Report Identity Theft To Other Organizations

You can also report the theft to other organizations, such as:

-

Credit Reporting Agencies – Contact one of the three major credit reporting agencies to place fraud alerts or freezes on your accounts. Also get copies of your credit reports, to be sure that no one has already tried to get unauthorized credit accounts with your personal information. Confirm that the credit reporting agency will alert the other two credit reporting agencies.

-

National Long-Term Care Ombudsman Resource Center – Report cases of identity theft due to a stay in a nursing home or long-term care facility.

-

Financial Institutions – Contact the fraud department at your bank, credit card issuers and any other places where you have accounts.

-

Retailers and Other Companies – Report the crime to companies where the identity thief opened credit accounts or even applied for jobs.

-

State Attorney General Offices – Your state’s attorney general might offer tips, checklists, or an advocate to help you recover from identity theft. These resources don’t replace filing an ID theft report with the FTC.

You may need to get new personal records or identification cards if you’re the victim of ID theft. Learn how to replace your vital identification documents after identity theft.

Am I On The Hook For The Money

Per the Fair Credit Billing Act, most credit card companies have protections for those affected by identity theft, like zero-liability policies. The law also sets the maximum liability for unauthorized charges at $50.

Fraudulent ATM, debit cards and electronic transfers are protected under the Electronic Transfer Fund Act. However, it’s important to act fast to avoid charges. If you report your debit or ATM card as lost or stolen before anyone uses it, you’re off the hook for any fraudulent charges. Otherwise, if you report your card as lost or stolen within two days of learning of the loss or theft, your maximum liability for any unauthorized charges will be $50. If you report the card as lost or stolen between two days after learning of the loss or theft, but less than 60 days after your statement is sent to you, your liability is $500. If you report a card lost or stolen more than 60 days after your statement is sent to you, your liability is unlimited.

If you are a victim of identity theft, consider keeping a security freeze or fraud alert on your credit reports while you work to undo any damage. Being vigilant against signs of identity theft and catching the theft or fraud early can help keep the damages to a minimum.

Signs Of Identity Theft

Signs of identity theft might include:

- Receiving bills for items you did not buy, accounts you dont recognize, or medical services you did not use

- Charges on your credit card or bank statements you dont believe are yours

- Notification that an unfamiliar account has been turned over to a collections agency, or receiving calls from debt collectors about a debt that isnt yours

- Unexplained withdrawals from your bank account

- You stop receiving bills or other mail

- Notification that more than one tax return was filed in your name

- Denial of credit because of the fraudsters actions

Recommended Reading: What Do You Do To Become A Police Officer

How Identity Crime Occurs

There are numerous ways in which offenders are able to facilitate identity theft of an individual or Body Corporates and subsequently fabricate and manipulate that identity, including:

- Theft of mail articles

- Theft of wallets, bags and purses

- Skimming of credit and debit cards via ATMs or EFTPOS terminals

- Internet scams including phishing emails or spoofing sites designed to replicate banking and payment sites

- Remote access scams giving access to a computer

- Malicious computer programs such as malware or spyware

- Ransomware

- Hacking of websites or business servers containing personal information databases

- Fake online social media profiles

The use of stolen, fabricated or manipulated identities to commit or enable crime has been enhanced by the expansion of new technologies and change in online behaviour.

Identity Theft is organised crime. It is used to facilitate fraud offences but also used for terrorism, drug importation, people smuggling and money laundering.

How Filing A Report Helps Protect You

Why is it important to report identity theft? If you are a victim of identity theft, it means someone has taken your personal information and used it to commit fraud in your name.

Heres how filing a report helps:

- It acts as a declaration of your innocence.

- It helps start the investigation.

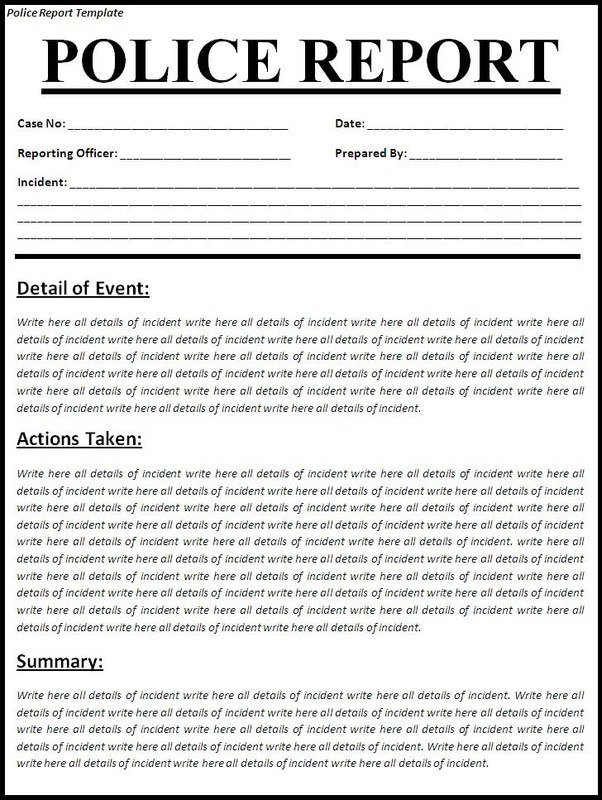

A police report serves as sworn statement that you were not responsible for any crimes the thief committed using your name. If someone accuses you of a crime committed in your name, you can show them your sworn statement.

Filing an Identity Theft Report at IdentityTheft.gov serves a similar function, in most cases. Its an official statement about the crime.

Important to note: The FTC recommends filing an Identity Theft Report first, and including it when you file a police report.

Keep in mind, with either report, youre legally obligated to tell the truth to the best of your knowledge. If you dont, you could face criminal penalties.

Steps to take when reporting ID theft to the police

If you decide you want to report identity theft to the police, here are steps you can take.

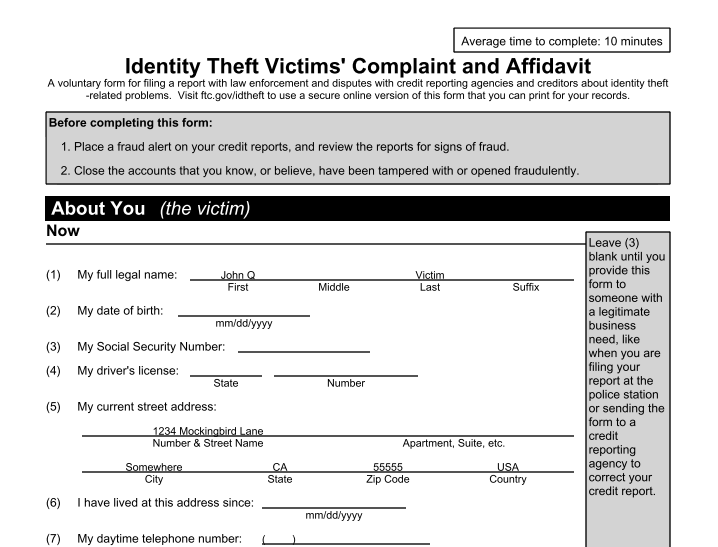

- A copy of your FTC Identity Theft Report

- A government-issued photo ID

- Proof of your address, such as a mortgage statement or utilities bill

- Any proof you have of the theft, such as credit card statements, IRS notices or collection notices

You May Like: Can You Check Your Police Record Online

Identity Theft: What It Is What To Do

Reading time: 6 minutes

Highlights:

- It may be helpful to familiarize yourself with the warning signs of potential identity theft

- If you believe your information has been stolen and used fraudulently, there are some steps you can take

- Consider placing a fraud alert or security freeze on your credit reports – both are free

Identity theft occurs when someone gets or steals your personal information. The information can then be used to open credit accounts in your name or receive benefits, such as employment, insurance or housing. Identity theft may impact your credit reports and credit scores.

Report The Crime To The Police

Under California law, you can report identity theft to your local police department.1 Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft. Black out other items not related to identity theft. Give the police any new evidence you collect to add to your report. Be sure to get a copy of your police report. You will need to give copies to creditors and the credit bureaus. For more information, see Organizing Your Identity Theft Case” by the Identity Theft Resource Center, available at

Also Check: Can Police Take Your Money

What If I Need To Change My Report After I File It

You will have the ability to file online supplemental reports. If you have already filed a report through the online system, we strongly encourage you to continue to update and add information through this system. This decreases the risk of filing the same report twice, and also makes it easier to keep your information tied to the correct report number.

You will need either:

- Your temporary transaction

- Your police report number

Replacing Lost Or Stolen Identification

You May Like: How To Become A Police Officer In San Diego

Immediate Steps To Take

- File a report with the police/sheriff in the jurisdiction in which you live and get a copy of the report for the credit reporting agencies, banks and credit card companies. You can file the report at the police station or file online.

- In Denver, you can file at www.denvergov.org/policereport.

- You can also complete the ID Theft Affidavit provided by the Federal Trade Commission at www.ftc.gov.

- Consider placing a Security Freeze or Fraud Alert on/in your credit reports. See below.

Online Crime Reporting System

The Online Crime Reporting System is designed to make it easier and more convenient to file a police report without leaving home however, not every crime can be reported using this system.

In the event of an emergency, if a crime is in progress or someone is hurt or threatened, 911 should be called or texted immediately.

The following incidents can be reported on the Online Crime Reporting System:

| Property Damage- Accidental |

Users who can answer “yes” to any of the questions below may call 216.621.1234 to file a report or visit the FAQ’s for more information.

- Did the crime or incident occur outside Cleveland City limits?

- Was someone injured as a result of this crime or incident?

- Is there information about the person, even if vague, who might have committed the crime ?

- Is the license plate number known for the vehicle the suspect was or may be in?

- Did the crime involve the use or threat of a weapon ?

- Did the crime involve drugs in any way?

- Are there serial numbers for stolen items?

- Was there house or garage break-in?

- Was this a motor vehicle accident?

Filing a false police report is a crime. Users must be 18 or older to use the Online Crime Reporting System. Prior to beginning the online filing, user should have a valid email address, pop-up blocking software should be turned off, and all the information related to the incident should be available.

Reports can be filed here

You May Like: How To Get Police Clearance Certificate In Usa

Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for “dispute” on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

Filing A Police Report Online

This system allows you to submit a report from your computer or mobile device without going to an OPP detachment. All submissions will be sent directly to the OPP and reviewed by an officer. You may be contacted to provide more information. You must have a valid e-mail address in order to submit a report.

To file a report online, please follow the simple steps below:

You May Like: When Does Police Use Of Force Become Excessive Or Unjustified

Request Additional Free Credit Reports

California identity theft victims with a police report of identity theft are entitled to receive up to 12 free credit reports, one per month for the 12 months following the date of the police report. The procedure for requesting free monthly reports is different for each of the credit bureaus.

Experian: Make a single request to receive all of your free monthly reports. Mail your request for 12 free monthly reports to Experian at P.O. Box 9554, Allen, TX 75013. Enclose a copy of the police report of identity theft, a copy of a government-issued identification card , and a copy of proof of current mailing address . Also provide your full name including middle initial , previous addresses for the past two years, Social Security number and date of birth.

TransUnion LLC: Write or call in your request each month. Mail to TransUnion LLC, P.O. Box 2000, Chester, PA 19016. Or call the toll-free number printed on your most recent TransUnion LLC credit report. Provide your full name including middle initial , Social Security number, date of birth, and proof of residence .

Equifax: Write or call in your request each month. Mail to Equifax Fraud Department, P.O. Box 740250, Atlanta, GA 30374. Or call the toll-free number printed on your most recent Equifax credit report.

Reporting A Sexual Assault Online

York Regional Police understands that while sexual assaults often cause long-lasting trauma, survivors may have difficulty speaking about incidents with friends, family members, or police officers. To help mitigate the challenges faced by sexual assault survivors, York Regional Police now accepts reports of historical sexual assaults online, which are received directly by qualified sexual assault investigators.

Learn more about reporting a sexual assault online.

Also Check: Can The Police Track Your Iphone

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Use The Id Theft Affidavit

Creditors may ask you to fill out fraud affidavits. The Federal Trade Commissions ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name. Also send copies to creditors where the thief made charges on your account, to the credit bureaus, and to the police. The form is available on the FTC Web site at ww.ftc.gov/bcp/edu/resources/forms/affidavit.pdf. File a complaint of identity theft with the FTC. See their Web site at www.consumer.gov/idtheft The FTC keeps a database of identity theft cases that is used by many law enforcement agencies.

Recommended Reading: How To File A Police Report For An Accident

If Someone Uses Your Social Security Number To Claim Unemployment Benefits Or To Work

If you suspect that someone else has claimed unemployment benefits using your Social Security number, call the California Employment Development Departments toll-free Fraud Hotline at 1-800-229-6297. For more information, see their Web site at www.edd.ca.gov. Search on the site for “fraud.” Sometimes, an identity thief will use someone elses Social Security number to be eligible to work. Its a good idea to check your Social Security earnings record to see if income earned by a thief is being posted to your account. You can get a copy of your earnings record by calling 1-800-772-1213. Or get a Request for Social Security Statement at www.ssa.gov/online/ssa-7004.html. If you believe a thief is using your Social Security number to work or claim Social Security benefits, call the Social Security Fraud Hotline at 1-800-269-0271. Or report Social Security benefits fraud online at www.ssa.gov/oig/hotline/index.htm..

What Types Of Reports Can I File Online

- Damage/Mischief to Motor Vehicle under $10,000.00

- Damage/Mischief to Property under $10,000.00

- Lost Property under $10,000.00

- Theft of Property – under $10,000.00

- Theft from Motor Vehicle – under $10,000.00

- Supplemental Report

- Driving Complaints Road Watch:- Constant Neighborhood traffic related issues- School bus violations.

Read Also: How Do You Fix An Incorrect Police Report