Victims Of Identity Theft: What Next File A Police Report

Identity theft has become a major problem for millions of consumers, companies and financial institutions throughout the world. The losses for victims of this crime add up to billions of dollars on an annual basis. As technology evolves, criminals are using more sophisticated methods of identity theft, making this act much more difficult to prevent.

When Should You File A Police Report For Identity Theft

If you attempt to file a police report for identity theft, most police officers will ask for a copy of your FTC Identity Theft Report. So, follow the steps outlined above before going to your local police department.

As mentioned above, itâs not always necessary to file a police report for identity theft when you make an official report to the FTC.

Here are some instances when should report identity theft to the police:

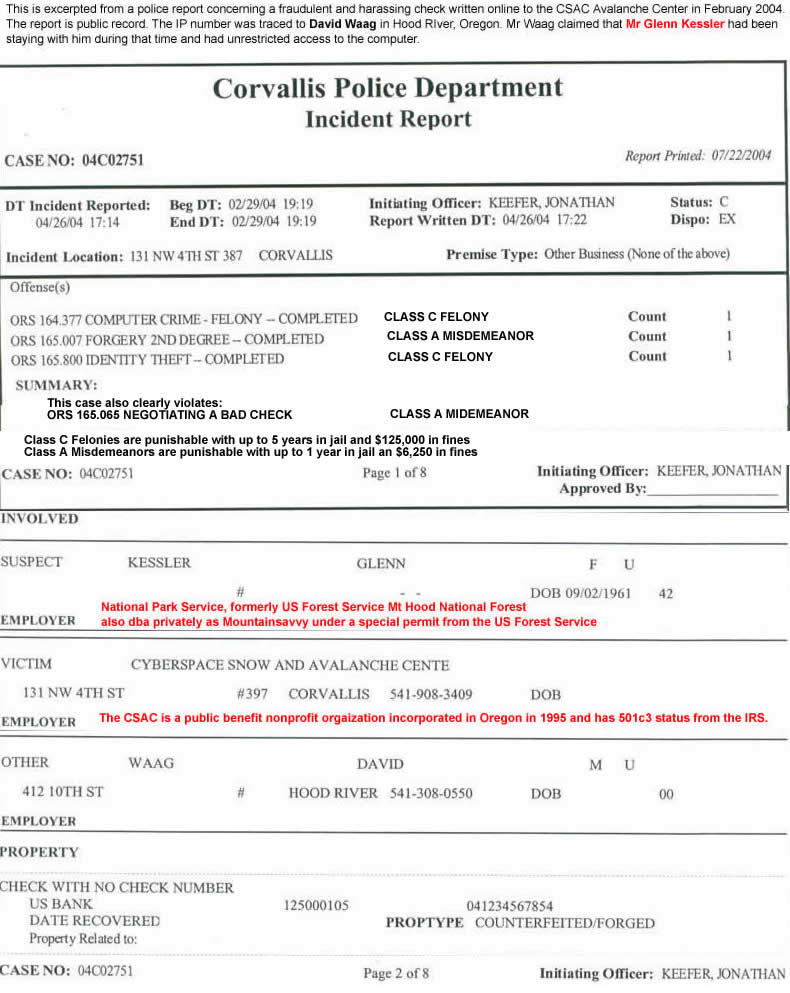

- âYou know the person who committed the crime. If you know that a roommate, family member, friend, etc. had access to your information right before something showed up on your credit report or accounts, the police may investigate that person.

- âYou have information that could aid a police investigationinto the theftâ if someone used your name and address and then filed for a change of address in your area, this may pinpoint a potential suspect.

- âYour identity was used during a police interaction or crime. If a person stole your identity and used your name and address during a traffic stop or an arrest, you may have police records in your name even though you didnât commit the crime. Filing a police report protects you from any unwarranted penalties.

- âYour financial institutions require a police report for identity theft. Some banking institutions, credit unions, and debt collectors will need to keep an official police report on file for their records as they resolve disputes.

How To File A Police Report For Identity Theft On Your Own

There are several methods available when it comes to filing a police report. Aside from online reporting, you can generally file a report by phone or in person. You could face severe criminal fines as well as civil penalties for filing a false report, regardless of the method chosen.

| In-Person | Visit your local police department to file a fraud report in person. You can generally do so 24 hours a day however, that does not mean that the process will be quick and easy. In fact, you could incur an extended wait time if officers are currently involved in more urgent matters. |

| Over the Phone | It is sometimes possible to file a police report for identity theft over the phone. To do so, contact your local agency and ask to speak with their white collar crimes division. You could be connected right away, but if all officers are busy you will need to wait for a return phone call. |

| Having an Officer Visit | If you are unable to visit the police precinct in person, you could request an officer be dispatched to your location. When doing so, keep in mind that you could experience a significant wait time. Officers must handle more urgent matters such as a crime in progress before attending to routine police reports such as those regarding identity theft. |

Read Also: How Old To Become A Police Officer

Freezing Your Credit And Placing Fraud Alerts

Place a credit freeze with each of the three major credit reporting agencies . This will protect you from having credit cards or other accounts opened fraudulently. The credit bureaus have three business days after receiving your request to place a freeze on your credit report. There may be a small fee to freeze your credit with each agency.

Learn more about freezing your credit and placing fraud alerts.

Filing An Identity Theft Police Report

ID theft victims should reach out to law enforcement

If you are a victim of identity theft, you should file a police report with the law enforcement agency closest to where you live.

Your local police or sheriff department must take an identity theft report if you have documents to show you were a victim.

When you go to the police station, bring supporting documents such as:

- Copies of bills or collection notices

- Bank or credit card statements

Make sure to write down the number on the police report. Your creditors may ask for the report number.

If the officers do not want to take your report, ask to speak the watch commander and mention Penal Code Section 530.6.

County of Los Angeles Department of Consumer and Business Affairs. Last change: Oct. 25, 2011

Don’t Miss: How To Hire An Off Duty Police Officer

What Happens If My Claim Is Approved

After you file your claim, you will be asked to enter your bank account wire information. Youll either find out instantly whether your claim has been approved, or youll get an email once the team has looked into your claim. Once your claim is approved, well issue payment, minus the amount of the deductible, directly into your account .

Also Check: How Can You Join The Police Force

Does A Police Report Say Who Was At Fault

Many police reports contain a responding officers opinion about who was at fault. If one party clearly violated any laws, that will be stated in the report. In most cases, any broad or specific mention of the other party violating a law that resulted in an accident is enough to satisfy an insurance company.

Recommended Reading: How To File A Police Report For Stolen Wallet

Read Also: How To Become A Police Officer In Ct

Was Your Identity Stolen Remain Calm And Follow These Steps To File A Police Report

If your personal information has been compromised, you may need to file a police report for identity theft.

The sooner you report identity theft, the faster you can prevent further damage to your financial reputation.

However, victims of identity theft are often surprised to hear that filing a police report is only required in certain situations.

Filing an Identity Theft Report with the Federal Trade Commission should be your top priority.

In this guide, you’ll learn when you should file a police report if your identity was stolen.

If Identity Is Stolen

If you think your financial accounts have been breached, you can pay to put an alert on your credit report. This can alert those checking your credit to make sure they are dealing with you and not an imposter.

To minimize any further incidences and to begin the process of clearing any harm done, you should:

- keep a log of all your phone calls

- follow up in writing with contacts youve made on the telephone or in person to make sure you have a record of all agreements

- make copies and keep all originals of supporting documentation, like police reports and letters to and from companies

- keep old files even if you believe the case has been resolved, in case errors reappear on your credit reports or if old issues arise

Recommended Reading: Do I File A Police Report For Identity Theft

Am I On The Hook For The Money

Per the Fair Credit Billing Act, most credit card companies have protections for those affected by identity theft, like zero-liability policies. The law also sets the maximum liability for unauthorized charges at $50.

Fraudulent ATM, debit cards and electronic transfers are protected under the Electronic Transfer Fund Act. However, its important to act fast to avoid charges. If you report your debit or ATM card as lost or stolen before anyone uses it, youre off the hook for any fraudulent charges. Otherwise, if you report your card as lost or stolen within two days of learning of the loss or theft, your maximum liability for any unauthorized charges will be $50. If you report the card as lost or stolen between two days after learning of the loss or theft, but less than 60 days after your statement is sent to you, your liability is $500. If you report a card lost or stolen more than 60 days after your statement is sent to you, your liability is unlimited.

If you are a victim of identity theft, consider keeping a security freeze or fraud alert on your credit reports while you work to undo any damage. Being vigilant against signs of identity theft and catching the theft or fraud early can help keep the damages to a minimum.

Consider Id Theft Protection

It is a long process to recover from identity theft. However, once you know where to start and the steps you need to take, hopefully it feels a little less daunting. Most importantly, you dont want it to happen again. Consider an identity theft protection service to put measures in place that make it more difficult for thieves to access your information and misuse it.

Also Check: How To Get Police Records On Someone

Next Steps For Filing A Police Report For Identity Theft Online If You Can’t Do It Yourself

Identity theft can sometimes involve a stolen phone in addition to credit or debit cards in a stolen wallet. Accordingly, some people may find it difficult to even call police, let alone file a report for identity fraud. Others are so shook up they have trouble articulating what actually happened. If you are having problems reporting identity theft, DoNotPay offers a safe, efficient solution that’s virtually hassle free.

What If I Need To Change My Report After I File It

You will have the ability to file online supplemental reports. If you have already filed a report through the online system, we strongly encourage you to continue to update and add information through this system. This decreases the risk of filing the same report twice, and also makes it easier to keep your information tied to the correct report number.

You will need either:

Also Check: How Do You Become A Police Officer In Minnesota

You May Like: What Is A Police Background Check

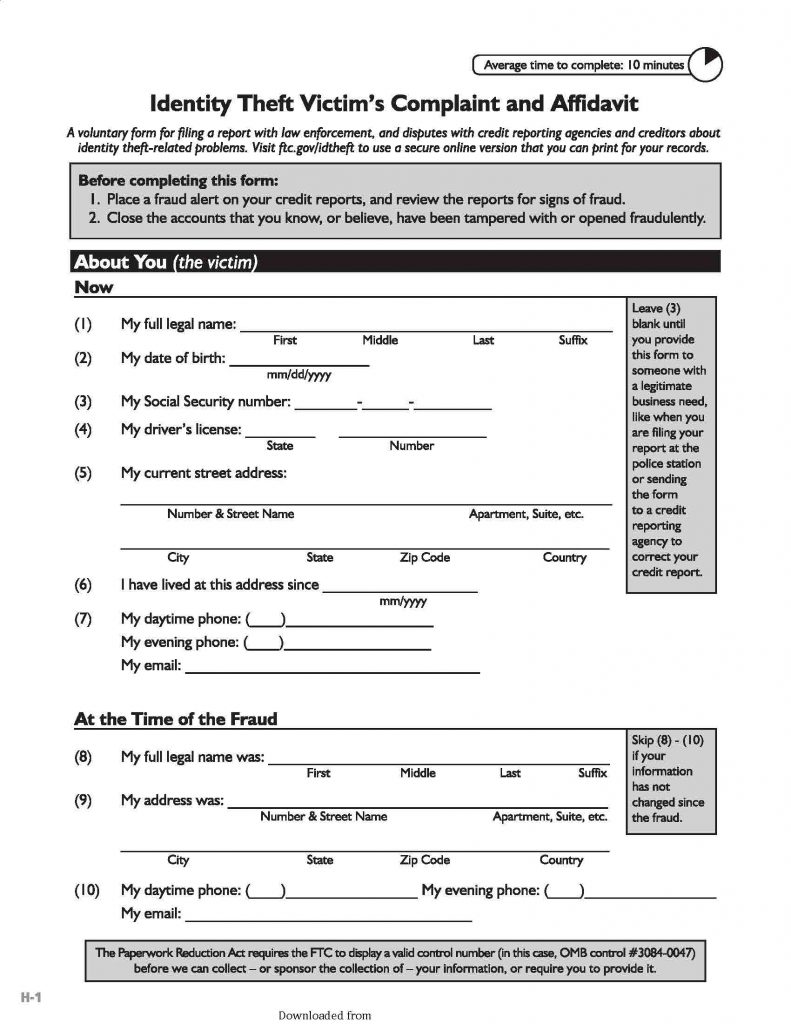

Write To The Credit Bureaus

Write a letter to each credit bureau. Repeat what you said in your telephone call . Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter. See the Sample Letter to Credit Bureaus on page 7.

Equifax

P.O. Box 2000Chester, PA 19016

As an alternative, you may dispute items with the credit bureaus online. Look for “dispute” on their websites: equifax.com/home/en_us, experian.com, and transunion.com.

Other Steps You Can Take To Limit Further Loss Of Funds Or Information

Your information may be gone, but that doesn’t mean all the damage is done. You can stop identity thieves from dragging your name farther through the mud by:

You May Like: Do Police Know If You Have Insurance

Why Should You File A Police Report After Identity Theft

10/22/2021

Does it serve a purpose if you dont know how to find the thief?

Filing a police report as soon as you discover your identity has been stolen has several benefits for your overall case.

With almost 1.4 million reported cases of identity theft in 2020, this particular menace doesnt seem to be slowing down any time soon. Identity theft typically involves a thief using your personal information to obtain certain benefits.

There are different types of identity theft, so there are different kinds of benefits such thieves could enjoy, whether its medical benefits, government benefits, or even personal gain through , allowing the thief to take money directly from the victims financial accounts. Worse still, the thief could open additional unauthorized lines of credit in the victims name.

If you think youve fallen victim to identity theft, there are a number of steps you should take, and filing a police report is one of them. This might seem extreme, but it isnt. Heres why.

If You Are Contacted By A Debt Collector

Tell the debt collector that you are the victim of identity theft. Say that you dispute the validity of the debt. Say that you did not create the debt and are not responsible for it. Send the collector a follow-up letter saying the same things. Include a copy of your police report and of any documents youve received from the creditor. Write in your letter that you are giving notice to a claimant under California Civil Code section 1798.93, subsection that a situation of identity theft exists. Send the letter by certified mail, return receipt requested. If the debt collector is not the original creditor, be sure to send your letter within 30 days of receiving the collectors first written demand for payment.

You May Like: How To Find Police Incident Reports

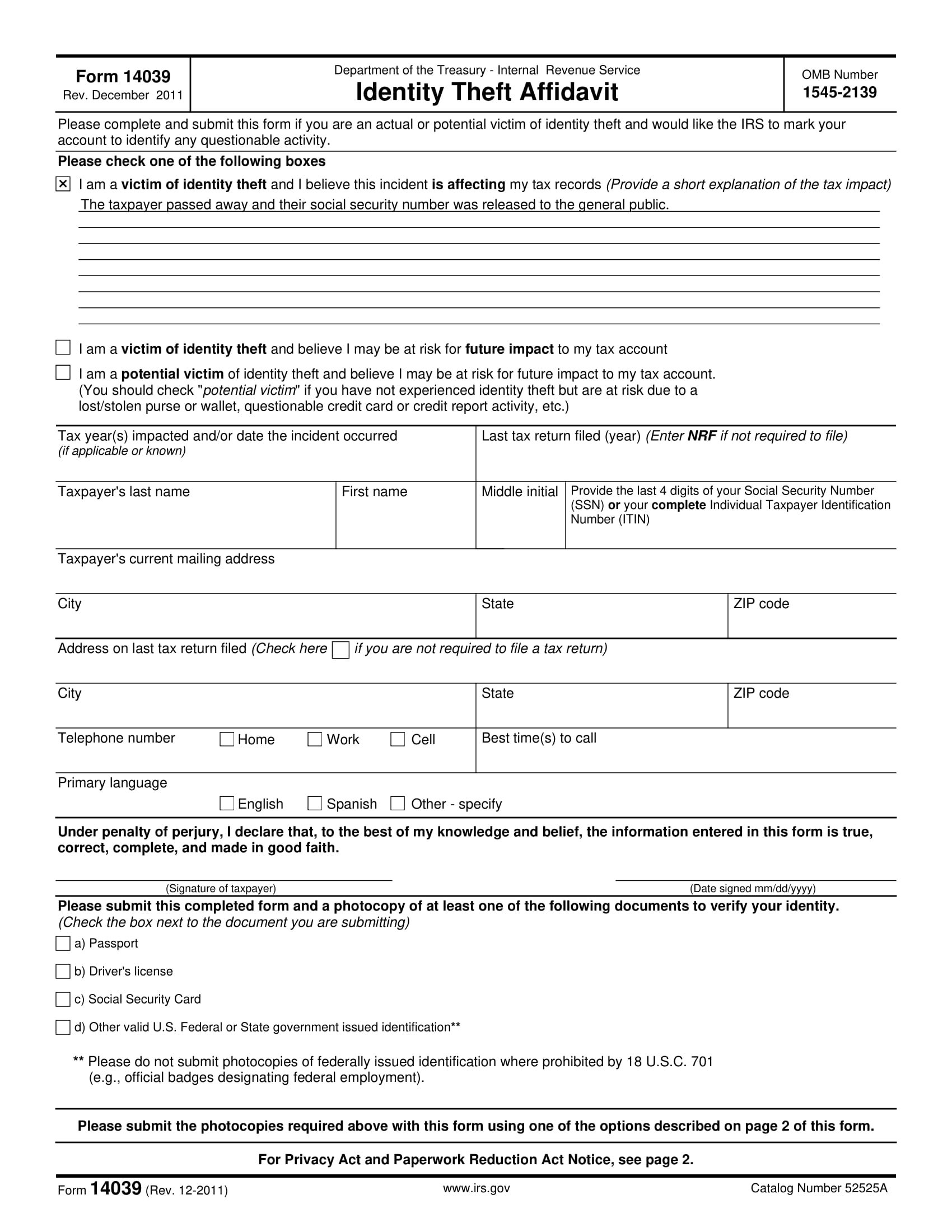

How To File An Identity Theft Report On Identitytheftgov

Head over to IdentityTheft.gov and choose the prompt that best describes your situation.

Continue to click the appropriate responses, and the online wizard will automatically fill out your Identity Theft Affidavit .

According to the FTCâs privacy policy, you can choose how much personal information you feel comfortable providing. Everything you share will be entered into a secure online database.

Aura’s White Glove Fraud Resolution Team Can Assist

Save time and hassle by allowing Aura to monitor and alert you to any new inquiries to your credit file across all 3 major credit bureaus .

Aura’s White Glove Fraud Resolution service eliminates the stress of recovering your identity and assets if youâre a victim of identity theft or financial fraud. A dedicated Aura case manager will work with you to craft a mitigation and remediation plan to recover your damages. Aura’s team of trained experts will help you navigate the challenges of dealing with credit bureaus and federal institutions.

Victims of identity theft have a right to:

Read Also: How To Sign Up To Become A Police Officer

Immediate Steps To Take

- File a report with the police/sheriff in the jurisdiction in which you live and get a copy of the report for the credit reporting agencies, banks and credit card companies. You can file the report at the police station or file online.

- In Denver, you can file at www.denvergov.org/policereport.

- You can also complete the ID Theft Affidavit provided by the Federal Trade Commission at www.ftc.gov.

- Consider placing a Security Freeze or Fraud Alert on/in your credit reports. See below.

Does The Police Investigate Identity Theft

Police do sometimes investigate identity theft cases, but the success of this investigation may depend on how much information you already have about the theft. Identity theft can happen to anyone and can affect your credit score and ability to do things like rent an apartment, buy a car or get a loan. The four main types of identity theft include financial, tax, medical, and child. You should report identity theft to the police, and file a report with the Federal Trade Commission .

Identity theft is a frightening prospect that affects millions of people each year. In 2021 alone, the FTC received nearly 1.4 million reports of identity theft from over 2.8 million people. Once a person has your personal information, they can use it to run up fraudulent charges on your credit cards, apply for loans in your name, and even give your name to a police officer if theyve committed a crime or appeared in court.

Identity theft takes a number of different forms and causes real damage to your credit report and financial accounts. Filing a police report and reporting the incident to the FTC can provide you with proof that the identity theft occurred, which will help you recoup any losses with creditors and begin rebuilding your credit.

Also Check: How Many Police Interactions Per Year

What Is Identity Theft

Identity theft is when someone uses your personal informationâsuch as your name, address, banking details, social security number, credit card number, etc.âwithout your permission, to perform criminal or fraudulent activities.

Hackers can open accounts in your name, sign up for loans, steal medical benefits, access your retirement accounts, and inflict severe financial damage. Identity thieves can hurt your credit score and ruin an otherwise reputable credit history.

Identity theft can happen in many ways. Someone might find documents with your personally identifying information. They may also steal sensitive data from your devices when you’re web browsing on a publicly shared Wi-Fi network. Spam emails, phishing attacks, texting scams, holiday shopping scams and unemployment fraud are other common ways identity theft can occur.

You could also fall victim to identity theft by way of phone scams, mail theft, card skimming, malware, ransomware, spyware, trojan viruses, social media phishing, and most notoriously – large corporate data breaches, which are becoming increasingly common. Over 1,000 data breaches have already been reported in 2021, which is an 17% increase compared to 2020.