Penalties For Driving Without Insurance

Driving without insurance is illegal in all states. Some states do not technically require auto insurance , although these states still require proof of some type of insurance like a surety bond.

If you are caught driving without insurance, then you may pay a fine for your first conviction. Most states charge a fine of $500 to $1,000 for the first offense, although some states charge as much as $5,000 even for the first offense. You might also have to pay the DMV hundreds of dollars in reinstatement fees.

You might also face higher insurance premiums in the future. If you are caught driving without insurance, then your insurer will consider you a high-risk driver. If you try to buy a policy, then you might pay significantly higher rates than a low-risk driver. You have a history of driving without insurance, and that means youre considered a higher risk.

Obviously, theres another cost of driving without insurance: you might have to pay accident costs out of pocket. If you cause an accident as an uninsured driver, then you still have to pay for any medical bills and vehicle damage. Typically, car insurance would cover these costs. As an uninsured driver, you must cover these costs yourself. That could mean paying thousands or hundreds of thousands of dollars to the other driver after an at-fault accident.

For all of these reasons, driving without insurance is rarely worth it.

Can A Cop Tell If You Have Insurance By Running Plates

We want to get straight into this article by telling you a big, fat YES! Cops can definitely tell if you have insurance by running your plates. The technology that they have requires little more than a number plate.

After running this, all of the car owner registration details will be available to them as well as information about the car including, of course, insurance details.

Police can now use their in-car computers to search on the law enforcement databases that they have access to and gain all kinds of information about our cars, and ultimately, us. Around 10 states in total have automatic license plate recognition that can check if your car is insured automatically if you ever get pulled over. Other states need officials to manually input your information into their search databases or to check your documents. It does, of course, vary depending on your state. Some states have an uninsured drivers database in which insurance companies can track who is and is not insured.

The police do not have immediate access to these databases, though, and must call up the company first to ask them to check it. As well as this, some states have a policy that the DMV must tell the authorities when someone cancels their insurance policy.

What Should I Tell My Insurer When Making A Claim

If the accident involved another car youll need to provide your insurer with the details. Here are the eight most important pieces of information your insurer will want to know:

-

The vehicle registration number of the other car

-

Name and address of the other driver

-

Phone number of the other driver

-

Car insurance details of the other driver

-

Names and addresses of other passengers in both cars or other involved/injured people

-

Names and contact details of any witnesses

-

A police reference number if the police were called

-

The time and date of the accident, the weather conditions at the time, and how the accident happened. If you took photos, then these will also come in hand

Having all of these details ready to give your insurer can reduce the risk of your car insurance claim being delayed.

Be aware that if you have a minor accident that’s below the cost of your excess, the insurance company will expect you to resolve it yourself.

Don’t Miss: How Much Does Police Training Cost

How Do Police Know If Youre Driving While Stoned

Make no mistake: Even if you live in a state where marijuana is legal, driving under the influence of weed is still against the law. While evidence shows that drunk drivers are, in general, more dangerous than stoned ones, marijuana slows reaction times and impairs judgment. In Washington state, fatal crashes involving stoned drivers more than doubled in 2014, after marijuana was decriminalized.

It can be hard for police to prove you were driving while high, however. Not only are the field sobriety tests pretty much useless, but blood tests arent very accurate. THC stores in fat cells and metabolizes differently than alcohol. An occasional smoker with low body fat may have no detectable THC in her blood after a few hours. A regular user with more body fat may test positive for THC even if she hasnt smoked for days. Compounding the problem, not every state agrees on what level of THC means a driver is impaired. Colorados DUI laws for marijuana define impairment as 5 nanograms of THC per milliliter of blood. However, California doesnt have a stated limit.

What Do Car Insurance Companies Do If I Dont Report A Car Accident

Its not uncommon for state law to indicate that no reporting is necessary following a minor accident void of personal injury or significant property damage.

In fact, its very common for drivers to be involved in a minor accident and both go on their way without reporting it to anyone.

But insurance companies vary in their reporting requirements based on who they are covering and to what extent the policy covers a vehicle. Some insurance policies specifically spell out the fact that every accident must be reported to them, regardless of how minor.

While they have no means of legal enforcement, they can certainly refuse to pay a claim if a non-reported accident becomes an issue in the future.

They also have the freedom to drop customers who pose a significantly higher risk or have a track record of routinely failing to report accidents.

Also Check: How To Get In To Police Academy

How Can I Check My Insurance Policy

There are several ways to get your auto contract:

- You should get a paper copy when you sign

- Many companies allow you to access your account and policy online

- Some companies even have an app that allows you quick access as needed. You can also pay your bill and add coverage.

With so many ways to access your policy, you should always know whats in your policy and when it ends.

Is Accidental Policy Lapse A Legitimate Defence

I accidentally let my policy lapse. Is that a legitimate defence? No. Even if its just for a day, driving uninsured can land you in hot water.

Theres no obligation on insurers to automatically renew your cover, although many will do that these days.

Its your responsibility to make sure youre covered before you drive a vehicle.

You may be able to argue mitigating circumstances, but youd still be guilty of the offence.

Also Check: Can I Be A Police Officer With A Misdemeanor

Can Police See If You Have Auto Insurance

So, can cops see if you have insurance by running your plates? The answer is a resounding yes. Police can check for our insurance at any time of the day. The make the process simpler for the police, The State of Michigan gave law enforcement a hand. They provided a tool that can do insurance checks without pulling motorists over.

Before, police asked for proof of insurance from motorists. This move opened up the police for fake insurance companies or even hoax cards. By September 2015, all this changed. The State Police of Michigan, working with many other law enforcement agencies, started to use license plates. They do so to check for documentation on automobiles, including checking on insurance. Heres how they do it.

Police officers will run the plates of a specific car they want to check with their onboard laptop. From here, they have access to a database that contains insurance records. They do so before approaching the motorist, which can be a problem. Most of the time, you need an experienced car accident lawyer to help you with this problem.

What Are Alternatives To Satisfying A Financial Responsibility Law

If youre in a state where you can bypass insurance requirements by presenting other proof of financial responsibility, you might not need to worry about presenting police officers with an auto insurance ID card.

Here are some ways that you can comply with the law without buying insurance:

- Depositing cash with your state treasurer

- Purchasing a surety bond in an amount required by the state

- Putting up collateral for a self-insurance certificate

Don’t Miss: How To Buy Old Police Cars

How An Insurance Company Calculates Premiums

Premiums are the amount you pay to buy insurance.

When determining how much you’ll pay for premiums, insurance companies may consider factors such as:

- your age

- how much you use your car

- your driving record

- the type of coverage you choose

- the amount of your deductible

A deductible is the amount of your claim you agree to pay before your insurance company pays the rest.

Can Police Search A Parked Car

It depends on where the car is parked and whether there is a reason for the police officer to approach the vehicle. If you are illegally parked, a police officer has the lawful right to approach the vehicle, and can then execute a search if there is a reasonable belief it is justifiable to do so. However, if your vehicle is legally parked in your driveway, for example, a valid search warrant may be required.

Don’t Miss: How Much Do Police Officers Make In Ohio

How Can You Obtain Car Insurance Information From The California Dmv

It is not uncommon for individuals to be involved in an accident with an uninsured driver or a hit-and-run. If you are in an accident and the police did not arrive on the scene or did not provide you the insurance information of the other driver or vehicle involved, you can still find if a relevant insurance policy exists.

Keep in mind that more than one policy may apply to the accident.

You may call or visit your local California DMV in person to request the insurance lookup for the accident you were involved in:

- If you have the drivers information, you can request the California DMV to look up their name for any applicable insurance coverage.

- If you have the license plate tag, you can provide that to the DMV to research whether the vehicle owner has any valid insurance policy on file.

California law requires that all vehicles present on a California road, whether parked or driven, must maintain valid insurance coverage to include liability insurance for injuries, death, and property damage.

In some cases, an insurance policy may apply to an accident even if the driver at the time was uninsured. This could happen when a driver is working for an employer during the accident or is borrowing a vehicle.

A car accident lawyer can research the specifics of your case and help you discover all potential liability for your damages and any insurance coverage that may be available.

What Auto Insurance Coverage Do I Need If The Other Driver Is Uninsured

If another driver has given you the runaround after an accident they caused and you find they dont have insurance, youre probably wondering where that leaves you.

Court bills can be expensive if you sue them, or you may never even see the other driver that hit your car in the parking lot.

In cases like these, the best coverage option is uninsured motorist coverage. If you have this coverage, your insurer will cover the costs of repairs to your vehicle if you were the victim of a hit-and-run or the other driver doesnt have insurance.

Read Also: How Much Do You Make As A Police Officer

What If Someone Hits My Car And I Dont Have Auto Insurance

First off, not having auto insurance regardless of whether someone hits your car – is illegal in most states. If youre caught driving without a license, you could face fines and other penalties, including losing your drivers license. So, you should always have auto insurance if you own a car and drive it.

However, if you dont have insurance and your car is damaged, you will be on the hook for covering all repair or replacement expenses.

What Steps Do I Take If My Auto Insurance Is Not Current

You may discover in your search to find your current auto insurance provider that your insurance is not up to date.

If your coverage has lapsed, you need to take quick action to make sure you are not left paying expensive fines or in jeopardy of having your drivers license suspended.

The sooner you make arrangements to get your auto insurance coverage reinstated or find different coverage, the lower your risk of being involved in an accident without coverage.

Before you decide to go with any particular auto insurance company for your coverage, shop around online to compare the available rates.

They will vary by area, which is why it is important to be accurate with your ZIP code when requesting various quotes online.

After you find affordable options, you can reach out to those companies to find out how they can take care of your auto insurance coverage needs.

Don’t Miss: How Can I Find My Police Report Online

When Is An Online Auto Insurance Policy Helpful

An online policy can be helpful in several different instances, especially when you want to look up an insurance policy number online quickly or check your vehicle insurance status.

Say you are thinking about renewing your next insurance policy with a different company, but you want to have the same coverage and deductible you have now.

When you can pull up your policy online, you can easily compare what your new company is offering you versus what your current company is providing you now.

An online policy can also be helpful in the event you were recently in some type of accident and you want to move forward with filing a claim.

You want to have an idea of what coverage you have and the limits associated with that coverage. Knowing this before you go forward with the claim filing can help you set your expectations.

Can Law Enforcement Verify That You Have Active Car Insurance Coverage

Years ago, driving without insurance was not as risky as it is today. The only time that drivers would really have to worry about their choice would be if they were involved in an accident.

It was not out of the ordinary for someone with no insurance to carry around an ID card that was not actually valid to present as proof of insurance to police officers. Insurance companies and officers had no way of stopping someone from doing this. The insurance card would show when the policy binder was issued and approximately how long it was supposed to be active. But the card would look exactly the same if you cancelled early.

For months, an uninsured driver could pose as if they were insured without being questioned.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Also Check: How To Become A Police Lieutenant

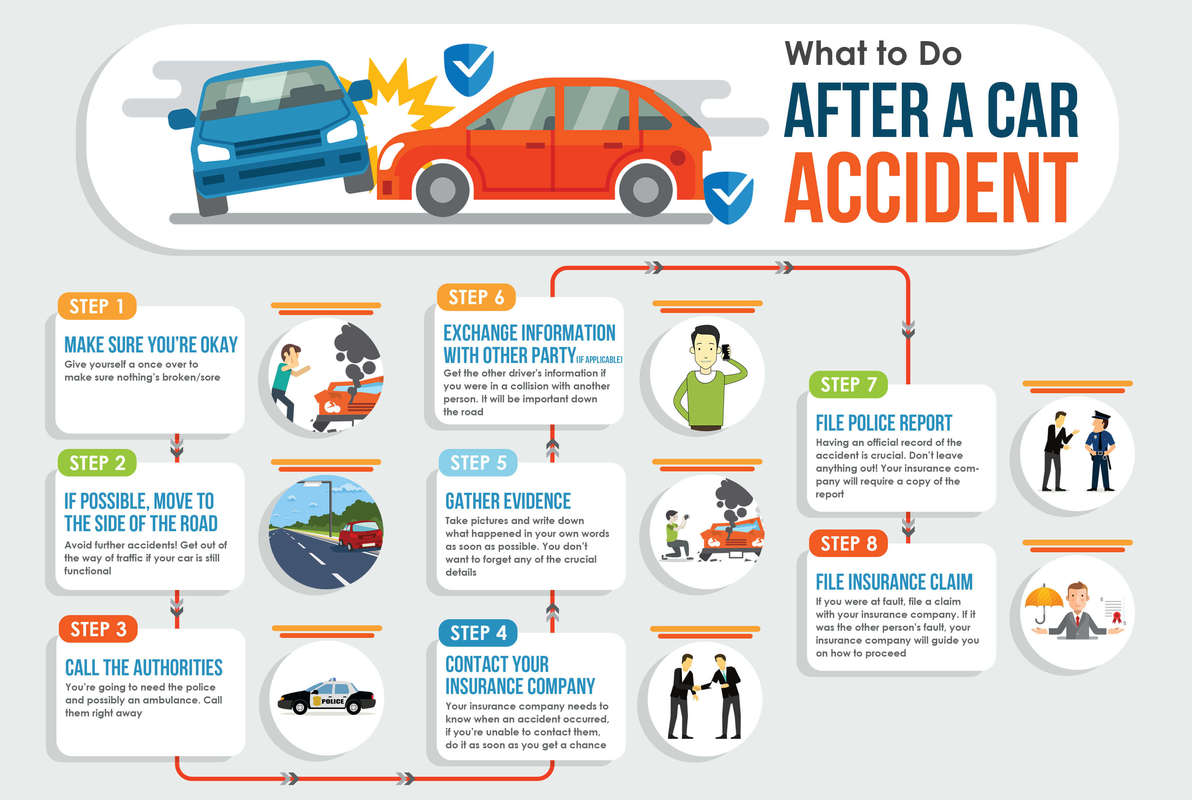

What Are The Basic Steps To Filing A Car Insurance Claim

The first step after any car accident, no matter how minor, is to call the police. Only call 911 if there is a significant medical need.

The second step is for the policyholder to exchange information with the other driver involved in the accident. Make sure you get the other drivers license plate, insurance information, and contact information.

After getting the other drivers information, the policyholder should then get the information of any witnesses that saw the accident.

A third-party witness is important if the other driver is at fault for the accident but decides to blame the policyholder instead.

The policyholder should call their car insurance provider as soon as possible. Most large insurance companies have a 24-hour claims service, so call the insurance company directly from the accident site.

The number for the claims service is typically located on the policyholders insurance identification card.

How To Get An Insurance Id Card

There are three different ways to get your vehicle insurance card, all relatively convenient.

- : The easiest way to get a vehicle insurance card is to request one from your insurer. They will usually mail you multiple paper insurance cards, often just as part of the process of starting a new policy.

- Print it our yourself: You can also ask your agent or company to email you a copy of the card, which you can print out and store in your glove compartment.

- Display your card on your phone: Multiple companies, including Allstate, Geico, State Farm and Progressive, allow you to access your insurance card through their mobile apps.

It’s worth noting, drivers in New Mexico cannot rely on law enforcement accepting electronic proof of insurance, although officers will sometimes accept it. Every other state, plus Washington, D.C., allows drivers to show proof of insurance without a card. That said, an officer might not be liable for damage that happens to your phone.

Recommended Reading: How To Get A Police Background Check On Yourself

Police Officers In Michigan Can See If You Have Car Insurance Before You Show Proof Of It

Police in Michigan are using an easy way to check whether a motor vehicle is properly insured.

Michigan State Police and other agencies can tell whether most vehicles are insured by running a license plate number through an in-car computer.

Were kind of excited about it, given its ability to help us target fraudulent insurance or people, frankly, who are driving around with no insurance, which is dangerous for everybody, said Sargent Amy Dehner, a legislative liaison with the Michigan State Police.

State law still requires drivers carry proof of insurance.

Insurance companies have to send information to the secretary of states office twice a month already. While that practice had been in place for some time, officials say the information wasn’t previously immediately available through the Law Enforcement Information Network, or LEIN. Now, that information is available to cops when they run your plate.

Michigan State Police officers dont treat it as a primary reason for a stop but its a really good reason to take a close look at what youre being handed at the window, Dehner said.

Dehner says theyve been able to crack down on people using fake insurance cards or who were conned into buying a policy from a fake insurer.

Things that could be made on a home computer, things that people were buying on Craigslist, fake insurance storefronts, Dehner said. She says this change was made after officials from the Secretary of States office recommended it.