Do Police Reports Impact Insurance

Contrary to popular belief, car accident police reports will not impact your insurance companys assessment of the car accident. It is up to your insurance provider to determine who is at fault for an accident and whether or not you will see an increase in your car insurance rates.

Learn more by reading At Fault Accidents and Insurance In Ontario.

What Can Happen If Your Vehicle Is Found To Be Without Insurance

It should be noted that the legal implications can vary state by state if you are caught driving without insurance, but most states in America will at least issue a penalty fine for it.

You also risk having your license and car registration taken from you. You may even risk jail time! The consequences worsen if you are caught Driving Under the Influence , speeding, causing an accident, and other criminal offenses without having insurance. You do not even need to be driving your car in order to be caught without insurance. Many states now monitor the insurance of cars electronically.

This can often mean that your car may get caught whilst it is unattended . In this instance, your car may well be towed or fitted with anti driving equipment such as clamps to stop you from using the vehicle. As well as this, as we mentioned a little earlier in the article, being caught driving without insurance can seriously affect your insurance rates in the future.

You will likely find that it will cost you far more to get insurance if you have previously committed a criminal offense including driving without insurance.

Insurance companies may even refuse to accept you as a customer as you may be classed as a high risk driver. It will go on your record as a car owner.

Your Responsibility For Reporting An Accident To Your Insurance Company

Your car insurance policy is a contract, and there are all sorts of requirements outlined in your policy booklet that both you and your provider have agreed to follow. One of the conditions policyholders agree to is to report all accidents to the insurer. The good news is you dont have to notify your insurer right away. Youre usually asked to notify them as soon as possible, but you must do so within seven days. Your insurer relies on you to uphold your end of the agreement and keep them in the loop of any collisions.

However, the reality is any driver involved in a collision especially a minor collision is wary of involving their insurance company. The only driver who isnt wary is the one who feels they are 100% not at fault for the accident. But what about the other driver who is envisioning a spike in their rates at renewal? Believe it or not, a hike in insurance premiums isnt always the case for a minor collision. In Ontario specifically, insurers are not allowed to use a minor at-fault accident to increase your premiums.

Yes, you read that right: In Ontario, insurers are not allowed to use a minor at-fault accident to increase your premiums so long as all of the following conditions are met:

- The collision happens on or after June 1, 2016

- There are no injuries and damage is less than $2,000 per vehicle

- None of the people involved submits an insurance claim for payment

- The at-fault driver pays for all of the damages

Also Check: How To File A Police Report After A Car Accident

Will The Police Come To The Scene Of The Accident

It depends. Police may or may not come to the scene of an accident based on many factors including the amount of damage, if there are injuries, and the location of the accident. Call the police, and they will let you know if they are en route to the scene or if you should visit an accident reporting centre to file a police report for the accident.

They Also Can’t Search Your Property Without A Warrant Or Your Consent

Not only do police officers not have the right to enter your home without a warrant, but they also can’t search your property without one or your consent. But this right is rather recent it was only in 2018 that the Supreme Court ruled in Collins v. Virginia that “when a law enforcement officer physically intrudes on to gather evidence, a search within the meaning of the Fourth Amendment has occurred.”

Don’t Miss: Can Police Find Your Location On Cell Phone

What Is Included In Police Reports For Car Accidents

The information included in a police report for a car accident can vary based on the details of the accident, who filed the report, and where the report was filed. For example, a car accident police report at the scene will be different from the police report filed at a reporting centre.

The following information is typically included in a police accident report form :

- Report Number : The police accident report reference number will be indicated.

- Date and Location : The report will have the date and location details of the accident.

- Accident Details : Photos of damage, location of damage, type of accident

- Driver Information : Drivers license, insurance, ownership, contact information of all drivers involved.

- Vehicle Information : Make and model of vehicles involved in the accident.

- Statements : Statements of what witnesses and passengers saw.

- Driver Statement : A statement of the events that led to the car accident from the drivers perspective.

- Other Information : Any other information that may be relevant to the accident, such as road and weather conditions.

When Dont I Need Car Insurance

Although the majority of cars do need to be insured, there are some exceptions to the rule. Your car doesnt need insurance if its:

- been declared off the road using the SORN procedure

- been scrapped, stolen or exported with notice

- between registered keepers or dealers

- registered as in trade with the DVLA

You May Like: How To Get Police Clearance Certificate In Usa

How To Prove That You Have Car Insurance

Typically, its your duty as the registered owner of your vehicle to show that you have insurance at all times by keeping your ID cards in your glove box.

If you dont have your ID card with you, you can be cited even if you do have coverage.

Some states accepted both the traditional printed ID cards and digital ID cards.

See if your company offers digital cards to policyholders for convenience.

You should verify that your state allows digital proof of insurance before you assume that its acceptable.

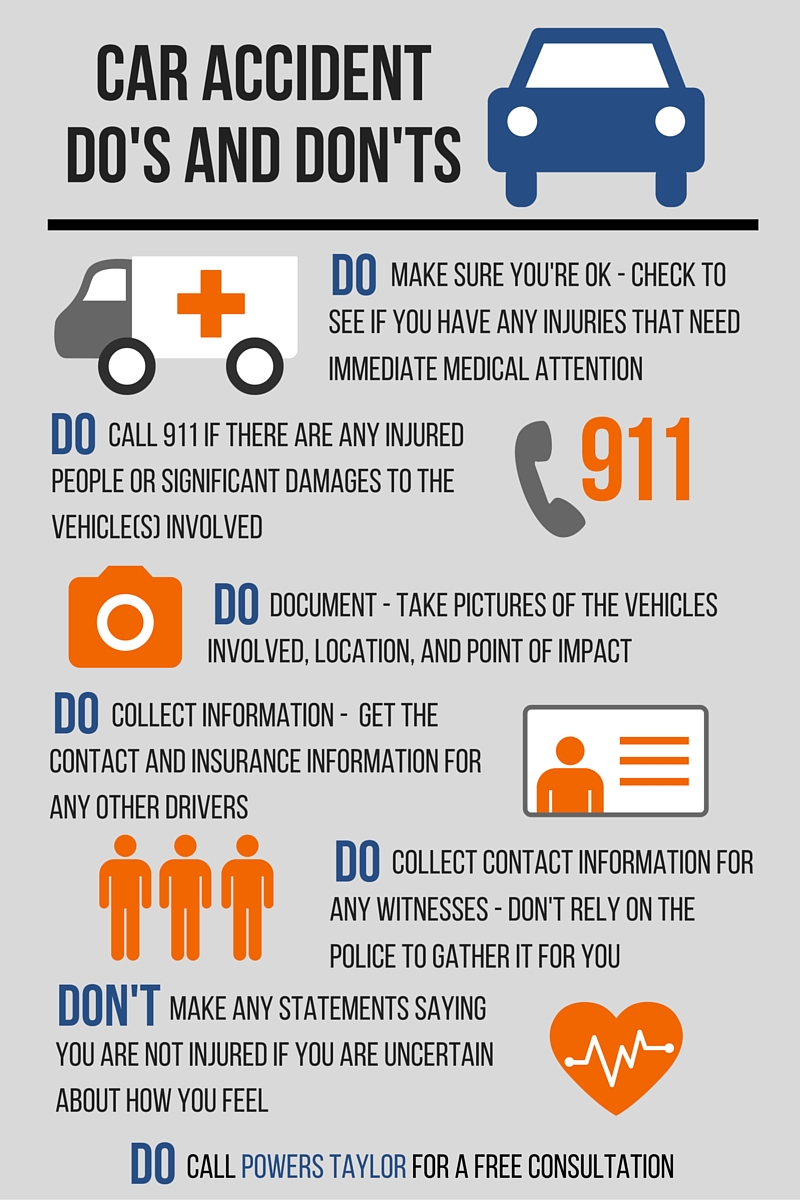

What Not To Do When Youre In An Auto Accident

Now that you know what to do after a minor car accident, and understand the importance of reporting an accident and how to file a motor vehicle accident report, here are some things NOT to do after an auto accident :

Don’t Miss: How Much Do Police Handcuffs Cost

Do I Have To Inform My Insurance Company If I Have An Accident

You dont have to report an accident to an insurance company if you dont want to.

Of course, both you and the other driver in the accident have to agree to this course of action because, if one of you reports the accident and the other doesnt, this could cause a problem when it comes time to collect on a claim.

Not many people forgo calling their insurance company if they have an accident.

However, if someone has the money to pay for the damages in an accident, they are not obligated to use their insurance to cover the costs.

If you are in an accident that someone else causes and they ask you not to call their insurance company because they will pay for the damages themselves, you still need to exchange insurance information.

The reason for this is that many people say they are going to pay and then they dont.

If you get their insurance information, then you can make a claim without them, so long as you have the police report proving that there was an accident.

If you dont inform your insurance company of an accident and you dont get the repairs done to your vehicle, your insurance company can refuse to pay a future claim based on the prior damage to your vehicle.

It is important that you get the repairs done on your vehicle if at all possible so that any future claims arent a problem. You can get repairs done without going through your car insurance.

Did You Receive A Letter

Questions about your Insurance and/or Registration Suspension letter?

Registration can be suspended and revoked for any vehicle in Georgia that does not maintain mandatory continuous motor vehicle liability insurance.

Georgia law requires motor vehicle owners and lessees to maintain continuous Georgia Liability Insurance coverage on vehicles with active registrations. Driving a vehicle while the registration is suspended, revoked or cancelled is a criminal offense. Additional penalties will apply, if convicted of driving a vehicle with a suspended or cancelled registration.

How do I prevent my registration from being suspended?

- If the vehicle was sold, repossessed, stolen, totaled or is out of service you should cancel your vehicle registration. Cancel your vehicle registration online using DRIVES e-Services or in-person at your County Tag Office by submitting Form MV-18J to avoid suspension, lapse, and reinstatement fines.

- Keep your vehicle liability insurance coverage active without any lapse.

- If your insurance status is incorrect with the state, contact your insurance company to get the information updated.

- Your insurance company must electronically transmit insurance coverage information within 30 days of the date the coverage is to begin to the Departments insurance database.

What is a lapse in coverage?

Notice of Pending Suspension

Suspension of Vehicle Registration Notice

More Information

Recommended Reading: How To Anonymously Report Someone To The Police Online

What Do Car Insurance Companies Do If I Dont Report A Car Accident

Its not uncommon for state law to indicate that no reporting is necessary following a minor accident void of personal injury or significant property damage.

In fact, its very common for drivers to be involved in a minor accident and both go on their way without reporting it to anyone.

But insurance companies vary in their reporting requirements based on who they are covering and to what extent the policy covers a vehicle. Some insurance policies specifically spell out the fact that every accident must be reported to them, regardless of how minor.

While they have no means of legal enforcement, they can certainly refuse to pay a claim if a non-reported accident becomes an issue in the future.

They also have the freedom to drop customers who pose a significantly higher risk or have a track record of routinely failing to report accidents.

Work With Your Claims Adjuster

Once your claim has been submitted, you will receive a call from one of your insurance companys Claims Adjusters. Your adjuster will review your policy with you so understand what you are covered for and which items your insurance company will compensate you for. Your claims adjuster can answer any questions you might have about the process.

If at any time you have questions that you want to get answered, reach out to your insurance broker or agent.

Being in a car accident is extremely stressful. Following these steps will not only help to ease your stress but also help to make sure that everyone is properly taken care of in the event of a collision.

Read Also: What Are The Steps To Becoming A Police Officer

How Do Insurance Companies Determine Who Is At Fault After An Auto Accident

Following an accident, car accident victims will need to file a claim with their respective insurance company. If you were injured, you will file a personal injury claim. If a death was involved, the family of the deceased victim will file a wrongful death claim on their behalf. Once a claim is filed with an insurance company, the company will assign an adjuster to the claim.

The adjustor oversees the investigation into the accident and the settlement of the claim. Typically, more than one adjustor will be involved during this process since each person that is in the wreck will need to file a claim.

In an investigation, adjustors will:

- Research the accident

- Examine vehicle damage

- And verify details about insurance policies

Ultimately, adjustors will determine which driver was at fault. This includes sometimes assigning a percentage of fault to each driver. The insurance companies will apportion the costs of the car accident based on this percentage and will indemnify the drivers involved. Texas courts rely on a legal rule known as modified comparative negligence. Under this rule, you can typically recoup losses if youre found to be less than 51% percent at fault for the accident.

What Are The State Insurance Laws

Insurance laws, limit requirements, and systems vary by state. Some states have mandatory insurance laws where theres no choice but to have auto insurance to pay for vehicle damages.

Other states have a different type of law called a financial responsibility law.

In this state, carrying auto insurance is just one of the options to satisfy the law.

Don’t Miss: Can I Request A Copy Of My Police Statement

Best Life Insurance Companies For Police And Law Enforcement Officers

| A.M. Best |

- Large selection of Term and permanent cash-value products

- Streamlined underwriting process that delivers rapid policy decisions

- Online applications with an average approval time of fewer than 21 days

- Liberal and competitive underwriting guidelines for applicants with various health conditions

- No medical exam policies available for healthy non-smokers

Cons:

- Lincoln National does not offer whole life insurance.

- Although claims can be filed online, typical service requests cannot be made online.

- Although a childrens term rider is available, you cannot buy a stand-alone policy for a child.

Does Filing A Police Report Mean You Need To File An Insurance Claim

Filing a traffic accident police report does not mean that you are required to file a car insurance claim for the accident. The police report is the record of the accident, and it will outline the details of what occurred. It can also help protect you because you dont know what the other driver may do or say after the accident.

Also Check: How To Report Cyber Stalking To The Police

Driving Without Insurance Is A Secondary Violation In Most States

In most states, a police officer cannot pull you over for not having insurance. In most states, driving uninsured is a secondary violation. That means police officers can ticket you for not having insurance, but they cannot pull you over primarily because you had no insurance.

If you are pulled over for speeding, for example, and the police officer finds you have no insurance, then you will receive a ticket for speeding and driving without insurance.

If you drive past a police officer at a normal speed limit, however, and have no insurance, and the officer runs your plate and finds you are uninsured, then the police officer cannot pull you over . As a secondary violation, driving uninsured cannot be the primary reason to pull you over in most states.

How Insurance Companies Help Law Enforcement

To keep the entire system healthy, insurance companies have a mandate to provide updated info. It happens every 1st and 15th of the month, given to the Secretary of States Office. The information they provide includes the name of the insured and the date of coverage. Once the update is complete, all law enforcement branches will have access to it. If the police run your plates for an insurance check, police officers can see if you have insurance or not. Its almost instant, so if youre having issues with law enforcement, talk to us for advice.

This digital insurance checking offers many different benefits to the police, saving time and effort. It reduces the number of steps they need to do while being accurate at the same time. They also get to do unbiased insurance checks rather than look at falsifiable proof. It helps them lay a hammer on those with fake insurance cards, which increase citations.

If you receive a citation or get an injury while driving uninsured, veteran personal injury lawyers are your best bet. They can be the best counsel you can pick to give you the advantage you need.

Also Check: How Do You Fix An Incorrect Police Report

How Do Police Know If Youre Driving While Stoned

Make no mistake: Even if you live in a state where marijuana is legal, driving under the influence of weed is still against the law. While evidence shows that drunk drivers are, in general, more dangerous than stoned ones, marijuana slows reaction times and impairs judgment. In Washington state, fatal crashes involving stoned drivers more than doubled in 2014, after marijuana was decriminalized.

It can be hard for police to prove you were driving while high, however. Not only are the field sobriety tests pretty much useless, but blood tests arent very accurate. THC stores in fat cells and metabolizes differently than alcohol. An occasional smoker with low body fat may have no detectable THC in her blood after a few hours. A regular user with more body fat may test positive for THC even if she hasnt smoked for days. Compounding the problem, not every state agrees on what level of THC means a driver is impaired. Colorados DUI laws for marijuana define impairment as 5 nanograms of THC per milliliter of blood. However, California doesnt have a stated limit.