What Is The Attorney General’s Identity Theft Passport

The Identity Theft Passport is a card that you can carry and present to law enforcement or other individuals who may challenge you about your identity should you become the victim of identity crime. The Passport is designed to serve as notification to help protect victims from unlawful detention or arrest for crimes committed by another under a stolen identity.

An Identity Theft Passport may be available to any Virginian who:

Has filed a police report because they believe they are a victim of identity crime and/or has obtained a court order expunging their record as a result of identity crime

You may You can then print, complete, sign and mail to this Office OR

You may write to this Office for an application for an Identity Theft Passport:

Office of the Attorney GeneralVictim Notification Program202 North Ninth StreetRichmond, VA 23219

All applications must be submitted in person or by mail and will be acted upon promptly.

Important Steps To Take If You Notice Any Red Flags

- Request a free credit report.

- Visit AnnualCreditReport.com which has data from the major credit bureaus: Experian, Equifax, and TransUnion.

- File an Identity Theft Report with the FTC.

- Report the Identity Theft to the Credit Bureaus.

- Consider a credit freeze.

- Notify your cellular carrier to prevent SIM swapping.

- Consider canceling all your bank accounts and credit cards.

- Immediately change the usernames and passwords to your online accounts.

Consider A Credit Freeze

The strongest protection against new accounts being opened in your name is a credit freeze, also called a security freeze. A freeze means that your file cannot be shared with potential creditors, insurers, employers, or residential landlords without your permission. For more information, see our CIS 10: How to Freeze Your Credit Files.

Recommended Reading: Do I Need A Police Report For An Accident

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Before You Report A Crime Online

Before choosing to report a crime online, please note that an incident cannot be reported online if:

- The crime occurred outside of York Region. If the crime occurred outside of York Region, please contact the areas local police service.

- Threats or violence occurred.

- The crime is rooted in hate or bias, or related to domestic violence.

- You know the suspect, have information related to a vehicle involved in the crime, or evidence is left behind.

Before reporting online, please also confirm you have a valid email address and have turned off any pop-up blocking settings, plugins or software.

Filing a false police report is a crime.

Recommended Reading: How To Get A Police Accident Report Online

Don’t Miss: What To Do If You Are Wanted By The Police

How Do I Report Identity Theft In The Philippines

How do I report identity theft in the Philippines? If youre in the Philippines, touch base with either the Philippine National Police or National Bureau of Investigation. At NBI, you may reach them at or call 028521-9208, local extensions 3429 and 3497 .

Is identity theft a crime in Philippines? In the Philippines, the crime specifically labelled as identity theft relates to cybercrimes. There is no such specific designation in traditional crimes, but identity theft is considered in relation to the crime of estafa under the Revised Penal Code of the Philippines.

What is the penalty of identity theft in the Philippines? When it comes to penalties, RA 10175 penalizes any person found guilty of computer-related identity theft with imprisonment of prision mayor or a fine of at least Two hundred thousand pesos up to a maximum amount commensurate to the damage incurred or both.

How do I file a report for identity theft? You can call the Federal Trade Commission at 1-877-438-4338 or TDD at 1-866-653-4261, or online at http://www.consumer.ftc.gov/features/feature-0014-identity-theft to report identity theft.

What Is The Law Of Identity Theft

California Penal Code 530.5 PC makes it a crime to take another persons personal identifying information and use it in any unlawful or fraudulent manner. Identity theft is a wobbler, meaning the charges can be filed as either a misdemeanor or a felony. A conviction is punishable by 3 years in jail or prison.

Also Check: How Can I Become A Police

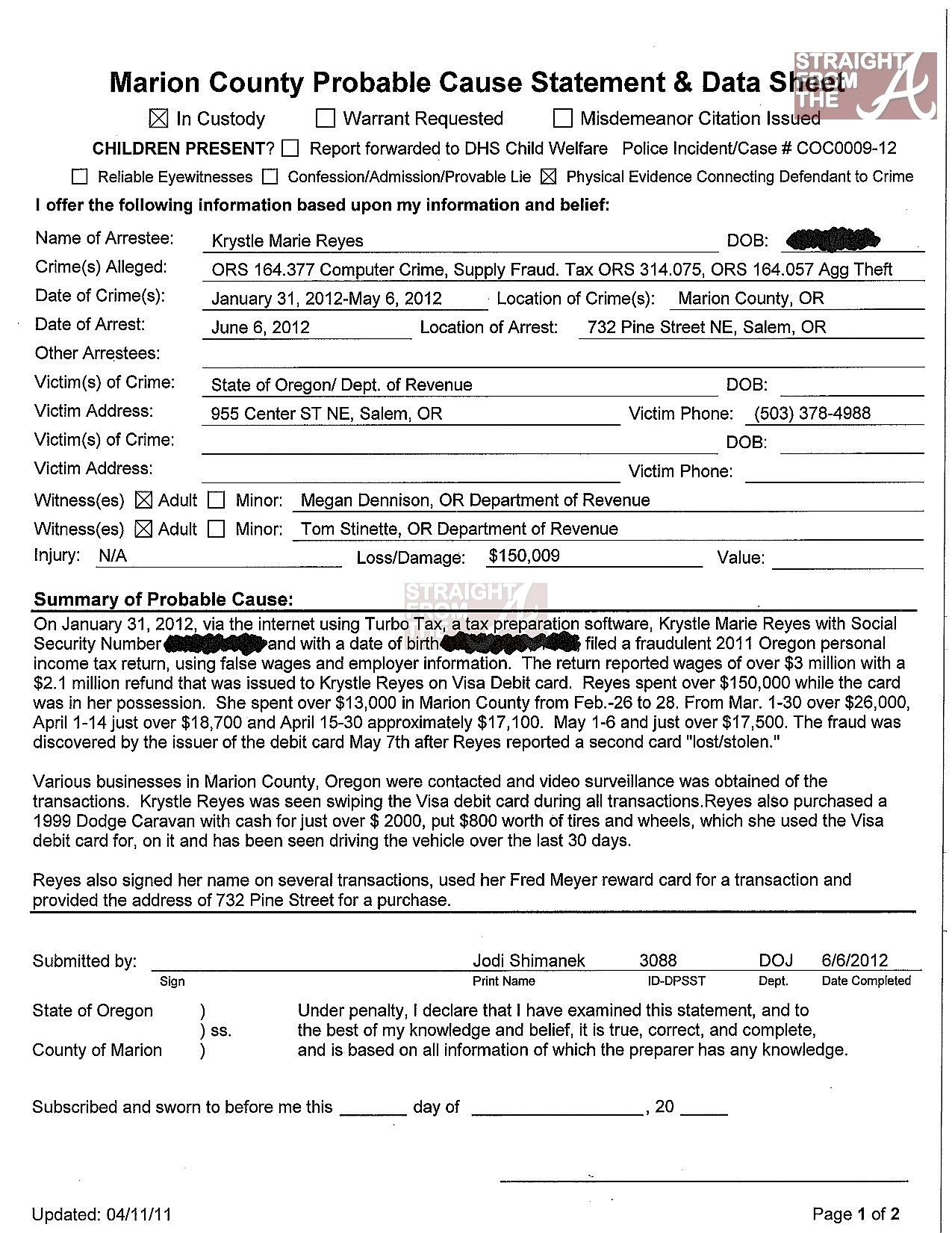

Identity Theft Is A Report

If you suspect that you may be a victim of identity theft, we strongly recommend that you file a police report as soon as possible because:

- A police report helps kickstart the investigation process and helps combat identity theft.

- It serves as initial proof of your innocence.

- It functions as documentation of the crime and provides evidence that you can use to dispute incorrect information in your credit report.

- A police report demonstrates to the creditor or debt collector that an identity thief was responsible for the debt, not you.

- The police report is necessary when youre completing your fraud affidavit.

These are all solid reasons to file a police report as soon as you discover unauthorized activity taking place in your name. There are also some other steps you should take after falling victim to fraud and any other kind of identity theft. If you even suspect foul play, dont hesitate to inform the police and other relevant agencies about it the quicker you take action, the more likely you are to achieve a satisfactory resolution.

While its important to acknowledge your own responsibility to take the right steps following identity theft, we say better safe than sorry. To that end, we urge you to take advantage of our legal protection packages for non-stop credit monitoring and steady protection against identity theft. Dont leave yourself vulnerable to identity thieves fight back.

Your Case Is Reviewed Ranked And Prioritized

Department processes vary, but in general, the case will be routed to a detective who will review the facts and materials. At that stage, he or she will make a decision about what to do about it if anything.

Is it something we can actively investigate and probably solve? If it is, then we will begin to pursue it, though how aggressively is also based on caseload, says DiDomenica.

You may have to contest the charges or demonstrate to a credit card company that you are 100 percent innocent. Having the report doesnt hurt. Its smart backup.

What most civilians dont know: Cases are numerically scored based on how much data is provided, and the highest ranking ones will garner the most attention. Is the suspect known, do we have anything to work with? If so, the higher points it gets, says Shipley. If not, the case gets a low score and will get thrown to the side. Fraud cases are all about the numbers.

Read Also: What Asvab Score Is Needed For Military Police

Report The Crime To The Police Or Sheriff’s Office In The Area Where You Live Or Where The Crime Occurred

Identity theft is a felony, and charges may be filed against the thief in the county where you live or where the crime took place. Ask the police to make a police report and give you a copy. A police report will help you correct your credit rating. Take the Identity Theft Affidavit, created by the FTC when you reported the identity theft to IdentityTheft.gov, and government-issued photo ID with you to local law enforcement.

Request Additional Free Credit Reports

California identity theft victims with a police report of identity theft are entitled to receive up to 12 free credit reports, one per month for the 12 months following the date of the police report. The procedure for requesting free monthly reports is different for each of the credit bureaus.

Experian: Make a single request to receive all of your free monthly reports. Mail your request for 12 free monthly reports to Experian at P.O. Box 9554, Allen, TX 75013. Enclose a copy of the police report of identity theft, a copy of a government-issued identification card , and a copy of proof of current mailing address . Also provide your full name including middle initial , previous addresses for the past two years, Social Security number and date of birth.

TransUnion LLC: Write or call in your request each month. Mail to TransUnion LLC, P.O. Box 2000, Chester, PA 19016. Or call the toll-free number printed on your most recent TransUnion LLC credit report. Provide your full name including middle initial , Social Security number, date of birth, and proof of residence .

Equifax: Write or call in your request each month. Mail to Equifax Fraud Department, P.O. Box 740250, Atlanta, GA 30374. Or call the toll-free number printed on your most recent Equifax credit report.

You May Like: How To Fix The Police System

What Is Required To File A Police Report In Detroit

When filing a police report, you will be asked to supply as much evidence as possible to support your claim. Evidence will depend on what is being reported. This could include photographs, recordings, messages, items, or witness statements. You will need to provide identification and the location of the activities being reported. You will also need to provide contact information in case officers need to follow up on the police report.

Place A Fraud Alert And/or Security Freeze On Your Credit Report And Get Copy Of It

You can a place a fraud alert with one, simple phone call. This can help prevent an identity thief from opening additional accounts in your name, but doesn’t block potential new credit like a security freeze. As soon as the credit bureau confirms your fraud alert, the other two credit bureaus will automatically be notified to place fraud alerts, and all three credit reports will be sent to you free of charge. Once you receive the reports, review them carefully for accounts you didn’t open, debts you can’t explain or inaccurate information.

A security freeze is even stronger and prevents your files from being shared with potential creditors. A security freeze can help prevent identity theft since most businesses will not open credit accounts without checking a consumer’s credit history first. You, too, will not be able to open new credit while a freeze is in place. Individuals can request that a freeze be temporarily lifted for the purpose of obtaining new credit.

You May Like: How To Find Out Police Report

Signs Of Identity Theft

Signs of identity theft might include:

- Receiving bills for items you did not buy, accounts you dont recognize, or medical services you did not use

- Charges on your credit card or bank statements you dont believe are yours

- Notification that an unfamiliar account has been turned over to a collections agency, or receiving calls from debt collectors about a debt that isnt yours

- Unexplained withdrawals from your bank account

- You stop receiving bills or other mail

- Notification that more than one tax return was filed in your name

- Denial of credit because of the fraudsters actions

Recommended Reading: What Do You Do To Become A Police Officer

Getting A Replacement Sim Card And Phone

Your network will usually send you a replacement SIM card, but they may charge an administration fee.

Your network wont normally replace your phone free of charge and youll have to carry on paying your monthly line rental until the end of your contract.

If you dont get a free replacement phone, youll have to decide whether to:

- buy a new phone and continue with your current contract

- wait until your current contract ends and get a new contract that includes a free phone

Read Also: Can Police See If Your License Is Suspended

You May Like: How To File A Complaint Against A Police Department

Will The Police Do Anything About Identity Theft

Reporting Identity Theft to the FTC. A police report usually isnt necessary to document identity theft because the FTC is a federal law enforcement agency. Just as when filing a police report, you must tell the truth as best you can and could face criminal penalties if you provide false information.

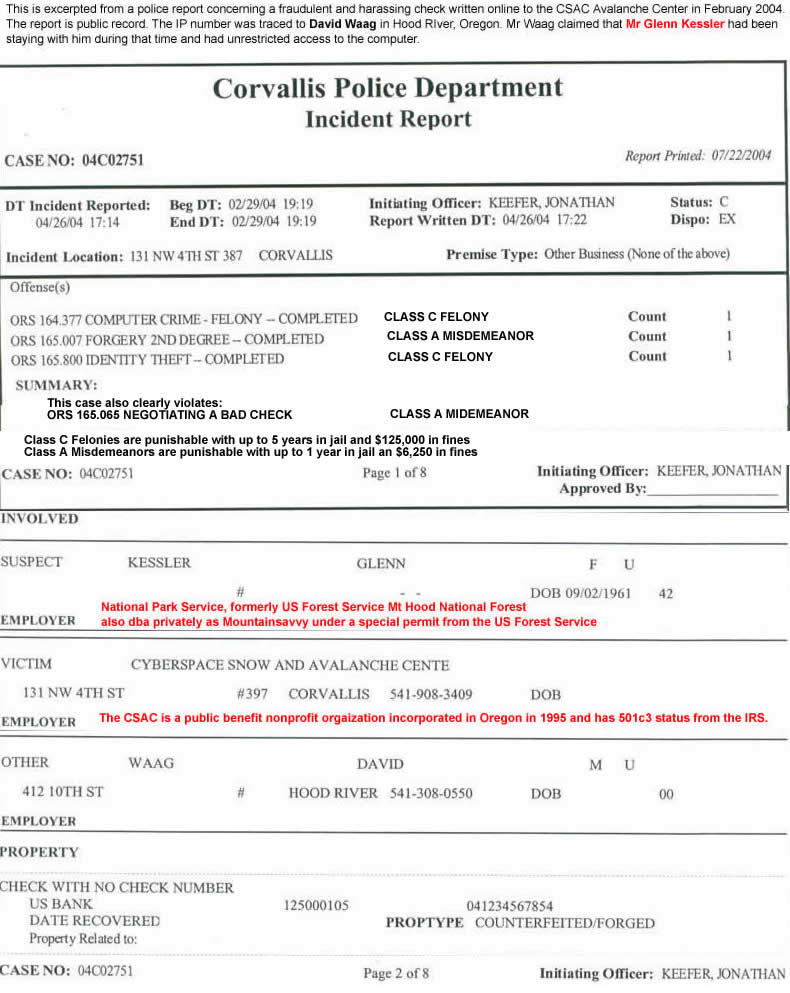

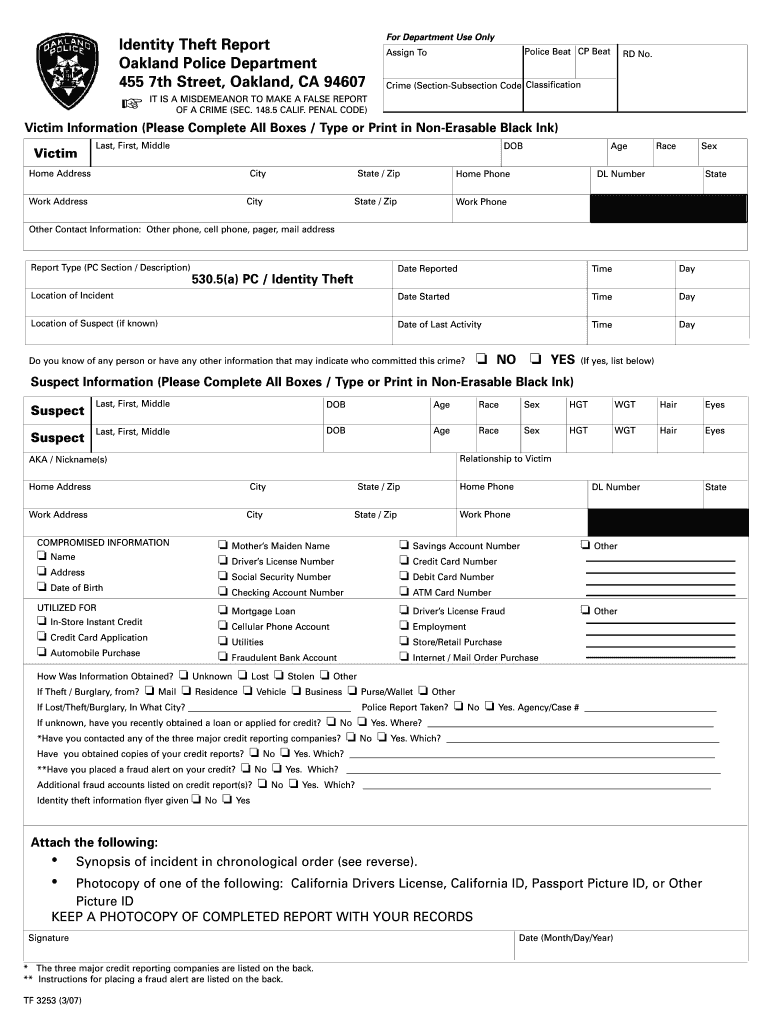

Filing An Identity Theft Police Report

ID theft victims should reach out to law enforcement

If you are a victim of identity theft, you should file a police report with the law enforcement agency closest to where you live.

Your local police or sheriff department must take an identity theft report if you have documents to show you were a victim.

When you go to the police station, bring supporting documents such as:

- Copies of bills or collection notices

- Bank or credit card statements

Make sure to write down the number on the police report. Your creditors may ask for the report number.

If the officers do not want to take your report, ask to speak the watch commander and mention Penal Code Section 530.6.

County of Los Angeles Department of Consumer and Business Affairs. Last change: Oct. 25, 2011

Read Also: How To See Police On Google Maps

Reporting To Creditors And Credit Agencies

Make a list of all the creditors and other financial institutions where you do business, such as credit card companies, banks, and phone and internet companies. Report to each of these companies that you are the victim of identity theft and ask each company to place a fraud alert on your account. You should close accounts that have been tampered with or opened fraudulently.

Aura’s White Glove Fraud Resolution Team Can Assist

Save time and hassle by allowing Aura to monitor and alert you to any new inquiries to your credit file across all 3 major credit bureaus .

Aura’s White Glove Fraud Resolution service eliminates the stress of recovering your identity and assets if youâre a victim of identity theft or financial fraud. A dedicated Aura case manager will work with you to craft a mitigation and remediation plan to recover your damages. Aura’s team of trained experts will help you navigate the challenges of dealing with credit bureaus and federal institutions.

Victims of identity theft have a right to:

Also Check: How To Write A Cover Letter For A Police Job

If You Are Wrongly Accused Of A Crime Committed By An Identity Thief

“Criminal identity theft” is a label given to a particular type of identity theft. Criminal identity theft occurs when a suspect in a criminal investigation identifies himself or herself using the identity of another, innocent person. A special database in the California Department of Justice can help victims of this kind of identity theft. See our Consumer Information Sheet 8: How to Use the California Identity Theft Registry- A Guide for Victims of “Criminal” Identity Theft.

Report Identity Theft To Other Organizations

You can also report the theft to other organizations, such as:

-

Credit Reporting Agencies – Contact one of the three major credit reporting agencies to place a fraud alert or freeze on your credit report. Also get copies of your credit reports, to be sure that no one has already tried to get unauthorized credit accounts with your personal information. Confirm that the credit reporting agency will alert the other two credit reporting agencies.

-

National Long-Term Care Ombudsman Resource Center – Report cases of identity theft due to a stay in a nursing home or long-term care facility.

-

Financial Institutions – Contact the fraud department at your bank, credit card issuers and any other places where you have accounts.

-

Retailers and Other Companies – Report the crime to companies where the identity thief opened credit accounts or even applied for jobs.

-

State Attorney General Offices – Your state’s attorney general might offer tips, checklists, or an advocate to help you recover from identity theft. These resources don’t replace filing an ID theft report with the FTC.

You may need to get new personal records or identification cards if you’re the victim of ID theft. Learn how to replace your vital identification documents after identity theft.

Read Also: Where To Get Police Report

Reporting Identity Theft To Local Police

If Your Debit Card Or Number Is Stolen

A debit card is an ATM card with a credit card logo on it. It accesses money directly from your bank account, and the legal protections are different from those for credit cards. If your debit card is compromised, call your bank right away and cancel the card. The bank will send you a new debit card and your checking account number will not change. The stolen money, however, will be gone while your bank investigates the matter. If you call the bank within two business days of the fraudulent transaction, your liability is limited to only $50. As time goes by, your liability for fraudulent transactions increases. If you wait more than 60 business days from the date the bank mailed the statement with the fraudulent transaction, you could lose the entire amount of the fraud.

Recommended Reading: How To Buy Police Seized Items