Before You File A Police Report Online

Filing a false police report is a crime.

Before filing a police report online you must verify you meet the criteria listed below:

- Incident happened in Unincorporated Hillsborough County

- These city limits are NOT unincorporated Hillsborough County:

- Plant City

When Should I Call Police Instead

- If you have a known suspect. If you know the name or address of the suspect, or if you know the license plate of the vehicle associated to the suspect, please contact Peel Regional Police at 905-453-3311

- If the value of theft, loss or property damage is more than $10,000.00

- If your vehicle has been stolen

- If the incident occurred outside of Brampton or Mississauga. Please contact the police service responsible for the area in which the incident occurred

- If someone broke into, or attempted to break into your home, garage or business

- If this is the theft or loss of a firearm

- If this is related to any form of personal violence, including domestic violence.

- If this is related to any kind of vandalism or graffiti that could be hate motivated

- If this is related to a traffic complaint that is in progress

You May Like: How To Get Police Clearance Certificate In Usa

Extent Of Identity Theft

The extent of identity theft is hard to quantify as most victims do not know they are victims until their personal information has already been used, if at all. With increasing levels of fraud, financial institutions have become more experienced in identifying fraud, and can terminate fraudulent transactions often before the victim realises they are a victim.

According to the Australian Bureau of Statistics the scale and impact of personal fraud is hard to measure, due to issues of definition, awareness of victimisation, low reporting rates and inconsistent data recording practices among agencies that detect or deal with these incidents.

The ABS conducted a national survey from July 2014 to June 2015 about Personal Fraud which covered Identity Theft.

- In that 12 month period, an estimated 126,300 persons in Australia were victims of identity theft .

- The majority of persons who experienced identity theft experienced a single incident only

The credit agency VEDA conducted a similar survey in 2015 claiming that 17% of Australians were the victim of identity theft however the validity of this result is questioned due to a commercial interest by the company.

Also Check: How To Get Police Clearance Certificate In Usa

Go The Extra Mile After Filing An Identity Theft Report

- âContact your bank, credit union, and credit card companies. Alert them regarding your case of identity fraud, so you can dispute fraudulent charges and unauthorized transactions instead of being held responsible for them.

- âCancel any compromised accounts and request new account numbers, card numbers, and PIN numbers. And of course, donât forget to change ALL your online passwords for your financial accounts, social media sites, online bill payment portals, and anywhere else your personal information may be stored.

- âGet in the habit of regularly checking your credit reports. Let Aura help you with this. Rather than contacting all three credit bureaus individually, Aura’s fraud resolution team can streamline the process for you.

- Consider an all-in-one digital security solution. Let Aura monitor your personal information and keep your devices secure. We’ll monitor your credit and online accounts 24/7.

- Get an Identity Theft Insurance Policy. Every Aura plan comes with a $1 Million Identity Theft Insurance policy that covers eligible losses due to identity fraud.

- Protect your family from identity theft. Keep your children and spouse safe with Aura’s family plans, which includes premium identity theft protection, credit monitoring, White Glove Fraud Resolution, and $1 million in identity theft insurance for every adult member in your plan.

When Do I Need To Report Identity Theft To The Police

There are many different forms of fraud and identity theft, and some warrant a police report more than others. Local law enforcement may be somewhat limited when investigating an internet crime or large data breach, and a police report may not be required for certain types of identity-related crimes. You should file a police report in the following situations:

- You know who committed the identity theft.

- You can provide specific information that may be able to help the police investigation.

- Your identity was used fraudulently in an encounter with the police.

- A creditor or other entity requires a police report as part of their investigation.

While not always required, filing a police report can potentially help the authorities catch and stop the person or group committing the crimes. Additionally, some creditors or companies may require you to obtain a police report in order to help you fix the damage.

Recommended Reading: How To Search A Police Report

Use The Id Theft Affidavit

Creditors may ask you to fill out fraud affidavits. The Federal Trade Commissions ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name. Also send copies to creditors where the thief made charges on your account, to the credit bureaus, and to the police. The form is available on the FTC Web site at ww.ftc.gov/bcp/edu/resources/forms/affidavit.pdf. File a complaint of identity theft with the FTC. See their Web site at www.consumer.gov/idtheft The FTC keeps a database of identity theft cases that is used by many law enforcement agencies.

What Can You Do To Protect Yourself From Identity Theft

- Be extremely careful when you provide personal information such as your SIN, or date of birth over the phone.

- Never provide personal information by Internet or email. The CRA does not ask you to provide personal information by email.

- Be suspicious if you are ever asked to pay taxes or fees to the CRA on lottery or sweepstakes winnings. You do not have to pay taxes or fees on these types of winnings. These requests are scams.

- Keep your access codes, user ID, passwords, and PINs secret.

- Keep your address current with all government departments and agencies.

- Register for My Account on the CRA Web site atcanada.ca/my-cra-account and check your personal information regularly to ensure it is current and valid.

- Choose your tax preparer carefully! Make sure you choose someone you trust and check their references. You may also consider authorizing your representative to use the CRAs secure Represent a client online service. Always review your return, agree with the content before filing, and follow up to ensure you receive your notice of assessment as it contains important financial and personal information that belongs to you.

- Before supporting any charity, use the CRA Web site at canada.ca/charities-giving to find out if the charity is registered and get more information on the way it does business.

- Be careful before you click on links in any email you receive. Some criminals may be using a technique known as phishing to steal personal information.

You May Like: How Obtain A Police Report

Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for “dispute” on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Recommended Reading: How To Get Old Police Records

Financial Crimes / Identity Theft

Definition: The unauthorized use of a check, credit card, social security number and or identification when the suspect is unknown. Example: unauthorized purchases made on your credit card, someone other than yourself using your identity internet scams and bank fraud. When the suspect is known by the victim , contact this Department by calling 744-4241.

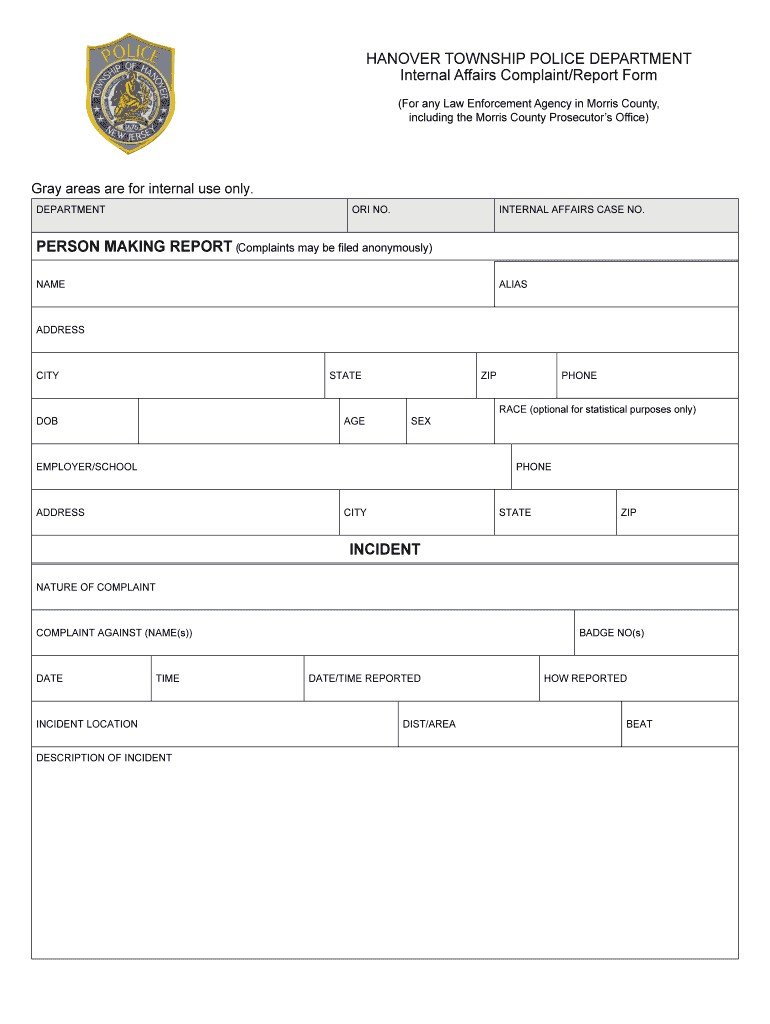

To report Financial Crimes / Identity Theft, fill out the form below. Print and deliver the report to the following address. You will sign the form at the Department in the presence of a police employee.

Pasadena Police Department

Replacing Lost Or Stolen Identification

Recommended Reading: What Degree Do You Need To Become A Police Officer

Should You File A Police Report After Identity Theft

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you believe you’re a victim of identity theft, there are several steps you need to take to help rectify the situation. But is filing a police report one of them? You should file a police report after identity theft if you can provide evidence for the investigation, know the person or group responsible for the theft, or are asked for a report by a creditor or other entity.

Depending on how and what type of information is stolen, scammers may use your identity to siphon money from your financial accounts, open new accounts such as credit cards or phone plans, commit tax fraud, or apply for government benefits. In 2020, 1.4 million Americans filed identity theft reports, according to the Federal Trade Commission, a 29% increase over the previous year. The most common form of ID theft involved scammers using stolen information to apply for or receive government benefits, such as unemployment insurance.

Read on to find out the steps you need to take if you’re a victim of identity theft, and when a police report may be necessary to help resolve the issue.

If Someone Uses Your Social Security Number To Claim Unemployment Benefits Or To Work

If you suspect that someone else has claimed unemployment benefits using your Social Security number, call the California Employment Development Departments toll-free Fraud Hotline at 1-800-229-6297. For more information, see their Web site at www.edd.ca.gov. Search on the site for fraud. Sometimes, an identity thief will use someone elses Social Security number to be eligible to work. Its a good idea to check your Social Security earnings record to see if income earned by a thief is being posted to your account. You can get a copy of your earnings record by calling 1-800-772-1213. Or get a Request for Social Security Statement at www.ssa.gov/online/ssa-7004.html. If you believe a thief is using your Social Security number to work or claim Social Security benefits, call the Social Security Fraud Hotline at 1-800-269-0271. Or report Social Security benefits fraud online at www.ssa.gov/oig/hotline/index.htm..

Also Check: How To Pay Police Ticket

Also Check: Where Can You Buy A Police Scanner

Filing A Police Report Online

This system allows you to submit a report from your computer or mobile device without going to an OPP detachment. All submissions will be sent directly to the OPP and reviewed by an officer. You may be contacted to provide more information. You must have a valid e-mail address in order to submit a report.

To file a report online, please follow the simple steps below:

What To Do If Identity Theft Happens To You

If you learn that your identity has been stolen:

- First, report the crime to your local police immediately and ask them to issue a police report about the theft. Local law enforcement must accept the complaint, prepare a police report, give the victim a copy of the report, investigate the allegation and any other related violations and where necessary, coordinate investigations with other law enforcement agencies. Keep a copy of your police report to share with your creditors. It may help in your dealings with the credit bureaus.

- Keep all documentation and log all telephone calls you make regarding the theft.

- Contact the fraud department of one of the three major credit bureaus — Equifax, TransUnion or Experian — and ask them to flag your file with a fraud alert and to include a statement that creditors should get your permission before opening any new accounts in your name. The credit bureau that you notify will notify the other two bureaus.

– Fraud departments of the credit reporting companies:

– Equifax 1-800-525-6285

– Experian 1-888-397-3742

– Transunion 1-800-680-7289

- Check your credit report carefully and look for items that you do not recognize. Verify your name, address and social security number on the report.

After thoroughly reviewing your credit report and documenting incorrect information:

Recommended Reading: How Long Is Police School

If Your Driver’s License Or Dmv

Immediately contact your local DMV office to report the theft. Ask them to put a fraud alert on your license. Then call the toll-free DMV Fraud Hotline at 1-866-658-5758. If the thief is using your license as ID, you may want to change your license number. Ask DMV for an appointment. Take a copy of the police report and copies of bills or other items supporting your claim of fraud. You will also need to prove your identity. Take current documents such as a passport, a certification of citizenship or naturalization, or a U.S. military photo ID. DMV will issue a new license or ID card number when you meet all the requirements.

Will The Police Investigate And Locate The Identity Thief

There is an expectation that the police will investigate and prosecute identity thieves. However in all reality, these types of issues are rarely investigated by the police. The report is filed and documented – and then no further action is taken. This most likely do to a variety of issues. First, is that the actual identity thief is not located within their geographic area. Second, many police departments lack the budget and manpower to pursue such claims. However a lack of police investigation does not negate how effective a police report operates in a or fraud affidavit. Do not let the lack of a police investigation or prosecution dissuade you from getting that police report filed.

Recommended Reading: Can A Felon Be A Police Officer

Was Your Identity Stolen Remain Calm And Follow These Steps To File A Police Report

If your personal information has been compromised, you may need to file a police report for identity theft.

The sooner you report identity theft, the faster you can prevent further damage to your financial reputation.

However, victims of identity theft are often surprised to hear that filing a police report is only required in certain situations.

Filing an Identity Theft Report with the Federal Trade Commission should be your top priority.

In this guide, you’ll learn when you should file a police report if your identity was stolen.

Here’s What You’ll Need To Provide To The Ftc

As you fill in the required fields about the incident, the FTC’s online tool generates a personalized recovery plan with tips explaining what to do next and how to take action.

For example, you can download forms and dispute letters to send to credit bureaus and your other financial institutions to help clear your name. You may also need to report the identity fraud to another government department, such as your local attorney generalâs office.

Once you complete your affidavit, print out the report and keep a copy for your records. Youâll need this in order to report the crime to your credit card companies and other financial institutions. If you choose to file a police report, theyâll ask you for a copy of your FTC Identity Theft Report.

While the FTC encourages identity theft victims to file an online report, you can also file a report over the phone. Simply call the FTC Consumer Response Center at 1-877-FTC-HELP.

Recommended Reading: How To Become A Police Officer In Florida