How Police Catch Uninsured Drivers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Although car insurance is required in 49 states and the District of Columbia, nearly 30 million Americans choose to drive uninsured. And, surprising as it may be, the majority manage to stay off Johnny Laws radar. But perhaps not for long.

The growing popularity of automatic license plate recognition systems, which allow law enforcement real-time access to uninsured-motorist databases in their state, may soon change how police catch uninsured drivers. In some places, it already has.

See what you could save on car insurance

Easily compare personalized rates to see how much switching car insurance could save you.

Get started on Insure.com

Why Is It Important That Police Can Tell If You Have Insurance By Running Your Plates

It is important that police can tell if you have insurance by running your plates because it motivates drivers to purchase and maintain the auto insurance that is required under Michigan law and, thus, avoid the severe criminal and financial penalties that Michigan imposes for driving without auto insurance.

Those penalties could include: being found guilty of a misdemeanor a fine between $200 and $500 a year in jail suspension of your drivers license inability to renew your vehicle registration being disqualified from suing for pain and suffering compensation and/or No-Fault benefits if you are injured in a crash and being held financially liable for the medical bills and lost wages of anyone else injured in a crash that you are involved in even if you were 100% not at-fault for the auto accident.

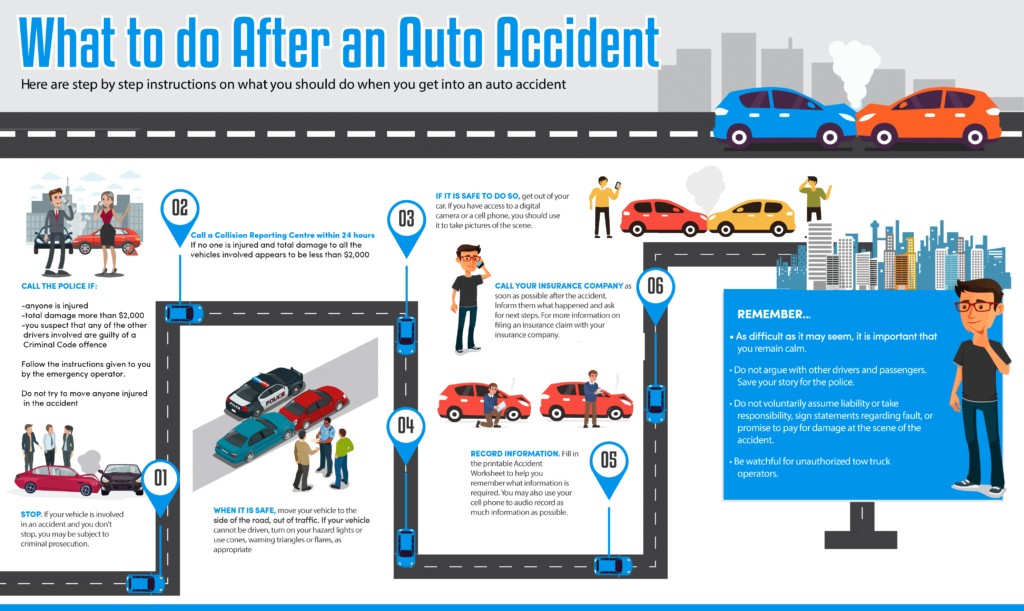

What You Should Do

Take time to write down carefully all of the details such as the time, date and location where the accident happened and the names and contact details of any witnesses. Note down the speed you believe you were travelling at and even the weather conditions. It will help if you draw a diagram. This information will be helpful to police and your car insurance company.

Don’t Miss: What Classes Are Required For Police Officers

How Nevada Live Workstop

Nevada LIVE validates your coverage with your insurer instantly as part of the registration process. The DMV also verifies coverage periodically throughout the year.

Newly-issued policies may not be validated immediately if the policy has not been processed. You should check back using the Insurance and Registration Status Inquiry to ensure the listing is completed.

Individual agents cannot send insurance information it must come from the companys corporate office.

Reported information includes Vehicle Identification Number, the name of the insured, The policy’s effective dates, expiration/termination dates and the insured’s Nevada driver license or business FEIN number.

It is important the name on your insurance and vehicle registration match. If you change the name on your insurance, you must also change the name on your vehicle registration. At least one person’s or business name on the registration must match a named insured on the policy.

An operator policy may be used in lieu of ownerâs policy of liability. Each registered owner of the vehicle must maintain an operator policy in order to meet Nevadaâs requirement for liability insurance.

The Steep Price Of Driving Without Auto Insurance

As police heighten their efforts to identify uninsured drivers, you might wonder just how much getting caught without coverage would cost. First-time convictions often run in the $500 to $1,000 range, and may go as high as $5,000 in West Virginia. There could also be hundreds of dollars in fees associated with reinstating a suspended license or registration.

Yet perhaps the most damaging consequence is the increased cost of future car insurance. In some cases, insurers might not write you a policy at all, Hageli says. But if they do, theyll charge a lot.

If you cant get traditional auto insurance because of an uninsured-driving conviction, you might need to buy high-risk car insurance instead. As youd expect, these policies tend to carry higher rates than standard plans.

See what you could save on car insurance

Easily compare personalized rates to see how much switching car insurance could save you.

Also Check: How To Become A Police Sniper

How Do I Tax A Brand New Car

Your dealer should be able to set this up for you, but youll need to have your car insurance in place before you can drive away from the showroom.

If you didnt buy the vehicle from a dealer but imported it or built it, you will need to register and tax it yourself by completing a V55/4 form.

If youre selling your old car, make sure the appropriate section of the V5C is sent to the DVLA to inform it about the change of ownership. Youll then receive a refund on any full months worth of tax youre owed. If you fail to notify the DVLA that you are no longer the registered keeper, you could be fined up to £1,000.

Canadian Drivers In The Us Need To Be Aware

All drivers in the U.S. whether they are visitors or residents are expected to obey U.S. driving laws. Pay close attention to speed limits, do not drink and drive, or carry alcohol, drugs or weapons in your vehicle.

If you find yourself pulled over, follow the general guidelines above to avoid creating a nasty situation. If you are arrested and have to appear in court, the process could take months, and you must remain in the country or a warrant will be issued for your arrest.

Most people would agree that they would rather avoid a police pullover than have to deal with it. But sometimes the situation is out of your control. Obey the rules of the road, keep a level head and know your rights, and chances are youll be headed to your destination in no time.

Read Also: Can I Find My Police Report Online

What Are Special Reasons For Driving Without Insurance

So-called special reason arguments can sometimes be used to reduce the severity of your punishment.

It could be argued that, while being technically guilty of driving without insurance, there are mitigating circumstances.

Examples of this include :

- An insurance provider cancelling a policy without notifying the holder

- No policy being in force, due to faults on the behalf of the provider

- A person being informed that they can drive the vehicle legally

- A person having a genuine reason to believe they are insured

Validity And Minimum Liability Amounts

Those wondering if their policy is valid by law do not really have to worry. Each state does have a minimum amount of liability insurance required to register a car in the state.

The insurance company licensed to sell insurance in a particular state knows what the states mandated minimum amount is. An amount lower than the mandated minimum is not going to be sold on to a customer.

The minimum amount only offers the minimum amount of coverage. While a policy may be valid, it might not be truly adequate. Meeting state legal requirements is not the same thing as best protecting ones financial well-being.

Protecting financial assets also requires not doing foolish with an insurance provider.

Read Also: How To Donate To Police Department

How To Verifyauto Insurance Coverage In California

First, to actually prove that you have a car insurance coverage when driving within California your insurance company will forward a proof of insurance card listing the covered cars and drivers and showing the policy number and expiration date.

Related: Top 3 Challenges Facing Insurance Industry and How to Overcome Them

This car insurance policynumber and expiration date will help the law enforcement officer to verify yourauto insurance coverage. Your policy or a temporary binder also isacceptable evidence of insurance. But however, you will be attracting a hefty fee as charges if you werecaught without an insurance.

Alternatively, you maywant to visit https://www.dmv.ca.gov/wasapp/cisa/index.html to know if a driver that bashedyour car also has car insurance coverage as you wait for the police to fileyour accident report. This DMV insurance inquiry is also what most law enforcementofficers use to verify a car insurance coverage in California.

What Information Should I Exchange With The Other Driver If I Get Into A Car Accident

If you both can get out of the car and are in a safe place to take down information, here are the critical pieces of information you should take down:

- Names

- Vehicle identification and license plate numbers

- Contact information for their insurance companies and policy numbers

- Cars registration and get the owners name and contact information if its not the driver

- Names, addresses and phone numbers of witnesses and passengers

If you have a camera or one on your cell phone, take photographs of the damage and the car accident scene. If you are without a camera, at least try to make a rough sketch of the accident.

Make sure to note the time, date, and location of the accident.

If a police officer does arrive, take down his/her badge number, and find out where and when you will be able to pick up this police report.

Also Check: How To Find A Police Officer By Last Name

When Dont I Need Car Insurance

Although the majority of cars do need to be insured, there are some exceptions to the rule. Your car doesnt need insurance if its:

- been declared off the road using the SORN procedure

- been scrapped, stolen or exported with notice

- between registered keepers or dealers

- registered as in trade with the DVLA

How Do Cops Receive Insurance Information About Your Car

Most states now have electronic insurance verification systems to keep track of insurance status by license plate number. This means police can simply run your license plate through a computer system in their cars to verify your insurance.

These systems allow police to quickly identify if:

- Youre driving without insurance

- Your insurance policy is expired

- Youre carrying an accurate, up-to-date insurance card

Because insurance companies communicate with the Department of Motor Vehicles when your insurance status changes, and to share data at regular intervals, the information police have access to with electronic verification systems will always be the most up-to-date.

Don’t Miss: What App Tells You Where Police Are

Does A Cop Really Check To See If Your Car Insurance Coverage Is Legit

Originally posted by: Ocguy31Here in CA the insurance companies actually tell the DMV when you have insurance now. Yay for police state!

Originally posted by: Brainonska511

Originally posted by: Ocguy31Here in CA the insurance companies actually tell the DMV when you have insurance now. Yay for police state!

Originally posted by: MermaidmanUnfortunately, some people get insurance just to renew their plates, then cancel. They’ll even have a “valid” insurance card to show a cop. 😐

Originally posted by: spidey07In KY you can’t renew your registration without proof of insurance. They actually require and take from you an actual insurance card from the issuer or certified facsimile.

Car Insurance With European Cover

Excluding Essential tier, Admiral Car Insurance comes with 90-day European cover as standard. All named drivers on your policy benefit from the cover but you must remember to take the certificate with you on your trip.

Your European cover is valid for the following countries: Andorra, Austria, Belgium, Bosnia & Herzegovina, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Republic of Cyprus, Romania, Serbia, Slovak Republic, Slovenia, Spain, Sweden, and Switzerland

Your International Motor Insurance Certificate will cover you up to a maximum of 90 days in any one year. If you do wish to exceed the 90 days, please call our customer services team.

Take a look at your policy book for more information on driving your car abroad.

You May Like: Do The Police Clean Up Crime Scenes

Can I Get Temporary Tax For My Car

If youre planning on driving a car on the UKs roads even if its just two miles down the road to the local garage you need to have valid road tax otherwise youll be breaking the law.

Unfortunately, the DVLA dont offer temporary road tax, which means youll have to pay for either six or twelve months VED before getting behind the wheel.

However, if you dont need road tax after making your short journey, you can apply for a refund from the DVLA for the remaining months that youve paid for. See more information on road tax refunds at GOV.UK.

Alternatively, if youre taking your vehicle to a mechanic, you may be able to get the garage to tow your car there, meaning you wont need road tax.

Is Accidental Policy Lapse A Legitimate Defence

I accidentally let my policy lapse. Is that a legitimate defence? No. Even if its just for a day, driving uninsured can land you in hot water.

Theres no obligation on insurers to automatically renew your cover, although many will do that these days.

Its your responsibility to make sure youre covered before you drive a vehicle.

You may be able to argue mitigating circumstances, but youd still be guilty of the offence.

Also Check: What Do You Need To Become A Police Detective

Why States Use Electronic Verification Systems

In the past, all you needed was a valid ID card to show that you had insurance. Now, police officers have real-time access to verification systems that show whether or not your coverage is in fact, active.

The reason for this advance in procedures is because so many drivers tried passing off fraudulent auto ID cards to police to avoid a citation.

Can You Find Insurance Info From A License Plate Number

Car accidents can be messy. In many cases, the only information you have from the other driver is a license plate number.

Fortunately, you can get a significant amount of information from a license plate number. You may be able to verify auto insurance coverage with a license plate number, for example. By contacting your local DMV or law enforcement organization, you could identify the name, address, and insurance status of the other driver.

Can you get insurance details from a license plate number? Can you look up someones car insurance? How can you find out someones insurance company? Below, were explaining everything you need to know about using a license plate number to find auto insurance info.

Also Check: What Are The Steps To Becoming A Police Officer

When Do Cops Check For Car Insurance

Police use electronic verification systems to check on your insurance status in real time, usually before or during a traffic stop. While you may think driving carefully will be enough to avoid a traffic stop, its possible for police to perform a routine scan of your plate while youre driving, detect an issue with your insurance, and target you for a traffic violation.

Here are some ways license scanning can cause you to be cited for driving without insurance:

- Secondary violation Driving while being an uninsured motorist is a secondary violation, meaning it will only be an issue after youre pulled over for speeding or another violation. In Michigan, for example, police are prohibited from pulling someone over solely for an insurance offense, even if the plates are scanned and displayed as uninsured.

- Repeat offenders Some states have initiated programs to scan the license plates of drivers previously cited for driving without insurance.

- Insurance checkpoints On occasion, you may be stopped at a roadside checkpoint designed to identify uninsured motorists. A popular road in Tulsa, for example, became the site of an insurance checkpoint one Saturday night. Every driver passing through was scanned for insurance. Cars without motor vehicle insurance were immediately towed, and drivers who werent carrying proof of insurance were ticketed with a $250 fine.

Do I Still Need Insurance If I Am Test Driving A Car

Yes, you still need insurance if youre test driving a car. You can take out a temporary car insurance policy for test drives.

If youre buying a car from a dealership, they may well have insurance in place to cover you for this, but you should check. If youre buying or selling a car privately you will need to make sure that insurance cover is in place, even if it is only for a short trip. These policies can be taken out for as little as an hour.

If you need to borrow or share a car for a short trip, you can purchase Temporary Car Insurance to cover you for an hour or up to 30 days. The cover is fully flexible, so if you buy an hour you can top it up online if you need more.

There are monthly subscription and pay as you go car insurance options. Our Pay by Mile car insurance is purchased on a monthly rolling subscription that you can cancel at anytime for no charge. You pay a monthly parked premium and then only for the miles you drive as you do them.

Don’t Miss: How Much Are Cars At Police Auctions