If Youve Been Scammed

If you think you may be a victim of a fraud or scam, there are some key steps you should take immediately to reduce your risk of losing more money, protect your personal information and avoid being scammed again.

You should:

- stop all communication with the fraudster or scammer

- report the scam or fraud to your local police, the Canadian Anti-Fraud Centre and any regulatory bodies

- notify financial institutions and other companies where you have an account that may have been affected

- avoid making any major financial decisions until you feel youve taken action to secure your accounts

- put an alert on your credit report by contacting a consumer reporting agency, such as Equifax Canada or TransUnion Canada

- gather all records you have of the fraud or scam, such as:

- correspondence with the scammer

- financial statements

- contact information the scammer used to contact you

- websites and social media accounts used for the scam

- any papers, marketing material or ads used for the scam

Contact The Credit Bureaus

- Reach out to one of the three bureaus confirm your identity and ask for a free fraud alert to be linked to your report. Once the alert is placed, it will become much harder for fraudsters to use your information maliciously. Note that you only need to order a fraud alert with one bureau: the others will be notified automatically.

- You can extend the default fraud alert lifespan to seven years, but you’ll need a police report or the Federal Trade Commission report to do this.

How To Report Credit Card Fraud

If you spot unauthorized transactions on a card, the best way to report credit card fraud is to call your credit card issuer. Its safe and easy to use the number on the back of your card, since you know this is the official phone number. But, if you dont have your card, you can usually find the issuers phone number on a recent billing statement or by logging in to your online account.

Youll want to use the phone number associated with your account if possible, as this will reduce the number of security questions you need to answer. Once you get a representative, tell them that youve detected an unauthorized transaction on your account.

This same advice holds true if your card has been lost regardless of whether it has been used. Report it immediately in order to prevent that loss from turning into fraud.

Don’t Miss: How To Become A Special Police Officer

Set Up Virtual Account Numbers

If your card issuer offers them, request a virtual credit card, which is good for a certain amount of time or for a particular merchant. That way if the number is compromised, the potential damage is minimized.

If you are shopping in person, consider using a mobile wallet. If you put your card information on your mobile device, you can use that to make payments. An encryption system substitutes a one-time digital token for your card information.

How To File A Fraud Report With Police

Reporting fraud, from embezzlement to identity theft, is important for two reasons: it can help you as a victim recover personal losses, and it can prevent other people from falling victim to the same scheme. Sometimes, whether because of the high volume of fraud reports or because your local police force is ill-equipped to deal with such cases, filing a fraud report with local authorities can be difficult. Still, you should always report a crime, including fraud, to the local police, as a police report will help protect you in the future. If you’re the victim of a fraud, close your affected bank accounts and credit cards, file a report with the Federal Trade Commission , place an alert on your credit report and begin the process of filing a police report with your local law enforcement agency.

Don’t Miss: How To Become A Police Officer In Nyc

Can I Sell My Credit Card

Yes, most cardholder agreements allow the credit card company to sell your account to another card company. This can happen even when your card is active and in good standing. The new card company mails a new card to you, often with a new account number. You might not receive the new card for a number of months.

Do The Police Investigate Credit Card Fraud

Home \ \ Do The Police Investigate Credit Card Fraud?

Join millions of Canadians who have already trusted Loans Canada

Studies show that approximately 72% of Canadians have a minimum of one credit card. While there is a lot of value to these financial tools, ranging from repairing credit to accessing funds in an emergency, there are also distinct risks. Credit card fraud is an ongoing issue, facing a large number of households across the nation.

The presentation of this pervasive issue is diverse. Credit card fraud can result in stolen identity and severe financial issues for the consumer. For financial institutions, it serves as an extremely costly expense. According to a 2018 report issued by the Canadian Bankers Association, the price tag was roughly $862 million. With the continued prevalence of this crime, it is important for consumers to stay informed so that they can take responsible action.

You May Like: How To Study To Be A Police Officer

How Credit Card Fraud Happens

- make a purchase at a place of business

- make a purchase or transaction online

- make a purchase or transaction by telephone

- withdraw money from an automated teller machine

A person can steal your credit card or credit card information by:

- going through your garbage or mailbox to find credit card statements or other banking information

- swiping your credit card through a device that copies the information stored on the magnetic stripe of your card

- hacking into the computers of companies and stealing credit card information

- installing small devices on payment terminals that record your credit card information

- phishing, that is, sending you an email that looks like it comes from a real business asking for credit card information

- asking you to use your credit card on an illegitimate website to make a purchase

How To Request Records Contained In A Major Collision File

Major Collision Bureau investigates all Motor Vehicle Collisions resulting in a fatality or serious personal injury that occur in the Region of Peel.

If you are NOTthe Involved Party to the Collision

You must provide proof of relationship to the involved party and a signed consent on behalf of the involved individual.

If the Involved Individual is Deceased

You are required to provide an authorization from the legal representative or power of attorney with supporting documents.

***Do Not Send Payment Until You Have Been Invoiced***

Contact Information

You May Like: Are Black People Disproportionately Killed By Police

Don’t Miss: Can The Police Unlock My Car

How Filing A Report Helps Protect You

Why is it important to report identity theft? If you are a victim of identity theft, it means someone has taken your personal information and used it to commit fraud in your name.

Heres how filing a report helps:

- It acts as a declaration of your innocence.

- It helps start the investigation.

A police report serves as sworn statement that you were not responsible for any crimes the thief committed using your name. If someone accuses you of a crime committed in your name, you can show them your sworn statement.

Filing an Identity Theft Report at IdentityTheft.gov serves a similar function, in most cases. Its an official statement about the crime.

Important to note: The FTC recommends filing an Identity Theft Report first, and including it when you file a police report.

Keep in mind, with either report, youre legally obligated to tell the truth to the best of your knowledge. If you dont, you could face criminal penalties.

Steps to take when reporting ID theft to the police

If you decide you want to report identity theft to the police, here are steps you can take.

- A copy of your FTC Identity Theft Report

- A government-issued photo ID

- Proof of your address, such as a mortgage statement or utilities bill

- Any proof you have of the theft, such as credit card statements, IRS notices or collection notices

Aura’s White Glove Fraud Resolution Team Can Assist

Save time and hassle by allowing Aura to monitor and alert you to any new inquiries to your credit file across all 3 major credit bureaus .

Aura’s White Glove Fraud Resolution service eliminates the stress of recovering your identity and assets if youâre a victim of identity theft or financial fraud. A dedicated Aura case manager will work with you to craft a mitigation and remediation plan to recover your damages. Aura’s team of trained experts will help you navigate the challenges of dealing with credit bureaus and federal institutions.

Victims of identity theft have a right to:

You May Like: Do You Need A Police Report For A Car Accident

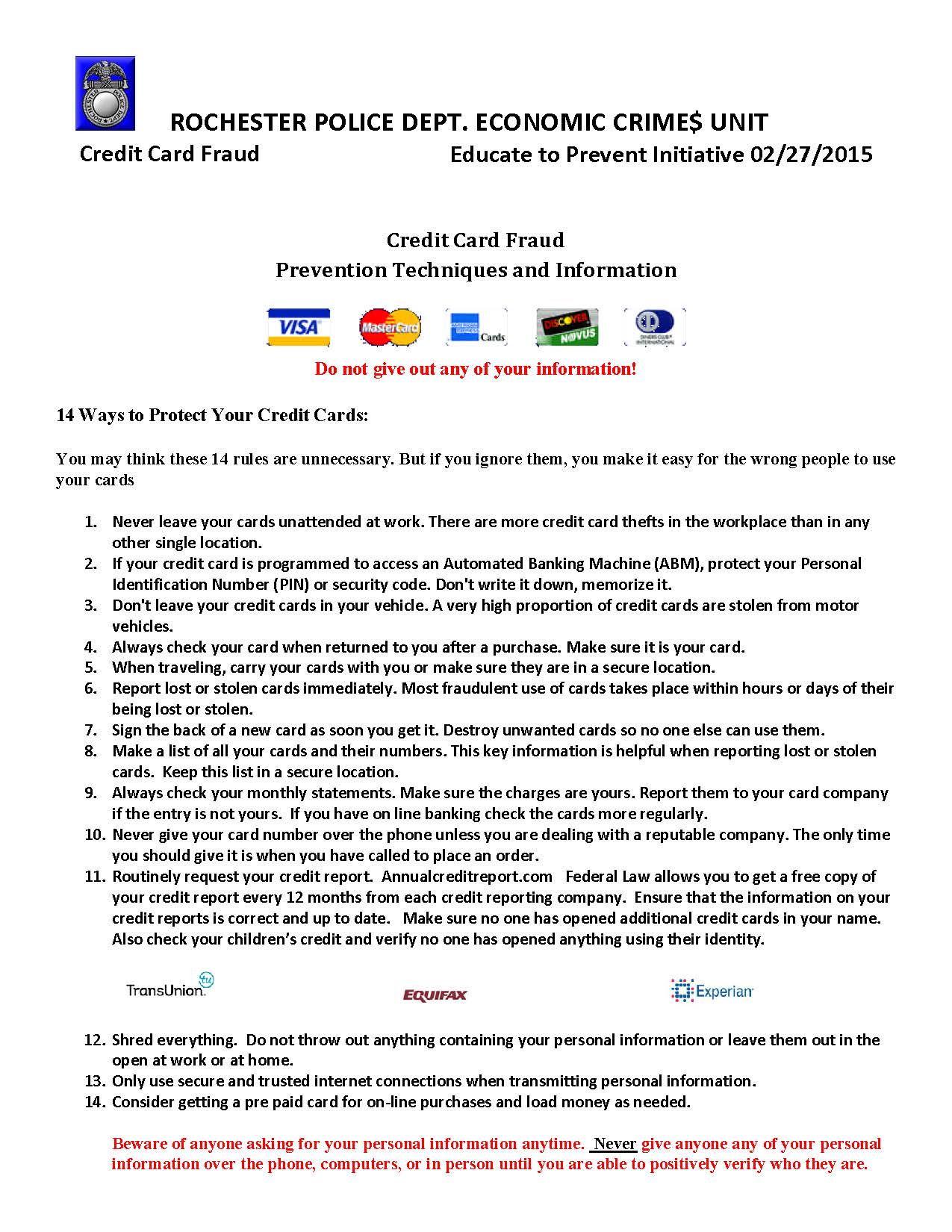

Protect Yourself Against Plastic Card Fraud

Keep all your cards and financial details safe:

- look after your cards and card details at all times. Try not to let your card out of your sight when making a transaction

- check receipts against statements carefully. Contact your card company immediately if you find an unfamiliar transaction

- store your statements, receipts and financial documents safely and destroy them, preferably using a shredder, when you dispose of them

- sign any new cards as soon as they arrive

- cut expired cards through the magnetic strip and chip when replacement cards arrive.

Secure your PIN:

- memorise your PIN and destroy any paper notification as soon as you receive it

- ensure that youre the only person that knows your PIN. Never write it down or record it. Your bank or the police will never phone you and ask you to disclose your PIN

- when entering your PIN, use your free hand and your body to shield the number from prying eyes or hidden cameras. If you think someone has seen your PIN or if you want to change it to something more memorable, you can change it at a cash machine or by contacting your bank.

Report Scams To The Federal Government

You can report scams to the federal government. Your report may keep others from experiencing a scam. Government agencies use reports of scams to track scam patterns. They may even take legal action against a company or industry based on the reports. However, agencies usually dont follow up after you report, and cant recover lost money.

Do not use the agency contact information included in scam messages. Use contact information in the federal agency directory to report other government imposters.

Report Disaster and Emergency Scams

Report coronavirus scams and other scams about disasters and emergencies.

-

Use the National Center for Disaster Frauds web complaint form or call .

-

Find more information on identifying and reporting coronavirus scams.

Report Most Common Scams

The Federal Trade Commission is the main agency that collects scam reports. Report your scam online with the FTC complaint assistant, or by phone at . The FTC accepts complaints about most scams, including these popular ones:

- Phone calls

- Demands for you to send money

- Student loan or scholarship scams

- Prize, grants, and sweepstakes offers

The FTC also collects reports of identity theft. Report identity theft online at IdentityTheft.gov or by phone at .

Report Online and International Scams

Report IRS or Social Security Imposter Scams

Scammers often pretend to work for the Social Security Administration or Internal Revenue Service . Common signs include:

Don’t Miss: How Do I File A Police Report For Fraud

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Reports You Can Submit Online

- Theft from vehicle no limit on value of property

- Theft of property no limit on value of property

- Theft of credit or debit card – regardless of fraudulent use.

- Mischief to vehicle such as vandalism, unless there is evidence of a collision such as paint transfer

- Mischief to property such as vandalism

- Lost property with the exception of government-issued ID such as passports. Please call your local district office to report lost government issued documents.

- Attempted stolen vehicle regardless of damage value

- Break & enter an unlocked premise Entry gained by unknown persons to detached garages, secure parkades, vehicle parkades, porches, sheds, storage lockers and laundry rooms. If entry occurs by forced or kicked indoor, or lock cut then report should be reported to 403-266-1234.

- Theft from a parkade or vehicle parked in a parkade only if no forced entry, otherwise call 403-266-1234.

- Theft of mail including deliveries from postal services such as UPS.

Filing a false police report is a crime.

Note: Please turn off your pop-up blocking software before filing the report.

Also Check: How To Find Public Police Reports

How Can Credit Card Fraud Impact My Credit

When credit card fraud goes undetected, thieves have a chance to run up charges in your namewhich they never intend to pay. This can be damaging to your credit profile. In most cases, you’ll be able to clear up these matters by proving you didn’t authorize the charges. In the meantime, however, anyone checking your credit may see fraudulent credit card accounts, missed payments or increased balances that are appearing as a result of fraud. The presence of these fraudulent items could paint a less-than-flattering picture of your credit habits. Card fraud can put negative marks on your credit reports, including:

- Late payments: If a fraudster opens a credit card account in your name and never pays a bill, late payments could be reported to the credit bureaus in your name and your credit scores could suffer. Payment history, the most important factor in credit scores, accounting for 35% of your FICO® Score.

- High credit utilization: If a fraudulent credit card, or one of your own cards, is being used to run up bogus charges, your the percentage of your borrowing limit represented by your outstanding balancescould skyrocket. Credit utilization is nearly as important as payment history in determining your credit scores, and a high utilization could cause your credit scores to suffer.

What Happens After I File A Report Online

- Upon submitting your completed report online, you will see the words Your online police report has been submitted indicating your report is complete.

- You will receive an email with a temporary case number until police have reviewed the report. Check your junk email folder if you do not receive the email in your inbox.

- Once a police officer has approved the online report, you will be notified and provided a permanent case number.

- The accuracy of the information you provide in the report greatly assists Peel Regional Police Service in investigating your incident. Please ensure the report is as complete and concise as possible.

Also Check: How Many Black People Were Killed By Police In 2016

How To Protect Yourself From Credit Card Fraud

If youre shopping online, experts urge you to exercise caution when dealing with merchants you havent used before, especially if the prices look too good to be true. Velasquez recommends doing a Google search before making a purchase, to see if there are any complaints about the merchant, using sites such as Yelp or the Better Business Bureau.

If the website looks suspicious, or you spot misspellings, be particularly wary, Arevalo says: Go with your gut.

S To Take If You Are A Victim Of Credit Card Fraud

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’ve fallen victim to credit card fraud, you’re far from alone. There were nearly 400,000 reports of credit card fraud reported to the Federal Trade Commission last year, a number that grew 44% from 2019 to 2020. The key to minimizing the damage of this insidious crime is to detect it early and act immediately. Adopting smart habits and taking advantage of resources from Experian and others can help. The right moves can even help you avoid becoming a victim altogether.

Here are some tips on how to protect yourself from credit card fraud and recover as quickly as possible if it does happen.

Recommended Reading: How Much Do Police Handcuffs Cost