Why You Should Report Fraud To The Police

Usually, the Police are called in only when the fraud has resulted in physical harm to someone or has caused significant financial loss to the person being defrauded. Credit card fraud is a serious crime that can result in a lengthy investigation, possible jail time, and an lengthy credit card investigation. If you suspect you have been a victim of fraud, you should contact the police as soon as possible. Reporting fraud can help protect you and ensure that the guilty party is brought to justice, in addition to protecting yourself.

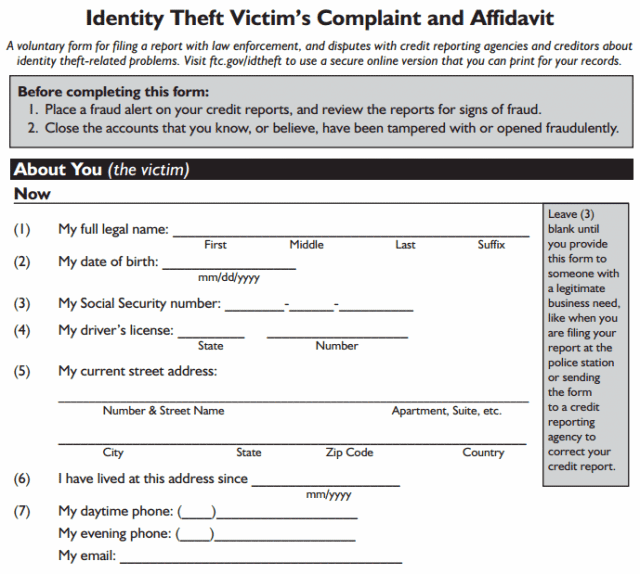

What Is The Attorney General’s Identity Theft Passport

The Identity Theft Passport is a card that you can carry and present to law enforcement or other individuals who may challenge you about your identity should you become the victim of identity crime. The Passport is designed to serve as notification to help protect victims from unlawful detention or arrest for crimes committed by another under a stolen identity.

An Identity Theft Passport may be available to any Virginian who:

Has filed a police report because they believe they are a victim of identity crime and/or has obtained a court order expunging their record as a result of identity crime

You may You can then print, complete, sign and mail to this Office OR

You may write to this Office for an application for an Identity Theft Passport:

Office of the Attorney GeneralVictim Notification Program202 North Ninth StreetRichmond, VA 23219

All applications must be submitted in person or by mail and will be acted upon promptly.

Replacing Lost Or Stolen Identification

Read Also: How Long It Takes To Be A Police Officer

Do You Have To Report Illegal Activities To The Irs

Individuals who profited from illegal activities such as drug dealing or bribery are required by the IRS to include it on their 2021 tax returns. If it is for self-employment, it must be reported on Schedule 1 , Line 8z , or Schedule C .

Drug Dealers Can File Taxes, But Not Without Consequences

How can a drug dealer file taxes? If your income comes from self-employment, such as money you earn dealing illegal drugs, you must include it in your Schedule 1 , line 8z, or Schedule C income. In most cases, if you receive a nondividend distribution, you must file Form 1099-DIV with the IRS. Return of capital appears as a result of the Non-Distributions column on the form. This form may be mailed to the investor by the company that paid the dividend. If the distribution was not recorded as an ordinary dividend, it would be classified as one.

Go The Extra Mile After Filing An Identity Theft Report

- âContact your bank, credit union, and credit card companies. Alert them regarding your case of identity fraud, so you can dispute fraudulent charges and unauthorized transactions instead of being held responsible for them.

- âCancel any compromised accounts and request new account numbers, card numbers, and PIN numbers. And of course, donât forget to change ALL your online passwords for your financial accounts, social media sites, online bill payment portals, and anywhere else your personal information may be stored.

- âGet in the habit of regularly checking your credit reports. Let Aura help you with this. Rather than contacting all three credit bureaus individually, Aura’s fraud resolution team can streamline the process for you.

- Consider an all-in-one digital security solution. Let Aura monitor your personal information and keep your devices secure. We’ll monitor your credit and online accounts 24/7.

- Get an Identity Theft Insurance Policy. Every Aura plan comes with a $1 Million Identity Theft Insurance policy that covers eligible losses due to identity fraud.

- Protect your family from identity theft. Keep your children and spouse safe with Aura’s family plans, which includes premium identity theft protection, credit monitoring, White Glove Fraud Resolution, and $1 million in identity theft insurance for every adult member in your plan.

Read Also: What Happens When A Police Report Is Filed

What Happens If You Cant File An Identity Theft Report With The Police

As mentioned, most ID theft cases donât actually require you to file an identity theft report with your local police department. Once you file an Identity Theft Report with the FTC, the federal government’s authority to investigate the matter supersedes your local law enforcement agency.

Plus, once you file with the FTC, local law enforcement has access to the report .

But, if your financial institutions require a police report and your local police department denies your request, you can always contact your state attorney generalâs office. Each state has a different process, and your attorney general’s office or website will provide details about how to proceed.

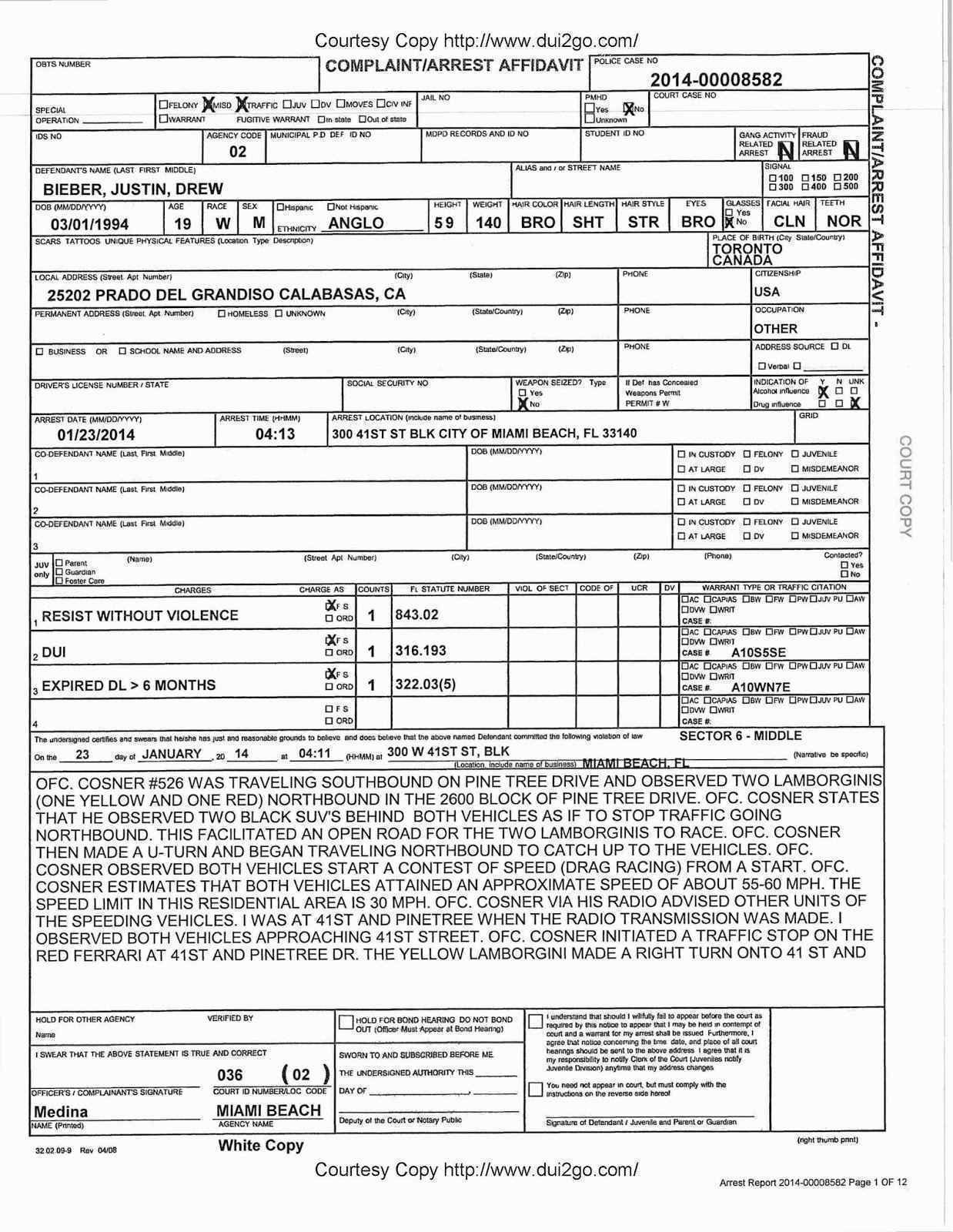

Why Do I Need A Police Report

Many people wonder if they actually need to get a police report when identity theft has occurred. The answer is YES, you really do need the report! Getting a police report plays several important roles in combatting the identity theft. First, it documents the theft and provides crucial evidence for disputing incorrect information on your credit report, or for completing a fraud affidavit. It also shows the creditor/debt collector that you are not making a bogus or fake dispute about a valid debt because victims of identity theft never shy away from notifying the police about these issues.

Don’t Miss: How Can I Get A Police Report Number

What To Do If You Are A Victim Of Criminal Identity Theft:

The California Identity Theft Registry is available to help victims of identity theft who are wrongly linked to crimes. The registry provides a centralized place that can be checked by police and other authorized persons to confirm that you are not wanted by law enforcement and that a mistaken criminal history was created in your name.

What Our Identity Theft Product Can Do For You

With our identity theft product, you can do more than file a police report in NYC. You can also:

Read Also: What Type Of Radio Do Police Use

You May Like: How Do I Know If A Police Report Was Filed

News & Headlines From Fox 40

In August, an identity theft victim contacted Fairfield police and said she had ordered a new drivers license but never received it from the Department of Motor Vehicles. According to police, it was suspected that it was stolen in the mail. It was also suspected the victims debit and credit cards were being used without her knowledge.

After checking her credit report, the victim found out that someone had used the victims information to buy a Mercedes.

According to police, the case was then handed to Detective Beck of the Property Crimes Unit and Detective Beck found that a woman had used the victims license and a fraudulently obtained insurance card to purchase the Mercedes listed on the victims credit report.

Detective Beck was able to obtain information regarding the vehicle and requested that officers stop it after seeing it on Flock cameras.

The Mercedes was eventually located and stopped by Officer Shackford on Sept. 15. Inside the vehicle officers found a man and woman along with multiple documents with the victims name on them. Officers also recovered other documents along with mail belonging to other people.

According to police, 29 additional mail theft victims have been identified so far.

Police said officers then arrested Wroten and booked her on various charges.

Reporting To Law Enforcement

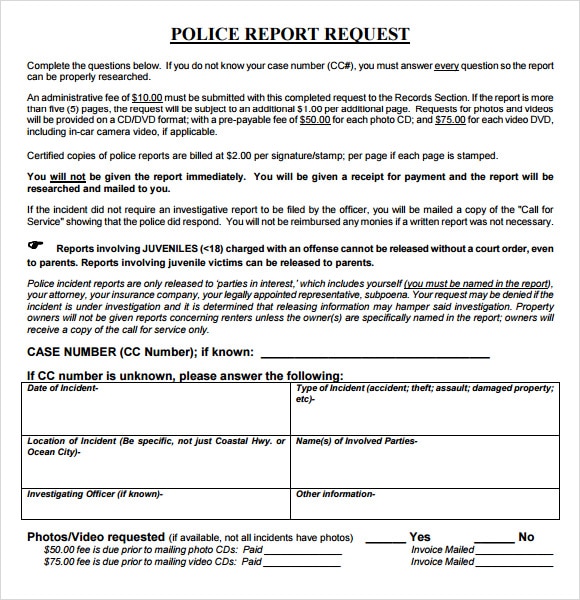

File a police report with your local police department. Keep multiple copies for yourself, your creditors, and the three major credit agencies.

While not all identity theft reports can be individually investigated, by reporting to law enforcement you make it possible for investigators to spot trends and patterns and help protect others from identity theft. The written police report will help you as you report identity theft to creditors and credit agencies.

You May Like: How Long Do Police Have To File Charges For Dui

Request Information On Fraudulent Accounts

When you file your police report of identity theft, the officer may give you forms to use to request account information from credit grantors, utilities or cell phone service companies. If the officer does not do this, you can use the form in our Consumer Information Sheet 3A: Requesting Information on Fraudulent Accounts. When you write to creditors where the thief opened or applied for accounts, send copies of the forms, along with copies of the police report. Give the information you receive from creditors to the officer investigating your case.

If You Are Contacted By A Debt Collector

Tell the debt collector that you are the victim of identity theft. Say that you dispute the validity of the debt. Say that you did not create the debt and are not responsible for it. Send the collector a follow-up letter saying the same things. Include a copy of your police report and of any documents youve received from the creditor. Write in your letter that you are giving notice to a claimant under California Civil Code section 1798.93, subsection that a situation of identity theft exists. Send the letter by certified mail, return receipt requested. If the debt collector is not the original creditor, be sure to send your letter within 30 days of receiving the collectors first written demand for payment.

Also Check: Do I File A Police Report For Identity Theft

Why Use Donotpay To File An Online Police Report For Identity Fraud

What are the advantages to using DoNotPay to file your online police report for identity fraud? For starters, you won’t have to waste time trying to reach the right person or face endless hold times. You also won’t feel pressured to “fill in the blanks” when you don’t know all the details.

A common misconception about identity fraud is that it only happens to those who are careless. Consequently, people sometimes feel judged whenever they tell others they have been a victim of identity theft. There won’t be any of that when you use DoNotPay to help you file your police report. You’ll get great service with no judgment on our part whatsoever.

Can I Get Money Back After Being Scammed

Contact your bank immediately to let them know whats happened and ask if you can get a refund. Most banks should reimburse you if youve transferred money to someone because of a scam. If you cant get your money back and you think this is unfair, you should follow the banks official complaints process.

Don’t Miss: How Do Police Know If You Have Insurance

How Long Do You Have To File A Police Report

If you have been involved in circumstances that require you to file a police report, its best to do it as soon as possible. However, the actual time that is legally mandated for you to do this will depend on the crime and the state where you currently reside.

Following the Statutes of Limitations

There are all types of crimes that can be committed against you burglary, assault, rape or theft, just to name a few. Each one of these crimes has a different statute of limitations, which means that there is a maximum amount of time in which an offender can be charged for committing the crime.

The statute of limitations will typically be set at one year for offenses such as minor theft, vandalism or traffic accidents. In cases where a serious felony has been committed, there may be no statute of limitations. These would be crimes like murder, child abuse or rape where the seriousness of the crime is more severe.

Rule Of Thumb For Offenses

While different crimes have different types of statute of limitations, there is a rule of thumb that you can use to determine if you still have time to file a police report. For petty offenses, you typically have a year to file a report. Most misdemeanors will have a statute of limitations that is equal to two years. For felonies, you usually have five years.

When Does Statute Of Limitations Start?

Investigation and Preparation

Freezing Your Credit And Placing Fraud Alerts

Place a credit freeze with each of the three major credit reporting agencies . This will protect you from having credit cards or other accounts opened fraudulently. The credit bureaus have three business days after receiving your request to place a freeze on your credit report. There may be a small fee to freeze your credit with each agency.

Learn more about freezing your credit and placing fraud alerts.

Don’t Miss: Will Police Enforce Child Custody In Texas

Notify The Company Involved

Contact the business or lender with whom the fraudulent transaction took place. Close the account in question, whether its one youve had for a while or one that the thief opened in your name. Make sure creditors mark the account as closed upon your request a notation that your credit card was lost or stolen can have a negative effect on your credit report.

There may be more than one transaction involved, and you might encounter some resistance, especially from smaller businesses that dont fully understand your dilemma. Insist on receiving copies of all paperwork involved in the transactions anyway.

How To Place A Fraud Alert And Get Your Credit Report Fraud Alert

To place a fraud alert on your credit file, you simply need to request it from any one of the three nationwide credit reporting agencies. They are free, and once you place a fraud alert with one nationwide credit-reporting agency, federal law requires that it be forwarded to the other nationwide credit-reporting agencies. Automatic reporting is helpful to you, because you dont know which credit-reporting agency a creditor is using.

Its the same with fraud: you never know where the perpetrator is applying for credit and which credit reporting agency is being used.

There are three types of fraud alerts:

1. Initial fraud alerts:

If you are concerned about or you suspect identity theft, an initial fraud alert can make it harder for an identity thief to open accounts in your name. These alerts last for one year and may be renewed. Anyone requesting your credit file during this year-long window is alerted that you suspect you are a victim of fraud. When you or someone else attempts to open a credit account in your name, increase the credit limit on an existing account, or get a new card on an existing account, the creditor is required to take additional steps to verify that you have authorized the request. If the creditor cannot verify your authorization, then the request is supposed to be denied.

2. Extended fraud alerts:

3. Active duty military alerts:

You May Like: How Many Police Officers Are In The United States

Protect Your Social Security Number

Always protect your Social Security numberto identity thieves, it’s like finding a pot of gold. If someone asks you to provide your SSN, always ask why and never hand it over if you cant guarantee its protection. Other best practices include storing it in a safe place and shredding all paperwork containing it before throwing them away.

What Is Identity Theft

Identity theft is when someone uses your personal informationâsuch as your name, address, banking details, social security number, credit card number, etc.âwithout your permission, to perform criminal or fraudulent activities.

Hackers can open accounts in your name, commit loan fraud, steal medical benefits , access your retirement accounts, and inflict severe financial damage. Identity thieves can hurt your credit score and ruin an otherwise reputable credit history.

ID theft can happen in many ways. Someone might find documents with your personally identifying information. They may also steal sensitive data from your devices when you’re web browsing on a publicly shared Wi-Fi network. Spam emails, phishing attacks, texting scams, holiday shopping scams and unemployment fraud are other common ways identity theft can occur.

You could also fall victim to identity theft by way of phone scams, mail theft, card skimming or carding, malware, ransomware, spyware, trojan viruses, social media phishing, and most notoriously – large corporate data breaches, which are becoming increasingly common. Over 1,000 data breaches have already been reported in 2021, which is an 17% increase compared to 2020.

The list below represents a summary of common warning signs of identity theft.

You May Like: How To Search A Police Officer