Tips When Filing A Police Report

With luck, filing a police report will go smoothly. You can then concentrate on taking steps to recover from identity theft.

But some police departments may not be fully prepared to take your report. For instance, officers may be preoccupied with other crimes or unfamiliar with how to handle identity theft cases.

Here are some tips that can help.

- Be firm, but calm when seeking to file a police report.

- Try to remain flexible. The police may send you to a website to fill out a form, instead of taking your information in person.

- Contact your state attorney generals office if the police are unable or unwilling to take your report. States may have different processes for filing a report. An attorney generals office or website may be able to provide the details.

- Be specific. When you make a police report, give detailed information about the identity theft, such as dates accounts were opened in your name or who might have committed the fraud.

- Make copies of your identity theft police report and your FTC complaint. Youll need these to resolve any disputes with companies where the identity thief used your name.

Bottom line: Reporting identity theft to the police or the FTC is a smart step to take. It could save time and money as you recover from identity theft.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Start your protection now. It only takes minutes to enroll.

Reporting Identity Theft Here’s A Breakdown Of How To Do It Effectively

Ed Smith

Having your identity stolen is a disturbing and stressful event. Thankfully, the FTC has made it much easier to report identity theft so victims can start recovering from the incidence without having to file a police report.

By submitting a report on IdentityTheft.gov, you’ll get the tools most people need to start your recovery, including pre-filled letters to send to merchants, banks, and other parties, as well as an Identity Theft Report, which is your official statement about the crime.

However, there are some circumstances under which you do need to file a police report when you become a victim of identity theft. These include:

- The identity thief may be involved in a police investigation

- The identity thief has used your name or other personal information in a police encounter, such as a traffic violation

- A creditor, debt collector, or other affected parties request that you produce a police report

Filing a police report helps create a paper trail about the incident and open an investigation.

The police report will become an official statement about the incident and relieve you from any crime committed by the identity thief using your personal information.

In the event that you need to file a police report, here’s what you need to do:

Protect Yourself Against Identity Fraud

- Dont throw out anything with your name, address or financial details without shredding it first.

- If you receive an unsolicited email or phone call from what appears to be your bank or building society asking for your security details, never reveal your full password, login details or account numbers. Be aware that a bank will never ask for your PIN or for a whole security number or password.

- If you are concerned about the source of a call, wait five minutes and call your bank from a different telephone making sure there is a dialling tone.

- If you move house, ask Royal Mail to redirect your post for at least a year.

- These credit reference agencies offer a credit report checking service to alert you to any key changes on your credit file that could indicate potential fraudulent activity: TransUnion Equifax Experian ClearScore Noddle

- It is particularly helpful to check your personal credit file 2-3 months after you have moved house.

Read Also: Can I Become A Police Officer Without College

Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for “dispute” on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

Use The Id Theft Affidavit

Creditors may ask you to fill out fraud affidavits. The Federal Trade Commissions ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name. Also send copies to creditors where the thief made charges on your account, to the credit bureaus, and to the police. The form is available on the FTC Web site at ww.ftc.gov/bcp/edu/resources/forms/affidavit.pdf. File a complaint of identity theft with the FTC. See their Web site at www.consumer.gov/idtheft The FTC keeps a database of identity theft cases that is used by many law enforcement agencies.

Recommended Reading: When Does Police Use Of Force Become Excessive Or Unjustified

If You Are Wrongly Accused Of A Crime Committed By An Identity Thief

“Criminal identity theft” is a label given to a particular type of identity theft. Criminal identity theft occurs when a suspect in a criminal investigation identifies himself or herself using the identity of another, innocent person. A special database in the California Department of Justice can help victims of this kind of identity theft. See our Consumer Information Sheet 8: How to Use the California Identity Theft Registry- A Guide for Victims of “Criminal” Identity Theft.

Replacing Lost Or Stolen Identification

Read Also: Do I Need A Degree To Be A Police Officer

Next Steps: How To Prevent Identity Theft

Its challenging to completely protect yourself against identity theft, but you can implement a couple of strategies. With people spending so much time online either working, on social media, or purchasing items, the internet has become an opportunistic place for scammers, so you must protect the information you store and share online.

There are lots of ways you can protect your identity online, one is to get ID theft protection plan like for example Lifelock which has great reviews from clients.

Monitor your accounts closely and stay alert for any unusual activity. When surfing the internet, use an encrypted internet connection and stay off public Wi-Fi. Use complex passwords, and dont use the same password for every account. You should also consider investing in high-quality antivirus software for your computer.

Reporting Identity Theft To Local Police

Also Check: Can You Check Your Police Record Online

Assistance In Reporting Or Responding To Id Theft

IdentityTheft.gov is the federal governments one-stop resource for identity theft victims. The site provides streamlined checklists and sample letters to guide you through the recovery process. Go to

If you create an account, the site will walk you through each recovery step, update your plan as needed, track your progress, and pre-fill forms and letters for you.

You may also simply browse the informational checklist of things to do if you are a victim or suspect you are a victim of identity theft.

How To Recover From Identity Theft

Its important to act very quickly if you suspect theft to protect yourself from identity fraud. Once youve contacted the FTC, a major credit bureau and the police if necessary, here are the actions you can take to speed up the recovery process.

- Sign up for a : You might qualify for a free credit monitoring service if your information was compromised in a data breach.

- Get a fraud alert: Youll then want to contact one of the three major credit bureaus to place a fraud alert on your records. As long as you contact one of the three major credit bureaus, the other two will be contacted.

- Use a credit lock: A lock allows lenders to access your report, and then immediately lock it again. You can sign up for a credit lock at each bureau, but unlike a freeze, a credit lock is not governed by federal law.

- Open a new, secure account: This step will vary depending on which type of account the fraudulent activity occurred. You also might have to visit the Department of Motor Vehicles if your drivers license number has been compromised.

- Change passwords: After youve shut down the compromised account, you should change all your passwords and PINs.

Recommended Reading: How To File A Police Report For An Accident

Provide An Account Of The Incident

Clearly communicate that your identity has been stolen and you need to file a police report.

If you encounter any reluctance on behalf of the local police department, try to file a Miscellaneous Incident report or contact your state Attorney Generals office.

Be firm, calm, and specific when you’re communicating the details of the identity theft. Make sure you hand in a copy of the FTC Identity Theft Report for the police officer to attach to the file.

How Does Identity Theft Occur

Your personally identifying information may be compromisedthrough a variety of methods.

Dumpster Diving – Looking through your garbage for bills or other paper with your personal information on it.

Skimming – Skimmers are small electronic devices that can be easily concealed in a pocket and when your credit card is swiped through it, the device reads all of the information encoded on the magnetic strip on your card.

Phishing – Phishing scams are electronic mails sent from what appears to be a legitimate financial institution. They are devised to trick you into sending them account and password information. A common scam would be an email advising you that due to a security issue your bank would like you to confirm or reset your password.

Address Change – Your bills are diverted to another address where they are read or your mail is stolen from your mail box.

Theft – Your personally identifiable information is acquired through the theft of a wallet, purse, home burglary or car burglary.

Pretexting – Your are called or receive a text message from what appears and sounds like a legitimate financial institution in an attempt to trick you into revealing personally identifiable information.

Additional information can be found at:

Also Check: What Do You Need To Join The Police Academy

Review Your Credit Reports Carefully

When you receive your credit reports, read them carefully. Look for accounts you dont recognize. Look in the inquiries section for names of creditors from whom you havent requested credit. You may find some inquiries identified as promotional. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit. Promotional inquiries are not signs of fraud. Also, as a general precaution, look in the personal information section to verify your Social Security number, address and name.

If you find anything you dont understand, call the credit bureau at the telephone number listed on the report. Tell them you want to block, or remove, any information on the report that is the result of identity theft. For more on what to tell the credit bureaus, see the Privacy Rights Clearinghouses Identity Theft: What to Do When It Happens to Youwww.privacyrights.org/fs/fs17a.htm

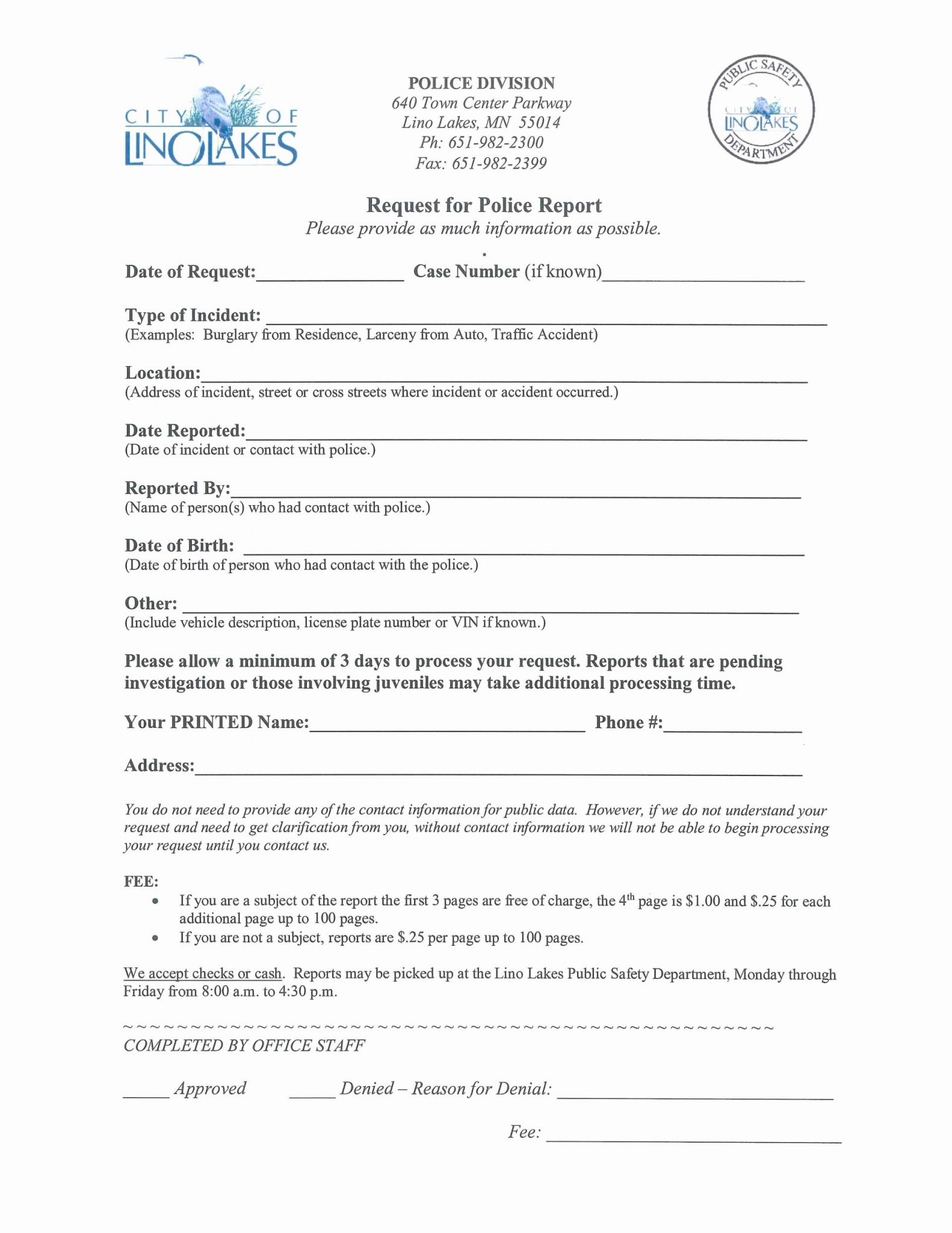

Filing A Police Report Online

This system allows you to submit a report from your computer or mobile device without going to an OPP detachment. All submissions will be sent directly to the OPP and reviewed by an officer. You may be contacted to provide more information. You must have a valid e-mail address in order to submit a report.

To file a report online, please follow the simple steps below:

Don’t Miss: What Are The Steps To Becoming A Police Officer

Reports You Cannot Submit Online

- Robbery

- House and business break and enters

- Domestic disputes

- Theft of a vehicle

- Any type of fraud resulting in the loss of funds/personal information or property, including fraudulent use of debit or credit cards

- Incidents that involve lost / stolen citizenship cards, permanent resident cards, immigration documents, government cheques, or cash from the government

- Incidents involving firearms

- Stolen property for sale online such as on Kijiji, Craigslist, Facebook, etc.

These crimes may require a dispatched call. Please phone the Police non-emergency line 266-1234.

FOR EMERGENCIES OR CRIMES IN PROGRESS CALL 9-1-1.

Contact Id Theft Services

- Equifax Canada:

- TransUnion of Canada:

Both companies have procedures to deal with ID theft and will put a warning on your file. They can review copies of your credit record and report any false information.

Call Service Canada at if your SIN card has been lost or stolen, or you believe someone is using it.

Call the Canadian Anti-Fraud Centre at . The information you give will help law enforcement agencies in possible investigations.

If your debit or credit card is lost or stolen, call the card issuer as soon as you notice the card is missing.

If your credit card was used after it was reported lost or stolen, your maximum liability is $50.

If your lost or stolen card is used at an ATM and requires a PIN, you may be liable for all losses. Keep your PIN private.

You May Like: How To Make A Police Report Over The Phone

If Your Debit Card Or Number Is Stolen

A debit card is an ATM card with a credit card logo on it. It accesses money directly from your bank account, and the legal protections are different from those for credit cards. If your debit card is compromised, call your bank right away and cancel the card. The bank will send you a new debit card and your checking account number will not change. The stolen money, however, will be gone while your bank investigates the matter. If you call the bank within two business days of the fraudulent transaction, your liability is limited to only $50. As time goes by, your liability for fraudulent transactions increases. If you wait more than 60 business days from the date the bank mailed the statement with the fraudulent transaction, you could lose the entire amount of the fraud.

Cancel Credit Or Debit Card

A criminal doesnt need your physical credit or debit card to steal from you. They can use your card number, PIN, and security code to make transactions. If your credit or debit card has been stolen, get in touch with your bank immediately and block the account. Some banks allow you to do this quickly via their app.

If you arent entirely sure, but yoususpect that someone might have your personal, bank account, or credit card information, you should still contact your bank and block the card to be on the safe side. You can take additional measures to protect yourself, such as adding a fraud alert to your credit report through a credit bureau.

Recommended Reading: How To Get Police Clearance Certificate In Usa