What Can You Do To Protect Yourself From Identity Theft

- Be extremely careful when you provide personal information such as your SIN, or date of birth over the phone.

- Never provide personal information by Internet or email. The CRA does not ask you to provide personal information by email.

- Be suspicious if you are ever asked to pay taxes or fees to the CRA on lottery or sweepstakes winnings. You do not have to pay taxes or fees on these types of winnings. These requests are scams.

- Keep your access codes, user ID, passwords, and PINs secret.

- Keep your address current with all government departments and agencies.

- Register for My Account on the CRA Web site at canada.ca/my-cra-account and check your personal information regularly to ensure it is current and valid.

- Choose your tax preparer carefully! Make sure you choose someone you trust and check their references. You may also consider authorizing your representative to use the CRAs secure Represent a client online service. Always review your return, agree with the content before filing, and follow up to ensure you receive your notice of assessment as it contains important financial and personal information that belongs to you.

- Before supporting any charity, use the CRA Web site at canada.ca/charities-giving to find out if the charity is registered and get more information on the way it does business.

- Be careful before you click on links in any email you receive. Some criminals may be using a technique known as phishing to steal personal information.

If Your Debit Card Or Number Is Stolen

A debit card is an ATM card with a credit card logo on it. It accesses money directly from your bank account, and the legal protections are different from those for credit cards. If your debit card is compromised, call your bank right away and cancel the card. The bank will send you a new debit card and your checking account number will not change. The stolen money, however, will be gone while your bank investigates the matter. If you call the bank within two business days of the fraudulent transaction, your liability is limited to only $50. As time goes by, your liability for fraudulent transactions increases. If you wait more than 60 business days from the date the bank mailed the statement with the fraudulent transaction, you could lose the entire amount of the fraud.

Also Check: How To Buy Old Police Cars

Are Banks Liable For Identity Theft

Limits on Financial Losses If you report the loss to the credit card company before your credit card is used by a thief, you arent responsible for any unauthorized charges. If your ATM or debit card is lost or stolen, you can limit your liability by reporting the loss immediately to your bank or credit union.

You May Like: How Do You Know If Someone Filed A Police Report

Other Steps You Can Take To Limit Further Loss Of Funds Or Information

Your information may be gone, but that doesn’t mean all the damage is done. You can stop identity thieves from dragging your name farther through the mud by:

Reporting Identity Theft With Donotpay

If the thought of filing the police report yourself is overwhelming, let DoNotPay do the work for you. In just three steps, you can have one less task on your plate.

And that’s it. DoNotPay will make sure your issue gets sent to the right place. We’ll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Read Also: How To Become An Undercover Police Officer

Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

Report Identity Theft To The Credit Bureaus

There are three main credit bureaus in the US: Experian, TransUnion, and Equifax. Each bureau is a separate company, but each should share your claim with the other two. Reporting identity theft is free and will place a fraud alert on your credit reports for a year, protecting you from fraudulent charges or new lines of credit being put in your name.

-

Experian

-

Go to TransUnions fraud alert page or report the identity fraud at 1-800-680-7289.

-

Equifax

Place a fraud alert with Equifax online or call in to report a theft at 1-800-525-6285.

If you’re really worried, consider signing up for a credit monitoring service that sends monthly or weekly credit reports. These more dedicated services aren’t free, but they keep a close eye on your credit activity for possible identity theft.

When communicating online, consider using a VPN to talk and browse more privately. And get dedicated security software to protect yourself online and prevent identity theft.

Read Also: How To Become A Police Dispatcher In Nj

What Happens If You Cant File An Identity Theft Report With The Police

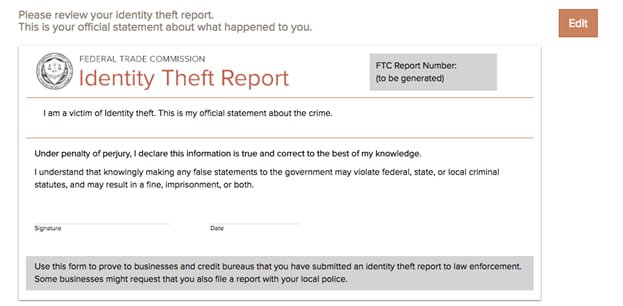

As mentioned, most ID theft cases donât actually require you to file an identity theft report with your local police department. Once you file an Identity Theft Report with the FTC, the federal government’s authority to investigate the matter supersedes your local law enforcement agency.

Plus, once you file with the FTC, local law enforcement has access to the report .

But, if your financial institutions require a police report and your local police department denies your request, you can always contact your state attorney generalâs office. Each state has a different process, and your attorney general’s office or website will provide details about how to proceed.

Make Sure Your Occurrence Can Be Reported Online

Use the information below to see if you can use this system. If your occurrence qualifies for online reporting, proceed to the next step. If your occurrence does not qualify for online reporting, it cannot be accepted by the officer managing online reporting. These occurrences require contact with a local OPP officer for investigation. Please call the OPP toll-free at 1-888-310-1122 to file a report. Links to external websites including those with video, digital images or documents that are not supported by this application cannot be managed through this online reporting service. Please include a narrative description of the occurrence if you will be filing an online report.

Read Also: What Company Makes Police Body Cameras

What To Do If Identity Theft Happens To You

If you learn that your identity has been stolen:

- First, report the crime to your local police immediately and ask them to issue a police report about the theft. Local law enforcement must accept the complaint, prepare a police report, give the victim a copy of the report, investigate the allegation and any other related violations and where necessary, coordinate investigations with other law enforcement agencies. Keep a copy of your police report to share with your creditors. It may help in your dealings with the credit bureaus.

- Keep all documentation and log all telephone calls you make regarding the theft.

- Contact the fraud department of one of the three major credit bureaus Equifax, TransUnion or Experian and ask them to flag your file with a fraud alert and to include a statement that creditors should get your permission before opening any new accounts in your name. The credit bureau that you notify will notify the other two bureaus.

Fraud departments of the credit reporting companies:

Equifax 1-800-525-6285

Experian 1-888-397-3742

Transunion 1-800-680-7289

- Check your credit report carefully and look for items that you do not recognize. Verify your name, address and social security number on the report.

After thoroughly reviewing your credit report and documenting incorrect information:

Place A Security Freeze

Federal law allows consumers to place and lift a security freeze on their credit reports for free. A security freeze prohibits a credit reporting agency from releasing any information from a consumers’ credit report without written authorization. Note: placing a security freeze on your credit report may delay, interfere with, or prevent the timely approval of any requests you make for new loans, credit, mortgages, employment, housing or other services.

Freezing a minor’s credit file:

Federal law also now allows parents, guardians, and representatives acting on behalf of a young person in foster care, to freeze a minor child’s credit report. In this instance, a minor is someone 16 years old or younger.

If the child does not have a credit report , parents and guardians may request that the credit reporting agency create a credit report for the child in order to freeze it.

Read Also: Where Do You Apply To Be A Police Officer

When To Report Identity Theft To The Police

Another option is reporting the identity theft to the local police. However, reporting identity theft to the police works a bit differently. You should only report the case to the police if:

- A creditor or another company requires you to provide a police report

- The thief used your name in an interaction with the police

- You know the identity thief

How Does Identity Theft Occur

Your personally identifying information may be compromisedthrough a variety of methods.

Dumpster Diving – Looking through your garbage for bills or other paper with your personal information on it.

Skimming – Skimmers are small electronic devices that can be easily concealed in a pocket and when your credit card is swiped through it, the device reads all of the information encoded on the magnetic strip on your card.

Phishing – Phishing scams are electronic mails sent from what appears to be a legitimate financial institution. They are devised to trick you into sending them account and password information. A common scam would be an email advising you that due to a security issue your bank would like you to confirm or reset your password.

Address Change – Your bills are diverted to another address where they are read or your mail is stolen from your mail box.

Theft – Your personally identifiable information is acquired through the theft of a wallet, purse, home burglary or car burglary.

Pretexting – Your are called or receive a text message from what appears and sounds like a legitimate financial institution in an attempt to trick you into revealing personally identifiable information.

Additional information can be found at:

Read Also: How To Report Online Harassment To The Police

Report Identity Theft To Credit Bureaus & Your Financial Institutions

After you file an FTC report, youâll need to alert all three major credit bureaus to the theft. You can do this online at:

- TransUnion

If any fraudulent accounts were opened in your name, or any fraudulent charges appear on your bank statements or credit card statements, you should dispute these immediately. It’s a good idea to have a copy of your ID theft affidavit, and a copy of the police report handy to prove that you are a victim of fraud.

ð¡ Related: How Long Does It Take To Recover From Identity Theft? –>

What Is The Attorney General’s Identity Theft Passport

The Identity Theft Passport is a card that you can carry and present to law enforcement or other individuals who may challenge you about your identity should you become the victim of identity crime. The Passport is designed to serve as notification to help protect victims from unlawful detention or arrest for crimes committed by another under a stolen identity.

An Identity Theft Passport may be available to any Virginian who:

Has filed a police report because they believe they are a victim of identity crime and/or has obtained a court order expunging their record as a result of identity crime

You may You can then print, complete, sign and mail to this Office OR

You may write to this Office for an application for an Identity Theft Passport:

Office of the Attorney GeneralVictim Notification Program202 North Ninth StreetRichmond, VA 23219

All applications must be submitted in person or by mail and will be acted upon promptly.

Also Check: Can I Get A Police Report After An Accident

What Happens With Identity Theft Victims

If you believe youve been the victim of identity theft, one of the most important things you can do is contact your credit card companies and financial institutions to dispute any fraudulent charges. In addition to this, file an FTC identity theft report and report the identity theft to the police as soon as you can.

Additionally, many victims of identity theft report experiencing mental, emotional, and even physical distress due to the damage it has caused. Depending on how much information the thieves collected and the financial hit you took, it can take an extended period of time to put your life back together. This can also cause fear in the future of using your credit card or giving out personal information.

Consider A Credit Freeze

The strongest protection against new accounts being opened in your name is a credit freeze, also called a security freeze. A freeze means that your file cannot be shared with potential creditors, insurers, employers, or residential landlords without your permission. For more information, see our CIS 10: How to Freeze Your Credit Files.

You May Like: Are All Police Reports Public Record

Also Check: Do I Need A Police Report To File A Claim

Notify The Ftc Submit A Claim Online

As a federal law enforcement agency, the FTC supersedes your local police department. If youâre a victim of identity theft, head over to www.identitytheft.gov

Because identity theft has become so common, reporting it has become much easier. The FTC makes the process of filing an Identity Theft Report very easy.

Their intuitive online tools will help you complete the forms for your report automatically. When youâre done, your FTC report becomes an official statement about the crime. Then, other law enforcement agencies can access this report during their own investigations.

Aura’s White Glove Fraud Resolution Team Can Assist

Save time and hassle by allowing Aura to monitor and alert you to any new inquiries to your credit file across all 3 major credit bureaus .

If you have no idea what to do after your identity is stolen, Aura is fully equipped with a U.S. based victim assistance team ready to support you every step of the way.

Our White Glove Fraud Resolution service eliminates the stress of recovering your identity and assets if youâre a victim of identity theft or any of the different types of financial fraud.

A dedicated Aura case manager will work with you to craft a mitigation and remediation plan to recover your damages. Aura’s team of trained experts will help you navigate the challenges of dealing with credit bureaus and federal institutions.

Victims of identity theft have a right to:

Related: Child Identity Theft: The Parental Guide to Protecting Your Kids â

You May Like: How To File A Police Report For A Car Accident

When To Report Identity Theft To Police

The FTC says its important to report identity theft to the police in these three cases:

In most other cases, you can report identity theft to IdentityTheft.gov. The FTC set up the website as a one-stop shop for reporting many types of identity theft. It also helps you to set up a recovery plan.

How To Create An Electronic Signature For The Identity Theft Police Report Example Form On Ios Devices

To sign a identity theft police report template right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your sample police report for identity theft: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as effective and powerful as the web solution is. Connect to a strong web connection and begin completing forms with a legally-binding eSignature within a couple of minutes.

Recommended Reading: How To Become A Police Officer In Ma

Also Check: How Much Does A Police Officer Get Paid