If A Person Is Injured

Insurance for personal injury is included in the cost of vehicle registration and is administered by the Transport Accident Commission. This is a government organisation that pays medical costs for people who are injured in a motor vehicle accident.

Visit the Transport Accident Commission’s page What to do after an accident for more information.

How Do You Check If Your Insurance Is Active

Wondering how to check if your insurance is active? Doing so is easy. Pull up your policy online — or look at a paper copy of your insurance policy or most recent renewal notice. The policy will tell you when the policy expires.

The card you carry that shows your proof of insurance also should list when the policy expires. Or, if you prefer, simply call your insurer and ask a representative to tell you whether the policy is still active and how long it will remain in effect.

How Do Police Officers Check To See If Your Insurance Is Valid

Years ago, when asked for a license, registration, and proof of insurance, a driver could hand over fake or invalid insurance documents and drive off uninsured without any type of ticket. However, times have changed.

Can cops tell if you have insurance by running plates? The answer is yes.

Since state officials are buckling down on the persistent uninsured driver dilemma, a majority of states have rolled out an electronic insurance verification system.

The purpose of electronic insurance systems is to reduce the incidence of uninsured drivers on the roadways. The systems are used both at the administrative level and at the law enforcement level.

Also Check: How To Sue A Police Officer For Excessive Force

What Is The Penalty For Providing Fake Proof Of Insurance

Is not having auto insurance a criminal offense? Not only is it a criminal offense, but its also an additional crime to drive uninsured and attempt to use fake or invalid proof of insurance. If you hand over a card that appears to be valid, you could get in even more trouble when the officer discovers the policy was canceled for non-payment months back.

In some states, officers are allowed to arrest people on the spot who are knowingly furnishing fake ID cards. In addition to your moving violations, you may face penalties for falsifying documents or using counterfeit documents to government officials.

What Are The Penalties For Driving Without Insurance In Ontario

In addition to fines, there are other penalties for driving without insurance. They include :

- Suspension : You could face a drivers license suspension for up to one year.

- Impound : You could have your vehicle impounded for up to three months.

- Additional fees : The Provincial Offense Act tacks on an additional 25% surcharge to your fine.

Don’t Miss: How To Train A Dog To Be A Police Dog

If You Have Been Victim Of Fraud

You can ask for a new SIN only if you can prove that your SIN was used fraudulently.

However, getting a new SIN will not necessarily protect you from fraud or identity theft. If someone else uses your old SIN as identification and the business does not check the person’s identity with the credit bureau, credit lenders may still ask you to pay the impostor’s debts. Each time, you will have to prove that you were not involved in the fraud.

If we issue you a new SIN, you will need to contact all your financial institutions, creditors, pension providers and employers to ask them to update your files.

Note: Service Canada cannot correct a credit file. It is up to you to contact your financial institution, report any discrepancies and have them resolved.

If you have proof that someone else is using your SIN, an investigation is required.

An indication that your SIN is being used fraudulently is when you receive a Notice of Reassessment from the Canada Revenue Agency concerning undeclared earnings. This means that another person has used your SIN for employment purposes or to receive other taxable income.

You must visit your nearest Service Canada Centre with your original proof of identity documents and provide proof that another person has used your SIN.

Here’s what you will need to provide to Service Canada if you suspect someone is using your SIN:

Its All About You We Want To Help You Make The Right Car Insurance Coverage Choices

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships dont influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- Officers can see if your car is insured electronically

- You may be pulled over for driving with suspended plates

- Many states no longer require vehicle owners to present proof of insurance when registering a vehicle

While car insurance premiums can be expensive when you have a high-risk driver in the household, insurance is a must-have when you want to pass the burden of paying for financial losses onto a car insurer.

Failure to comply with the mandatory car insurance requirements can lead to much more than fees that much be paid out-of-pocket, it can lead to criminal penalties and court fees.

Start comparing car insurance rates now! Enter your zip code above to get started!

Recommended Reading: Where Can I Find Police Auctions

Always Be Properly Insured When Driving

If you get into an accident and do not have proper coverage, you’ll be held responsible for your repairs and medical bills. If you are found at-fault, you’ll also be liable for any costs towards the other driver’s vehicle, medical expenses, and even loss of wages. Don’t forget finding a lower rate will be difficult.

Your Rights When Stopped By The Police

Your rights are enshrined in Canadian Charter of Rights and Freedoms. Its important to know your legal rights when dealing with the police. These rights form part of the foundation of our legal system and are in place to protect your privacy and liberty. A failure to know and utilize these rights can lead to there erosion and put you in greater legal jeopardy.

Recommended Reading: Is College Required To Be A Police Officer

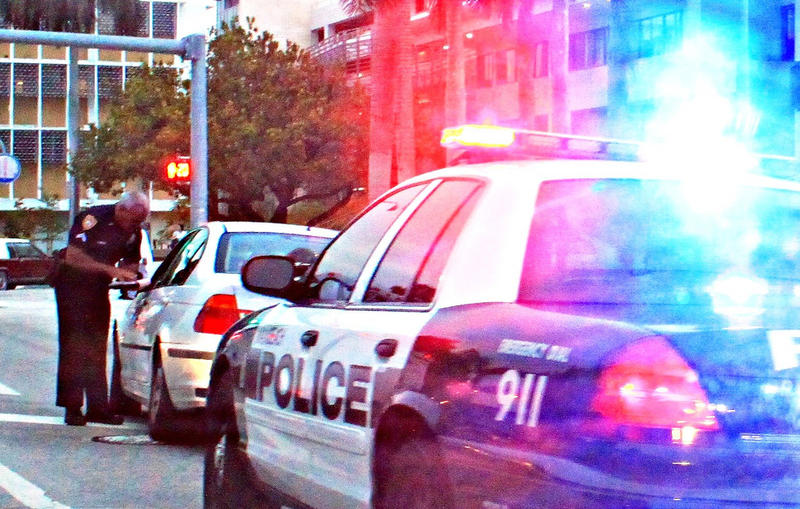

Police Can Now See If You Have Insurance Before They Even Pull You Over

MICHIGAN — It’s something every driver should have on them when they get behind the wheel and it’s one of the first things police look for if you happen to get stopped.

But now, some existing technology is providing a new tool that’s being used by Michigan State Police and other agencies across the state giving officers the upper hand to determine if you’re driving without insurance.

Officers can run a driver’s license plate through their in-car computer systems to access the information which began to be available last September.

Insurance companies are now required to send information to the Secretary of State’s office twice a month, on the 1st and 15th, making that information readily available through the statewide Law Enforcement Information Network, or LEIN.

Its now linked to the license plate for that car so when were on a traffic stop and we run that persons license plate then it will come back either that they have insurance or dont,” said F/Lt. Chris McIntire with the Michigan State Police Rockford Post.

McIntire said state law still requires drivers to carry proof of insurance in their vehicles.

While the information might be more readily available, it doesn’t mean officers will be specifically targeting drivers for just this reason, McIntire said.

Not having insurance for your vehicle is considered a secondary violation which means police technically can’t pull a driver over just for that offense, according to McIntire.

What Information Is Needed In A Crash Report

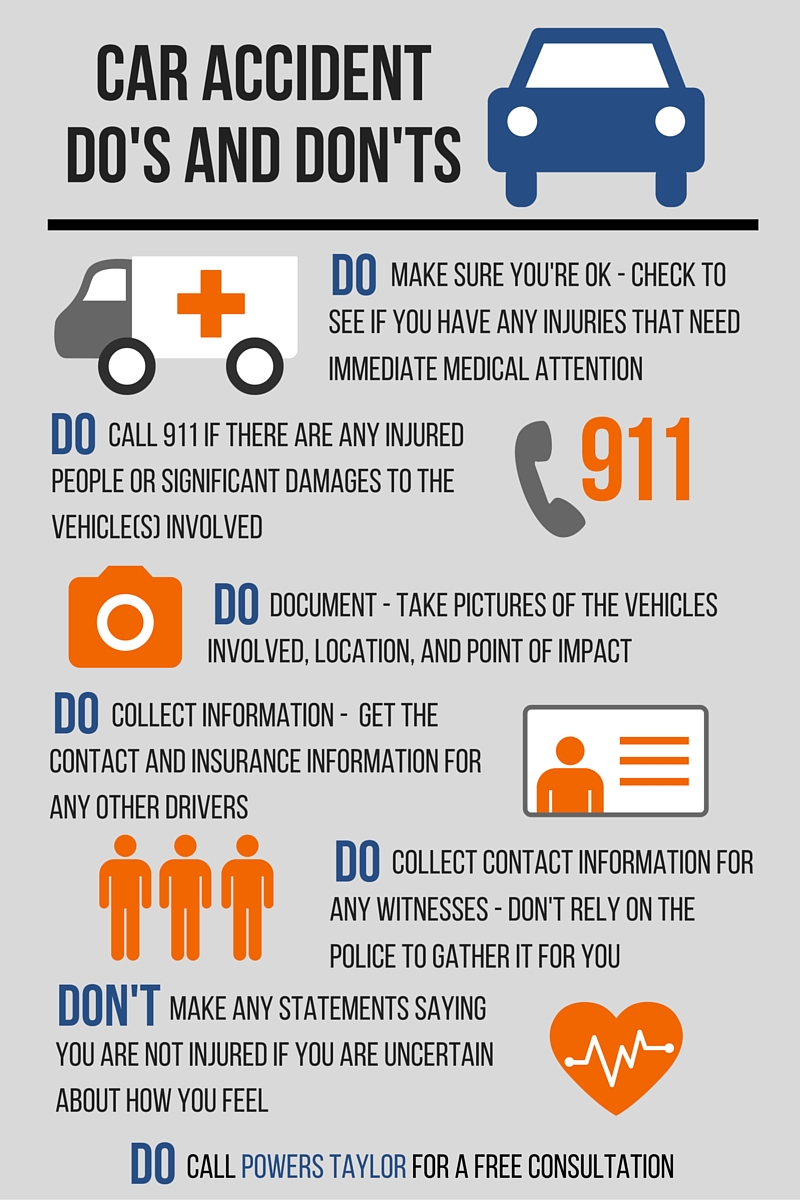

When you file a crash report, the police will ask for specific details. The exact nature of the information you will need may vary, but, in general, police will want:

- Details about the crash, including who was involved and a description of the vehicles that crashed

- Statements from the drivers involved and any passengers or witnesses

- A diagram that shows where the accident happened and where the vehicles collided

In addition, the police officer might add his or her comments about what happened to the report.

Also Check: How To Obtain Car Accident Police Report

Can The Police Search My Car

The police cannot search your car when they pull you over. However, they are allowed to look in the windows of your car, and may use a flashlight during the night to do this. If they see an illegal substance in your vehicle in plain view, they will place you under arrest and then have the ground to search your vehicle for officer safety and for the purpose of their investigation.

What Is Uninsured Motorist Coverage

Uninsured motorist coverage provides protection if you get into an accident with someone who doesnt have insurance. If you have this optional coverage its required in many states, but not all your insurance provider will step in and help cover costs for bodily injuries to you and your passengers which is typically what someones liability insurance does. Itll help cover your medical costs and loss of income, among other expenses.

Also Check: What Do You Do To Become A Police Officer

How To Find Out If Someone Has Auto Insurance Coverage

Finding out if someone has car insurance is sometimes simple, but you may have trouble tracking down the information depending on the situation.

When you get into a car accident, one of the first things you should do is exchange car insurance information with the other driver. But in some situations, getting this information is easier said than done.

A driver may refuse to divulge the details. Or, in a worst case, the driver could flee the accident without exchanging any information.

Wondering how to check if a car has insurance? Read on to learn more about your options to verify auto insurance coverage.

- Exchanging insurance information with another driver after an accident is crucial to ensuring the claims process unfolds smoothly.

- In some situations, a driver may refuse to provide insurance information. In other cases, the driver may flee the scene of the accident.

- Turning to the police or your state’s department of motor vehicles are options for checking if a car has insurance.

- If you cant learn more about the other driver’s insurance status, your own insurance might still cover the damages, depending on your coverage.

What You Should Do

Take time to write down carefully all of the details such as the time, date and location where the accident happened and the names and contact details of any witnesses. Note down the speed you believe you were travelling at and even the weather conditions. It will help if you draw a diagram. This information will be helpful to police and your car insurance company.

Read Also: How To Become A Police Officer San Diego

How Do Police Know If A Car Is Insured

All states require drivers to have some type of insurance. If a police officer catches you driving without insurance, then you could face penalties. But how do police know if a car is insured?

Police use various strategies to check the insurance status of a vehicle. Some police officers simply check paperwork. Other police officers check your insurance immediately after pulling you over. Some check your insurance against a public database, while others dont check insurance at all.

Today, were explaining how the police know if a car is insured.

When Can The Officers Pull Me Over

-

If the officers know your driver’s license is suspended or invalid by running your license plate.

-

If officers observe a problem with your car, such as a broken headlight, expired vehicle registration, or a defective exhaust system.

-

If officers observe you driving dangerously, such as by running red lights and stop signs, speeding, or making illegal turns.

-

If officers have a reasonable suspicion that you or someone in your vehicle committed a crime, such as theft or assault.

Don’t Miss: Can You Get A Copy Of Police Report

Will I Get A Criminal Record For Driving Without Insurance

Driving without insurance is not an imprisonable offence in itself, so a conviction will not appear on a criminal record.

However, if youre convicted of driving without insurance, an IN10 endorsement will remain on your driving licence for four years – and youll need to disclose it to insurance providers for a further year.

What Are The State Insurance Laws

Insurance laws, limit requirements, and systems vary by state. Some states have mandatory insurance laws where theres no choice but to have auto insurance to pay for vehicle damages.

Other states have a different type of law called a financial responsibility law.

In this state, carrying auto insurance is just one of the options to satisfy the law.

You May Like: How To Be A Military Police

The Extent Of Damages Or Injuries Affects Reporting

Many people make their decision about whether or not to report a car crash to their insurance company based on:

- the extent of the damages

- whether there are any injuries

- whether other people involved in the accident are threatening to contact their insurance carrier

If there are any injuries involving either party, even very minor ones, it is definitely in your best interest to report the accident to your insurance company and the police.

Small injuries at the time of the accident often have a way of turning into something more serious later.

When there are no injuries involved and only very minor damage, both parties often decide between themselves to either pay for their own damages or to just put up with the slight damage to their vehicle.

However, if it is a clear case of who is at fault, like in the case of one car being rear-ended by another, the person at-fault may agree to pay for the repairs.

This may save the at-fault individual high increases on their insurance policy premium for years to come.

No matter your circumstance, do not consider keeping this information from your insurance company. This could be the start of some major insurance trouble and is not worth it.

Auto Body Repair Shops

Under California Insurance Code §758.5 an insurance company cannot require that an automobile be repaired at a specific repair shop. However, an insurance company can recommend that an automobile be repaired at a specific repair shop under the following conditions outlined by law:

- The consumer specifically requests a recommendation from the insurance company to a repair shop.

- The consumer has been informed in writing of the right to select a repair shop of his or her choice.

- If the consumer agrees to use the recommended repair shop, the insurance company must restore the damaged vehicle to its condition prior to the accident or loss with no additional cost other than as stated in the policy or as otherwise allowed by law.

- If the company makes an oral recommendation to a repair shop, and it is accepted by the consumer, then the company must follow the oral recommendation with the prescribed written notice within five calendar days as specified by law.

If the vehicle is repaired in a shop chosen by the consumer, then the insurance company must pay the reasonable costs to repair the vehicle made in accordance with accepted trade standards for good and workmanlike automotive repairs.

Read Also: How Does One Become A Police Officer

Driving Uninsured Isnt Legal

The impulse to drop car insurance to save money is certainly understandable. But its also short-sighted. The amount youd save initially likely wont outweigh what you could owe in citations, fees and higher car insurance premiums if youre caught not to mention your exposure to costly lawsuits and repair bills if you cause an accident.

As advances continue in how police catch uninsured drivers both Tennessee and Mississippi should be adding their own ALPR systems in 2016, according to Hageli it will only get harder for motorists to hide.

For a safer way to trim insurance costs, consider improving the way you shop for coverage. You can stay on the right side of the law and find a policy that fits your budget with NerdWallets car insurance comparison tool.

About the author:Alex Glenn is a former insurance writer at NerdWallet. His work has appeared in USA Today, Time, Money magazine and Business InsiderRead more

Where The Accident Takes Place

The location of the accident will often have an impact on whether an insured individual actually decides to report it. The time and location will influence when to report an auto accident to your insurance company.

If you do not report a car accident, you could become at fault for not reporting.

Accidents that occur on private property, such as parking lots, are automatically deemed to be 50-50 in terms of who is at fault. Therefore, it is often easier for each party to cover the costs of repairs to his or her own vehicle only and not involve the insurance companies.

Such accidents often go unreported to insurers in order to avoid having the at-fault accident contribute to a rise in premiums.

Single car accidents, especially on ones own property, in which a driver hits a stationary object, like a fence or tree, are often unreported. If you are ever involved in a car accident in your area, make sure you follow the correct reporting procedures from your insurance company.

Don’t Miss: What Do You Have To Become A Police Officer