How Police Catch Uninsured Drivers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Although car insurance is required in 49 states and the District of Columbia, nearly 30 million Americans choose to drive uninsured. And, surprising as it may be, the majority manage to stay off Johnny Laws radar. But perhaps not for long.

The growing popularity of automatic license plate recognition systems, which allow law enforcement real-time access to uninsured-motorist databases in their state, may soon change how police catch uninsured drivers. In some places, it already has.

See what you could save on car insurance

Easily compare personalized rates to see how much switching car insurance could save you.

Get started on Insure.com

Calculating Your Insurance Premiums

Police reports will also be used to calculate the cost of car insurance. If you have had multiple accidents and seem to be at fault for all of them based on what the reports say, you could be identified as being higher risk.

Insurance companies are likely going to charge you more on insurance premiums because of higher risk.

You have the opportunity to get quotes from multiple insurance companies. They will use police reports as well as your driving history, information about your car, and more to determine the cost of premiums.

You can control how much you pay by comparing the quotes and choosing the best company.

Even if you dont give the police report to the insurance company, they are going to find out about it one way or another. Knowing how it will impact you is vital. It could help or hinder you regarding the claims process as well as obtaining affordable premiums.

Need more affordable auto insurance? Start comparison shopping today by entering your ZIP code below!

Obtaining Police Reports From The Dmv

The DMV will have the police reports as these are submitted to the state directly from the law enforcement agencies.

They use a system such as CLUE that will provide details about the accident. It is a report generated by LexisNexis, and the information has the potential to stay on your driving record for as long as seven years.

In most cases, insurance companies will use the information for three years and then it goes away.

Even if you dont file a police report on the spot, the information about the accident might still get into the system. Many collision centers and other mechanic shops have access to the CLUE database as well, and they will include details about the accident once you bring your car in for repair.

The CLUE report will contain:

- Date of the incident

- Description of incident

- Amount that was paid

No matter what, you wont be able to hide a police report from the insurance company. You provide your drivers license number when getting quotes which allows them to get your driving history from the DMV. Accidents and more will be visible to them.

Recommended Reading: Are Police Officers Names Public Record

Does Comprehensive Insurance Insure Me To Drive Any Vehicle

While DOC cover is included in many comprehensive policies, its always subject to terms and conditions, including age and experience, so its always best to check your policy details first.

Many people have fallen foul of the law in the belief that their comprehensive insurance covers them to drive another vehicle owned by someone else.

The owner of the car has also committed an offence if theyve allowed their vehicle to be used by an uninsured driver, and you may both receive points and a fine.

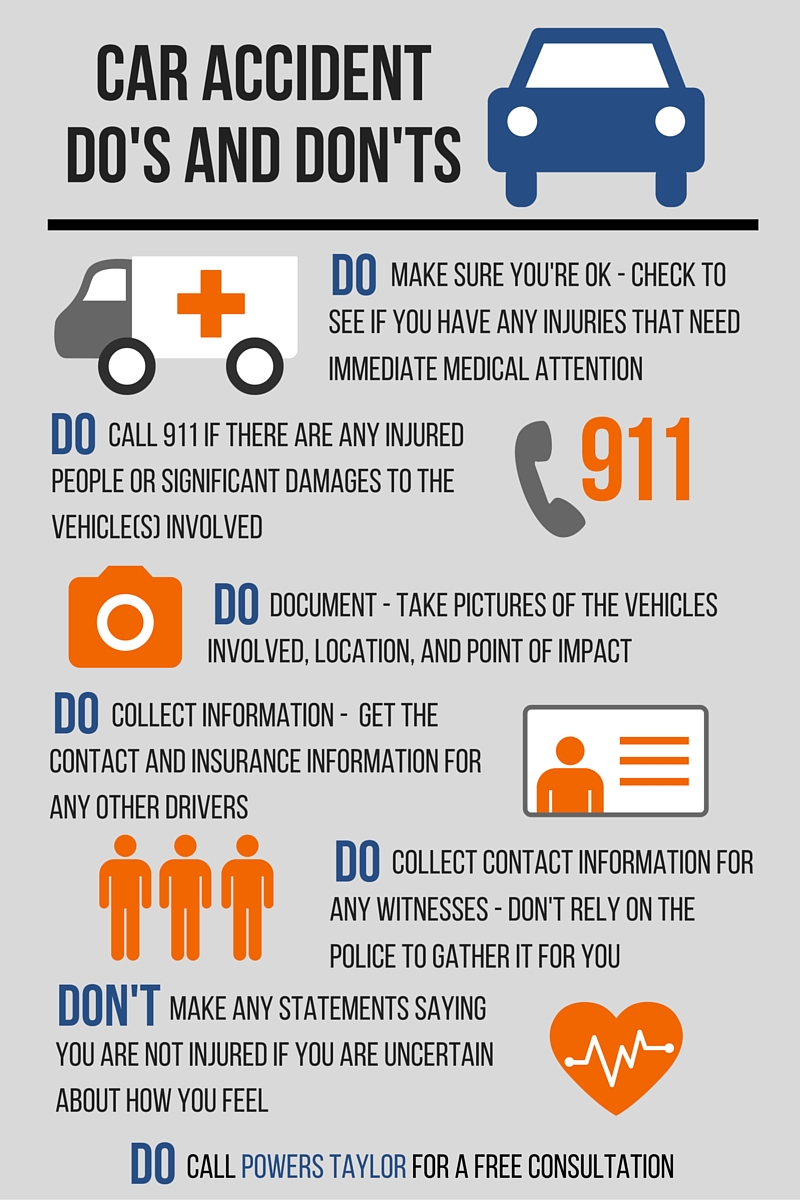

What Questions Will My Car Insurance Company Ask Me After An Accident

After reporting the accident, your insurance agent may contact you to get the details surrounding the accident.

The details help determine who was at fault, what is covered, what kinds of repairs are needed, and who will be paying for those repairs.

If you leave a message for your insurance agent or have questions regarding your car insurance claim, it is the responsibility of the insurance company to call you back.

If it has been a few days and you still have not heard from them, you may want to try to contact them again.

Try using our FREE tool to get instant online car insurance quotes from many high-quality companies. Enter your ZIP code to start now!

Read Also: How To Be A Police Officer In Las Vegas

How Can I Find Out If A Car Has Insurance

In Ontario, it is the law to have insurance on your car. You may get a new car or a used car as you plan to buy a vehicle. That is when you may want to know if that used car has insurance. You could check with the owner. You may also verify the insurance documents. If may want to check the vehicle records. You could check on many government systems to find out if a car has insurance.

How Do Police Know If A Car Is Uninsured

If you get involved in a car accident or get pulled over by the police, it doesnt take a seasoned detective to find out if you lack car insurance. Here a few ways the police know if a car is uninsured:

- You dont have active insurance registered with the department of motor vehicles . Insurers in many states are required to report active insurance policies to the DMV. Some police departments have access to DMV records from their patrol car and can determine if you have an active insurance policy.

- Automated license plate readers . Some states allow for the use of cameras mounted on police cars, road signs and traffic lights. For example, Oklahomas Uninsured Vehicle Enforcement Diversion uses photos of license plates and compares them to the Oklahoma Insurance Verification System in an effort to reduce uninsured drivers.

- The officer asks for your insurance ID card. Cops dont necessarily need to rely on technology. They can use this old school method: ask you for proof of insurance. This is typically a paper or digital document stored on a mobile app that has your information along with your insurance policy number and the effective dates.

Recommended Reading: What Do Police Drones Look Like

What To Know About Law Enforcement Car Insurance

Insurance companies often offer discounts on law enforcement car insurance and policies for similar professions. They consider police officers less risky than normal drivers because of the job they do and because they know the rules of the road. Insurance providers also consider police officers less likely to receive a citation or file a claim. Thus, law enforcement often get more affordable rates.

Insurance companies often offer discounts on law enforcement car insurance and policies for similar professions. They consider police officers less risky than normal drivers because of the job they do and because they know the rules of the road. Insurance providers also consider police officers less likely to receive a citation or file a claim. Thus, law enforcement often get more affordable rates.

Police Officers In Michigan Can See If You Have Car Insurance Before You Show Proof Of It

Police in Michigan are using an easy way to check whether a motor vehicle is properly insured.

Michigan State Police and other agencies can tell whether most vehicles are insured by running a license plate number through an in-car computer.

Were kind of excited about it, given its ability to help us target fraudulent insurance or people, frankly, who are driving around with no insurance, which is dangerous for everybody, said Sargent Amy Dehner, a legislative liaison with the Michigan State Police.

State law still requires drivers carry proof of insurance.

Insurance companies have to send information to the secretary of states office twice a month already. While that practice had been in place for some time, officials say the information wasn’t previously immediately available through the Law Enforcement Information Network, or LEIN. Now, that information is available to cops when they run your plate.

Michigan State Police officers dont treat it as a primary reason for a stop but its a really good reason to take a close look at what youre being handed at the window, Dehner said.

Dehner says theyve been able to crack down on people using fake insurance cards or who were conned into buying a policy from a fake insurer.

Things that could be made on a home computer, things that people were buying on Craigslist, fake insurance storefronts, Dehner said. She says this change was made after officials from the Secretary of States office recommended it.

Don’t Miss: How To Make A Police Statement

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

Canceling Your Insurance Or Registrationtop

If you drop the liability insurance on any vehicle for any reason, you must first cancel the registration and surrender the license plates.

If you cancel your insurance, it is extremely important for you to do the following:

- If you cancel your insurance because your vehicle is not in use, you must first cancel your Nevada registration. You may cancel your registration online through MyDMV.

- If you sell your vehicle, you must remove the license plates, then cancel your Nevada registration. The license plates do not stay on the vehicle.

- You will receive credit toward registration of another vehicle for the unused portion of the canceled registration. You may qualify for a refund under certain limited circumstances.

- If you have personalized plates and wish to keep them, you may do so by bringing the rear plate to the DMV and scraping off the decal in person.

Don’t Miss: How To Get A Police Report Online

Will I Get A Criminal Record For Driving Without Insurance

Driving without insurance is not an imprisonable offence in itself, so a conviction will not appear on a criminal record.

However, if youre convicted of driving without insurance, an IN10 endorsement will remain on your driving licence for four years – and youll need to disclose it to insurance providers for a further year.

Failure To Surrender Insurance Card

Even if you have valid Ontario car insurance, you can still face a fine if you fail to surrender your slip when prompted by police. You know that if you are pulled over by police during a traffic stop, they are going to ask for your drivers licence, vehicle registration and proof.

If you cannot provide proof, you can be charged with :

- Operating a motor vehicle without insurance : This charge implies you were driving without insurance.

- Failure to surrender proof : This charge implies that you failed to produce proof of insurance to police.

If you have simply forgotten your card, all you will need to do is attend court to show proof of a valid policy and the charge will be cancelled.

However, if you choose to pay the ticket for failure to surrender proof it will go on your driver’s abstract. It could also impact your premium, even if you do have a valid and active policy.

Also Check: How Much Does A Military Police Officer Make A Year

How Each State Deals With Uninsured Drivers

Every state has its own punishments and penalties for driving without insurance. Some may be more lenient than others, but none accept driving without financial responsibility. While there are other methods of proving financial responsibility, the easiest method is to purchase coverage from an insurance company. Click below to see your state’s penalties for uninsured drivers.

| Texas |

When The Police Report Blames You

Mistakes in a traffic collision report can be fixed, especially if its a factual error, like an incorrect address or name spelling. But changing the officers opinion of fault in the crash is much more difficult.

Learning about the traffic laws in your state can help you convince the claims adjuster to take a closer look at your claim, instead of solely relying on the police report.

The other drivers insurance company will not accept liability for their insured if they feel the accident was clearly your fault. Your injury claim will be denied.

Fault and liability arent always clear-cut, no matter what the adjuster says. Many states have comparative or contributory negligence rules, meaning you can pursue compensation even if you are partly to blame for causing the accident.

Read Also: How Can I Find A Police Officer By Name

What To Do If Youre Pulled Over

- Stay calm and compliant even if you feel the officers treatment is unfair.

- Be polite. Its important not to swear or display anger.

- Keep your hands where the officer can see them, and avoid sudden movements.

- If you need to get your documents from the glove compartment, inform the officer that you are doing so.

- Be honest. If you are caught in a lie, you may be charged with obstructing justice.

- Pay close attention. If youve had a negative experience, take note of the circumstances surrounding the encounter, including the police officers name and badge number, and file a complaint.

Is It A Criminal Offence To Abandon Your Vehicle

Any car owner can be prosecuted by a local authority for abandoning their vehicle under Section Two of the Refuse Disposal Act 1978.

If convicted, you could get a fine of up to £2,500. Theres even the possibility of a three-month prison sentence.

Depending on the circumstances there might also be a fixed penalty notice of £200 from the local authority.

If theyve had to remove or store a vehicle then the owner could be liable for these costs too.

Theres another classification to be aware of. Older cars could potentially be classed as hazardous waste. This is an offence under Section 33 of the Environmental Protection Act 1990.

The courts also have one lasting punishment for anyone abandoning a vehicle. Depending on the circumstances, your driving licence could be withdrawn.

And having convictions against you could result in your car insurance costs rising when you come to renew.

Also Check: How To Get A Police Report

Whats The Bottom Line

Instead of being fined by the motor vehicle department, you should get protection. Talk to your auto insurance company about what constitutes as valid insurance proof in your area, so that you can request a copy of your ID, or see if its possible to get an online version. Unsurprisingly in some states, acceptable proof has now moved to our devices.

Youll definitely want to double check whether or not having current proof of insurance on your phone is accepted within your state, but digital copies are also being considered acceptable forms now. If youre currently in between coverage, you also have a couple of options to avoid committing a criminal offense, which would then be on your driving record.

Use an online insurance rate comparison tool to price the cost of coverage and get legal today. Enter your zip code in our FREE tool below to compare car insurance rates now!

If I Respond To A Situation While Off

Each employer may handle this differently. Speaking to your employer about this and how the work auto insurance would respond could be helpful. You may also want to check with your personal insurance company. If you respond to a situation in your personal vehicle, your company may consider that to be business use and deny coverage.

Don’t Miss: Where To Buy Police Scanners

What Are Other Ways Police Officers Can Save Money On Their Auto Insurance

While driving safely is one of the best ways to keep your insurance rates low, police officers can also look into other options for cheap auto insurance. Obtaining quotes from multiple companies can help give you an idea of what insurance rates are in your ZIP code and help you see what additional discounts are available with each company. Some might have an occupation discount for police officers, and many companies will provide a multiple policy discount for bundling your auto insurance with either a homeowners, condo owners or renters insurance policy. If you feel that you drive your squad car more than your personal car, you can also look into usage-based insurance, also known as telematics insurance, that uses your driving habits and mileage to calculate your rate.

Using The Crash Report To Support Your Claim

After you file a claim with the at-fault drivers insurance company, a claims adjuster will begin collecting statements from you, their insured, the passengers, and any witnesses. Even if the police report clearly shows their insured was at fault, the adjuster will still investigate the claim.

Police officers arent perfect. Occasionally, a thorough investigation by the claims adjuster may uncover something the officer missed. But in most cases, the adjuster relies on the police accident report for determining fault.

Police reports are very persuasive in personal injury claims. Unlike the adjuster, the police officer was physically at the scene of the accident. The officers special training provides a reliable evaluation of the accident and its causes, especially each drivers fault.

Claims adjusters can disagree with police officers, but its uncommon. If the adjuster disagrees with the officers assessment, and the case ends up in court, most juries will take the officers opinion over the adjusters opinion. A police officers testimony has automatic credibility with a jury.

If youve recovered from minor injuries and didnt miss much work, you can probably settle your claim on your own, without the help of an attorney.

Read Also: How To Become A Police Officer In Dallas