Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for “dispute” on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

Review Your Credit Reports Carefully

When you receive your credit reports, read them carefully. Look for accounts you dont recognize. Look in the inquiries section for names of creditors from whom you havent requested credit. You may find some inquiries identified as promotional. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit. Promotional inquiries are not signs of fraud. Also, as a general precaution, look in the personal information section to verify your Social Security number, address and name.

If you find anything you dont understand, call the credit bureau at the telephone number listed on the report. Tell them you want to block, or remove, any information on the report that is the result of identity theft. For more on what to tell the credit bureaus, see the Privacy Rights Clearinghouses Identity Theft: What to Do When It Happens to Youwww.privacyrights.org/fs/fs17a.htm

Fbi Field Offices Mortgage Fraud

White Collar Crime Supervisor

John J. Duncan FOB, Suite 600

710 Locust Street

Eagle Crest Building, Suite 3000

225 N. Humphreys Blvd

710 Locust Street, SW, Suite 300

Knoxville, TN 37902-2526

200 Jefferson Avenue, Suite 300

Memphis, TN 38103-2389

235 Cumberland Bend, Suite 200

Nashville, TN 37228-1803

Suite 400 Nashville City Center

Nashville, TN 37219

7000 Central Parkway, Suite 1600

Atlanta, GA 30328

Tennessee Division of Financial Institutions

John Sevier Bldg., 4th Floor

500 Charlotte Avenue

Also Check: How To Get Full Police Report

Contact The Credit Bureaus

- Reach out to one of the three bureaus confirm your identity and ask for a free fraud alert to be linked to your report. Once the alert is placed, it will become much harder for fraudsters to use your information maliciously. Note that you only need to order a fraud alert with one bureau: the others will be notified automatically.

- You can extend the default fraud alert lifespan to seven years, but you’ll need a police report or the Federal Trade Commission report to do this.

Identity Theft And Fraud Reporting Procedures

The Metropolitan Police Department is committed to providing the best customer service possible. The Financial and Cyber Crimes Unit has established a list of guidelines for reporting identity theft and fraud crimes, which are investigated by the unit. Being prepared for this meeting helps reducing the stress and confusion that may arise after the theft. It will also help provide a clear direction for members of the department who are trying to assist you with your case.

Recommended Reading: How To Get A Police Report Of A Car Accident

If Youve Been Scammed

If you think you may be a victim of a fraud or scam, there are some key steps you should take immediately to reduce your risk of losing more money, protect your personal information and avoid being scammed again.

You should:

- stop all communication with the fraudster or scammer

- report the scam or fraud to your local police, the Canadian Anti-Fraud Centre and any regulatory bodies

- notify financial institutions and other companies where you have an account that may have been affected

- avoid making any major financial decisions until you feel youve taken action to secure your accounts

- put an alert on your credit report by contacting a consumer reporting agency, such as Equifax Canada or TransUnion Canada

- gather all records you have of the fraud or scam, such as:

- correspondence with the scammer

- financial statements

- contact information the scammer used to contact you

- websites and social media accounts used for the scam

- any papers, marketing material or ads used for the scam

When Filing A Report State:

- Your personal details. If you are filing a report on behalf of another person, you need to provide personal information for both of you.

- Time and place of the crime, in as much detail as possible.

In the case of fraud or crime connected to the internet:save as much documentation as possible. You do not need to submit this information when reporting the crime. The police may request the information at a later stage of the investigation.

If you have lost your passport or national ID card:you must always report this to the Swedish Police so that it can be blocked. Call +46 77 114 14 00.

Don’t Miss: How To Report Car Accident To Police

What Happens After An Fir Has Been Registered

Once your FIR is registered, the police will conduct an investigation based on the FIR, which may also include arrests of the accused. The offence under section 420 is a cognizable and non-bailable offence, which means that the police can make an arrest in such cases without a warrant. After the investigation is complete the police will record all the findings of their investigation and would make a charge sheet which will be submitted in the court. The charge sheet will state whether a case is made out against the accused and if substantial proof regarding the same has been found in the investigation or not.You can also file a detailed criminal complaint against the accused stating all the facts of the case. It is recommended to have an experienced criminal lawyer with you during this step. He can guide you with the court procedure and can also draft and file the criminal complaint on your behalf.

Reporting To Your Bank

Don’t Miss: How Many People Killed By Police

Common Types Of Financial Crimes

For a detailed overview of common financial crimes and action steps for reporting please see our Taking Action guide to financial crimes.

Identity theft:

Someone steals your personal financial information to make fraudulent charges or withdrawals from your accounts. Sometimes people will use the information to open credit or bank accounts and leave the victim liable for all the charges.

Identity theft often results in damaged credit rating, bounced checks/denied payments, and being pursued by collections agencies.

Examples:

- Unfamiliar charges or purchases on your credit card or bank account statements.

- Perpetrators posing as a bank, government office, or official institution in order to steal your personal financial information

Investment Fraud:

Selling investments or securities with false, misleading, or fraudulent information. This may be false/grandiose promises, hiding/omitting key facts, and insider trading tips among other things.

Examples:

Mortgage and Lending Fraud:

Someone else opens a mortgage or loan using your information or using false information or lenders selling you mortgage or loans with inaccurate information, deceptive practices, and other high-pressure sales tactics.

Examples:

Mass Marketing Fraud:

Examples:

Reporting Internet Banking Fraud

If you receive an email asking for your bank account details, report it to the ACSC.

If you are the victim of internet banking fraud, report it to your financial institution and find out about their process for investigating the incident. Once the financial institution clears you of any involvement, generally under the Electronic Funds Transfer Code of Conduct they will reimburse your bank account. Under Victorian law, the financial institution is the victim of the criminal offence not you. The responsibility for reporting the crime is therefore with the financial institution.

If you also report to ACSC, this will give Australian law enforcement a national picture of the overall cybercrime issue and will assist in reducing the incidence of cybercrime.

For more information on unauthorised and mistaken transactions visit www.moneysmart.gov.au

Also Check: How To Get A Police Record Expunged

Florida Fbi Field Offices Mortgage Fraud

White Collar Crime Supervisor7820 Arlington Expressway, Suite 200Jacksonville, FL 32211-7499

North Miami Beach, FL 33169-6508Phone: 305-944-9101

500 Zack Street, Room 610, FOBTampa, FL 33602-3917

Charles E. Bennett Federal Building400 W. Bay Street, Suite 1015Jacksonville, FL 32202

3751 Maguire Boulevard, Room 270Orlando, FL 32803-3032

500 Zack Street, Suite 402Tampa, FL 33602

Start With Your Card Issuer

- Contact your card issuer via the phone number on the back of the card or the issuer website’s live-agent chat.

- Tell the customer service representative that you think you were the victim of fraud. The agent may have you confirm recent transactions to be sure any authentic purchases are processed correctly.

- Ask for your account to be suspended or closed. Be sure to change any passwords or PINs you think may have been compromised.

Read Also: How To Report Cyber Stalking To The Police

Immediate Steps To Take

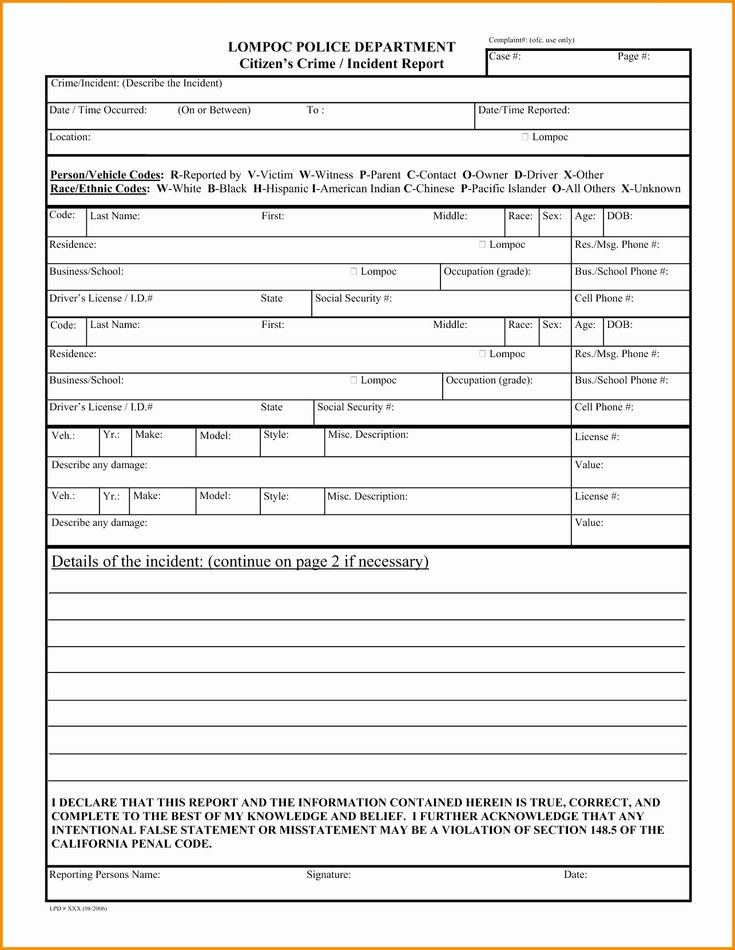

- File a report with the police/sheriff in the jurisdiction in which you live and get a copy of the report for the credit reporting agencies, banks and credit card companies. You can file the report at the police station or file online.

- In Denver, you can file at www.denvergov.org/policereport.

- You can also complete the ID Theft Affidavit provided by the Federal Trade Commission at www.ftc.gov.

- Consider placing a Security Freeze or Fraud Alert on/in your credit reports. See below.

Citizen Online Report Entry

If your incident:

- Requires IMMEDIATE police attendance or a lengthy on-scene investigation

- Is related to Domestic Violence

- Involves an Emotionally Disturbed Person

- Involves the reporting of Theft of E-Bike

- Is motivated by hate bias

Please call the Toronto Police at 416-808-2222 and DO NOT submit your report online.If this is an emergency, please call 911.

In order for the Toronto Police Service to process your CORE report, the following information is MANDATORY

- Your EMAIL ADDRESS, PHONE NUMBER and other contact information.

- The INCIDENT START AND END DATE

- The LOCATION of the incident, including the place or area your property was believed stolen.

- Please CREATE A SEPARATE PROPERTY ENTRY for EACH piece of property that you are reporting stolen.

The accuracy of the information you provide in the report greatly assists the Toronto Police Service in investigating your report. Please ensure it is as COMPLETE AND CONCISE as possible.

If you have filed a report online and would like to add/change/update your report, please submit a Supplemental Report.

It is the policy of the Toronto Police Service to not accept reports of non-emergency incidents that occur outside of the City of Toronto.

Read Also: How Hard Is It To Be A Police Officer

Tips When Filing A Police Report

With luck, filing a police report will go smoothly. You can then concentrate on taking steps to recover from identity theft.

But some police departments may not be fully prepared to take your report. For instance, officers may be preoccupied with other crimes or unfamiliar with how to handle identity theft cases.

Here are some tips that can help.

- Be firm, but calm when seeking to file a police report.

- Try to remain flexible. The police may send you to a website to fill out a form, instead of taking your information in person.

- Contact your state attorney generals office if the police are unable or unwilling to take your report. States may have different processes for filing a report. An attorney generals office or website may be able to provide the details.

- Be specific. When you make a police report, give detailed information about the identity theft, such as dates accounts were opened in your name or who might have committed the fraud.

- Make copies of your identity theft police report and your FTC complaint. Youll need these to resolve any disputes with companies where the identity thief used your name.

Bottom line: Reporting identity theft to the police or the FTC is a smart step to take. It could save time and money as you recover from identity theft.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Start your protection now. It only takes minutes to enroll.

On This Pageskip This Page Navigation

If you received an email from a sender posing as Public Health Ontario offering you next steps for signing up for a vaccine certificate or asking for your private health information: Do not open it or click on any links.

*A phishing scam is an attempt to deceive you into giving sensitive information to someone posing as an individual or company that you know .

Read Also: How To Get A Certified Police Report

To Report Any Of The Types Of Financial Crimes Described Below Complete An Online Crime / Incident Report Or Call 277

Forgery, Fraud and Identity Theft are investigated by the Financial Crimes Unit of the Bureau of Investigations. The Financial Crimes Unit is located on the third floor of the Police Administration Building located at 201 W. Mission Street, San Jose, CA 277-4521.

The Financial Crimes Unit investigates financial crimes occurring in the City of San Jose, including:

- Forgery

- Unauthorized Use of Credit, Check, Debit Cards or Account Numbers

- Identity theft

- Embezzlement

- Theft by Deception Including Scams, Con Games, Misrepresentation, and Elder Fraud.

To report any of these types of crimes in San Jose complete an ONLINE CRIME / INCIDENT REPORTor call 277-8900.

- Dispatchers are available 24-7 however phone reports should be made between noon and 4 pm.

If you have other questions Call our Financial Crimes Unit at 408-277-4521 or e-mail us via our contact form. The contact form is for general information and cannot be used to report crimes.

Merchants who accept a check that is subsequently returned by the bank marked “NSF” , or “Account Closed” may – Bad Check Restitution Program Victim Hotline: 877-520-6137 or visit www.checkprogram.com/santaclaracounty.

If the Bad Check Restitution Program is unsuccessful and if they believe a criminal case can be made, you may file a Police Report Online or you may call 277-8900 and make a report, or you can visit the Police Administration Building to make your report to an officer or via a computer kiosk in main lobby.

| Agency |

Should You File A Police Report After Identity Theft

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you believe you’re a victim of identity theft, there are several steps you need to take to help rectify the situation. But is filing a police report one of them? You should file a police report after identity theft if you can provide evidence for the investigation, know the person or group responsible for the theft, or are asked for a report by a creditor or other entity.

Depending on how and what type of information is stolen, scammers may use your identity to siphon money from your financial accounts, open new accounts such as credit cards or phone plans, commit tax fraud, or apply for government benefits. In 2020, 1.4 million Americans filed identity theft reports, according to the Federal Trade Commission, a 29% increase over the previous year. The most common form of ID theft involved scammers using stolen information to apply for or receive government benefits, such as unemployment insurance.

Read on to find out the steps you need to take if you’re a victim of identity theft, and when a police report may be necessary to help resolve the issue.

Read Also: Can I See My Police Report Online