What You Should Know About Reporting Your Credit Card Fraud To Police

If your identity has been stolen or your credit card has been hacked, you definitely need to report these instances to your local police department. But in order to do that, there are a couple of things you need to do first to keep from making extra trips back and forth to the police station.

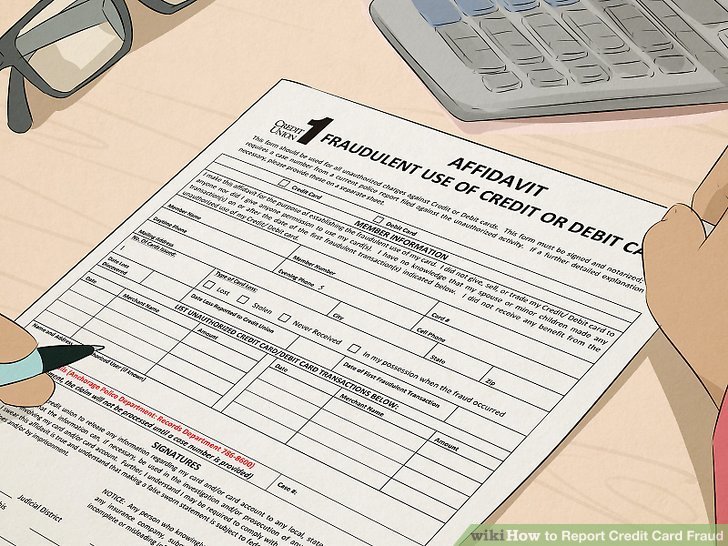

The first thing you need to do is to file a credit card fraud affidavit with the Federal Trade Commission. This affidavit will serve as an official written statement of the credit card fraud issue, and you will copy this document for the police report and the report you will file with the credit bureaus.

Your credit card issuer will send you an affidavit of credit card fraud, or to save time, you can get one directly from the FTC, just download, print as many copies as you need, and fill them out accordingly. Be sure you

- Sign and date in the presence of a notary or law enforcement.

- Do not leave any information out. Make sure every numbered item on the affidavit has been addressed.

- Be as detailed as possible about the specific incident you are reporting. Leave nothing to chance, and even the most minute detail can be beneficial.

Now your credit card fraud affidavit is complete, and you can now involve local law enforcement.

What To Do If Your Identity Has Been Stolen

If you are a victim of identity theft, the FTC recommends taking the following four steps as soon as possible.

As you work through these steps, it’s important to keep a record with the details of all your conversations and copies of all correspondence.

How To Use Donotpay To Learn About Police Investigations Of Credit Card Fraud

DoNotPay was designed to level the playing field and make important information available to the masses. If you have been victimized by a credit card fraudster and you need some further information on the matter, just follow these easy steps on the DoNotPay identity theft product page.

DoNotPay can help you

Getting the ball rolling with the local police

And that’s it. DoNotPay will make sure your issue gets sent to the right place. We’ll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Read Also: How To Become Fire Police

Citizen Online Report Entry

- Requires IMMEDIATE police attendance or a lengthy on-scene investigation

- Is related to Domestic Violence

- Involves an Emotionally Disturbed Person

- Involves the reporting of Theft of E-Bike

- Is motivated by hate bias

Please call the Toronto Police at 416-808-2222 and DO NOT submit your report online.If this is an emergency, please call 911.

In order for the Toronto Police Service to process your CORE report, the following information is MANDATORY

- Your EMAIL ADDRESS, PHONE NUMBER and other contact information.

- The INCIDENT START AND END DATE

- The LOCATION of the incident, including the place or area your property was believed stolen.

- Please CREATE A SEPARATE PROPERTY ENTRY for EACH piece of property that you are reporting stolen.

The accuracy of the information you provide in the report greatly assists the Toronto Police Service in investigating your report. Please ensure it is as COMPLETE AND CONCISE as possible.

If you have filed a report online and would like to add/change/update your report, please submit a Supplemental Report.

It is the policy of the Toronto Police Service to not accept reports of non-emergency incidents that occur outside of the City of Toronto.

You May Like: Are All Police Reports Public Record

Signs That You May Be A Victim Of California Credit Card Fraud

Keeping a close eye on your financial information is one of the first lines of defense against California credit card identity theft. To avoid becoming the victim of credit card fraud, watch out for the following signs:

- Contacts from debt collectors regarding debts that do not belong to you

- You stop receiving your bank or credit card statements

- You spot suspicious charges on your credit card

- You find suspicious withdrawals from your bank account

- You receive notices from your bank about suspicious transactions

- Products are delivered to your home that you did not order

Also Check: How To Get Sponsored By A Police Department

What Happens When You Report Credit Card Fraud

When you call your card issuer to report credit card fraud, the representative will ask you questions and then usually deactivate your compromised card and card number. Youll be issued a new card, which will generally be sent to your home address. If you need the card urgently, be sure to say so as the issuer may be willing to overnight you the new card.

Usually, calling your card issuer is all you need to do if you detected unauthorized transactions on just one card account. But, its a good idea to check your credit report, keep an eye on your other accounts and bank statements and regularly change your online passwords. When you check your credit report, look for unfamiliar inquiries, new accounts you didnt authorize or addresses where youve never lived as these can be signs that someone has stolen your identity. And, make sure you recognize all activity on your accounts and bank statements. If you notice any issues, take appropriate action quickly as you could be a victim of identity theft.

Related reading: How to check your credit score for absolutely free

How To File A Police Report For California Credit Card Identity Theft

Creating a record of your California credit card fraud case may be vital to proving your case to your creditors and credit bureaus. It may also help in preventing future cases of identity theft. To file a police report about California credit card fraud, follow the steps listed below.

Read Also: Is The Police Action Fund Legitimate

How To Detect Fraud

Checking statements and account activity regularly, line by line, can help you spot fraud. Sometimes, it will be glaring for instance, a $250 charge in New Mexico, when youve never left Ohio. Other times, it may be more subtle.

Fraudsters often test out small amounts, even pennies, to see if they can get away with using your card, says Grogan. A pending charge for $1.99 might signal someone is gearing up to go on a spending spree, she says.

You want to report in a timely manner, which means as soon as possible.

Immediate Steps To Take

- File a report with the police/sheriff in the jurisdiction in which you live and get a copy of the report for the credit reporting agencies, banks and credit card companies. You can file the report at the police station or file online.

- In Denver, you can file at www.denvergov.org/policereport.

- You can also complete the ID Theft Affidavit provided by the Federal Trade Commission at www.ftc.gov.

- Consider placing a Security Freeze or Fraud Alert on/in your credit reports. See below.

Read Also: How To Be A Reserve Police Officer

Read Also: How To Become A Police Officer In Dallas

How To Protect Yourself From Credit Card Fraud

While fraud is frightening, there are simple steps you can take to preserve your credit and financial wellbeing. These include:

- Checking your credit report at least once a year: Look into your directly from TransUnion and Equifax at least once every year. Ensure that all the charges are accurate. If you suspect foul play, take action.

- Keeping your pin and passwords safe: It is important to never share your passwords or your pin number. This offers a basic level of security and prevents many issues if your card is lost or stolen.

- Use your information responsibly: In general, do not issue personal information over the phone or the internet. This includes, but isnt limited to, your date of birth, social insurance number, credit card details, and address. If you are in doubt as to whether to provide the information, wait, check their credentials, and either call back or return to the website when you are certain of its ethical nature. Its always best to be cautious.

What Is Fraud What Isnt

At its basic level, fraud is any transaction thats not authorized by the cardholder, says Matt Freeman, head of credit card products at Navy Federal Credit Union.

An important second element, says David Pollino, senior vice president and deputy chief security officer at Bank of the West, is that the charges must not benefit you.

In other words, if your spouse went into your wallet without your knowledge and used your credit card to pay the phone bill, thats not reportable. It may be unauthorized, but you were receiving a benefit, so it isnt fraud, says Pollino.

Other cases of mistaken fraud include when consumers dont remember or dont realize that they authorized a purchase, says Eileen Grogan, assistant vice president of payment solutions at Affinity Federal Credit Union.

People think theyre signing up for a free trial of something, but embedded in the terms and conditions is a recurring order of an item, she says. In such cases, you will have to fight with the merchant directly, unless the merchant makes it extremely difficult to cancel, which is when youd call your card issuer for help.

Finally, before you jump to fraud conclusions, be aware that merchant names sometimes appear differently on your statement. If youre not sure about a transaction, Grogan suggests looking for the phone number listed under the merchant name on your statement. A quick call to that number can often help jog your memory , she says.

Read Also: Are Police Reports Public Record In Oregon

Are You Liable For Unauthorized Charges On Your Credit Card

One fear when you see unauthorized charges on your credit card is that you might be liable for those charges. Luckily, the Fair Credit Billing Act limits your liability. Specifically, the Federal Trade Commission notes that:

Under the FCBA, your liability for unauthorized use of your credit card tops out at $50. However, if you report the loss before your credit card is used, the FCBA says you are not responsible for any charges you didnt authorize. If your credit card number is stolen, but not the card, you are not liable for unauthorized use.

In other words, if you keep your physical card in your possession or youre able to report that your card is stolen before its actually used, you wont be liable for any charges. Even if the physical card is stolen and charges are made before you report the theft to your card issuer, youll only be liable up to $50. In fact, many cards go a step farther by offering a fraud liability benefit that means you wont be responsible for any unauthorized charges if your card is lost or stolen.

If Youve Been Scammed

If you think you may be a victim of a fraud or scam, there are some key steps you should take immediately to reduce your risk of losing more money, protect your personal information and avoid being scammed again.

You should:

- stop all communication with the fraudster or scammer

- report the scam or fraud to your local police, the Canadian Anti-Fraud Centre and any regulatory bodies

- notify financial institutions and other companies where you have an account that may have been affected

- avoid making any major financial decisions until you feel youve taken action to secure your accounts

- put an alert on your credit report by contacting a consumer reporting agency, such as Equifax Canada or TransUnion Canada

- gather all records you have of the fraud or scam, such as:

- correspondence with the scammer

- financial statements

Learn more about the Government of Ontario eliminating licence plate stickers.

Recommended Reading: Can You File A Police Report For Identity Theft

Are Your Cards Protected Against Fraudulent Charges When Youre Traveling Internationally

As a credit card holder, you have protection from fraudulent purchases. But what happens if you travel overseas? Are you covered by the same fraud liability protections that credit card companies routinely provide to cardholders in the U.S. while abroad?

The good news? You are. The liability protection that credit card providers offer is tied to consumers credit cards, not to their location.

These are a few steps you can take before traveling to prevent fraudulent charges, and/or if you notice a suspicious charge or activity on your card while overseas:

When You Receive Your Personal Identification Number

- In the event the sealed package containing your PIN is compromised, please contact our Customer Service immediately at / .

- Memorise your Personal Identification Number immediately and destroy the PIN advice.

- It is advisable to go to the nearest HSBC Amanah branch to change your PIN and do not use sequential numbers and obvious numbers, such as your telephone number, ID number, date of birth, driving licence, passport or other easily accessible personal information as your PIN

- Change your PIN regularly for precaution.

- Do not disclose your credit card-i details or PIN to any other person, including any employee of the Bank.

- Do not write your PIN on the credit card-i or on anything kept in close proximity with your credit card-i.

- Do not allow anyone to have access to your PIN.

You May Like: Is There An App For Police Scanner

How Credit Card Fraud Happens

- make a purchase at a place of business

- make a purchase or transaction online

- make a purchase or transaction by telephone

- withdraw money from an automated teller machine

A person can steal your credit card or credit card information by:

- going through your garbage or mailbox to find credit card statements or other banking information

- swiping your credit card through a device that copies the information stored on the magnetic stripe of your card

- hacking into the computers of companies and stealing credit card information

- installing small devices on payment terminals that record your credit card information

- phishing, that is, sending you an email that looks like it comes from a real business asking for credit card information

- asking you to use your credit card on an illegitimate website to make a purchase

How Filing A Report Helps Protect You

Why is it important to report identity theft? If you are a victim of identity theft, it means someone has taken your personal information and used it to commit fraud in your name.

Heres how filing a report helps:

- It acts as a declaration of your innocence.

- It helps start the investigation.

A police report serves as sworn statement that you were not responsible for any crimes the thief committed using your name. If someone accuses you of a crime committed in your name, you can show them your sworn statement.

Filing an Identity Theft Report at IdentityTheft.gov serves a similar function, in most cases. Its an official statement about the crime.

Important to note: The FTC recommends filing an Identity Theft Report first, and including it when you file a police report.

Keep in mind, with either report, youre legally obligated to tell the truth to the best of your knowledge. If you dont, you could face criminal penalties.

Steps to take when reporting ID theft to the police

If you decide you want to report identity theft to the police, here are steps you can take.

- A copy of your FTC Identity Theft Report

- A government-issued photo ID

- Proof of your address, such as a mortgage statement or utilities bill

- Any proof you have of the theft, such as credit card statements, IRS notices or collection notices

Dont Miss: How Do I Check My Police Record

Don’t Miss: Can The Police Track Your Iphone