car accident that you have within a 24-hour timeframe after it occurs.

What To Do After An Accident

Check for injuries and call 911 after an accident.

Tell the dispatcher your location with a description of any landmarks if you or anyone else is injured, feeling sick, or trapped in the wreckage or if there are any immediate dangers, like leaking fuel or downed power lines.

While waiting for emergency responders, pay attention to whats going on around you. You can provide valuable information to help the officers investigation by reporting your observations.

Look and listen for:

- How many occupants are in the other car, if they switch seats or anyone leaves the scene

- Statements from the driver or occupants of the other car, such as I really screwed up this time or I told you to slow down!

- Anything being tossed out of the other car, including paper bags, bottles, or anything else that could be evidence of drugs or alcohol

- Attitudes and behavior of the driver, like arguing, cursing, stumbling, or other erratic actions

- If the vehicle or any debris from the accident is moved

Police officers are trained in vehicle accident investigations. Once they secure the scene, officers will investigate the accident and its causes. Police dont normally create their official accident report at the scene. They use a worksheet, then later prepare and file the official report.

How Long Do I Have To File A Claim

Youll want to get the claims process rolling as soon as possible, so filing a claim should be done promptly. Usually, the state statute of limitations is only two to three years, but some insurance companies may only pay the costs of repairs for the year in which the accident occurred. Putting it off isnt in your best interest since the longer you wait, the harder it may be to track down other people involved in the accident for interviews or other research related to the claim thatll help your case.

Our advice? File the claim right away or at least contact your insurance agent as soon as you can after the accident.

You May Like: How To Become A Police Officer Florida

Why Is It Important To Get In Touch With My Car Insurance Company Promptly

Getting in touch with your provider will allow you to get the car insurance claim filed and handled quickly. Click here to learn how to file a car insurance claim.

There are times when your ability to access those funds is essential to paying the medical bills resulting from an accident.

Rather than waiting for the company to contact you, take the initiative and call them immediately.

Normally when an insurance agent or claims representatives contacts you, they are looking for details regarding the accident.

They then process the information to determine who is at fault, what will and will not be covered, who will pay for the repairs of the damage, and the amount that will be paid out.

Whether To Report Your Accident To Your Car Insurance Company

The state of New York does not require you to report your accident to your insurance carrier. However, when you signed the contract between you and your car insurance provider, you agreed to their terms, which includes reporting all accidents to them within a reasonable period of timewhich may be interpreted to mean just a couple days.

our personal injury lawyers today

Read Also: Can You Adopt Retired Police Dogs

How Do I Pay My Deductible

Often, you will pay your deductible directly to the repair shop thats completing your repairs. Then, we cover everything over and above your deductible, for losses covered by your policy. To learn more about where you can pay your deductible, log in to MyInsurance or contact your dedicated Claims Advisor.

Making a car insurance claim might seem a bit confusing. There are terms, concepts and no shortage of fine print that can make things feel more complicated than they need to be. Thats why weve looked at the most frequently asked questions about car claims and answered each one.

What If I Want To Make A Claim But Dont Have A Police Report

You can still file a claim even if you dont have a police report. Itll just take a little more work and it may take longer to process.

Any of the following information will be helpful when filing a claim without a police report:

- Statements of the parties involved

- Eyewitness statements

- The weather and road conditions at the location of the accident

You May Like: Where Can I Get A Copy Of A Police Report

What If I Was In A Minor Vehicle Accident In Georgia

If the damages are negligible and there are no injuries, should you file an accident report? The answer is yes. This bottom line is that it is always a good idea to report a car accident, and not doing so can have life-changing consequences.

Even if there was no legal requirement to report your accident, not documenting a collision is a risk to your rights. When an accident gets reported to the police, they come to the scene, create a car accident report, and take down the information of everyone involved. If that doesnt happen and you try to claim damages later, its your word against everyone else. Therefore, you may face blame for what happened even if the collision was not your fault.

Another reason to always file an accident report is to secure coverage for all damages. In many cases, damages and injuries may not be immediately apparent, such as engine failures or delayed symptoms of medical injuries. For example, a traumatic brain injury can take hours or days to appear.

How Long Do You Have To Take Legal Action

Something else to keep in mind is that your state has laws called a statute of limitations that determine how long you have to file a lawsuit following personal injury or property damage. That technically guarantees you a certain amount of time to pursue legal action following a car accident.

This window can be anywhere from 1 to 10 years long, depending on your state and the type of damages, so, if you want to leave open the possibility of suing another party after an accident, make sure you take action before your stateâs statute of limitations expires.

Recommended Reading: How To File Police Report Car Accident

Does A Police Report Automatically Go To Your Insurance Company After A Car Accident

Hi, my name is Matt Eason, and in this video, were going to address the question of whether a police report automatically goes to your insurance company after an accident. Ive been practicing personal injury law here in Sacramento for 25 years and regularly see police reports that are wrong.

Please to view the video.

Clients will ask me, will that report automatically go to their insurance company? The short answer is no.

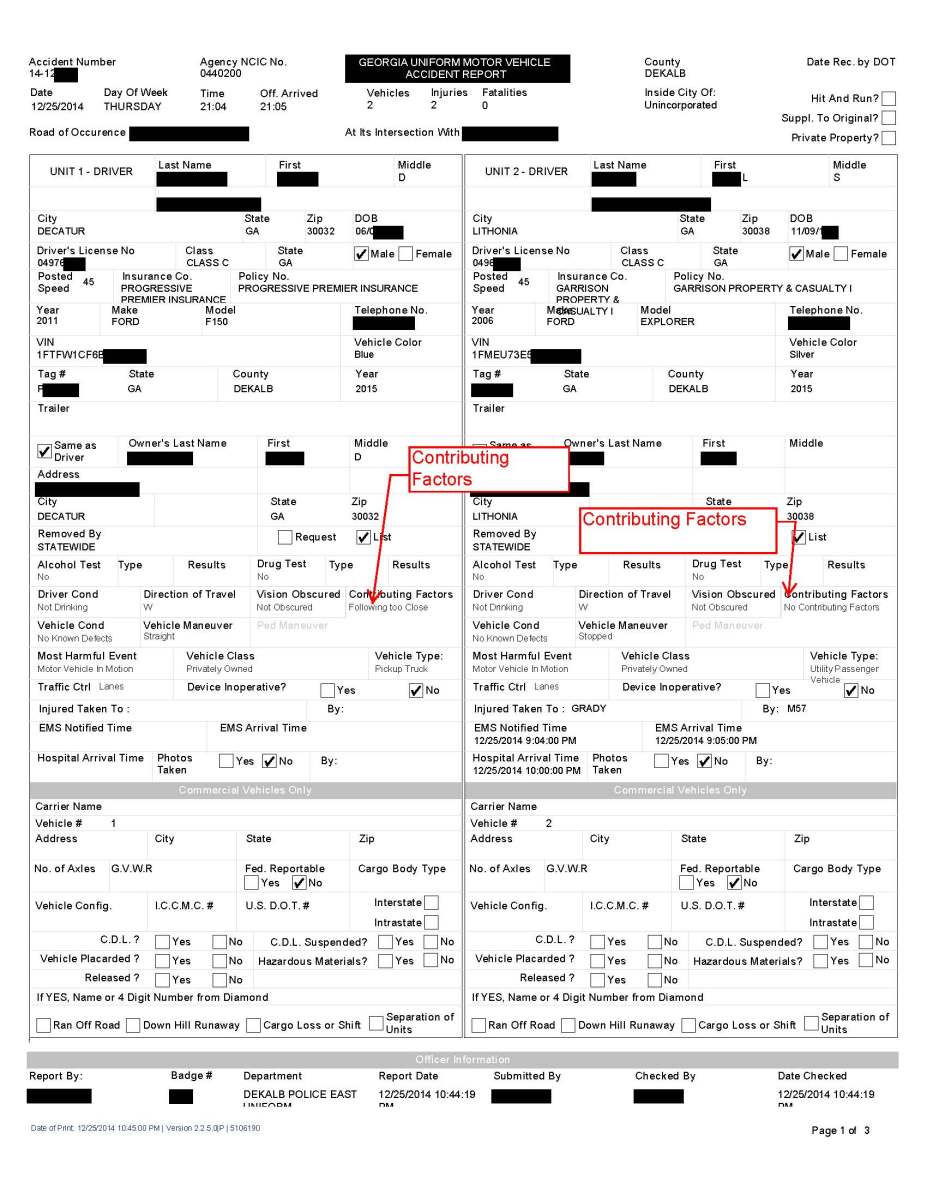

Its helpful to understand the purpose of the police report to understand why a police report does not automatically go to an insurance company. A police officer is not a judge, is not a jury, not an arbitrator. A police officer typically did not actually see the accident occur. A police officer is rather someone who acts as a historian. They come to the accident scene. They may take statements from witnesses. They may take photographs. They may take measurements to help someone, later on, conclude who was at fault in the accident. Yes, at the bottom of the police report, an officer often will attribute fault, but thats really just their opinion of fault and not binding on anybody.

All that said, it is one of the first documents an insurance company will ask for after an accident because it helps the insurance company perform its due diligence to determine who is at fault in an accident.

What Else Should You Do

There are also several other things that you should do if you are involved in an accident.

You should write down everything about the accident:

- the licence plate of the other car, its make, model, and year

- the other drivers licence number, address, and telephone number

- the name of the other drivers insurance company and their insurance policy number and

- the names and phone numbers of witnesses to the accident.

Upon request, you must provide in writing, your name, address, phone number, vehicle permit number, and insurance information to other drivers who were involved in the accident, or to police officers or witnesses. But you should be careful about what you say. You should not admit anything. You should not apologize or make a statement to anyone except a police officer. You should not offer to pay for anything, and you should not accept any payments from anyone.

You should contact your lawyer or an insurance agent before you accept a payment or sign a release. You should also keep a record of your medical or mechanical expenses, damaged property, and injuries.

Read Also: Can I Report A Number To The Police

How Fault Is Determined

After you report an accident, your insurance company will determine fault by following the Insurance Act and Fault Determination Rules. These rules:

- Use diagrams to cover more than 40 accident situations that can be applied to almost every possible road collision scenario

- Are applied regardless of road or weather conditions, visibility, point of impact on the vehicles, or the actions of pedestrians

Note that in some cases, fault may be shared between multiple parties involved in an accident.

What Happens If You Dont Report A Car Accident

If someone else damages your vehicle and fails to report an accident, they can be charged with leaving the scene. Another person has the exact same 24 hours to report an accident to an accident reporting center. Many drivers assume that you dont need to notify your insurance company if the damage is less than $2000. However, you are required to notify your insurance company of all accidents regardless of the amount of damage, even if you are paying for their repairs with your own money.

Recommended Reading: How To Make A Police Report For Car Accident

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships dont influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- Insurance companies can access police reports in a variety of ways

- The DMV gains access to all reports, allowing insurance companies to see them as well

- The reports are used to help with investigations and calculate insurance premiums

Car insurance companies can access police reports. The reports can be obtained in a variety of ways.

The police reports are used to learn about whether you have been involved in an accident or not, towards an investigation when you file a claim, as well as to adjust your premiums periodically.

If you were in a car accident recently and need better auto insurance, compare at least three to four policies today to find the best rates for you! Enter your ZIP code above to begin!

Your Responsibility For Reporting An Accident To The Police

Any accident where the damages are significant must be reported to the police, usually within 24 hours. A collision report must be filed in Ontario if its believed the total damages caused to the cars involved will reach a combined repair cost of $2,000. This amount is shockingly easy to reach in todays new high-tech vehicles. The same threshold is true in Alberta. If you live outside of these two provinces, the limits may differ so its best you check your provinces collision-reporting rules should you be involved in a collision.

Regardless of the dollar value of damages caused, theres no question that police need to be notified right away if:

- Theres been an injury or death

- The collision is due to a suspected criminal act like impaired driving

- Theres a government vehicle involved, or a vehicle is transporting dangerous goods

- The collision is with an uninsured or unlicensed driver

- Theres damage to private, municipal, or highway property

- Pedestrians or bicyclists are involved in the collision

Whether the repairs needed are minor or significant generally, the police do not report the accident to your insurance company. That doesnt mean your insurer wont find out in another way though. For example, should the other driver choose to report the collision to their auto insurance company, yours will be notified as well, whether you like it or not.

Read Also: How To Get Sponsored By A Police Department

What Else Should I Document At An Accident Scene

In addition to contacting the authorities and filing a report, you should also:

- Take photos or videos of the accident scene and any visible property damage

- Get the names and contact information of everyone involved in the collision

- Speak with witnesses and collect their contact details

The more information you have regarding your vehicle collision, the easier it will be to file an insurance claim and collect recovery for your losses.

Failing To Take Enough Pictures Of Damage To Cars And Injuries

Nowadays, most people take pictures after an accident. The problem is that, many times, they just take pictures of their own car. You are allowed to take pictures of the other person’s car too! Do it! Also, people don’t take enough pictures. You can never have too many pictures. Take them from far away, from close-up, from very close-up. Take them from different angles â from the left, from the right, from above, from below. As relates to your own car, if you were rear-ended, open the trunk and take pictures of the inside. If the impact was to the front, open the hood and take pictures in there. Take pictures of the inside of the doors if they were hit. Then, follow this same advice for your injuries too.**BONUS: If possible, have someone take a picture of you sitting in the car in the position that you were in at the time of the accident. This can be done at the scene or the next day. And, have them open the driver door when taking the picture, so that your whole body can be seen from the side. This is actually VERY important if we need to hire a biomechanical engineer later. This will also explain why maybe a person is hurt more at a lower speed, especially if you show that your head was turned, or your body was out of position. Also, if the distance between your head and the headrest is more than 4 inches, a neck injury is much more common in a rear-end accident.

Read Also: Do You Need A Police Report For A Car Accident

When You Must Report A Car Accident

In all other cases, you should call your insurance company unless you dont mind finding yourself down the facing a lawsuit that you have no chance of winning. Reporting the accident to both law enforcement and your insurance company is especially important if anyone involved is injured, damage appears to be significant and the other driver is uncooperative or shady.

Failing To Take Pictures Of Accident Scene

Not to make light of the situation, but, obviously, this would be hard to do if you are on your way to the hospital in an ambulance. However, if everyone’s injuries are relatively minor , you’ll be standing around waiting for the police to arrive, at least for a little while. This is the perfect time to snap some pictures with your cell phone. Take as many pictures as you can from various viewpoints . Take pictures of the light, the intersection, the stop signs, the road markings, skid marks, any possible obstructions to the driver’s view, and anything else that may be relevant to the crash. Donât assume that the police will do this â because they won’t.

You May Like: How Many Years To Become A Police Officer

What Is A Liability Or Third

Many people think that the other drivers insurance policy is there to protect them if the other driver is at fault. This is one of the biggest myths of how liability insurance really works.

When you make a claim on the other drivers insurance policy, you are essentially asserting a legal claim against the other driver. Therefore, the other drivers insurance company has a duty to protect their driver against your claim.

They can protect their driver in several ways:

- They can investigate your claim

- If the adjuster feels like their driver is at fault, they can choose to settle with you

- Or, they can reject your claim and retain legal counsel to defend the other driver if you file a lawsuit.

Either way, the insurance companys focus is to protect their driver and not you.